6 Ways Hong Kong’s e-HKD Pilot Initiative Explores the Future of Currency

by Johanan Devanesan November 21, 2023As part of its forward-looking “Fintech 2025” strategy, the Hong Kong Monetary Authority (HKMA) is preparing for the advent of central bank digital currencies (CBDCs), aiming to enhance Hong Kong’s capacity to issue CBDCs at both wholesale and retail levels, thereby stimulating financial innovation within the region.

The HKMA commenced its exploration into retail CBDCs with Project e-HKD in 2021, diving into the global conversation with active participation in cross-jurisdictional collaborations. “Given the plethora of convenient retail payment options in Hong Kong, an e-HKD would need to add unique value to the current payment ecosystem, for instance, by providing new or innovative use cases,” reflects the authority.

e-HKD Pilot Programme Tests the Waters with Industry Collaboration

Adopting a practical use-case driven methodology, the HKMA initiated the e-HKD Pilot Programme in November 2022 under Rail 2 of its strategic plan. This programme is critical for exploring commercially viable applications for e-HKD in partnership with the industry. The programme has attracted submissions from 16 firms across the financial, payment, and technology sectors to participate in its Phase 1.

The submitted use cases are diverse, encompassing six distinct categories: full-fledged payments, programmable payments, offline payments, tokenised deposits, settlement of Web3 transactions, and settlement of tokenised assets. These categories represent the potential scope of e-HKD’s application, indicating the HKMA’s commitment to integrating innovative technology with everyday financial transactions.

Versatile, Full-Fledged Payment Solutions

The programme’s first case study, involving HSBC, demonstrates e-HKD’s capability as a comprehensive payment method, mirroring the convenience of cash, credit cards, and electronic payments.

The use of a private blockchain for transactional processes underscores the potential for secure, swift settlements, enhancing the efficiency of everyday transactions.

Programmable Payments and Smart Contracts

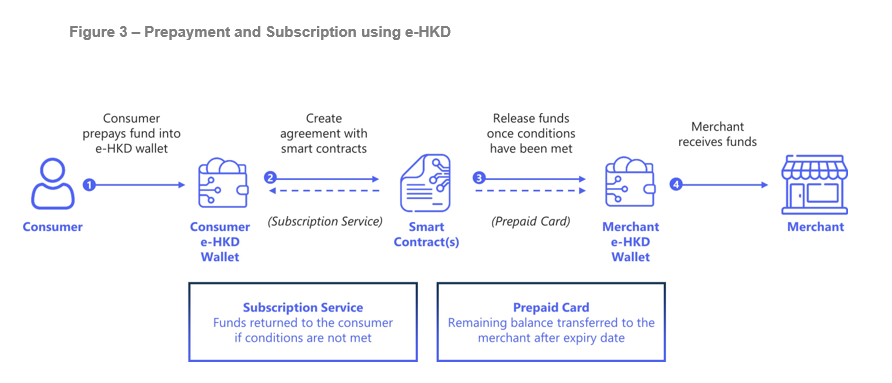

The second case centers on programmable e-HKD. This approach leverages smart contract technology to establish a more secure and trust-based environment for consumer transactions, particularly in the context of prepayments in the retail sector.

This use case, explored by China Construction Bank (Asia) and Bank of China (Hong Kong), involves programmable e-HKD to bolster consumer protections through “retail escrow” products, highlighting the versatility of smart contracts.

Bridging the Digital Divide with Offline e-HKD Transactions

Recognising the diverse demographic of Hong Kong, where digital literacy varies, the programme has piloted offline e-HKD transactions. Standard Chartered Bank, Giesecke+Devrient, and ICBC (Asia) have focused on enabling e-HKD transactions through both digital and physical means, exploring the use of technology like near-field communications (NFC) for secure offline transactions.

Their pilots focused on secure, offline transactions using NFC technology, integrating e-HKD within both smartphone wallets and physical smart cards. This ensures that the benefits of digital currency are accessible to all, regardless of their comfort with technology.

Tokenised Deposits and Web3 Integration

The fourth case study, undertaken by Visa, Hang Seng Bank, and HSBC, blurs the lines between tokenised deposits and e-HKD, offering insights into how these two concepts can coexist and complement each other within the same ecosystem. The three pilot participants studied and tested the atomicity and interoperability of various payment scenarios.

Furthermore, Mastercard’s pilot into the integration of e-HKD with Web3 transactions, particularly involving NFTs, opens a new frontier for digital currency applications beyond traditional financial markets. Mastercard’s pilot explored the “wrapping” of e-HKD for use in non-native blockchains, simulating transactions involving physical goods and corresponding NFTs.

Real Estate and Credit Innovations

The sixth case, explored by Fubon Bank and Ripple, delves into the realm of real estate, demonstrating how e-HKD can be used in innovative credit solutions like home equity lines of credit.

This pilot involved using property lien tokens as collateral for residential mortgage loans, highlighting the potential for digital currencies in streamlining and securing complex financial transactions such as property mortgages.

Future Prospects and Collaborative Approach

The completion of Phase 1 of the e-HKD Pilot Programme has shed light on the versatile applications of e-HKD, setting the stage for further exploration. The next phase aims to expand upon these initial successes, delving deeper into selected pilots to address business and implementation challenges.

Key areas of interest will include enhancing transaction efficiency, expanding accessibility, and exploring new use cases that could benefit from digital currency integration.

The success of the e-HKD Pilot Programme thus far can be attributed to the collaborative efforts of various stakeholders, including financial institutions, technology firms, academia, and government bodies. As the HKMA moves forward, it will continue to foster these partnerships, both locally and internationally. This approach is crucial for staying aligned with global trends and ensuring that Hong Kong remains at the forefront of digital currency innovation.

By laying the groundwork for a digital currency, the HKMA is not only positioning Hong Kong as a leader in financial technology but also ensuring the city remains at the cutting edge of payment solutions. The e-HKD Pilot Programme serves as a cornerstone for this venture, heralding a new era in digital finance.