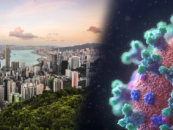

The COVID-19 outbreak has taken a toll on startup funding with fintech investment dropping to levels not seen since 2016 and 2017, according to CB Insights’ State of Fintech Q1’20 Report.

Q1’20 VC-backed fintech activity declined to US$6.1 billion across 404 deals, making the quarter the worst Q1 since 2016 for fintech deals and the worst Q1 for funding since 2017, the company found.

Annual global VC-backed fintech deals and financing, 2016 – Q1’20 ($B), Source: CB Insights, State of Fintech Q1’20 Report, May 2020

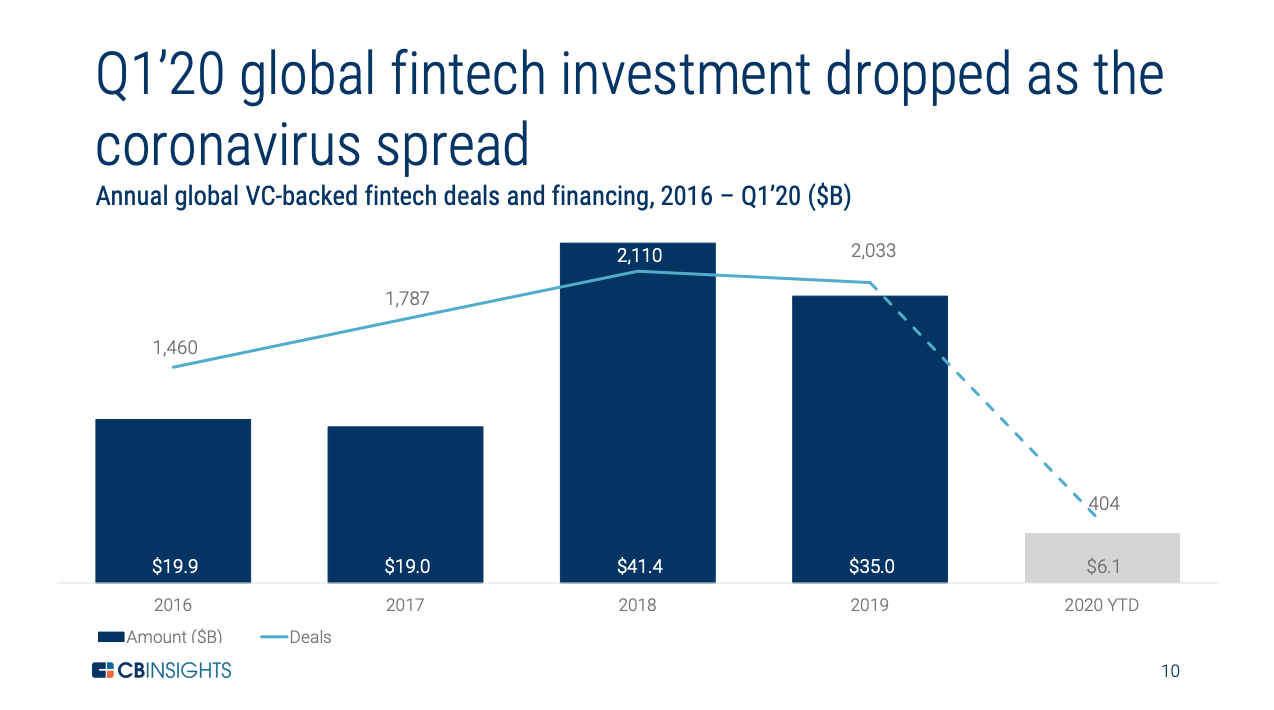

China took the biggest hit, witnessing its worst quarter for fintech funding since 2015 with just 29 deals totaling US$175 million.

China vs. India VC-backed fintech funding, Q1’19 – Q1’20 ($M), Source: CB Insights, State of Fintech Q1’20 Report, May 2020

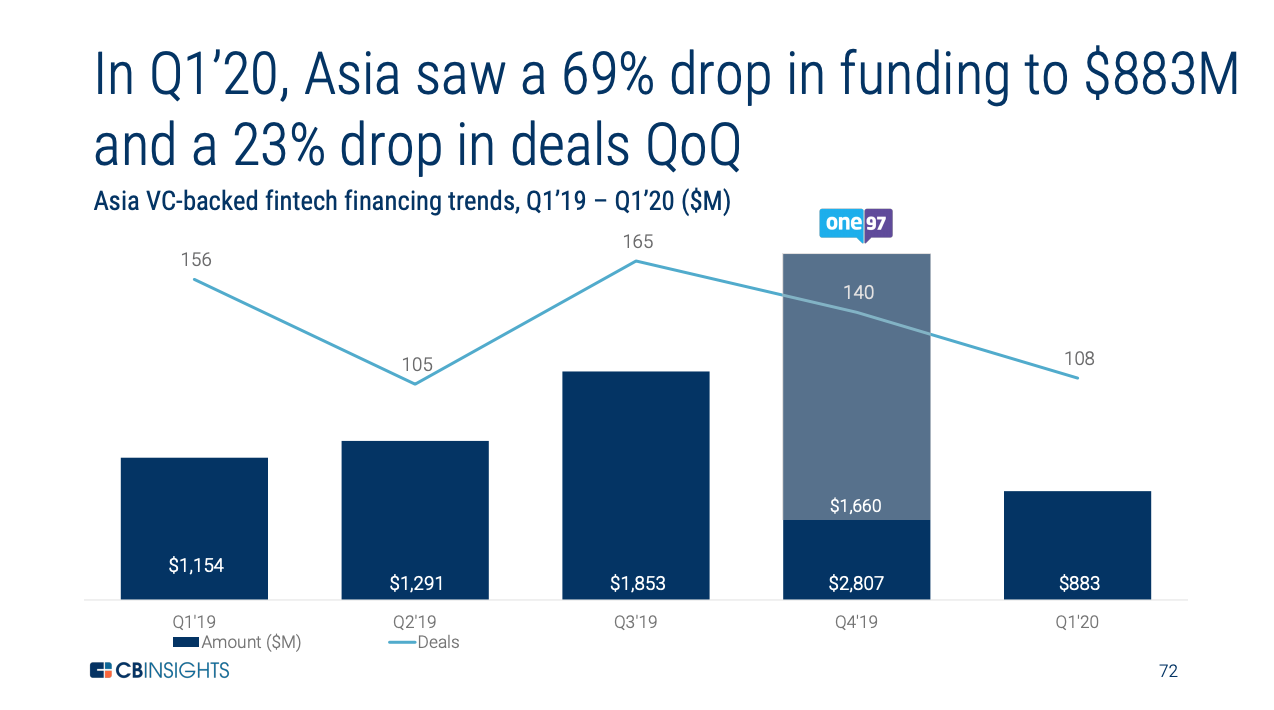

Europe was the only region to record growth in fintech funding, which rose 27% quarter-over-quarter (QoQ), while Asia, North America, Australia, South America, and Africa all saw a drop QoQ.

Asia VC-backed fintech financing trends, Q1’19 – Q1’20 ($M), Source: CB Insights, State of Fintech Q1’20 Report, May 2020

Q1’20 was marked by a significant decline in seed and early-stage fintech funding activity, with only 228 deals, a 13-quarter low, and US$1.1 billion raised, a nine-quarter low. This showcases that in Q1’20, investors shifted their focus from making new bets to fortifying portfolios for a projected recession, the report says.

New fintech unicorns and M&A exits

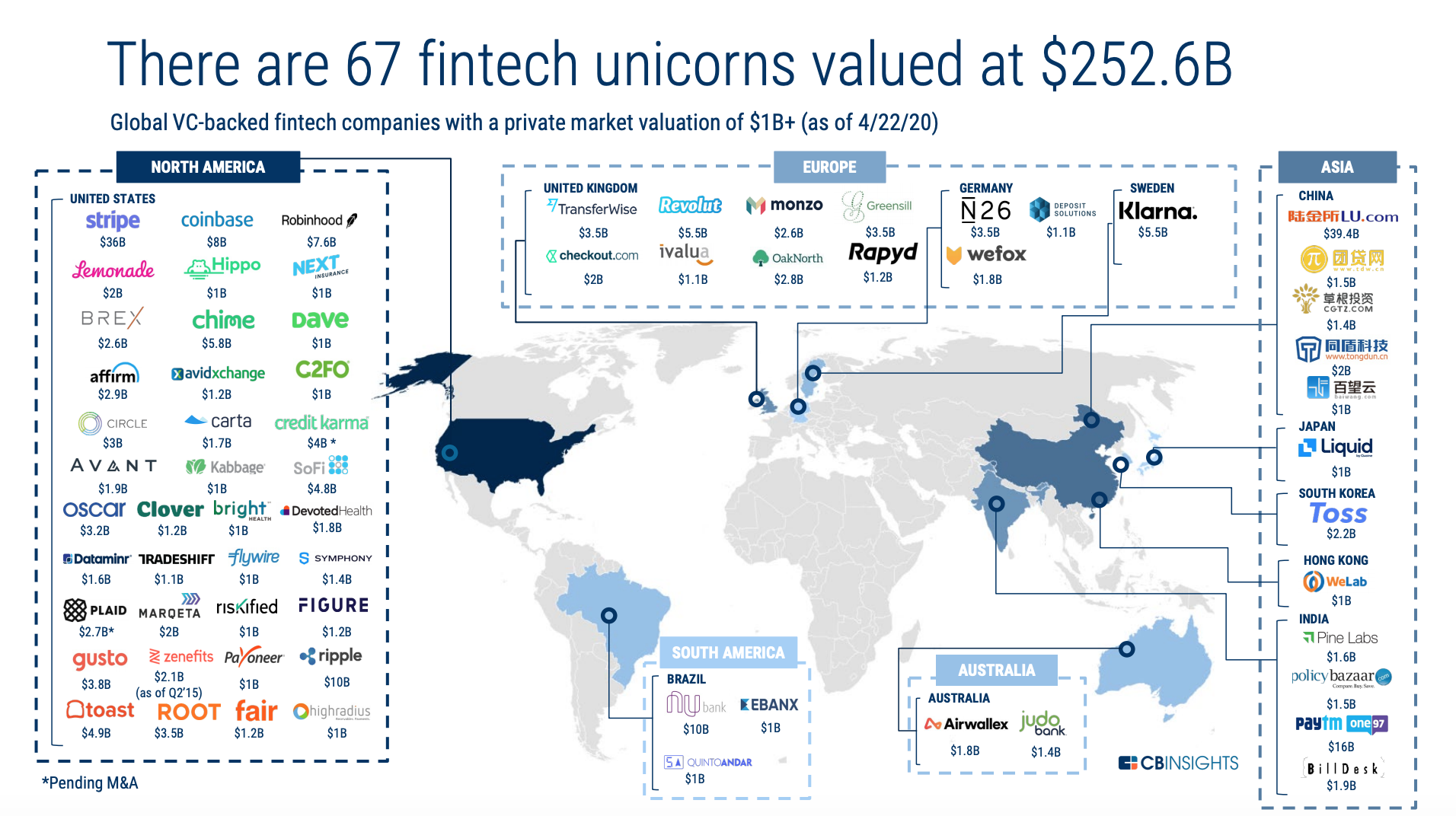

Despite the turmoil, Q1’20 nevertheless saw the birth of three fintech unicorns: HighRadius, which provides an integrated platform for accounts receivables and treasury management; Pine Labs, a merchant platform offering financing and last-mile retail transaction technology; and Flywire, a payments company. These three additions brought the total number of fintech unicorns to 67 that were worth a combined US$253 billion, as of late-April.

Global VC-backed fintech companies with a private market valuation of $1B+ (as of 4:22:20), Source: CB Insights, State of Fintech Q1’20 Report, May 2020

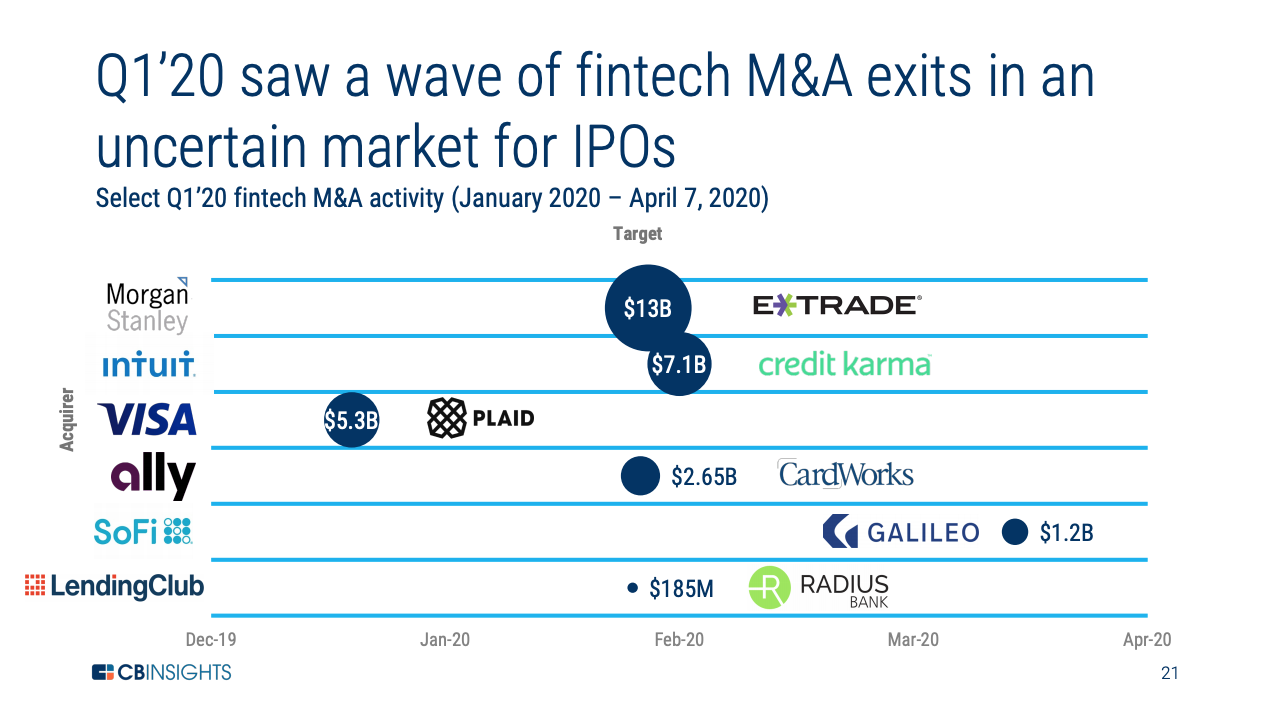

The quarter also saw a wave of big fintech M&A exits, providing investors with some liquidity, the report notes.

It highlights five major acquisition deals: Visa’s acquisition of Plaid for US$5.3 billion; Intuit’s acquisition of Credit Karma for US$7.1 billion (pending close); SoFi’s acquisition of Galileo for US$1.2 billion; LendingClub’s acquisition of Radius Bank for US$185 million; and Morgan Stanley’s acquisition of E-Trade for US$13 billion (pending close).

Select Q1’20 fintech M&A activity (January 2020 – April 7, 2020), Source: CB Insights, State of Fintech Q1’20 Report, May 2020

Fintech enablers and B2B providers gain traction

Demand for B2B fintech services and interest in digital innovation were on the rise in Q1’20 as the COVID-19 pandemic put a sense of urgency for digital transformation.

Financial institutions began seriously looking to fintech automation to reduce costs and drive efficiency, leading to startups in the fields of client onboarding automation, background checks, and back up documentation management gaining significant traction in Q1’20.

Mantl, a platform that streamlines back-office processes for banks and credit unions; Certn, a background check solution that uses machine learning (ML) and artificial intelligence (AI) to automate applicant screening; and Eigen Technologies, which uses nature language processing (NLP) to extract qualitative information from documents and contracts, are amongst those that raised funding in Q1’20.

Startups specializing in behavior monitoring for fraud prevention also gained favor in Q1’20 as remote working became the new normal.

Notable deals in Q1’20 include Behavox’s US$100 million Series C, and Biocatch’s US$145 million Series C. Behavox is an enterprise compliance software company, while Biocatch is developing AI-driven behavioral authentication solutions to secure banking, insurance, and e-commerce transactions.

Regtech is another segment that saw rising popularity in Q1’20. In Europe, Fenergo, a provider of client lifecycle management platform solutions, and Privitar, a provider of enterprise data privacy software raised US$6 million and US$80 million, respectively. In the US, data privacy compliance startups BigID and OneTrust raised US$50 million and US$210 million respectively.

Other trends recorded by CB Insights in Q1’20 include continued consolidation in wealthtech and payments, as well as rising opportunities in loan servicing, debt collection and debt management as defaults become more likely and delinquencies begin to emerge.