This year’s PwC Global CBCD Index is seeing the addition of new countries into its ranking of the world’s most advanced retail central bank digital currency (CBDC) projects, with India, Japan and Hong Kong joining the list and leading the way for CBDC in Asia.

Each year, PwC releases findings of an analysis on central banks’ digital currency efforts, reviewing the different projects that are being conducted worldwide. The PwC Global CBDC Indexes measure and rank both retail and wholesale CBDC projects’ level of maturity based on published speeches and gauges general public interest using Google Trends and Baidu Index data.

Top 10 retail CBDC projects, Source: 2023 PwC Global CBDC Index, Nov 2023

Results from this year’s research show that India is leading the way in retail CBDC development with its Digital Rupee project and tops the 2023 Top 10 Retail CBDC Projects.

India is currently undertaking both retail and wholesale CBDC pilots, which the government launched in December and November 2022, respectively.

These efforts aim to tap into the promises of improved efficiencies in the inter-bank market, cost savings, and enhanced settlement risk management. As of its retail CBDC project, the key driver is the shift in the global payments landscape, including the growth of private digital currencies, and the vast majority of global central banks exploring potential CBDCs.

As of July 2023, 13 banks were participating in the retail CBDC pilot. The government hopes to launch the digital currency at the national level by the end of the year.

Besides India, Japan is another jurisdiction that made it into the top ten retail CBDC list this year, taking the fourth position for the progress the government has made in its Digital Yen efforts.

The Bank of Japan launched a pilot program for the Digital Yen in May 2023, focusing on conducting simulated transactions with private entities in a test environment. This followed in July by the establishment of a CBDC forum for private businesses to engage in retail payments or related technologies to participate in the discussion.

In addition to the top 10 retail CBDC index, Japan also made it into the wholesale CBDC ranking, taking the 10th position for its efforts in the area.

Another freshly added jurisdiction into the ranking is Hong Kong, taking the 8th position in the 2023 retail CBDC index.

Over the past year, the Hong Kong Monetary Authority (HKMA) has made considerable strides in retail CBDC research. In September 2022, the authority released the roadmap to issuing a retail CBDC, the e-HKD, which was subsequently followed in November 2022 by the launch of a pilot program for the digital currency.

Phase 1 of the pilot program, which wrapped up in October 2023, saw participating firms and banks explore potential use cases, including fully fledged payments, programmable payments, offline payments, tokenized deposits, settlement of Web3 transactions and settlement of tokenized assets. Now in its Phase 2, the project is focusing on new use cases for the e-HKD scheme as well as delving deeper into select pilots from Phase 1.

Separately, the HKMA is collaborating with the Bank for International Settlements Innovation Hub and the Bank of Israel on Project Sela, an initiative that aims to explore the technical viability of a retail CBDC with an architecture that can support non-bank intermediaries to directly connect to the central bank’s CBDC ledger.

The jurisdiction is also conducting research on wholesale CBDC, working alongside the Bank of Thailand, the Central Bank of the United Arab Emirates and the Digital Currency Institute of the People’s Bank of China on mBridge, a project that’s experimenting with a multiple-CBDC common platform for wholesale cross-border payments.

Project mBridge is currently at the minimum viable product (MVP) development phase and the HKMA aims to launch the MVP in 2024 to pave the way for a production-ready system.

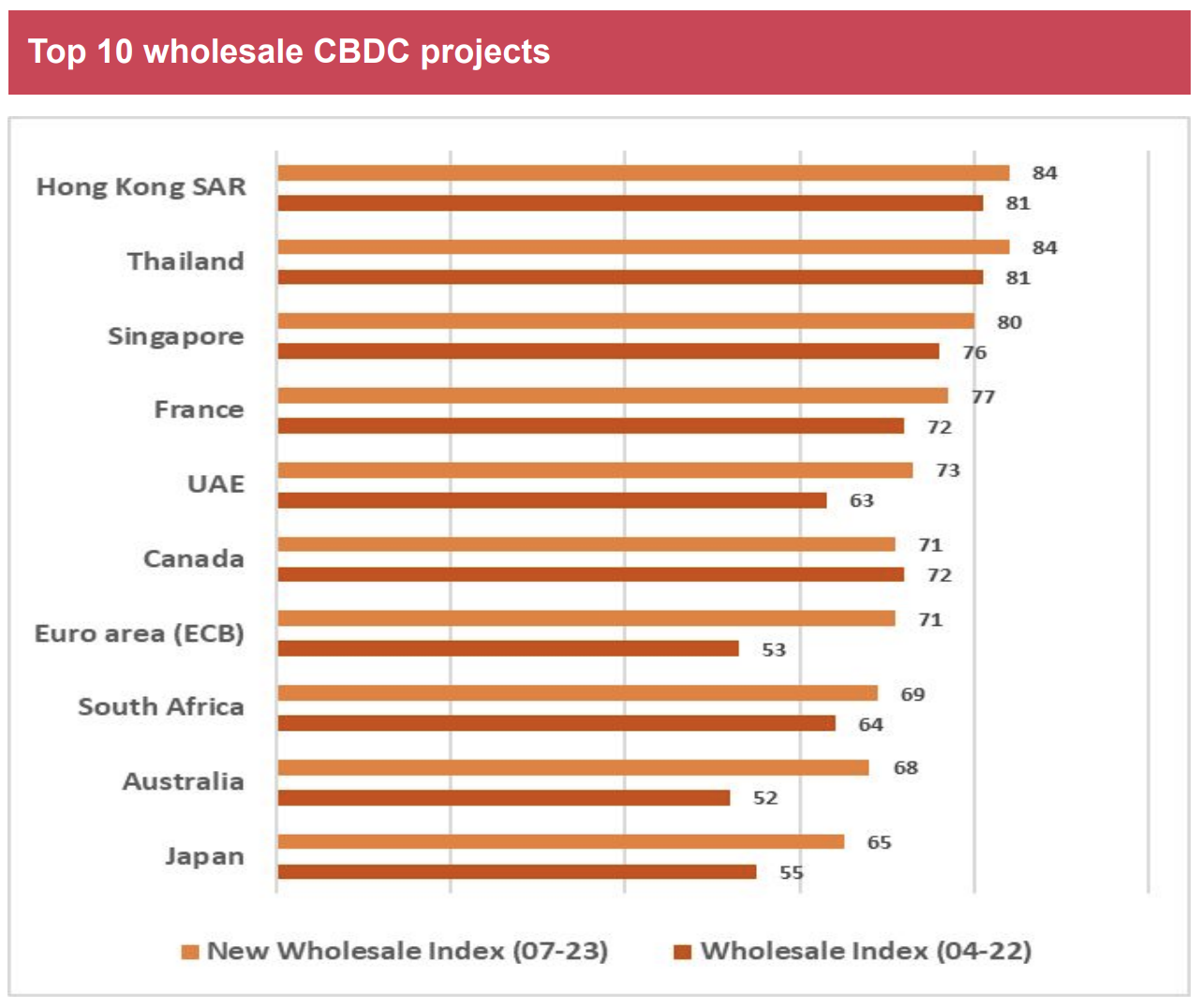

Hong Kong’s wholesale CBDC efforts are putting the city at the top of the ranking in terms of development, ranking first in the 2023 Top 10 Wholesale CBDC Projects list, ahead of Thailand, Singapore and France.

Top 10 wholesale CBDC projects, Source: 2023 PwC Global CBDC Index, Nov 2023

In 2022 and 2023, central banks from around the world continued to actively engage in the development of retail and wholesale CBDC. Findings of a survey conducted in late 2022 by the Bank for International Settlements (BIS) reveal that the proportion taking part in some form of CBDC work has risen to 93%, up from 90% the prior year.

In addition, the research shows that most central banks see potential value in having both a retail CBDC and a fast payment system, and that there could be 15 retail and nine wholesale CBDCs publicly circulating in 2030.

Their motivations are multiple and varied, and include drivers such as the decline in cash use, financial stability, monetary policy implementation, domestic and cross-border payments efficiency, payments safety and robustness, financial inclusion, competition, innovation and the increase of privately issued digital assets, including stablecoins.

The PwC Global CBDC Index and Stablecoin Overview 2023 report, released in November, aims to provide an overview of recent CBDC development but also looks at the stablecoin market, outlining the evolution of the industry and the key events observed over the past year.

It notes that stablecoins, which are cryptocurrencies designed to maintain a stable value by pegging their worth to the value of other assets such as fiat currencies, have evolved beyond serving as a refuge for digital asset during volatility, to becoming a significant part of the digitally native world.

These cryptocurrencies are now being used in diverse instances and are being applied to support digitally native markets, facilitate payments, and empower decentralized finance services, among many other use cases.

But despite their growth and market potential, stablecoin arrangements face challenges, including regulatory uncertainties and scalability concerns, the report says.

Some of these challenges are being tackled by global regulators which are progressively maturing their oversight of stablecoins and the broader digital asset market. Notable developments in this regard include the New York Department of Financial Services guidance for US dollar-backed stablecoins released in June 2022, Singapore’s stablecoin legislation that was finalized in August 2023, and the European Union’s Markets in Crypto-Asset Regulation (MiCA) cross-jurisdictional framework, which is expected to enter into application in December 2024.

Featured image credit: edited from freepik