In 2023, Hong Kong’s fintech landscape continued to evolve, maintaining its position as a significant player in the global financial sector.

This thriving metropolis hosts a dynamic ecosystem comprising over 800 fintech companies, 3,900 startups, and ten unicorn companies.

With a blend of innovation, regulatory support, and a burgeoning startup ecosystem, Hong Kong’s fintech sector experienced a year of significant milestones and transformative developments.

Extensive regulatory support

Throughout this year, the Hong Kong Monetary Authority (HKMA) introduced several crucial initiatives to promote greater fintech adoption while ensuring stability and integrity.

In alignment with the regulator’s “Fintech 2025” strategy, the HKMA launched a new Fintech Promotion Roadmap in August 2023. This roadmap outlined critical initiatives aimed at promoting the adoption of fintech in various sectors, including wealthtech, insurtech, greentech, artificial intelligence (AI), and distributed ledger technology (DLT)

The HKMA Roadmap includes establishing a ‘fintech knowledge hub’, which will act as an interactive directory connecting regulators, institutions, and fintech service providers.

The roadmap will also serve as a blueprint to plan to host regular events like Hong Kong Fintech Week, hands-on seminars, and discussion forums to foster stakeholder collaboration and ensure a well-calibrated regulatory environment that encourages innovation. The guidance will cover all adoption aspects, from initial ideation to implementation and risk management.

In addition to active engagement, the HKMA has established working groups to assess the risks and ethical considerations surrounding the adoption of AI and big data in finance this year. Their Fintech Cross-Agency Coordination Platform facilitates sharing knowledge between regulators regarding emerging services.

e-HKD Pilot Programme

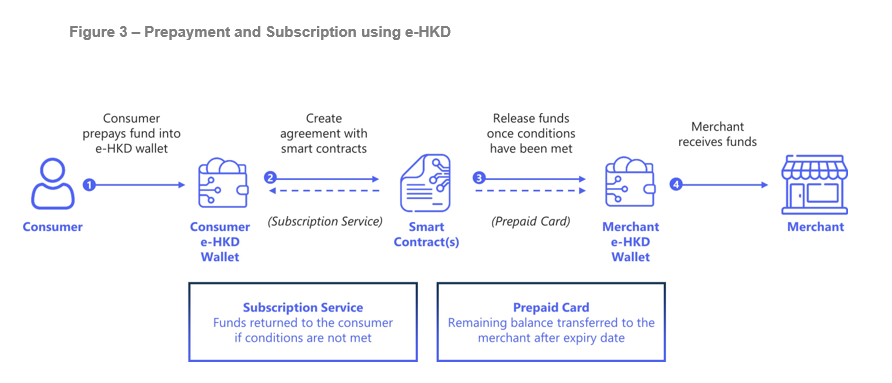

A significant development in 2023 was the successful completion of Phase 1 of the e-HKD Pilot Programme by the HKMA in November. This phase explored innovative use cases such as online payments, tokenised real estate assets, loyalty programs, and NFT trades.

To mark this milestone, a comprehensive assessment report was released in preparation for Phase 2, scheduled to commence in 2024, primarily focusing on commercialising viable use cases.

Participants included HSBC, which conducted tests for e-HKD payments on private blockchains for transaction settlement, while Mastercard simulated the use of e-HKD on its network for purchasing NFTs.

Phase 2 aims to delve deeper into the potential applications of e-HKD, further exploring its practical benefits and implications for Hong Kong’s financial system.

Besides e-HKD, Hong Kong has also collaborated with China to test the digital yuan e-CNY through banks such as Bank of China (Hong Kong), HSBC, Hang Seng Bank, and Standard Chartered.

This collaboration sets the stage for seamless cross-boundary commerce between mainland China and Hong Kong using Central Bank Digital Currencies (CBDCs) and interconnected QR codes.

FPS x PromptPay QR Payment Service

Eddie Yue, Chief Executive of the Hong Kong Monetary Authority (L) and Dr Sethaput Suthiwartnarueput, Governor of the Bank of Thailand (R)

Hong Kong and Thailand jointly launched the FPS x PromptPay QR Payment service in December. This collaborative effort connects Hong Kong’s Faster Payment System (FPS) with Thailand’s PromptPay, creating a seamless cross-border payment solution.

This initiative effectively bridges the two economies, enabling real-time, cross-border transactions that are convenient and cost-effective.

For instance, a user in Hong Kong can effortlessly scan a QR code to make payments at any of Thailand’s eight million PromptPay merchants. Conversely, Thai visitors in Hong Kong can use PromptPay to make payments at approximately 50,000 FPS merchants that accept QR payments.

Tokenised Government Green Bond

In April 2023, the HKMA issued the world’s first tokenised government green bond of HK$800 million, leveraging Distributed Ledger Technology (DLT). This groundbreaking approach to bond issuance set a new standard in the financial world, enhancing efficiency and transparency.

A subsequent report provided valuable insights and a blueprint for future tokenised bond issuances.

Looking ahead, the HKMA is preparing to launch a second round of tokenised green bonds in the coming year. This endeavour also involves exploring the potential of blockchain technology to streamline the entire lifecycle of bond issuance, from creation to redemption.

Market developments and trends: Virtual Wealth and Insurance

Hong Kong has witnessed a high adoption rate of digital payment services in 2023. A PolyU Asklora Fintech Adoption Index in April 2023 revealed that 74 percent of respondents used at least two fintech services, with over 90 percent adopting digital payments.

Adoption rates for specific services included 57 percent for Virtual Wealth, 55 percent for Virtual Bank, and 41 percent for Virtual Insurance.

As of 9 May 2023, the Hong Kong government has offered 45 grants to enterprises and organisations across different sectors. The 2023-24 budget aligns with national development strategies and Hong Kong’s role in fostering fintech innovation and technology enhancement in the city.

The Hong Kong government has supported fintech growth through grant and funding initiatives. This includes allocating HK$50 million to develop the Web3 ecosystem and actively fostering an environment conducive to fintech innovation and development.

Hong Kong currently has three sandboxes for the banking, insurance, and securities sectors to promote the development of mainland fintech companies in the region.

As of the end of March 2023, pilot trials of 283 fintech initiatives were allowed in the Financial Sandbox Scheme. Additionally, banks have engaged in 203 trial cases in collaboration with tech firms.

Emerging developments: Virtual Assets

In January 2022, the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA) introduced guidelines for virtual assets.

These guidelines were expanded in October 2023, imposing a 10 percent cap on virtual asset investments in discretionary accounts and enhancing oversight for advisory services.

On 23 May 2023, the SFC published its Consultation Conclusions, establishing regulatory requirements for Virtual Asset Trading Platform Operators (VATPs).

Effective 1 June 2023, this new regime opened VATP services to retail investors under strict investor protection measures. It included guidelines like trading, custody, token admission, AML/CFT measures, and more.

Additionally, the SFC introduced lists of licensed VATPs and applicants, aiming for transparency and clarity in this evolving sector. Among the lists are licensed VATPs, including OSL Digital Securities Limited and Hash Blockchain Limited, and VATP applicants, such as Hong Kong BGE Limited and Victory Fintech Company Limited.

Amidst these regulatory developments, April 2023 saw ZA Bank emerge as the first virtual bank in Hong Kong to extend crucial banking services to Web3 enterprises.

Fintech collaboration

Hong Kong continued to foster fintech innovation and collaboration both domestically and internationally.

Prominent events like Hong Kong Fintech Week 2023, HKMA Investment Summit, and the Global Fast Track programme showcased the city’s vibrant fintech ecosystem.

Furthermore, Hong Kong strengthened its fintech partnerships with mainland China, Guangdong-Hong Kong-Macao Greater Bay Area (GBA), Thailand, and Singapore to promote cross-border fintech cooperation.

A notable example of this growing fintech collaboration is Project Sela. This project is a joint venture between the BIS Innovation Hub Hong Kong Centre, the Bank of Israel (BoI), and the Hong Kong Monetary Authority (HKMA).

The primary goal of Project Sela is to test the viability of a secure and easily accessible retail Central Bank Digital Currency (rCBDC) as a proof of concept. This initiative builds on the Bank of Israel’s ongoing digital shekel project and leverages the cybersecurity expertise of the HKMA.

Looking towards 2024

The year 2023 marked a significant phase in the evolution of Hong Kong’s fintech sector.

The city-state’s strategic approach, characterised by comprehensive regulatory measures, vibrant market growth, and technological progress, has contributed to developing a dynamic fintech landscape.

This progression has reinforced Hong Kong’s status on the global stage as a prominent player in the fintech industry and established a solid groundwork for ongoing advancement and innovation in this field.

Looking ahead to 2024 and the future, Hong Kong appears well-positioned to continue its journey as a leading fintech innovation and excellence hub.

Featured image credit: Edited from Freepik