BIS, Hong Kong and Israel Collaborate on Project Sela for Secure Retail CBDCs

by Rebecca Oi October 12, 2023Central bank money has always been the bedrock of global monetary systems, providing a rock-solid foundation of security, impartiality, accessibility, and integrity. Traditionally, this has manifested in physical cash, tangible notes and coins.

Yet, in an era of accelerating digitalisation, the use of physical cash is in decline, giving rise to the exploration of retail Central Bank Digital Currency (rCBDC).

The concept of rCBDC represents a new addition to the world of public money, offering the potential to combine the stability of central bank money with the efficiency of digital transactions.

However, designing such a functional rCBDC platform comes with challenges. Central banks must strike a delicate balance between maintaining control over the system’s core functions and fostering an environment that encourages competition, innovation, and access through a network of intermediaries.

These questions give rise to alternative design possibilities, each with its unique set of considerations.

Unveiling Project Sela

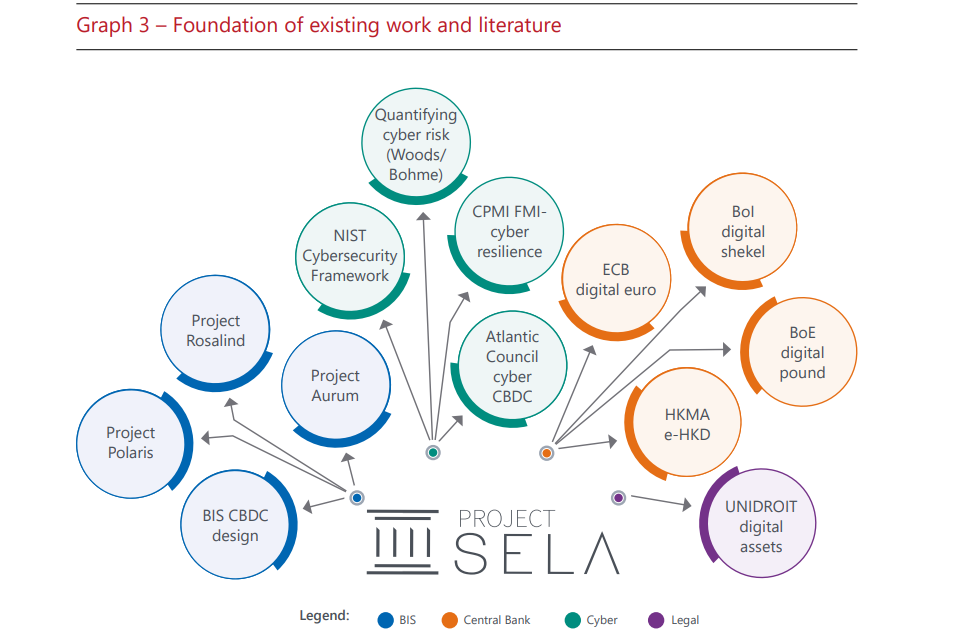

Enter Project Sela, a collaboration between the BIS Innovation Hub Hong Kong Centre, the Bank of Israel (BoI), and the Hong Kong Monetary Authority (HKMA).

At its core, Project Sela seeks to test the feasibility of a secure and accessible rCBDC proof of concept (PoC).

This ambitious initiative builds upon the ongoing work of the Bank of Israel’s digital shekel project and harnesses the cybersecurity expertise of the HKMA.

Maintaining the integrity and singleness of money within the broader economy is a paramount consideration for any rCBDC system. Within the framework of Sela, financial institutions (FIs) play a pivotal role in this regard.

FIs are entrusted with managing end users’ deposit accounts, facilitating the seamless conversion of rCBDC into bank deposits and physical cash, and ensuring the continued interchangeability of rCBDC with other forms of regulated currency. This strategic orchestration upholds the harmony of the monetary landscape.

Project Sela also benefits from the contributions of private-sector service providers, including FIS, M10 Networks, Clifford Chance, and Check Point Software Technologies, ensuring a comprehensive exploration of this groundbreaking concept.

A crucial objective of Project Sela is to tear down the barriers to entry, creating an environment where competition and innovation can flourish organically. To achieve this, the project introduces a novel category of rCBDC payment service providers known as access enablers (AEs).

AEs revolutionise the landscape by offering customer-facing rCBDC services without holding end users’ rCBDC or maintaining liquidity on their balance sheets.

This approach not only widens accessibility but also fuels heightened competition and innovation, breathing new life into the ecosystem.

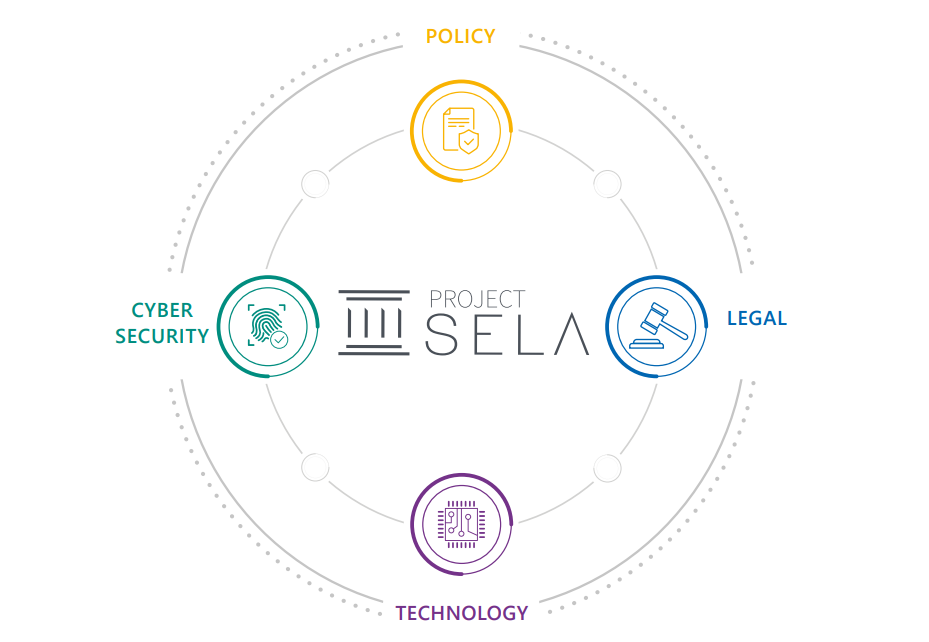

Four pillars of success

Project Sela’s approach is underpinned by four fundamental pillars: policy, legal, cybersecurity, and technology. Each pillar is crucial in shaping the rCBDC ecosystem and ensuring its viability.

1. Regulatory and privacy considerations

While Project Sela promotes accessibility and innovation, it also addresses critical regulatory and privacy concerns.

AEs are responsible for complying with customer due diligence and transaction screening requirements, ensuring that the rCBDC system adheres to anti-money laundering (AML) and counter-terrorist financing (CFT) regulations.

At the same time, proper data management and privacy safeguards are implemented to protect user information and ensure the ecosystem’s security.

2. Legal considerations

Project Sela’s legal framework is essential for ensuring compliance with relevant laws and regulations. One of the key legal considerations is the definition of “control” over rCBDCs. In the Sela ecosystem, AEs act as intermediaries and are not liable for returning customer funds, nor do they hold customer funds on their balance sheets.

Defining when an rCBDC is considered “held” is critical, and this definition may vary across jurisdictions. The UNIDROIT Principles on Digital Assets and Private Law provide a valuable framework for assessing who holds the rCBDC.

According to these principles, control includes the exclusive ability to prevent others from obtaining benefits from the digital asset, the ability to obtain such benefits, and the exclusive ability to transfer these abilities to another person.

3. Cyber considerations

Project Sela places paramount importance on cybersecurity, especially for its digital financial infrastructure like rCBDCs. The project employs multifaceted security measures, including robust authentication, secure enclaves, and advanced encryption, to safeguard user data and mitigate risks.

Hash functions ensure the uniqueness of rCBDC accounts, though additional privacy measures are necessary. Personally Identifiable Information (PII) is distributed and minimised to prevent concentration.

Key cryptography, ensures secure communication, and programmability is carefully managed to limit execution on the ledger, reducing cyber threats. Network isolation, firewalls, cloud-native protection, and a security operations centre enhance overall cybersecurity and resilience.

4. Technology Implementation

In the realm of technology and Proof of Concept (PoC) implementation, Project Sela is committed to a multifaceted approach encompassing both accessibility and cybersecurity. The primary objective is to maximise accessibility for end-users and service providers while simultaneously addressing critical cybersecurity concerns through thoughtful software design.

This balance ensures users have seamless access to the rCBDC platform while maintaining the highest security standards.

Project Sela places great importance on preserving the cash-like attributes that users value, such as the absence of credit risk, broad accessibility, safety, instant settlement, low operational costs, and safeguarding user privacy vis-à-vis the central bank.

Lastly, the project embraces the advantages of digitalisation, enabling frictionless, location-independent payments with instant liquidity and programmability, offering a robust and efficient digital counterpart to physical cash.

Policy-Driven Accessibility

At its core, Project Sela seeks to foster an accessible and competitive rCBDC ecosystem catering to various use cases. A pivotal policy goal is to reduce barriers to entry for rCBDC service providers and streamline rCBDC processes among public and private entities.

This approach encourages a diverse range of intermediaries to compete creatively, enhancing services for a broad user base. Introducing a novel intermediary known as the access enabler (AE) plays a pivotal role in this strategy.

Access enablers (AEs) offer customer-facing rCBDC services without the need to “hold” end-users rCBDC at any point in the transaction process. By facilitating direct settlements on the central bank’s balance sheet, AEs mitigate credit risks.

Although this new intermediary model may require tailored regulation, it could decrease financial regulatory burdens, reducing friction and operational costs for payment service providers within the rCBDC ecosystem.

The promising path forward

Project Sela sets a precedent that an accessible, competitive, and innovative rCBDC ecosystem does not inherently pose more significant cybersecurity risks.

It introduces the concept of access enablers, innovative intermediaries that lower barriers to entry, foster competition, and enhance rCBDC payment services. This promising approach and meticulous preventative architecture design demonstrate that cybersecurity risks can be effectively mitigated.

The project identifies several areas ripe for future exploration. Similar to existing open banking regulations, regulatory frameworks and business viability offer fertile ground for examination.

Additionally, interoperability with existing payment systems, such as Real-Time Gross Settlement (RTGS) and fast payment systems, warrants further study.

Automation’s advanced functionality, cybersecurity implications, privacy-enhancing technologies, and comprehensive cybersecurity dimensions are ripe for future research.

As Project Sela continues to pave the way for accessible and secure rCBDC ecosystems, it invites us to reimagine the future of digital finance.