Posts From Fintech News Hong Kong

WeLab Bank Appoints Tat Lee as New Chief Executive

WeLab Bank, a virtual bank licensed by Hong Kong Monetary Authority, announces that Tat Lee has been appointed as the new Chief Executive. He succeeds Adrian Tse, who has stepped down from the role for what the bank described as

Read MoreCyberport & R3 Identify Potential Blockchain Projects in Block adVenture

Hong Kong digital tech park Cyberport has partnered with R3, a distributed ledger and blockchain software development company, for its accelerator programme Block adVenture where so far 10 teams have been selected. The three-month startup programme focusing on blockchain technology

Read MoreZA Offers Free Post-Vaccination Protection for Hong Kong Customers

ZA International, digital insurer founded by ZhongAn Online, announced the launch of its “Free Post-Vaccination Protection” as a part of its ZA Relief Fund worth HK$ 6 million established in February 2020 to offer its customers support amidst the pandemic.

Read MoreCrypto.com Ties up With Booking.com to Offer Travel Discounts

Hong Kong-based cryptocurrency platform Crypto.com has announced a partnership with Booking.com to deliver travel deals to all its users within its app. Crypto.com users who make Booking.com reservations in the app will receive a discount of up to 25% for

Read MoreHuawei and IDC’s Banking Resilience Index Uncovers How FIs Responded to COVID-19

A new whitepaper by Huawei and the International Data Corporation (IDC) looks at how banks around the world have responded to the COVID-19 pandemic and identifies the way forward in the new normal. In a report titled Banking Industry Rises

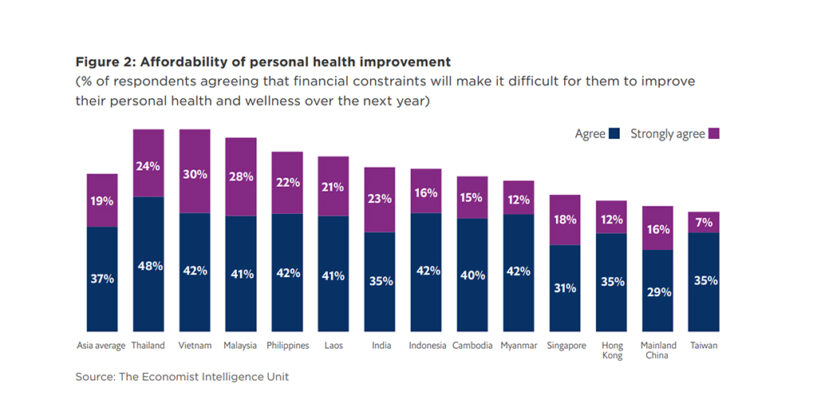

Read MorePrudential: Digital Health Technology Adoption on the Rise

Prudential released The Pulse of Asia – The Health of Asia Barometer, a report written by The Economist Intelligence Unit (EIU), which underscores the opportunities offered by digital health technologies to improve access to healthcare in Asia. The research, which

Read MoreFWD Hong Kong Leverages HKMA’s Faster Payments System for Instant Claims Service

FWD Hong Kong has launched its instant claims service through its eServices app. The solution allows FWD customers to receive claims payments within seconds after claims applications approval via the Faster Payment System (FPS) and 7-Eleven convenience stores. Claim applications

Read MoreAnt Group Ordered to Revamp Its Business As Beijing Pursues Crackdown on Tech Giants

On December 26, 2020, four Chinese financial regulators, including the central bank, summoned Ant Group for regulatory talks, ordering the fintech giant to “rectify” its regulatory violations and “return to its payment origins.” Pan Gongsheng, a deputy governor at the

Read MoreNeat Issues Visa Cards for Hong Kong SMEs

Neat, a Hong Kong based fintech company offering modern financial solutions to SMEs and startups, has become a member of the Visa network and will issue its own Neat Visa card for businesses incorporated in Hong Kong. As a member

Read MoreEMQ Expands Cross Border Payments Service to South Korea

EMQ, a Hong Kong-based financial settlement network, announced that it has expanded its operations into the South Korean market, offering cross-border payment capabilities worldwide. “South Korea has one of the most vibrant digital economies in the world with its retail

Read More