In 2023, Hong Kong’s banking sector remained resilient despite numerous challenges, thanks to the Hong Kong Monetary Authority (HKMA) oversight.

The HKMA’s regulatory and supervisory measures were crucial in maintaining stability, protecting consumers, and bolstering operational efficiency within the banking system, while also ensuring monetary stability and enhancing the city’s financial infrastructure. The industry saw improvements in cybersecurity, fraud detection, and climate risk management.

Looking forward to 2024, the HKMA plans to focus on balancing digital innovation with risk management, enhancing operational resilience, combating financial crimes, protecting consumers, and supporting sustainable practices. The agenda also includes adapting to new trends such as virtual assets, AI, and sustainability.

With the HKMA’s guidance, Hong Kong banks are expected to continue their growth, maintaining robustness, competitiveness, and social responsibility. The HKMA aims to ensure stability while fostering progress in the sector.

Building toward full operational resilience

The foundation for operational resilience laid down in 2023, with comprehensive frameworks developed by May of the same year, set the tone for a resilient banking infrastructure poised to achieve full operational resilience by 2026.

This proactive approach was emblematic of a sector keen on mitigating potential disruptions, be they from cyberattacks, natural disasters, or systemic operational failures, thereby ensuring the unwavering stability of the financial system.

Moving into 2024, the HKMA maintained its vigilant oversight, focusing on the industry’s adherence to these frameworks and continually enhancing them to adapt to the rapidly evolving technological landscape and emerging threats.

Enhancing cybersecurity and fraud prevention

Recognising the escalating sophistication of cyber threats, 2023 saw the HKMA bolster the banking sector’s defences through regular assessments, intelligence-led cyber simulation tests, and the pioneering implementation of Secure Tertiary Data Backup (STDB) systems.

These initiatives were reactive measures and a testament to the sector’s foresight and readiness to counteract emerging cyber threats. As the calendar turned to 2024, this foundation facilitated a seamless transition into further fortifying cybersecurity measures and refining fraud detection and prevention mechanisms.

The collaboration platforms established, such as the Fraud and Money Laundering Intelligence Taskforce (FMLIT) and the Bank-to-Bank Information Sharing Platform (FINEST), continued to play a pivotal role, enabling real-time information sharing and rapid response to fraud threats.

The Anti-Scam Consumer Protection Charter, launched in 2023, and the subsequent initiatives in 2024, embodied the HKMA’s enduring commitment to safeguarding consumers against the evolving tactics of digital fraudsters.

Consumer protection and financial integrity

The sector’s approach to consumer protection was multifaceted, addressing the emergent threats of digital fraud and the broader aspects of customer service and financial product offerings.

HONG KONG BANKING SECTOR 2023 Year-end Review and Priorities for 2024

The HKMA’s strategies, stretching from 2023 to 2024, encompassed developing and updating policies, standards, and guidelines to ensure that customers’ rights were staunchly protected and that the banking services offered were fair and transparent.

The authority’s efforts in elevating anti-money laundering (AML) practices and combating financial crimes using advanced analytics and artificial intelligence underscored a holistic approach to maintaining the financial system’s integrity and promoting customer confidence.

Advancing sustainable banking

HONG KONG BANKING SECTOR 2023 Year-end Review and Priorities for 2024

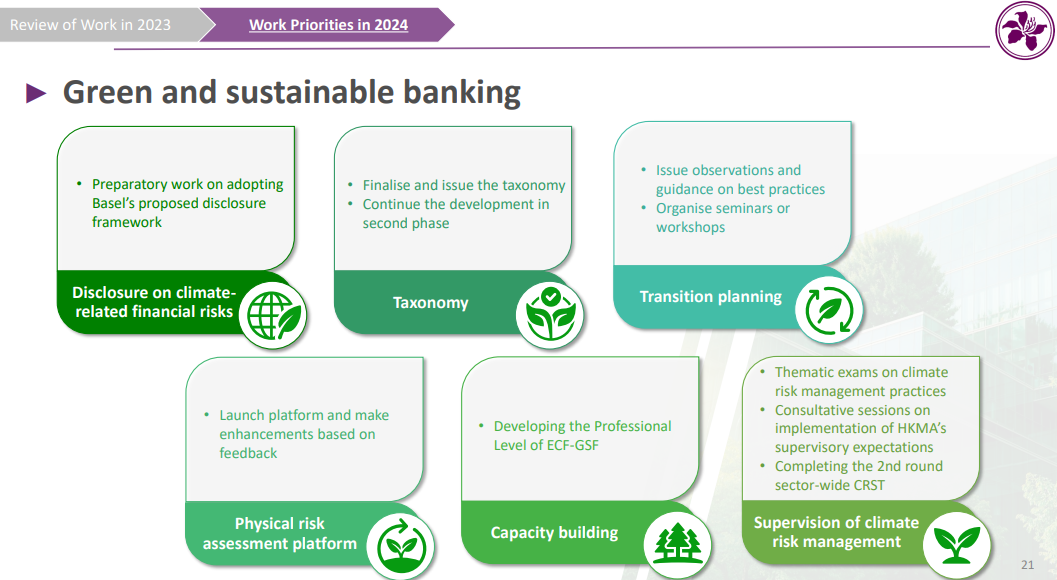

The period also witnessed an intensified focus on integrating sustainability into the banking sector’s ethos. The HKMA’s supervision of banks’ climate risk management, exemplified by the launch of the second round of the climate risk stress test with an enhanced framework in 2023 and the subsequent efforts in 2024 to solidify these practices, reflected a strategic alignment with global efforts to combat climate change.

The preparatory work undertaken in adopting Basel’s proposed disclosure framework, finalising the taxonomy, and issuing observations and guidance on best practices indicated a sector aligning its operational ethos with sustainability principles.

The HKMA’s initiatives were not just about compliance. Still, they demonstrated a vision of the banking sector as a catalyst for channelling funds into sustainable projects and playing a central role in the global transition to a low-carbon economy.

Hong Kong’s leap forward in fintech and supervisory technologies

Throughout 2023 and into 2024, Hong Kong solidified its reputation as a vibrant fintech hub.

Initiatives such as the exploration of Generative AI (GenAI) in Supervisory Technology (Suptech) and the rollout of the New Fintech Promotion Roadmap underscored a dynamic approach to integrating technological innovations into the financial sector.

HONG KONG BANKING SECTOR 2023 Year-end Review and Priorities for 2024

In 2024, the HKMA will continue strengthening its fintech infrastructure, enhancing advanced analytics capabilities, and solidifying Hong Kong’s position at the forefront of fintech innovation.

The authority’s unwavering commitment to fostering an environment conducive to fintech development was evident in its continuous efforts to enhance advanced analytics capabilities and adapt to the evolving digital landscape.

This ensures that Hong Kong’s banking sector in 2024 remain at the cutting edge of financial services and continues to provide innovative, efficient, and consumer-friendly banking solutions.

Strategically navigating change

The combined efforts and achievements of 2023 and 2024 were emblematic of a banking sector that was not merely reactive but was strategically poised to anticipate and navigate the complexities of a rapidly evolving financial landscape.

The HKMA’s guidance and the industry’s proactive adherence to principles of resilience, consumer protection, sustainability, and innovation positioned Hong Kong’s banking sector to confront emerging challenges and thrive and set benchmarks for global banking standards.

As the world grappled with new challenges and opportunities, the sector’s accomplishments during this period underscored its readiness to embrace the future, ensuring that Hong Kong’s banking industry continues to be synonymous with robustness, competitiveness, and social responsibility.

Featured image credit: Edited from Unsplash