Most Consumers Still Prefer Incumbent Banks Over Virtual Banks and Neobanks

by Fintech News Hong Kong September 21, 2020A recent report published by consulting firm EPAM Continuum outlined behaviors, expectations and motivations, with key findings suggesting that, despite recent innovations in financial services, the fundamental behavioral drivers of customers remain largely unchanged.

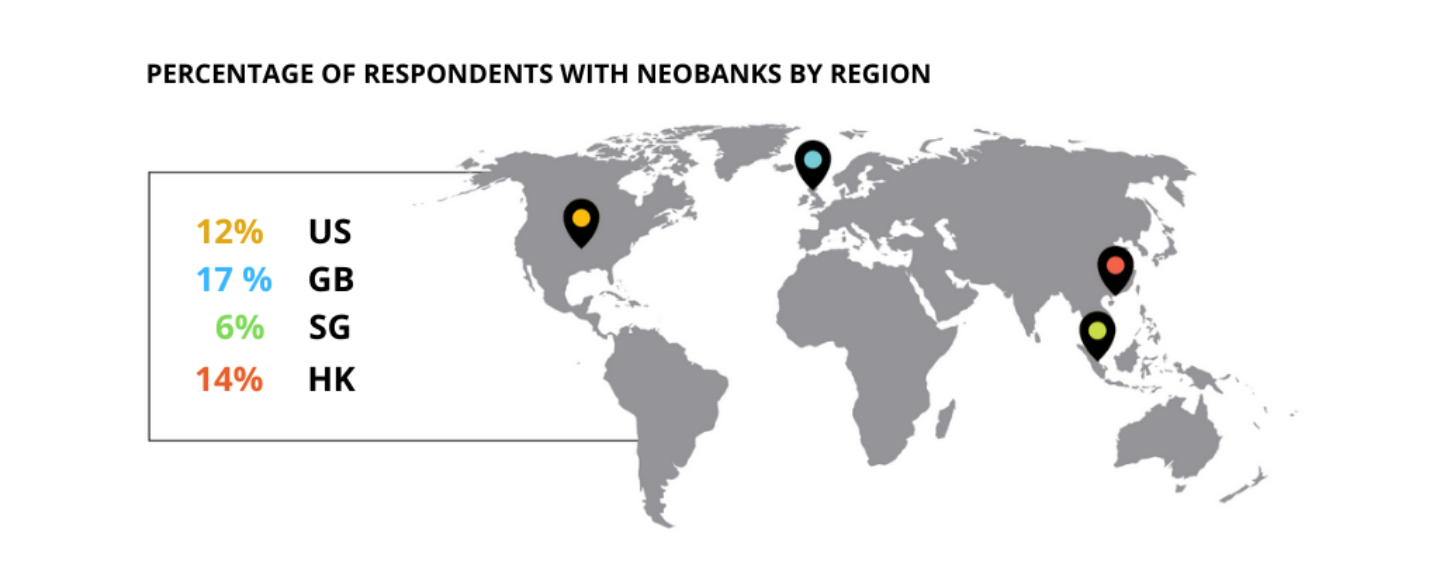

The report surveyed 4,500 people across key banking regions including the United Kingdom, the United States, Hong Kong and Singapore.

Key statistics from the research

The report said that for any radical change to happen, banks need to become more ubiquitous and have the ability to seamlessly integrate with the platforms and services that make up their customers’ personal digital ecosystem in order to bring banking to them – not the other way around.

Highlights of key emerging themes in the report

Key findings show that an overwhelming majority, 82%, are satisfied with their traditional banks. Only 4% of respondents are “slightly unhappy,” with just 1% “extremely unhappy.” While COVID-19 has had a strong impact on customer attitudes, with 50% of customers reassessing their banking needs in response to the pandemic, it has not influenced behaviors with customers behaving cautiously during this period of uncertainty and risk.

Despite paving the way for innovation, neobanks have yet to penetrate the market in a meaningful way and, as a result, face significant challenges in sustaining growth. According to EPAM’s survey, only 3% of all respondents use a neobank as their sole account—not in combination with other banks—whereas 14% use it in combination with one or more banks, with 5% of those using their neobank as the primary account.

For those who would consider switching banks, more than half of respondents would be tempted by value-add benefits, such as good interest rates, a sign-up bonus, cashback, or insurance. Developing a resonant brand and creating a strong customer experience are important elements of a competitive banking proposition, but that alone won’t be enough to convert customers at scale.

Banks that find a way to support and facilitate people’s lives in meaningful and purposefully differentiated ways will be well-placed to outperform the competition and drive sustained growth.

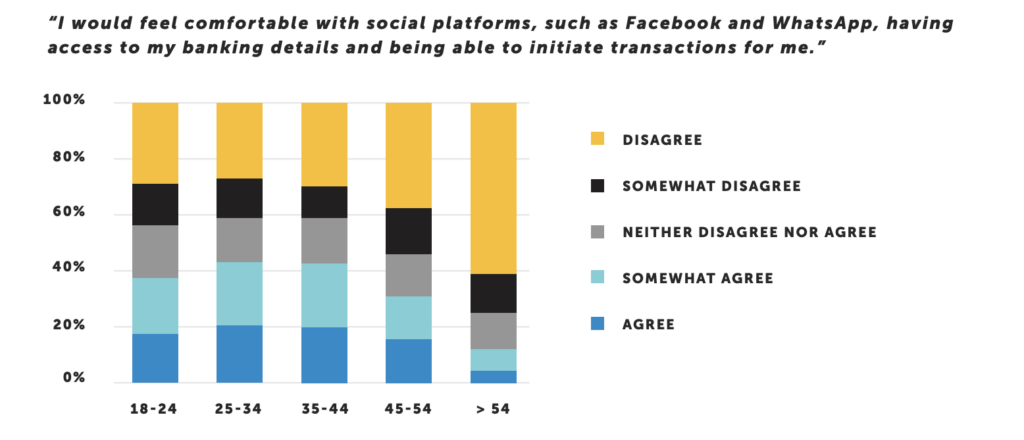

The survey shows that there is an openness to innovation, especially across certain age groups, with 40% of 18-44 year-olds open to banking through social platforms and intelligent assistants. It is not such a big leap for banks to consider meeting people where they spend most of their time—on social media.

In addition to creating the right products and services, they need to be offered and consumed with minimal friction. This means having a strong and visible presence in the channels where banks’ target customer segments are already active. The future is ubiquitous banking: bringing banking to the customer – not the other way around.