gini, a local fintech startup, today announced the launch of its namesake app, the city’s first all-in-one personal financial management application.

The gini app introduces a new alternative for Hongkongers to get insights into their spending habits, take control of their financial life, and aims to help users enjoy the best deals based on their habits and preferences.

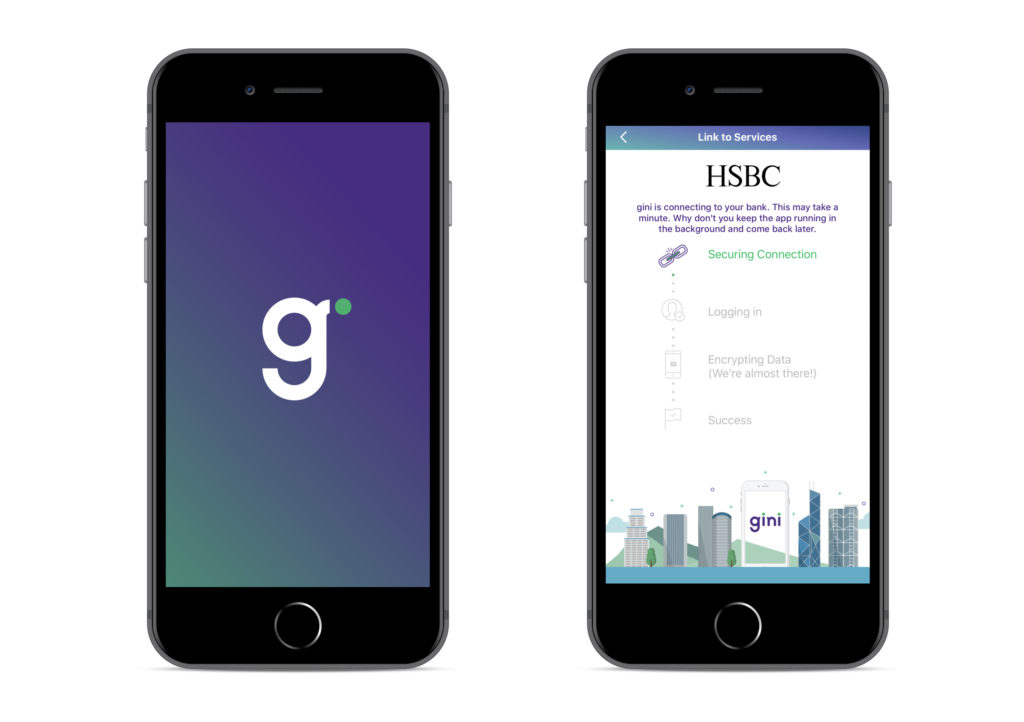

At launch, the app is compatible with Bank of China (Hong Kong), Citibank, Hang Seng Bank, HSBC and Standard Chartered Hong Kong. The beta version of gini is now available for download via Apple App Store.

gini has recently conducted a survey to study the spending habits of millennials. Titled “Millennials’ Spending and Saving Habits”, the study reveals that nearly half (43%) of the post-90s save less than 10% of their monthly income, with one in four (26%) spending the entirety of it by the end of every calendar month.

Furthermore, a third of the post-80’s and 90’s (32%) do not even remember how they had spent their money. Living in Hong Kong, one of the world’s most expensive cities, these millennials could use a serious helping hand when it comes to managing their finances.

“Many Hongkongers, particularly millennials, are really struggling because they lack the tools to organize their personal finances. At present, Hong Kong lacks a local company that is built around the consumer and is committed to helping them save money – and gini is proud to fill that space.”

said Raymond Wyand, Co-Founder and CEO of gini.

“We built our app to be a single place that not just feeds you info about personal finances, but also finds better deals for you.”

Set out to revolutionize personal finance in Hong Kong, gini – both the app and the company – is built from the ground up to empower consumers with better knowledge about their own money. Users can expect the following features in the gini app:

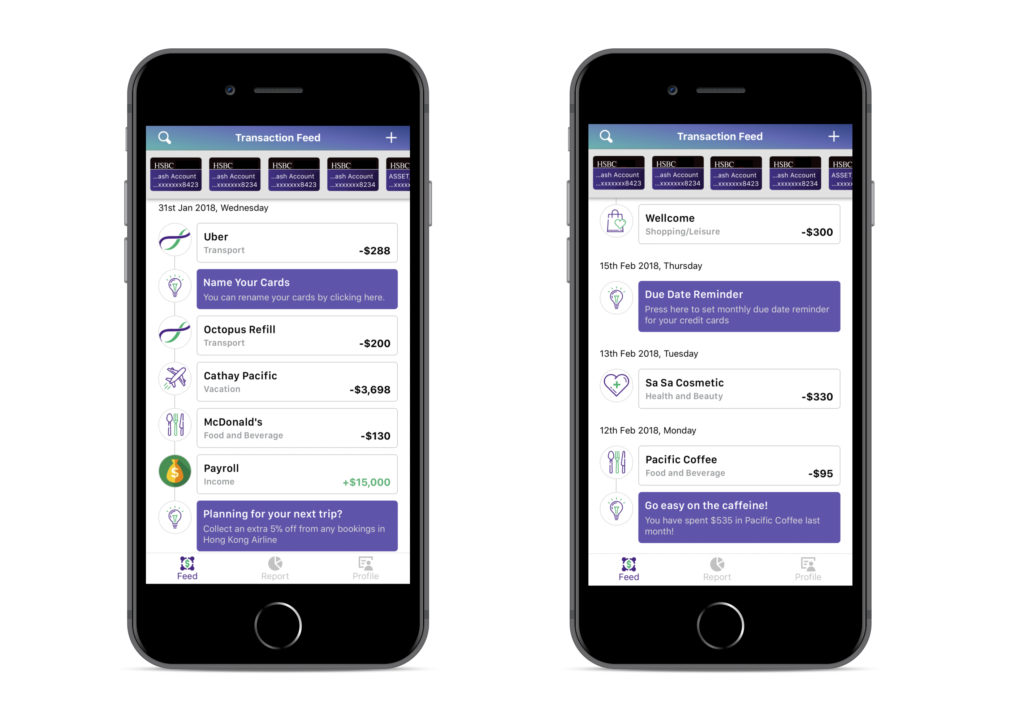

- Personal finances at a glance – The first app in Hong Kong to enable the linking of multiple bank accounts, gini streamlines personal finance by logging all expenses and presents it all on one clean and intuitive dashboard. Say goodbye to the days of checking multiple statements.

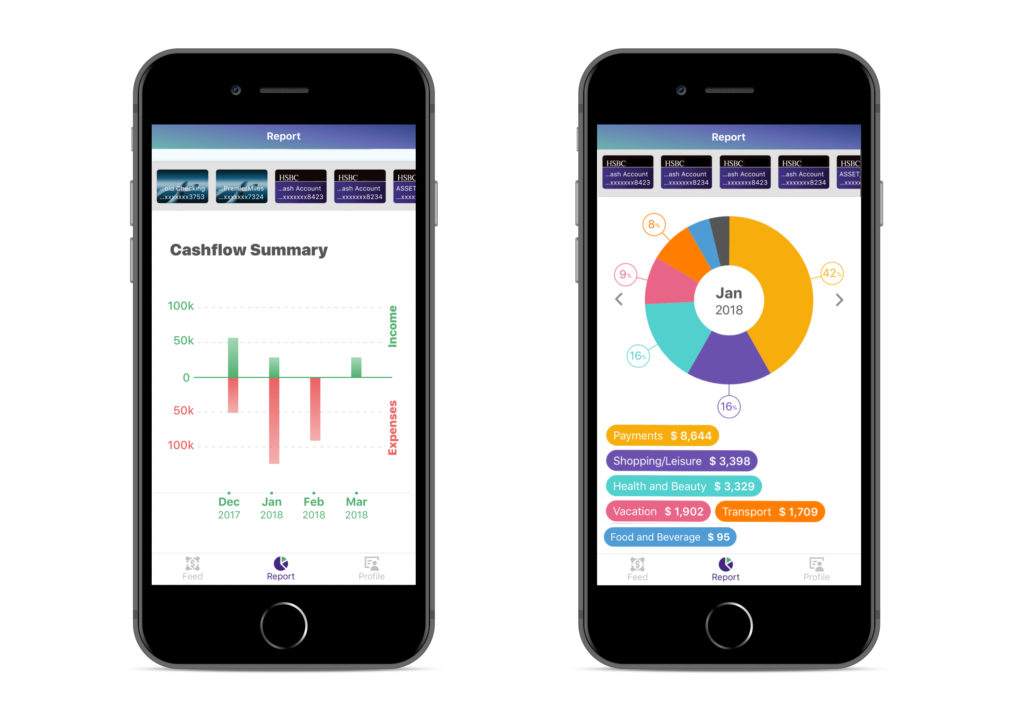

- Insights into you, for you – All expenses are sorted by search function and period and categorized in easy-to-read graphs and charts that paint the full picture of a user’s spending habits. Want to check if you’ve overspent this month? It’s just one tap away. A great number of additional features such as credit card payment reminder and budgeting are in the plans and will be added in a future update.

- Better bang for your buck –What separates gini from others is the app’s use of data science. gini’s goal is to help users get the most from their money by learning the habits and preferences of each user, and doing the hard work for them.By helping them find cheaper deals and flagging transactions that are priced above the users’ average, gini aims to give people the feeling of financial control and power that they didn’t have before.In addition, as gini operates independently from banks, users can rest assured that the app’s recommendations are honestIn a future update, gini plans to expand its artificial intelligence capabilities to identify savings in a wide range of areas such as utilities, mortgages, aviation and subscriptions.

- Bank-level security – The gini app allows a user to get read-only access to multiple banks in one app. gini protects user privacy by anonymizing and encrypting sensitive information on its users’ devices with 256-bit encryption – as in the world’s leading banks.Personally identifiable data and banking credentials are never stored on gini’s servers.gini is also in the process of becoming compliant with the Payment Card Industry Data Security Standard (PCI DSS), a set of comprehensive operational and technical requirements defined by the PCI Security Standards Council for protecting the safety of financial data.

Since its award-winning debut at Citi HK Fintech Challenge in July, gini continues to make winning strides, rubbing shoulders with some of the most respected names in the business. Some notable mentions include: winning Outstanding Intelligent Financial Management Mobile Application in the etnet Fintech Awards 2017; gaining admittance to the Standard Chartered backed SuperCharger Fintech Accelerator 2018; and adding the former head of Airbnb and WeWork Asia, Henek Lo, as a shareholder.

“Open banking is going to transform the way 1.7 billion digital banking users in Asia, and the gini team is at the forefront of reinventing the way people view their finances,”

said Henek Lo., CEO of HYPE Asia Ventures.