Posts From Fintech News Hong Kong

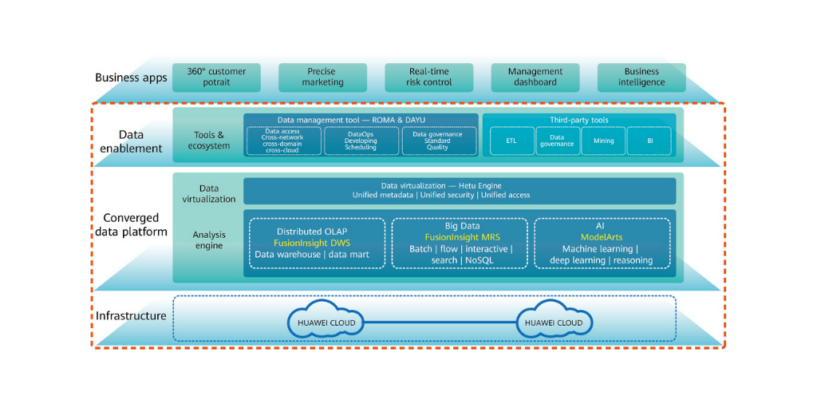

Financial Institutions Turn to Huawei’s Converged Data Lake Solution to Accelerate Banking Innovation

Like many other areas of the economy, the financial services sector is undergoing a data revolution. Every day, the global banking industry generates massive amounts of data by processing hundreds of billions of financial transactions as well as through interactions

Read MoreHKMA Highlights 4 Regtech Uses Cases During COVID-19 Pandemic

As the COVID-19 pandemic continues to profoundly disrupt the financial services landscape, technology holds to key to overcoming the operational challenges caused by the public health crisis, according to Hong Kong Monetary Authority (HKMA). In HKMA’s fifth issue of

Read MoreAll You Have to Know About the Asian Financial Forum 2021

The Asian Financial Forum, Asia’s premier thought leadership platform for financial and business leaders, investors, technology pioneers and entrepreneurs, will return on January 18 and 19, 2021 in a brand-new virtual format with over 150 distinguished speakers exchanging insights, intelligence

Read MoreThe Last Virtual Bank in Hong Kong Launched

Fusion Bank, Hong Kong’s virtual bank jointly owned by Tencent, Hong Kong Exchanges and Clearing, Hillhouse Capital and Perfect Ridge, has announced the full public launch of its banking services. Previously known as Infinium Limited, the virtual bank had soft-launched

Read MoreCrypto.com Picks AWS as Its Cloud Provider

Hong Kong-based cryptocurrency platform Crypto.com announced that it has selected Amazon Web Services (AWS) as its preferred cloud provider. Running on AWS, Crypto.com will scale to offer financial services beyond its existing user base. By using AWS Trusted Advisor, a

Read MoreYear End Message to Our Readers – Offline from 24th December to the 3rd January

Fintech News Hong Kong would like to take this opportunity to wish all our readers a Merry Christmas and a very Happy New Year. We will be taking a break from the 24th December 2020 to the 3rd January 2021.

Read MoreZA Tech Forms Insurtech Joint Venture With Indonesian E-Wallet OVO

ZA Tech, the technology venture founded by insurance company ZhongAn Online and backed by Softbank’s Vision Fund, announced that it has formed a joint venture with the holding company of e-wallet OVO, to offer Indonesian insurance companies easy and secure

Read More6 Developments That Shaped Hong Kong’s Fintech Industry in 2020

Hong Kong’s fintech industry continued to grow in 2020, on the back of rising adoption by incumbents and a rapidly expanding startup community. 86% of banks have adopted or plan to adopt fintech solutions across all types of financial services,

Read MoreOSL Receives Green Light From Hong Kong Regulator for Crypto Trading Platform

OSL, a digital asset platform and member of BC Technology Group, has received the license from Hong Kong’s Securities and Futures Commission (SFC) to operate regulated brokerage and automated trading services for digital assets following a rigorous vetting process. They

Read MoreMUFG Bank Ropes in Velotrade to Automate Its Trade Invoice Processing

Velotrade, a digital trade finance marketplace, announced that its trade finance platform has been selected by MUFG Bank to manage its internal invoice processing requirements. The new system automates the processing of thousands of trade invoices every month by MUFG’s

Read More