HKMA Highlights 4 Regtech Uses Cases During COVID-19 Pandemic

by Fintech News Hong Kong January 5, 2021

As the COVID-19 pandemic continues to profoundly disrupt the financial services landscape, technology holds to key to overcoming the operational challenges caused by the public health crisis, according to Hong Kong Monetary Authority (HKMA).

In HKMA’s fifth issue of Regtech Watch, a newsletter that promotes the adoption of regulatory technology, the regulator shares four regtech use cases that are relevant to COVID-19.

In the paper, the HKMA says that regtech can be used to help banks better manage work-from-home arrangements, ensure efficient and compliant business communication, automate business processes, and enable more efficient surveillance and contact tracing.

Remote access and work-from-home arrangements

The first regtech use case mentioned in the paper relates to the use of technology to support remote working.

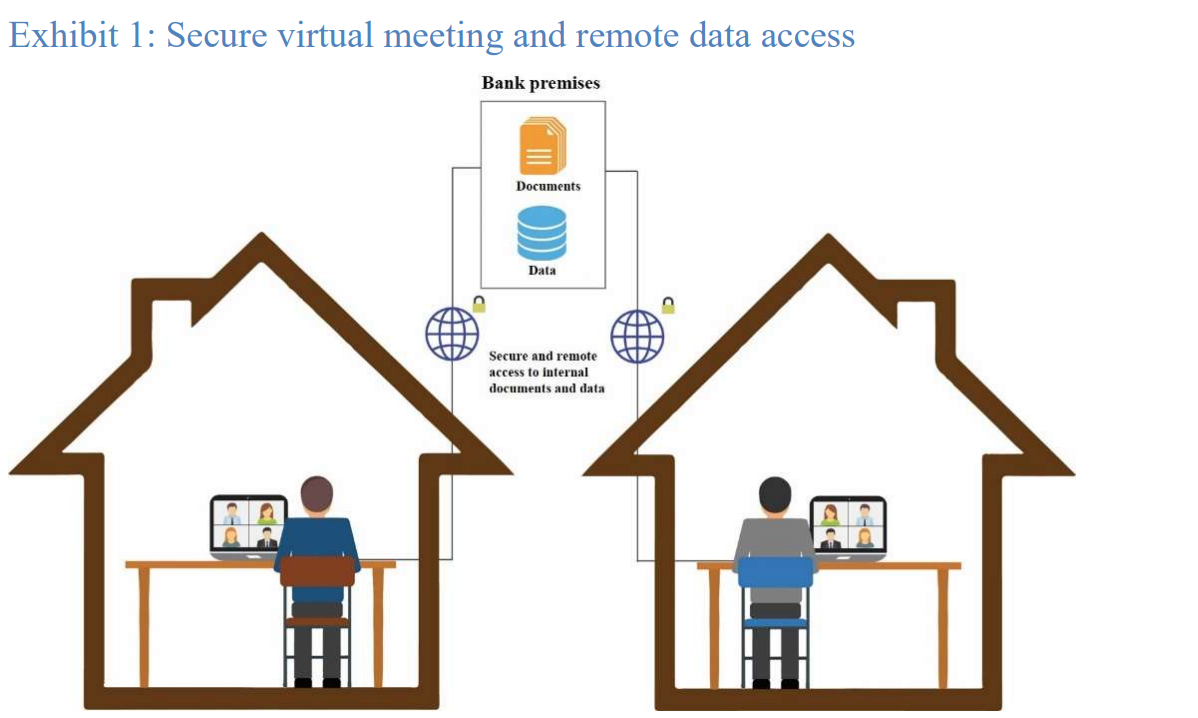

According to the HKMA, video conferencing solutions, fortified with additional security settings, including end-to-end encryption, are increasingly being adopted by banks to ensure that all kinds of meetings can be held no matter where employees are located.

In addition to that, several banks are making the appropriate IT infrastructural changes to ensure business continuity. Some of them are moving to store certain data on centralized and cloud-based data management solutions so that employees can securely and remotely access the latest internal data while achieving better operational resilience.

Not only that, but moving to the cloud also offers other advantages that will come in handy in the future, including additional scalability and flexibility, the paper says.

Secure virtual meeting and remote data access, Regtech Watch issue no 5, Hong Kong Monetary Authority (HKMA), Dec 2020

Compliant business communication

The second regtech use case outlined in the paper is the use of technology to ensure efficient and secure business communication.

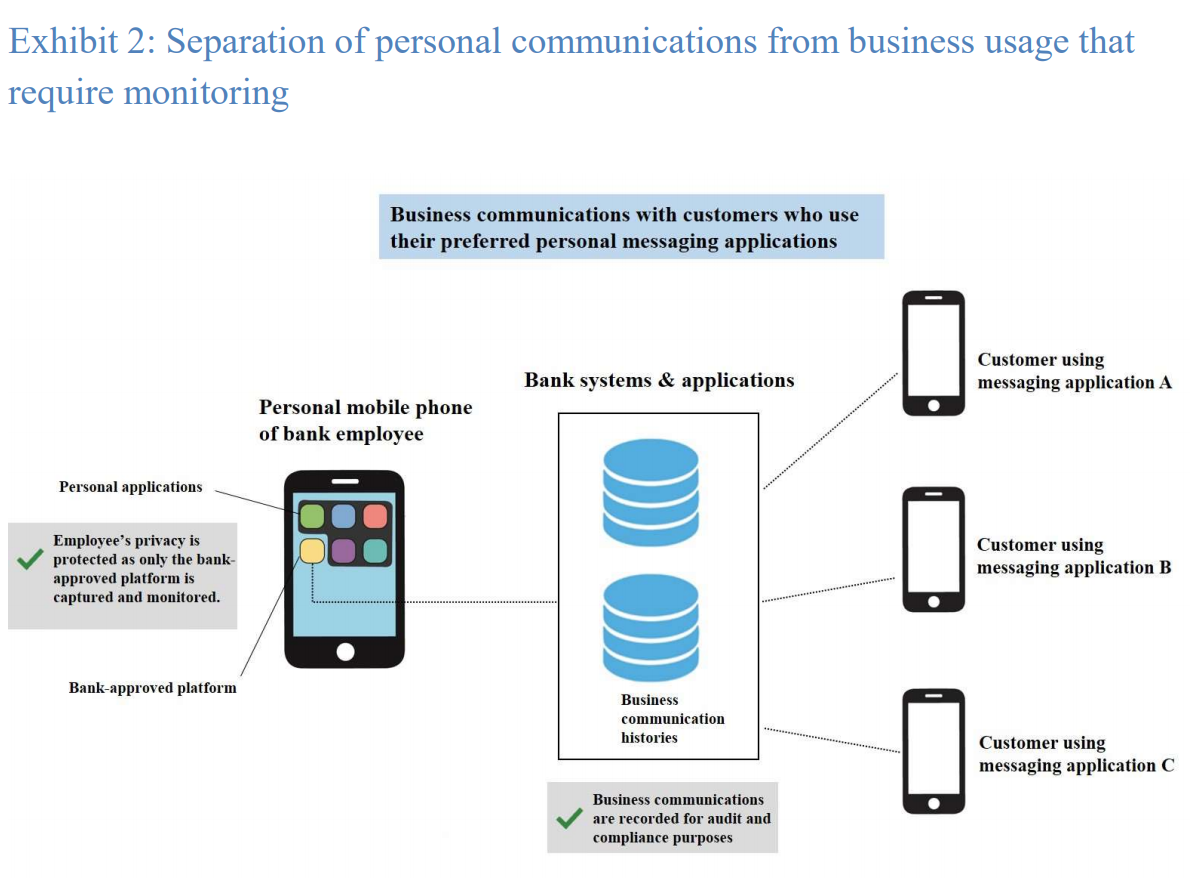

Banks can opt for an all-in-one enterprise messaging platform that’s compatible with common personal messaging applications, allowing both internal communication but also employee-to-customer interactions.

These enterprise messaging platforms can be connected to services such as WhatsApp and WeChat through for example APIs, providing a single, bank-approved platform that allows employees to not only communicate between themselves, but also communicate with customers.

And since all communications pass through a standalone and dedicated messaging solution managed by the bank, communication histories can be recorded for audit and compliance purposes without sacrificing customer experience, the paper says.

Separation of personal communications from business usage that require monitoring, Regtech Watch issue no 5, Hong Kong Monetary Authority (HKMA), Dec 2020

Automating COVID-19 relief grants

Banks in Hong Kong are also adopting technology to streamline the process of granting COVID-19 relief, notably the Pre-approved Principal Payment Holiday Scheme, which defers principal payments owed by corporate borrowers for up to 12 months.

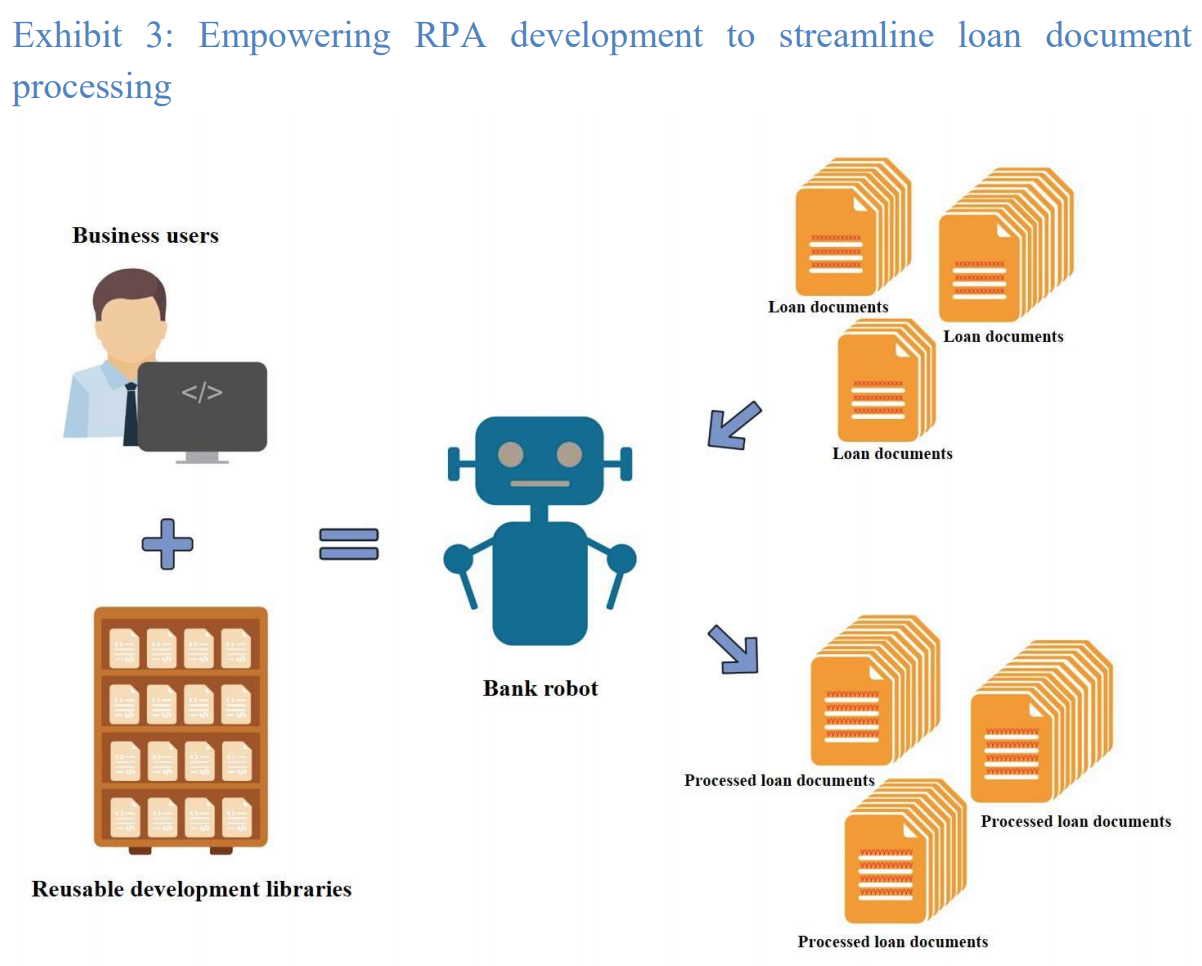

Many Hong Kong banks are relying on robotic process automation (RPA) to perform time-consuming and repetitive work on a 24×7 basis.

These software are able to pick up a borrower’s application from a system, determine if the loan is valid for payment postponement through whitelist checking, modify the payment terms in each of the relevant loan documents and send letters of confirmation to the borrower.

Such solutions not only streamline processes, they also help reduce operational risks by limiting the possibilities for human or manual errors.

Empowering RPA development to streamline loan document processing, Regtech Watch issue no 5, Hong Kong Monetary Authority (HKMA), Dec 2020

Enforcing social distancing measures and enabling contract-tracing

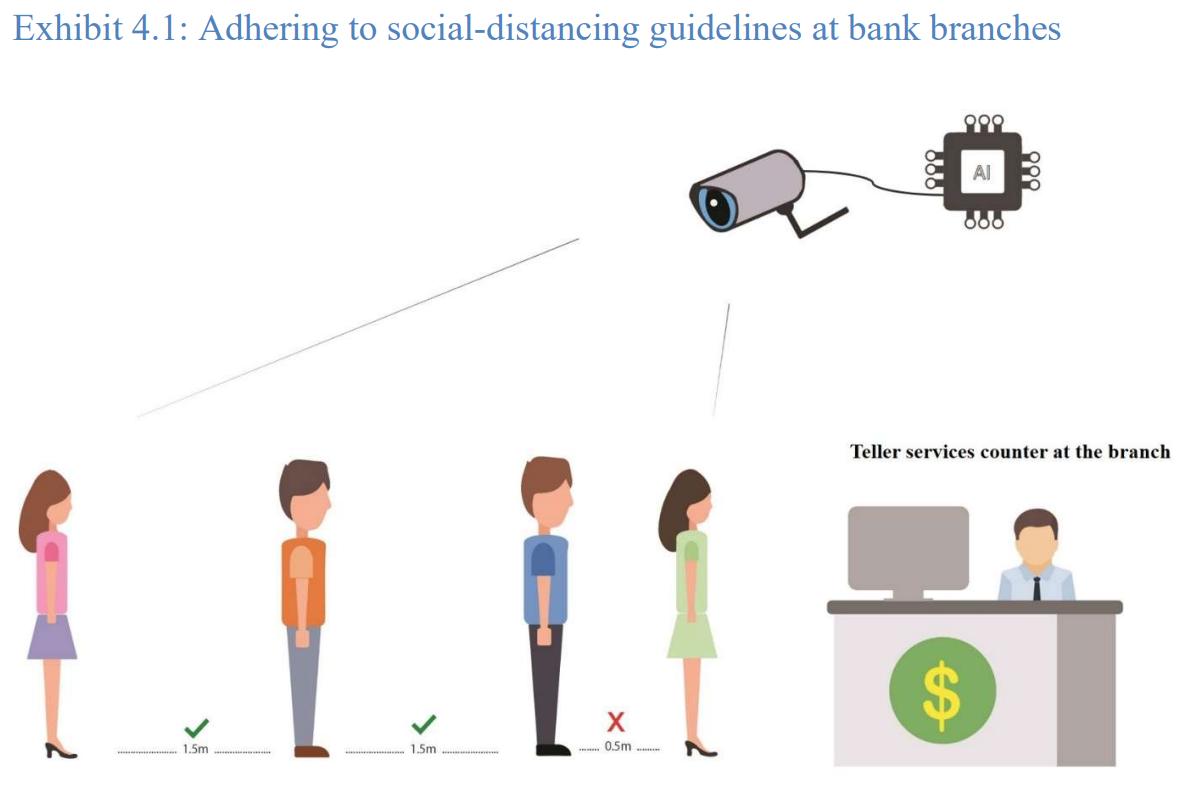

Finally, the fourth use case of regtech described in the paper is the use of technology to ensure that social-distancing measures are respected.

For example, organizations can use artificial intelligence (AI) and the Internet-of-Things (IoT) to be informed when social-distancing requirements are breached. In addition to that, there are emerging innovative solutions which can advise how closely or for how long an infected employee has been in contact with other employees. Such solutions use electronic signals such as Bluetooth and WiFi of mobile phones and proximity data, combined with techniques like tagging and geofencing, to determine the contact history of an individual.

Adhering to social-distancing guidelines at bank branches, Regtech Watch issue no 5, Hong Kong Monetary Authority (HKMA), Dec 2020

Regtech in the spotlight

As Hong Kong works its way to becoming a leading fintech hub, regtech has been named amongst the region’s top priorities.

During this year’s Hong Kong Fintech Week in November, the HKMA formally introduced a two-year roadmap aimed at promoting regtech adoption by facilitating innovation, developing the talent pool, and enhancing regulatory engagement with the ecosystem, among other things.

In the coming two years, the HKMA said it will roll out a series of events and initiatives including organizing a large-scale regtech event to raise awareness, launching the so-called Regtech Adoption Index, and organizing a global regtech challenge to stimulate innovation.

Featured image credit: By Alan Mak – Own work, CC BY-SA 3.0, Link