Posts From Company Announcement

easyMarkets Introduces New Cash Indices – An Attractive Trading Opportunity

easyMarkets introduces cash indices as a new trading instrument which will offer clients more diverse trading options. Cash indices are the latest addition to easyMarkets’s already diverse offering of trading instruments. With this latest addition, the company now offers access

Read MoreStatrys and DBS’ Payments and Collections Solution Bags The Asset Triple A Award

Statrys, a Hong Kong-based fintech providing virtual business accounts for SMEs, has been recognised together with DBS Bank as the ‘Best Payments and Collections Solution Hong Kong’ at The Asset Triple A Treasury, Trade, Sustainable Supply Chain and Risk Management

Read MoreCrypto.com Announced as Official Title Partner of the Formula 1 Miami Grand Prix

South Florida Motorsports (SFM) announced the HK based Crypto.com as the official title partner of the Formula 1 Miami Grand Prix. This prestigious new deal will see Crypto.com become an integral part of the newest Formula 1 event on the

Read MoreCSCI Unveils its Bond Credit Rating and Trading Service at Hong Kong Fintech Week

China Securities Credit Investment a national comprehensive credit service organization, together with its subsidiaries that focus on overseas strategy and business development – China Securities Credit Technology and Pengyuan Credit Rating (Hong Kong) made its debut again at the global

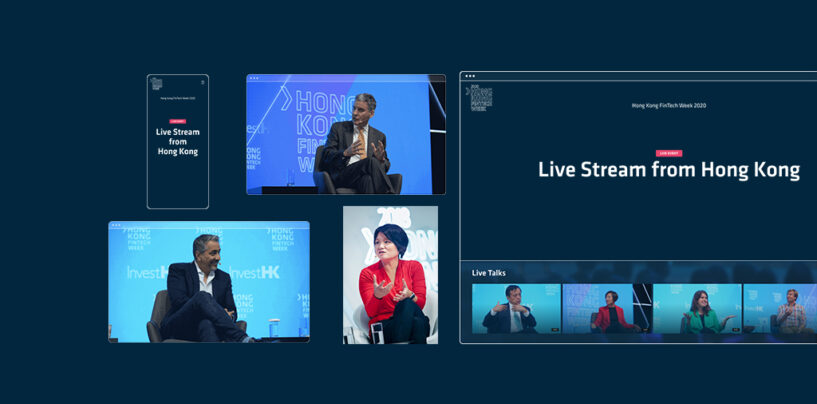

Read MoreHong Kong Fintech Week 2020 to Humanise Fintech and Drive Growth

Invest Hong Kong today revealed details about Hong Kong FinTech Week 2020, which will take place virtually from November 2 to 6. The Week highlights a golden opportunity to humanise fintech to reignite growth, build trust and financially empower society

Read MoreHKSTP and HSBC Team Up to Drive Open Banking Innovation in Hong Kong

Hong Kong Science and Technology Parks Corporation (HKSTP) has teamed up with HSBC today to drive open banking innovation for start-ups and technology ventures. HSBC will be the lead partner in the API EcoBooster (Programme) to mentor and co-create API

Read MoreAvaloq Hires in Hong Kong to Strengthen Its Greater China Footprint

Avaloq, the Swiss-based provider of digital banking solutions, core banking software and wealth management technology, has appointed Pascal Wengi as Head of Sales for the Greater China region. He will be based in Hong Kong. Pascal Wengi joins from Crealogix,

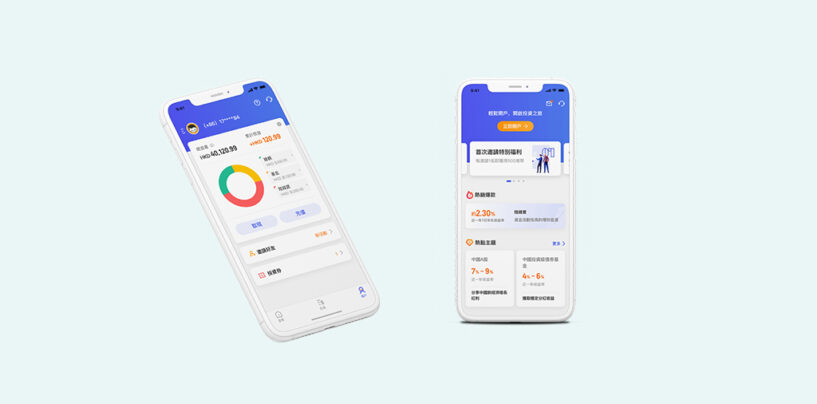

Read MoreLufax’s Subsidiary Receives Nod to Provide Investment and Wealth Services in Hong Kong

Lufax Holding’s subsidiary LUI HK announced today that Hong Kong Securities and Futures Commission (SFC) has granted the company regulatory approval to provide investment and wealth management services for all customers in Hong Kong. They expect their app to go

Read MoreHKTDC’s Start-Up Express Pitching Contest Showcases Innovative Solutions

Start-up Express, an entrepreneurship development programme organised by the Hong Kong Trade Development Council (HKTDC), has returned for its third edition. The pitching contest under the programme successfully concluded today as a judging panel selected exceptional start-ups to participate in

Read MoreNiche Global Selects Volante Technologies’ SEPA Instant Payments as a Service in the Cloud

Volante Technologies, a global provider of payments and financial messaging solutions to accelerate digital transformation announced that Niche Global, a rising intech player, has selected Volante’s cloud-based SEPA instant Payments as a Service solution to accelerate its expansion into the European

Read More