Customer deposits are a critical pillar for virtual banks’ operations in Hong Kong, serving as a core foundation of their future growth and success.

However, most Hong Kong virtual banks are facing challenges around their customer acquisition and deposit strategies, resulting in a slow uptake and low deposit levels, a new report by Hong Kong strategy consulting firm Quinlan and Associates says.

The report, titled the Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks, investigates the various challenges facing the city’s digital banks with respect to their deposit acquisition, retention and monetization strategies, examining how these challenges can be addressed in the coming years to reach profitability.

According to the report, although Hong Kong virtual banks have managed to accumulate a combined 2.1 million customers in H1 2023, these players have seen the growth of their customer base slow down each year since their launch. In 2021, Hong Kong virtual banks’ customer base grew by a remarkable 200% year-over-year (YoY), a rate that stood at only 28% between 2022 and H1 2023.

Moreover, the report notes that account dormancy is a key issue for Hong Kong virtual banks, with an average of 55% of registered users of virtual banks in Hong Kong being inactive, including a considerable number of customers with zero-balance accounts.

Hong Kong virtual banks’ customer base, # million, 2020-H1 2023E, Source: Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks, Quinlan and Associates, Dec 2023

In addition to a slowdown in customer growth, the report notes that Hong Kong virtual banks’ deposits have slowed even more sharply. In H1 2023, Hong Kong’s eight virtual banks held HKD 32.2 billion in customer deposits, increasing by just 11% from 2022’s HKD 30.4 billion, against the 60% and 20% YoY growth rates recorded in 2021 and 2022, respectively.

The figure implies that after about three years of operations, Hong Kong’s virtual banks managed to only capture a mere 0.2% of the city’s HKD 15.4 trillion in total customer deposits.

Hong Kong virtual banks’ customer deposit (HKD billion, 2020-H1 2023), Source: Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks, Quinlan and Associates, Dec 2023

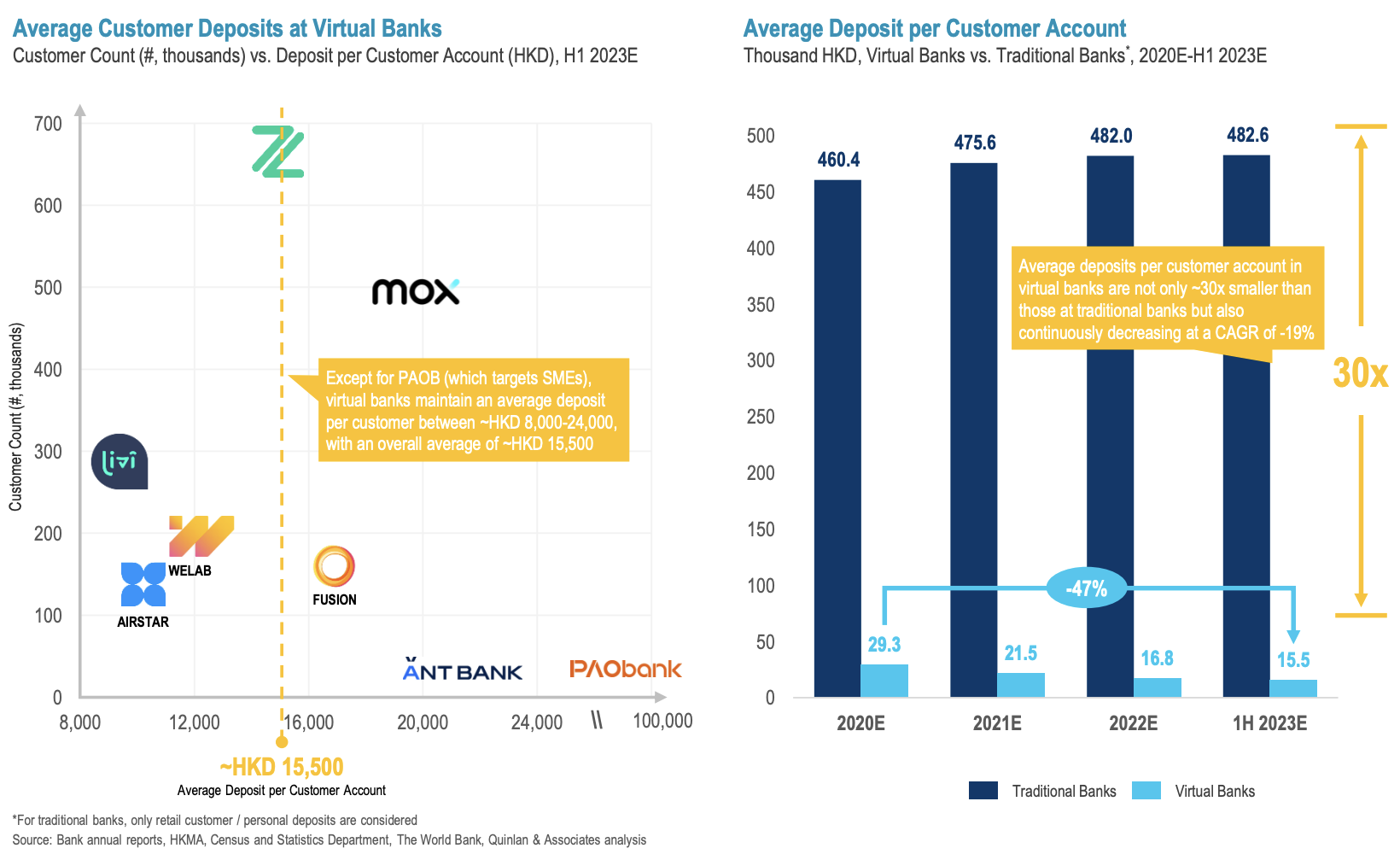

Average deposit per customer account was also found to be lower at virtual banks than traditional banks, standing at HKD 15,500 in H1 2023, against HKD 482,600 at traditional banks. Average deposits were not only 30-times smaller than those at traditional banks in H1 2023, they also continued their downward trend, declining by a 19% compound annual growth rate (CAGR) between 2020 and H1 2023.

Average customer deposits at virtual banks, Source: Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks, Quinlan and Associates, Dec 2023

Limited offerings and monetization challenges

According to the report, these weak performances can be in part explained by virtual banks’ narrower offerings and limited capabilities to address customers’ financial demands.

These hurdles have led to considerable deposit attrition and prevented them from becoming customers’ primary accounts. In fact, the research found that more than 70% of customer deposits will leave virtual banks once promotion periods end, and about 85% of customers will not consider switching their primary accounts to virtual banks.

Taking a close look at the products and services offered by Hong Kong’s virtual banks, the study found that most of their offerings remain limited to payments, lending and foreign exchange (FX) services.

Only a handful of virtual banks have launched wealth management and insurance offerings, which allow banking institutions to funnel customer deposits into new fee-based income sources, and none of them have introduced embedded lifestyle solutions within their apps, such as movie bookings, restaurant reservations and travel bookings.

To address ongoing challenges related to attracting deposits, Quinlan and Associates advises virtual banks to tailor unique strategies for customers at different stages of their life.

Customers in the “growth” stage include university students, whom, despite having the least deposit potential, can yield long-term dividends for customer acquisition.

Customers in the “exploration” stage, represented by fresh graduates, offer an opportunity for virtual banks to capture early-career professionals who have yet to establish loyalty to a primary payroll account.

The “establishment” stage, involving mid-career professionals with the highest deposit potential, requires virtual banks to offer a portfolio of financial products comprising wealth, insurance and investment products.

Finally, the “maintenance” phase involves pre-retirees and retirees with substantial wealth, a preference for savings and risk aversion, requiring virtual banks to build secure and trusted solutions.

After identifying the characteristics of each customer segments, virtual banks must implement strategic and tactical initiatives to scale deposit size, fortify deposit loyalty, diversify deposit monetization streams, and expand their overall ecosystems. A focus should be placed on acquiring more attractive customer segments, attracting new funds from existing customers, preventing deposit outflows and creating new revenue streams.

Hong Kong granted eight virtual banking licenses in 2019, opening the doors to new industry players in a bid to enhance competition, offer customers more choices in the banking sector and stimulate innovation.

But despite their potential, Hong Kong’s virtual banks have yet to turn a profit, hampered by high customer acquisition costs, trust issues, and fierce competition from digital rivals and incumbents investing in digitalization.

Quinlan and Associates estimates that Hong Kong’s virtual banks lost an average of US$148 million each between 2020 and 2022.

These poor performances can be in part explained by their high customer acquisition costs, which stood at an average of US$65-90 in 2022 for Hong Kong virtual banks, a level that’s considerably higher than the US$15-50 range observed in emerging markets and the US$1-5 range in frontier Asian markets.

Featured image credit: Edited from Unsplash