Hong Kong Banks Lagging Behind in Openness to Apply New Tech Compared to Virtual Banks

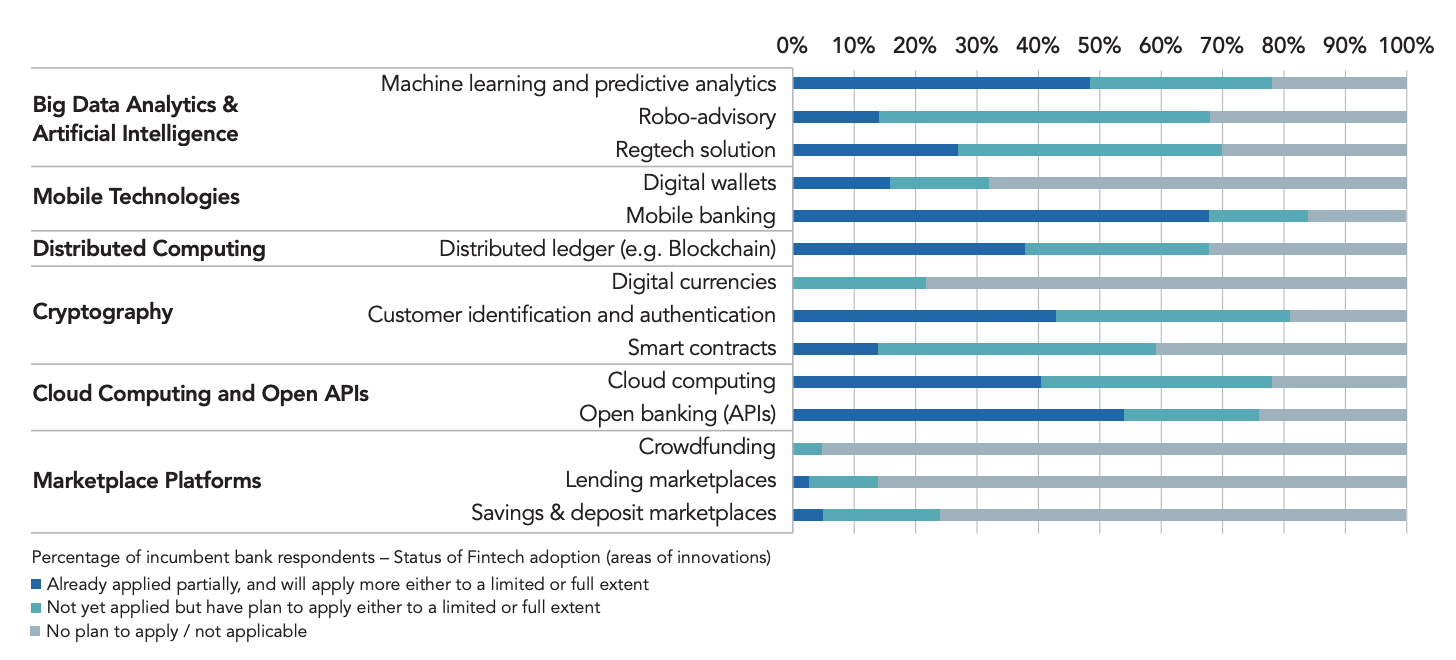

by Fintech News Hong Kong May 25, 2020Banks in Hong Kong are embracing fintech, with innovations relating to mobile banking, open banking (APIs), machine learning and predictive analytics, customer identification and authentication, and cloud computing, being commonly applied by over 40% to up to two thirds of the incumbent banks, according to a new report by the Hong Kong Institute for Monetary and Financial Research (HKIMR), the research arm and subsidiary of the Hong Kong Academy of Finance (AoF).

The report, based on a survey of 37 incumbent banks and eight virtual banks covering a combined 80% of Hong Kong’s total customer deposits and 75% of total assets, found that while applications related to robo-advisory, regtech, distributed ledger technology (DLT) and smart contracts, have been less widely used, most incumbents have plans to apply them in the future.

Fintech innovations adoption by Hong Kong incumbent banks, Source: Hong Kong Institute for Monetary and Financial Research, Fintech Adoption and Innovation in the Hong Kong Banking Industry, May 2020

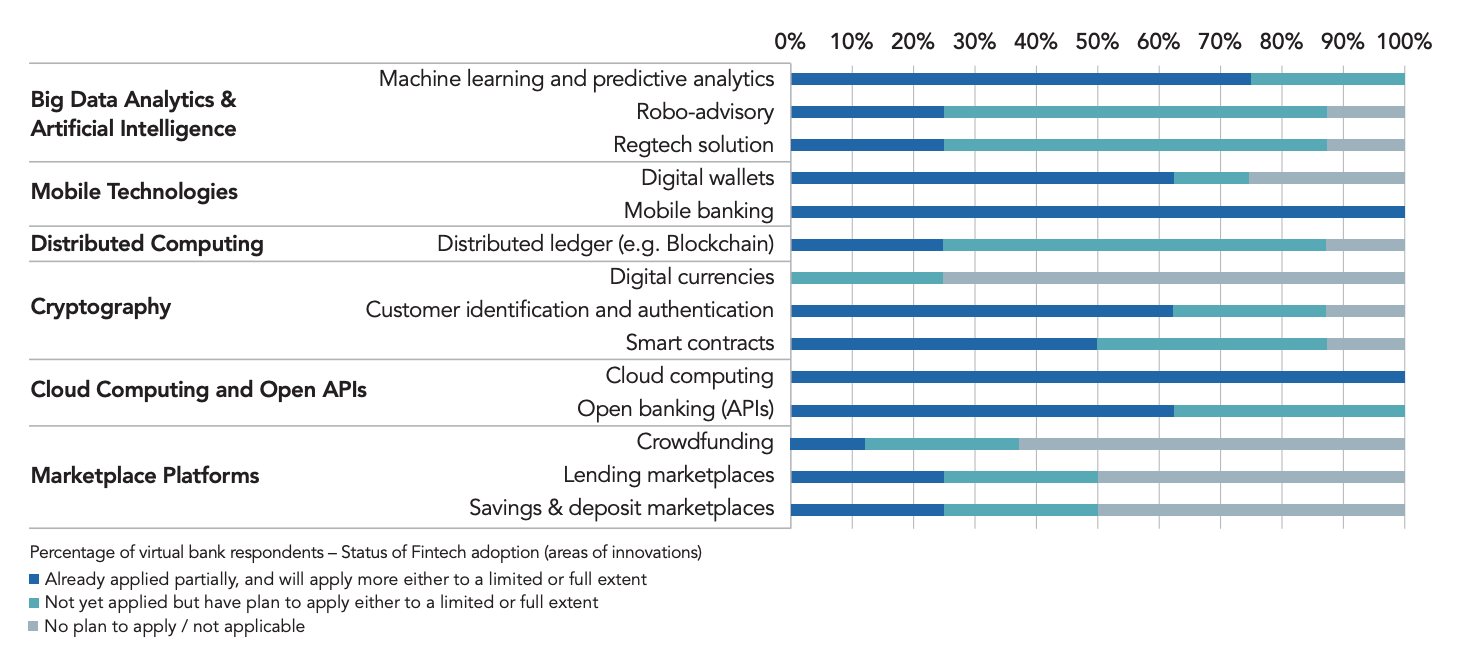

Unsurprisingly, fintech adoption has been greater for virtual banks, with all eight of them providing mobile banking and leveraging cloud computing as well as open APIs. Virtual banks are also more inclined to adopt technologies most incumbent banks are not so keen on, such as marketplace platforms in the areas of crowdfunding, lending, as well as savings and deposits, with about 40% to half of them indicating likely adoption of such marketplace platforms, compared with only about 5% to 25% for incumbents.

Fintech innovations adoption by Hong Kong virtual banks, Source: Hong Kong Institute for Monetary and Financial Research, Fintech Adoption and Innovation in the Hong Kong Banking Industry, May 2020

Hong Kong banks embrace fintech

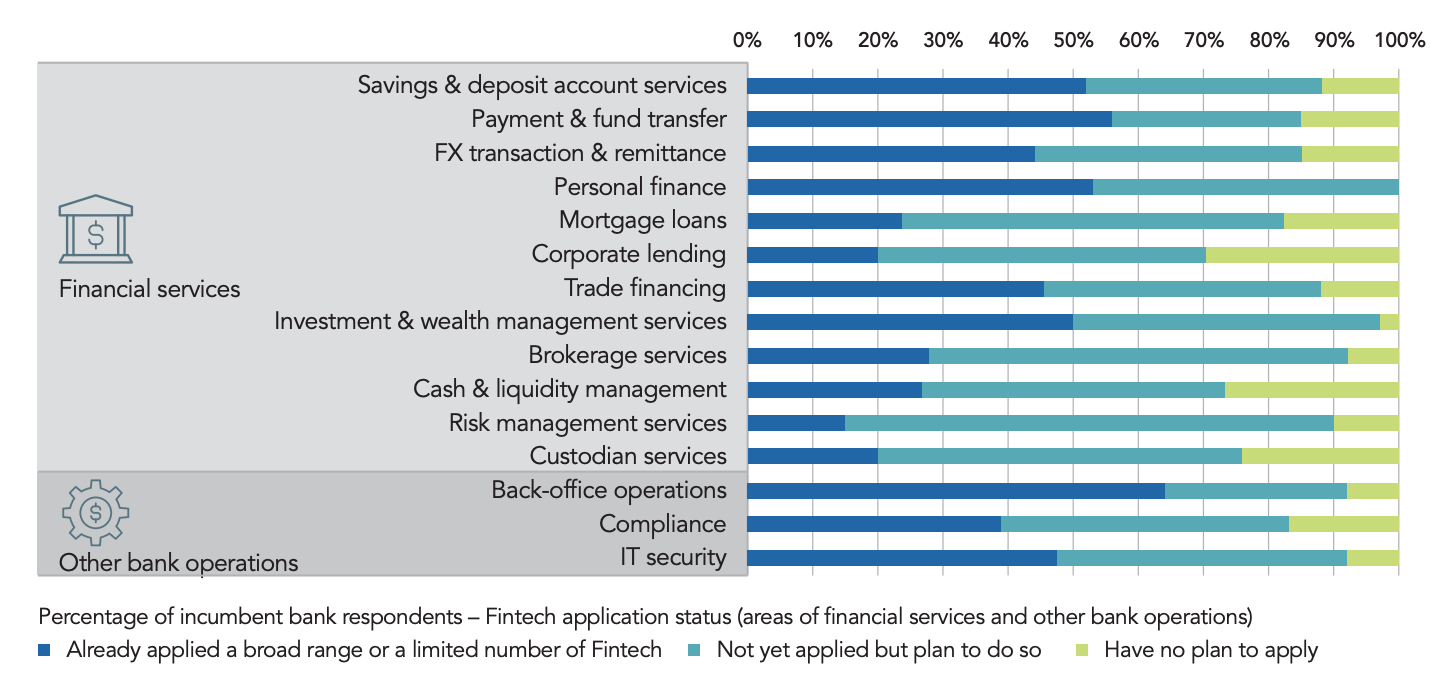

Across Hong Kong banks, fintech has been widely applied in all types of financial services, the study found.

Half or more indicated that they have adopted fintech innovations in payment and fund transfer, personal finance, savings and deposit account services, investment and wealth management services, and back-office operations.

Though adoption has been limited in areas including mortgage loans, corporate lending, brokerage services, cash and liquidity management, risk management services, and custodian services, most incumbents have plans to adopt fintech innovations in these lines of businesses.

Fintech application status, Source: Hong Kong Institute for Monetary and Financial Research, Fintech Adoption and Innovation in the Hong Kong Banking Industry, May 2020

When asked about their motivations in adopting fintech innovations, most incumbents (ranging from over three quarters to 89% of respondents) cited improved retention of customers, increased customer base, improved efficiency, better cyber and IT security risks mitigation, and response to increased competition as being either important or very important.

“Proactive adopters”

Hong Kong banks view fintech more as an opportunity than a threat, and are confident that through adapting to the new environment, they will not be displaced by new competitors, the research found.

More than 85% of the incumbent banks consider themselves as either “proactive adopters” or “reactive adopters.” Only a few see themselves as “passive adopters,” only engaging in fintech projects when the technologies are more mature and widely adopted.

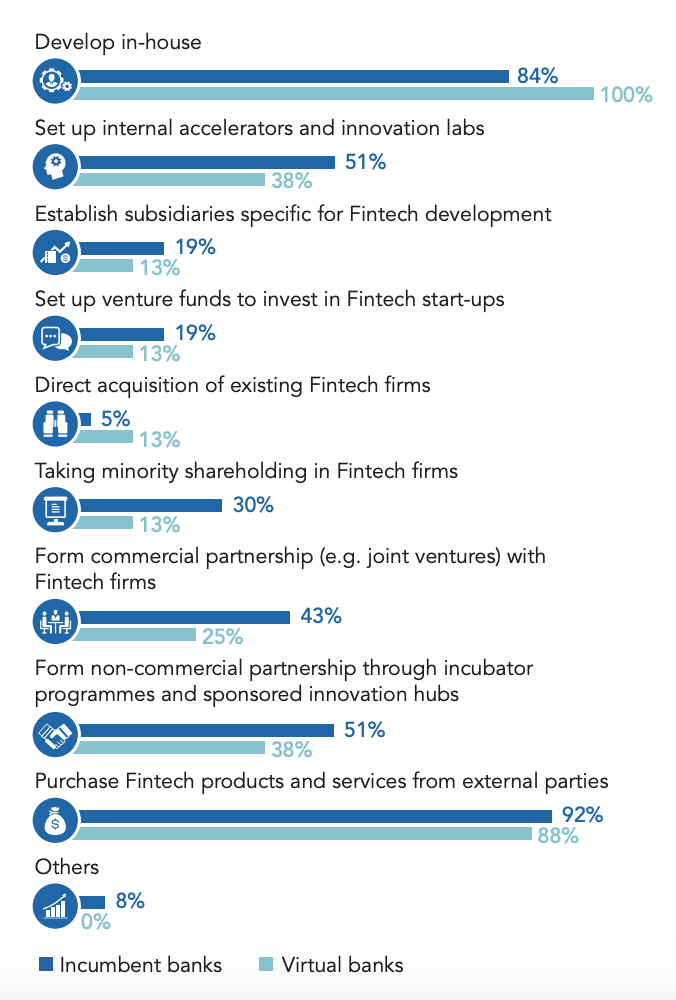

When asked about how they engage in fintech development, most respondents said they primarily purchase fintech products and services from external parties (92% of incumbents and 88% of virtual banks) and develop their solutions in-house (84% of incumbents and 100% of virtual banks).

Nevertheless, 51% of incumbents said they have set up internal accelerators and innovation labs, and 43% have formed commercial partnerships through joint ventures and such with fintech firms.

Forms of engagement for fintech development, Source: Hong Kong Institute for Monetary and Financial Research, Fintech Adoption and Innovation in the Hong Kong Banking Industry, May 2020

Fintech adoption already paying off

Already, Hong Kong banks are seeing some early signs of payoff from embracing fintech with 34% of incumbent banks stating that their objectives have been met, while most others said it was still too early to say.

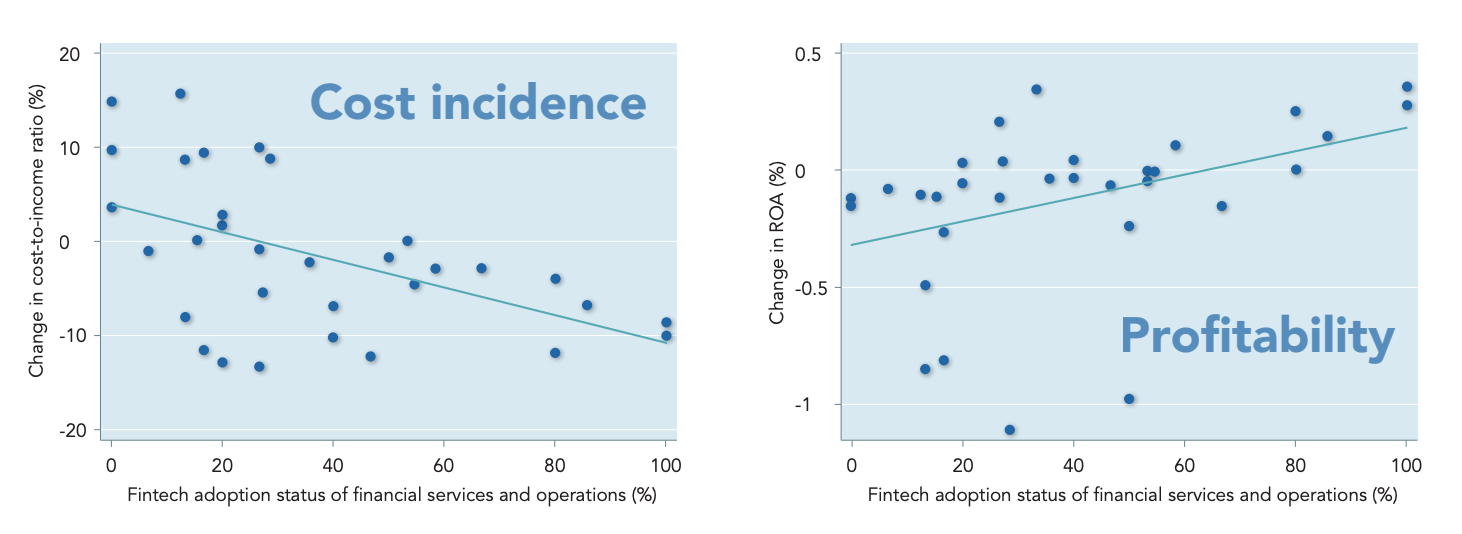

The report states that fintech adoption has also produced some positive effects on banks’ performance so far, noting a correlation between banks’ cost-to-income ratio and return on assets (ROA), with their fintech adoption status. It says that banks with more widespread adoption of fintech are seeing higher cost efficiency and profitability.

Source: Hong Kong Institute for Monetary and Financial Research, Fintech Adoption and Innovation in the Hong Kong Banking Industry, May 2020