High Customer Costs a Drawback for Hong Kong’s Digital Banks Profitability

by Johanan Devanesan June 14, 2023In the ever-evolving landscape of banking, even developed markets like Hong Kong face changing customer demands that traditional banks may struggle to meet. This has created an opportunity for digital banks to step in and offer highly personalized and digital experiences.

However, despite their potential, all eight digital banks in Hong Kong have yet to turn a profit since their introduction in 2020. A report by Quinlan & Associates explored the factors hindering digital banks’ profitability in Hong Kong and examined what those banks are doing to leverage their advantages to overturn negative balance sheets in the coming years.

Challenges for Digital Banks in Hong Kong

One of the significant challenges for the newer digital banks that have sprouted up in Hong Kong is the high cost of customer acquisition (CAC). Compared to emerging Asia and frontier Asian markets, the CAC for retail customers in Hong Kong is considerably higher, ranging from US$65-90.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Additionally, the average deposit levels per customer in Hong Kong are ten times lower than traditional banks, limiting the monetisation potential through lending and investment products.

Furthermore, digital banks in the Asia Pacific region face overarching challenges such as trust issues and fierce competition from both neobanks and incumbent banks investing in digitalization.

Digitally Addressing Pain Points

However, the Quinlan report highlighted Hong Kong has the opportunity to learn from profitable digital banks operating globally. By catering to a digitally-savvy customer base, digital banks can offer tailored solutions that meet their needs.

Source: APAC Digital Bank Landscape, Quinlan & Associates

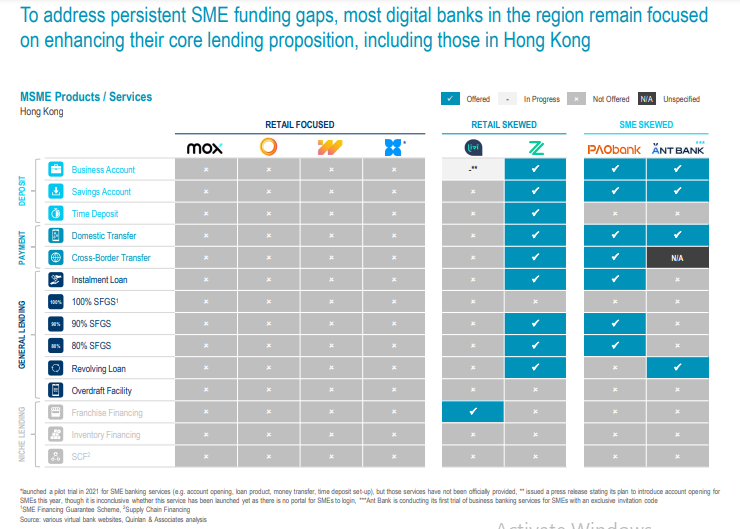

This extends to small and medium enterprise (SME) customers who face pain points such as a slow onboarding process, lengthy loan applications, and difficulty accessing credit due to collateral requirements and perceived risk.

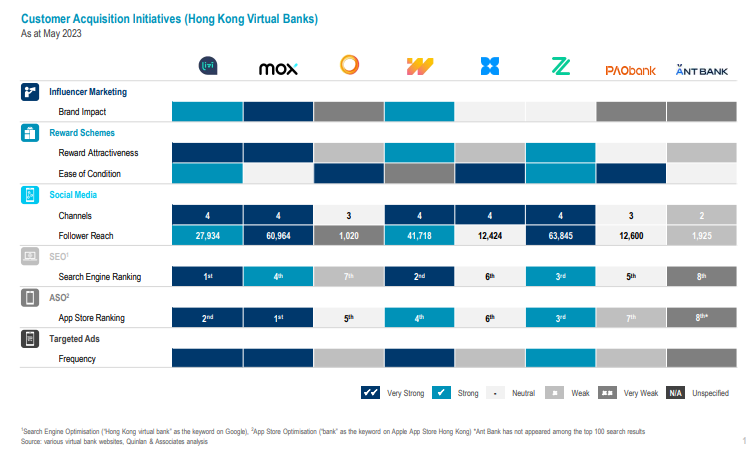

To address these pain points, Hong Kong digital banks are raising customer awareness through digital-first marketing strategies. Collaborating with local influencers, offering attractive rewards, maintaining an active presence on social media platforms, and targeted ads are some of the strategies employed.

Additionally, digital banks are simplifying and digitising the onboarding process using technologies like mobile phone OCR (optical character recognition) and biometric identification. These advancements eliminate the need for physical branch visits and provide 24/7 onboarding services, taking as little as two minutes to complete.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Innovative Strategies by Hong Kong Digital Banks

Leading digital banks in Hong Kong, such as ZA Bank and Mox Bank, have implemented innovative strategies to engage and serve their customers better. ZA Bank has introduced a gamification campaign called “ZA Quest,” where customers can earn rewards by completing quests within the bank’s app. This enhances the customer experience and encourages exploration of the bank’s offerings.

Mox Bank, on the other hand, has implemented granular budgeting tools called “Generation Mox” to boost customer engagement. Users can create sub-accounts with specific saving goals and receive reminders to save money, thereby helping them achieve their savings targets effectively.

Expanding Product Offerings

Most virtual banks in Hong Kong are prioritising the expansion of their lending capacity and product offerings. They have introduced deposit and lending products, and some are now offering additional financial services such as insurance and wealth products.

Source: APAC Digital Bank Landscape, Quinlan & Associates

These expanded offerings aim to cater to the diverse needs of both retail and SME customers, filling the funding gaps that many SMEs face in Hong Kong.

Streamlined Lending Process

Digital banks in Hong Kong have transformed the traditional lending process by leveraging credit algorithms, machine learning, AI technologies, and alternative data.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Through these technologies, banks have significantly reduced documentation and in-person interview requirements, making the lending process streamlined, convenient, and accessible. SMEs and consumers can now apply for loans completely online with minimal paperwork, resulting in faster turnaround times and improved efficiency.

Enhancing Customer Service

Digital banks in Hong Kong utilise various tools for customer maintenance and service, replacing the need for physical branches. Some offer a 24/7 customer hotline and leverage AI and natural language processing to provide automated and personalised responses to customer queries.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Chatbots and live chat functionalities connect customers with service representatives in real time, ensuring round-the-clock support.

Utilising Advanced Technologies

Cloud technology plays a significant role in Hong Kong’s digital banking landscape. Virtual banks like Mox Bank, WeLab Bank, and Ant Bank have adopted public clouds, which provide cost-effective solutions for data management, scalability, and product development.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Public clouds improve data collection and storage capabilities, streamline data processing, and ensure advanced security measures to protect sensitive information.

Building a Strong Partnership Ecosystem

Digital banks in Hong Kong have established extensive partnership ecosystems across the customer value chain. These partnerships allow for collaborative content marketing, joint incentives, and referral agreements, enhancing customer awareness and acquisition.

Additionally, partners can co-create innovative solutions that meet the specific needs of target customers, facilitating product delivery and development processes.

Source: APAC Digital Bank Landscape, Quinlan & Associates

Digibanks in Hong Kong face challenges in achieving profitability, primarily related to customer acquisition costs and lower average deposit levels. However, by learning from successful digital banks globally and employing innovative strategies, Hong Kong digital banks can overcome these challenges and enhance the customer experience.

Simplified onboarding processes, personalised marketing strategies, expanded product offerings, streamlined lending processes, advanced technologies, and strong partnership ecosystems are key components for their success. As the digital banking landscape continues to evolve, these banks are well-positioned to meet the evolving demands of customers in Hong Kong and drive the future of banking in the region.