Imagine a world where you can access all your banking needs at your fingertips without ever having to step into a physical branch. That’s the promise of virtual banks in Hong Kong – a new breed of digital-only financial institutions redefining how we think about banking.

Leading the way in Asia, Hong Kong’s virtual banks have set a precedent for the region, demonstrating how technology can transform financial services.

Virtual banks have disrupted the traditional banking model, offering new opportunities for consumers and businesses. By harnessing advanced technology, they have optimised financial processes, reduced costs, and broadened access to banking services.

However, virtual banking in Hong Kong faces challenges. These digital entrants compete with established traditional banks that have swiftly improved their digital services.

Additionally, virtual banks must navigate intricate regulations while building trust among consumers who may be reluctant to adopt branchless banking.

List of virtual banks in Hong Kong

Virtual banks signify a dramatic departure from traditional banking. This innovation emerged prominently in Hong Kong with the issuance of the first virtual banking license in 2018.

Hong Kong boasts eight licensed virtual banks, each offering unique services tailored to different market segments.

These banks include ZA Bank, Airstar Bank, WeLab Bank, Livi Bank, Mox Bank, Ant Bank, PingAn OneConnect Bank, and Fusion Bank.

Despite their focus on technology, these banks must accept all clients, emphasising inclusivity without minimum account balances, starkly contrasting many traditional banking norms.

ZA Bank

![]()

ZA Bank co-owned by mainland online insurer ZhongAn Online P&C Insurance and Sinolink Group was the first virtual bank to soft launch in Hong Kong in 2019. It offers a variety of services, including personal and business accounts, multi-currency support, investment opportunities in US stocks, and services such as “Banking for Web3”.

Airstar Bank

![]()

A joint venture by Xiaomi Corporation and AMTD Group. Airstar Bank’s mission is to provide inclusive financial services, branding itself as the “Bank for Everyone”. It offers services to both personal and corporate clients, with features like rapid account opening processes, multi-currency accounts, and competitive loan products. It was the second virtual bank to launch in Hong Kong in June 2020

WeLab Bank

Owned by Hong Kong fintech company WeLab Limited, WeLab Bank began offering virtual banking services in July 2020. It provides a range of retail banking services for personal account users, including debit and credit cards, savings, loans, and more. WeLab Bank was the third virtual banking to open its doors to the public in July 2020.

Livi Bank

Co-owned by Jingdon Digits Technology, Bank of China (Hong Kong), and Jardine Matheson Group, started operating in August 2020 making it the 4th virtual bank to launch in Hong Kong. It offers both personal and business account services, along with virtual debit cards, loan services, and travel insurance.

Mox Bank

Supported by giants like Standard Chartered and PCCW, Mox focuses on retail banking with features like numberless cards and extensive app services. Mox Bank launched its pilot in April 2020 and subsequently fully opened its doors in September 2020

Ant Bank

![]()

Owned by Ant Group, an affiliate of the Chinese Alibaba Group, Ant Bank began offering its services in Hong Kong in September 2020. It provides both personal and business account services, with features such as dual currency accounts (HKD and USD), savings, fund transfers, and zero-cost loan applications for corporate clients.

Ping An OneConnect Bank

![]()

Ping An OneConnect Bank wholly owned subsidiary of Lufax Holding Ltd and a member of Ping An Insurance (Group) Company of China, Ltd. launched its pilot in June 2020. PAOB offers a broad spectrum of services, including business loans and savings products, backed by its solid financial technology framework. PAOB is also exploring AI and machine learning to enhance customer interactions and streamline operations.

Fusion Bank

Established in December 2020, Fusion Bank is owned by Tencent, Hong Kong Exchanges and Clearing, Hillhouse Capital and Perfect Ridge. Previously known as Infinium Limited, the virtual bank was soft-launched in September 2020, making it the eighth and final virtual bank in Hong Kong to fully launch its services to the Hong Kong public. It provides both personal and business banking accounts and is the first Hong Kong virtual bank to apply self-developed AI eKYC technology, streamlining the user application process.

What’s the difference between virtual banks and traditional banks?

The primary distinction between traditional online banking and virtual banking lies in the physical presence of branches. Traditional banks have extended their services to digital platforms while maintaining their physical locations, whereas virtual banks operate solely online.

This approach significantly reduces operational costs, allowing these savings to be passed on to customers in the form of lower fees, making virtual banking an attractive alternative for the digitally savvy consumer.

These banks are fully regulated under the Hong Kong Monetary Authority (HKMA), ensuring they meet stringent security standards and are covered by local deposit protection schemes. They are also mandated to maintain a head office in the region, ensuring a local footprint without branch networks.

Their services range from daily transactions and customer support to complex financial services; all facilitated online with robust security measures and under the protection of local government insurance schemes.

Since the initial excitement surrounding their launch has subsided, Hong Kong’s eight virtual banks have faced increasing competition from traditional banks, which continue to invest heavily in their digital banking capabilities as they strive to stay ahead of the curve.

Traditional banks have responded to virtual banks’ arrival by amplifying their digital transformation efforts to maintain their position as the preferred choice of banking service provider.

In particular, they aim to capture the younger, affluent, and digitally savvy demographic, and some traditional banks have made significant progress in this area.

There has also been a growing trend of traditional banks focusing more on their digital footprint by merging, relocating, and even closing some physical branches as customers’ needs can increasingly be met via digital means.

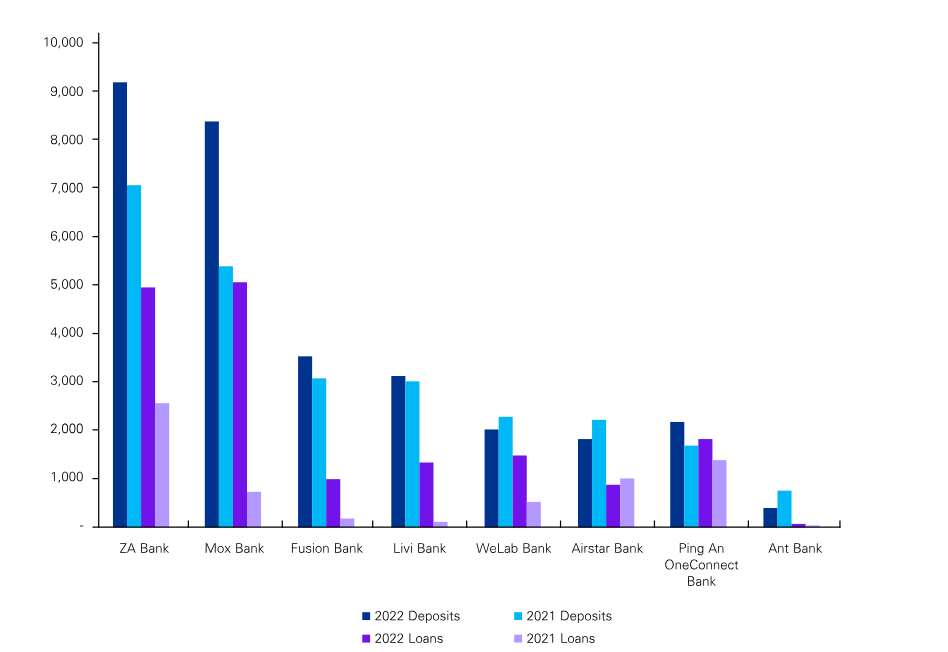

Even amid market challenges, virtual banks continued to see growth in the number of accounts opened in 2022, reaching 1.7 million as of October 2022. However, the growth rate was more muted than in 2021.

According to KPMG, the total number of accounts grew 42 percent from the fourth quarter of 2021 to the third quarter of 2022 (latest available data), compared to 186 percent from the fourth quarter of 2020 to the fourth quarter of 2021.

In financial performance in 2022, all virtual banks reported a loss before tax, albeit with slight improvements from the previous year’s results for six out of eight virtual banks.

Ping An OneConnect Bank and Airstar Bank had the best performance results relative to the other virtual banks, as indicated by the largest percentage decrease in loss before tax compared to 2021 (27 percent and 18 percent, respectively), while also reporting the smallest loss before tax in absolute terms. Their higher net interest margins notably drove this better performance.

The total combined gross loans offered by the virtual banks increased significantly from HK$6 billion in December 2021 to HK$16 billion in December 2022, as all virtual banks deployed more deposits into lending, evidenced by a higher overall loan-to-deposit ratio of 54 percent compared to 25 percent in the previous year.

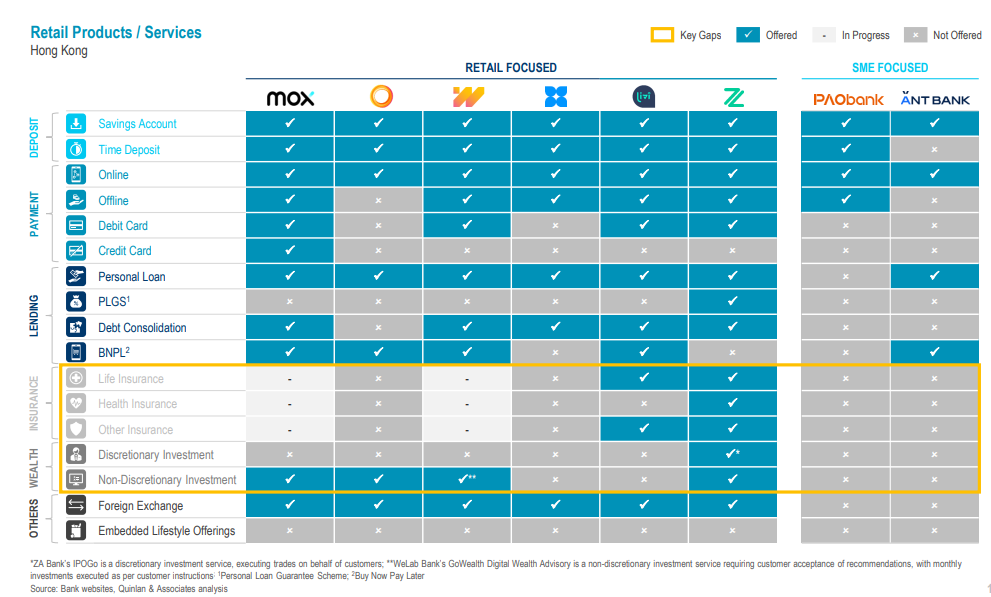

Virtual banking products and services in Hong Kong

In 2022, most virtual banks made efforts to solidify their brand identity and market positioning. ZA Bank, WeLab Bank, Mox Bank, and Ant Bank primarily cater to the mass retail market through new products and services such as credit card statement instalment programmes.

Meanwhile, Airstar Bank and Ping An OneConnect Bank aim to capture a slice of the market for lending to SMEs, particularly those that may find it challenging to meet traditional lending requirements.

For instance, Ping An OneConnect Bank partnered with an e-commerce company to launch Trade-Connect Loan, which extends pre-approved loans of as much as HK$5 million predominantly to export-import-oriented SMEs. Such loans can help to ease the financing needs of underserved or unserved smaller businesses in Hong Kong.

Moreover, ZA Bank, with the ambition of becoming the go-to bank for Web 3.0 crypto start-ups, has recently been pushing into transfers of crypto and fiat currencies by looking to offer token-to-fiat currency conversions with licensed exchanges.

ZA Bank has also been forging a path in international transfers. In partnership with a global technology company, it has become the first virtual bank in Hong Kong to offer international transfers with no foreign exchange mark-ups or hidden fees.

Virtual banks are also venturing into wealth management and insurance, capitalising on the rising trend of online distribution of such products and services. Younger customers, in particular, value the convenience of conducting research and purchasing investment and insurance products and services with just a few clicks.

Fusion Bank, WeLab Bank, and ZA Bank obtained the necessary licenses from the Securities and Futures Commission in 2022 to start offering customers wealth management products and services, while Livi Bank followed suit in early 2023.

ZA Bank and Livi Bank were granted an Insurance Agency License from the Insurance Authority to enable them to add fee-based insurance products and services to their offerings. More specifically, ZA Bank has collaborated with a fellow group company to offer health and life insurance products to customers.

At the same time, Livi Bank has leveraged its existing partnerships and network of shareholders to launch home and travel insurance products.

Challenges and opportunities for virtual banks in Hong Kong

Despite virtual banks’ potential in Hong Kong, they face challenges in attracting customer deposits, which serve as a critical foundation for their future growth and success.

Many virtual banks struggle with customer acquisition and deposit strategies, resulting in slow uptake and low deposit levels. Account dormancy is another key issue, with an average of 55 percent of registered users inactive.

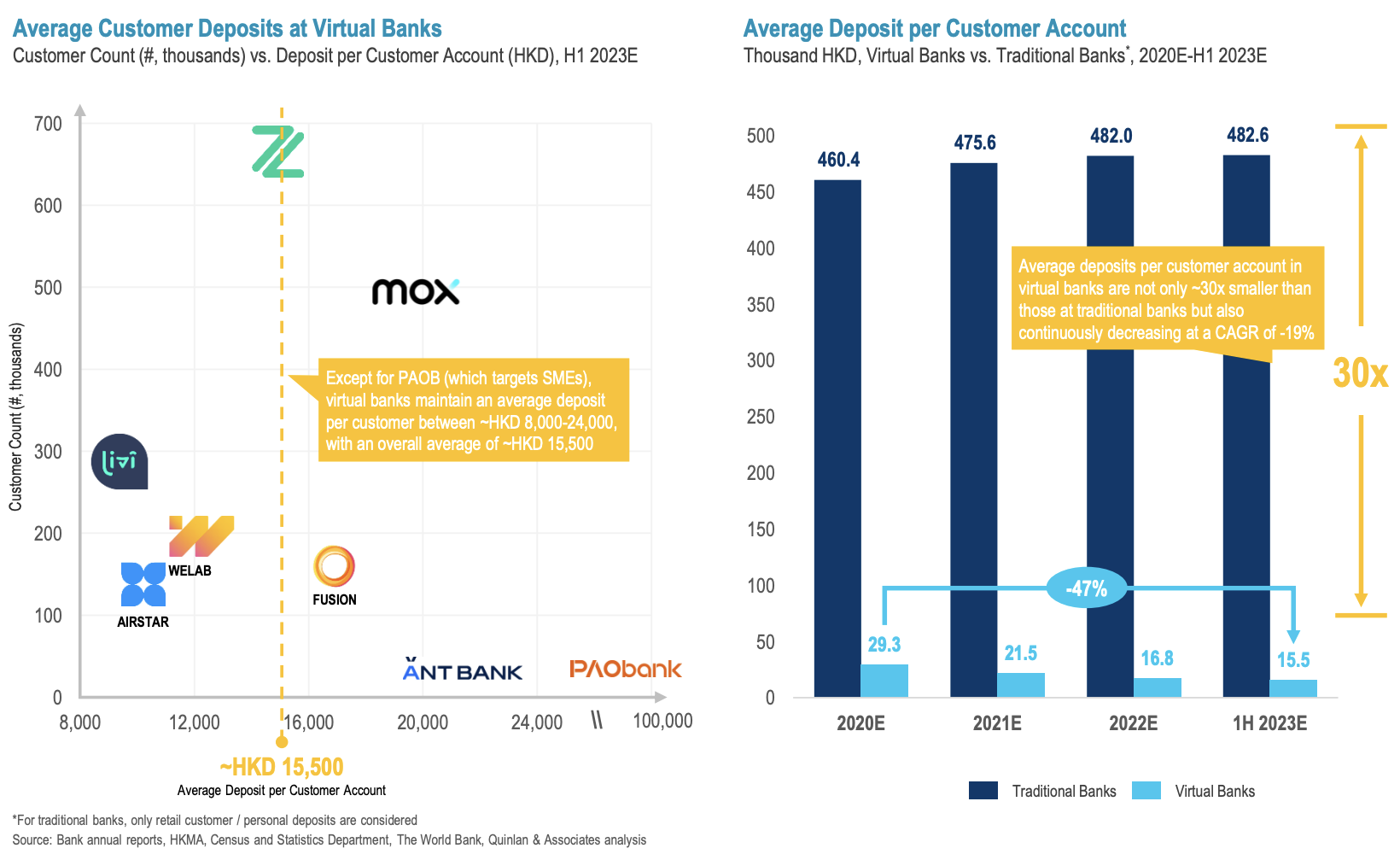

Average customer deposits at virtual banks, Source: Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks, Quinlan and Associates, Dec 2023

According to a report by Hong Kong strategy consulting firm Quinlan and Associates titled “Duel for Deposits: Crafting a Winning Strategy for Hong Kong’s Virtual Banks,” Hong Kong virtual banks had a combined 2.1 million customers in H1 2023. However, their customer base growth has slowed each year since their launch, from a remarkable 200 percent year-over-year (YoY) growth in 2021 to only 28 percent between 2022 and H1 2023.

The report also highlights that Hong Kong virtual banks’ deposits have sharply slowed. In H1 2023, Hong Kong’s eight virtual banks held HK$ 32.2 billion in customer deposits, increasing by just 11 percent from 2022’s HK$ 30.4 billion, against the 60 percent and 20 percent YoY growth rates recorded in 2021 and 2022, respectively.

This implies that after about three years of operations, Hong Kong’s virtual banks managed to capture only 0.2 percent of the city’s HK$ 15.4 trillion in total customer deposits.

The average deposit per customer account was also found to be lower at virtual banks than traditional banks, standing at HK$ 15,500 in H1 2023, against HK$482,600 at traditional banks.

Average deposits were not only 30 times smaller than those at traditional banks in H1 2023, but they also continued their downward trend, declining by a 19 percent compound annual growth rate (CAGR) between 2020 and H1 2023.

These weak performances can be partly explained by virtual banks’ narrower offerings and limited capabilities to address customers’ financial demands. These hurdles have led to considerable deposit attrition and prevented them from becoming customers’ primary accounts.

The research found that over 70 percent of customer deposits will leave virtual banks once promotion periods end, and about 85 percent of customers will not consider switching their primary accounts to virtual banks.

To address these challenges, virtual banks must tailor unique strategies for customers at different life stages, focusing on acquiring attractive customer segments, preventing deposit outflows, and creating new revenue streams.

Competition from traditional banks investing heavily in digital capabilities also poses a significant challenge for virtual banks.

However, opportunities for growth and differentiation exist. Some virtual banks have found early success in market positioning, catering to specific segments such as SMEs or the mass retail market.

Others are venturing into wealth management and insurance, capitalising on the rising trend of online distribution of such products and services.

Which virtual bank do Hong Kongers prefer?

In Hong Kong’s dynamic virtual banking landscape, brand recognition is paramount as consumers seek innovative financial solutions and a connection to banks aligning with their values.

According to YouGov BrandIndex data, virtual banks in Hong Kong experienced significant growth in brand equity metrics such as index score, consideration score, and ad awareness in 2023.

PAO Bank led the pack with the highest increase in index score, followed by Ant Bank and Airstar Bank. Mox Bank and ZA Bank maintained strong consideration scores, showcasing their prominence in the market.

Regarding ad awareness, Ant Bank and PAO Bank experienced considerable year-on-year growth, while Mox Bank and ZA Bank demonstrated resilience in sustaining brand visibility.

Embracing innovation and adaptability

The rise of virtual banking in Hong Kong has transformed the financial landscape, offering consumers and businesses innovative, accessible, and personalized banking experiences.

While challenges persist in attracting customer deposits and achieving profitability, virtual banks have the potential to drive financial inclusion and redefine the future of banking in the city.

As virtual banks continue to innovate, differentiate themselves, and adapt to customers’ evolving needs, they can capture a growing market share and shape the digital banking ecosystem.

By leveraging technology, data-driven insights, and strategic partnerships, virtual banks can create a vibrant and interconnected digital economy that offers users unparalleled value and convenience.

Virtual banks in Hong Kong’s path to sustainability lies in their ability to assert their brand identity, tailor strategies to different customer segments, and continuously push the boundaries of what is possible in digital banking.

As the virtual banking landscape matures and evolves, these innovative financial institutions will play a pivotal role in shaping the future of banking in Hong Kong and beyond.

Featured image credit: Edited from Freepik