The banking landscape is expected to witness significant changes in 2024, influenced by technological advancements, regulatory initiatives and shifting consumer preferences.

New reports released by the Hong Monetary Authority (HKMA), French consulting firm Capgemini and tech corporation IBM explore the top trends shaping the industry, highlighting the digital transformation sweeping across the sector, the adoption of generative artificial intelligence (AI), the emergence of tokenization and digital assets, and the growing focus on green and sustainable banking practices.

These trends are not just limited to Hong Kong but also reflect global developments as banks adapt to meet evolving market demands.

Digital transformation

The rising digitalization of banking services is a prominent trend in the sector, with an increasing proportion of banking services being now accessed via digital channels. In H1 2023, 19% of mortgage applications in Hong Kong were done via digital channels, according to a report by the HKMA, up 17% points from 2021. A similar trend is observed for time deposit placements and loan-on-cards via digital channels, which grew by 12% points and 20% points, respectively, during the period.

Rising digitalization of banking services, Source: Hong Kong Banking Sector: 2023 Year-end Review and Priorities for 2024, Hong Kong Monetary Authority, Jan 2024

Usage of regtech solutions is another trend outlined in the report, recording a 90% adoption rate across multiple risk management and compliance functions in credit risk, wealth management and foreign exchange (FX) settlement, among other use cases.

These trends are expected to carry on in 2024 as banks continue to adopt AI and network analytics to enhance their offerings and strengthen real-time fraud monitoring. Other strategies outlined in IBM’s 2024 Global Outlook for Banking and Financial Markets report include digitalization for access, leveraging cloud technology for omnichannel experiences, and incorporating AI and machine learning (ML) for improved communication and personalization.

Fintech innovation and development

Fintech promotion and development were other key areas of focus in 2023, with initiatives aimed at promoting financial inclusion, enhancing consumer protection, and exploring advanced analytics capabilities.

In August 2023, the HKMA launched the new Fintech Promotion Roadmap to give further impetus to fintech adoption in the Hong Kong financial services industry. The roadmap focuses on the fintech business areas of wealthtech, insurtech and greentech, as well as the technology types of AI and distributed ledger technology (DLT), paving the way for greater innovation in these areas.

Other areas of focus for HKMA in 2024 include strengthening the city’s fintech infrastructure, enhancing advanced analytics capabilities, and continuing to adapt to the evolving digital landscape, the HKMA has said.

Generative AI transformation

In 2023, Hong Kong banks emerged as the world’s top adopters of generative AI, a survey conducted by financial software company Finastra, found. The study, which polled ~1,000 finance professionals across nine markets in the Americas, Europe, the Middle East and Asia, revealed that 38% of Hong Kong financial organizations had already started rolling out generative AI, the highest rate across the markets studied and a figure that’s well above the global average of 26%.

Interest from the global finance sector in adoptive generative AI, Source: Financial Services State of the Nation Survey 2023, Finastra, Nov 2023

In 2024, banking institutions in Hong Kong and around the world will continue to explore and deploy generative AI tools, driven by hopes of improved customer experiences, streamlined core banking operations and enhanced productivity. The Capgemini report highlights code development, customer service enhancement and automation tasks like summarizing customer conversations and answering queries, as top use cases being piloted by banks and financial institutions.

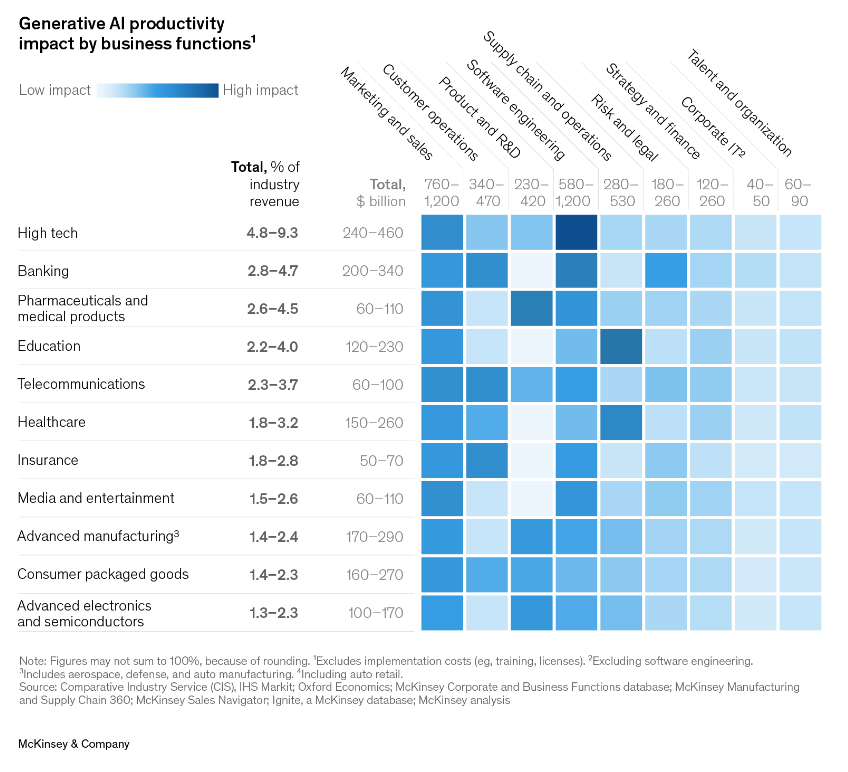

McKinsey and Company estimates that generative AI could potentially generate value from increased productivity of 2.8-4.7% of the banking industry’s annual revenues, translating to an additional US$200-340 billion in revenues annually.

Generative AI productivity impact by business functions, Source: McKinsey and Company, Jun 2023

Virtual assets and tokenization

As digital tokens and decentralized finance (DeFi) continue to evolve, banks continued to explore tokenization initiatives in 2023, developing frameworks and investigating multiple use cases through pilot programs, the Capgemini report notes. For instance, TransUnion, a major credit agency in the US, began offering credit scores for DeFi lenders in Q2 2023. In Singapore, DBS Bank became in November 2023 the first bank in Asia to complete an intraday repurchase transaction on a blockchain-based network.

Financial institutions are also actively engaging in blockchain innovation to enhance cross-border transactions, improve security, and explore new opportunities in the digital asset space. For example, JP Morgan completed its first live cross-border transaction on a public blockchain in 2022 as part of Singapore’s Project Guardian. JP Morgan is also developing a blockchain-based digital deposit token for accelerating cross-border payments and settlement, and is awaiting approval from US regulators.

Furthermore, the Capgemini report highlights that almost all central banks globally are exploring the opportunity of central bank digital currencies (CBDCs). In Hong Kong, the HKMA has been researching CBDCs since 2017, placing increased emphasis on strengthening its effort to increase the city’s readiness in issuing CBDCs at both wholesale and retail levels.

The growth of tokenization and digital assets in Hong Kong will be fueled by new regulations introduced over the past year. In November 2023, the Securities and Futures Commission issued a circular laying out guidelines for regulated intermediaries such as fund managers to issue tokenized securities.

Green and sustainable banking

The HKMA report draws attention to several trends in green and sustainable banking observed in Hong Kong. In particular, the report highlights a focus on transition planning to promote the use of technology and capacity building in green and sustainable banking practices, an escalation of supervision of banks’ climate risk management, and increased industry collaboration to promote green and sustainable banking practices.

At the regulatory level, efforts are currently underway to develop a framework for green and sustainable banking practices. In particular, the HKMA has committed to developing a common framework to assess the “Greenness Baseline” of individual banks and says that it will also be consulting with the industry on what expectations or requirements should be set for green banking. The central bank will also be implementing, monitoring and evaluating Hong kong banks’ progress in green banking.

Echoing the HKMA, the Capgemini report stresses that banks globally are actively incorporating environmental, social and governance (ESG) considerations into their strategies, offering green products and services, and aligning with global initiatives to promote sustainability in the financial sector. For example, Nasdaq launched in 2021 the ESG Data Hub to connect investors with sustainability data sets, while banks including Barclays, Citibank, and HSBC are providing various green financing options.

These efforts are arising on the back of a surge in investor demand for sustainable investments. Between 2019 and 2023, products featuring ESG-related claims grew by 28%, versus 20% for products that made no such claims, according to a 2023 McKinsey and NielsenIQ study.

Retail sales growth, US, CAGR 2018-2022, Source: Consumers care about sustainability—and back it up with their wallets, McKinsey and Company, Feb 2023

Featured image credit: Edited from freepik