Hong Kong Households Continue to Bear the Brunt of COVID-19 Economic Consequences

by Fintech News Hong Kong May 10, 2022In Hong Kong, the COVID-19 pandemic continues to take a toll on people’s financial health as family members from low-income households are put out of work and forced to turn to part-time work and credit to make ends meet.

This is according the Q1 2022 results of TransUnion’s quarterly Consumer Pulse Survey, which polled more than 1,000 adults in February 2022 to understand how Hong Kong consumers’ personal finances have changed and measure evolving consumer attitudes.

Results from the survey show that tightened social distancing regulations caused by the fifth wave of COVID-19 has affected companies and small businesses, leading some to close. This has impacted employment, with the proportion of full-time employed respondents decreasing 10 percentage points from Q4 2021 to 77%, and the proportion of part-time and gig workers increasing 5 percentage points to 11% in Q1 2022.

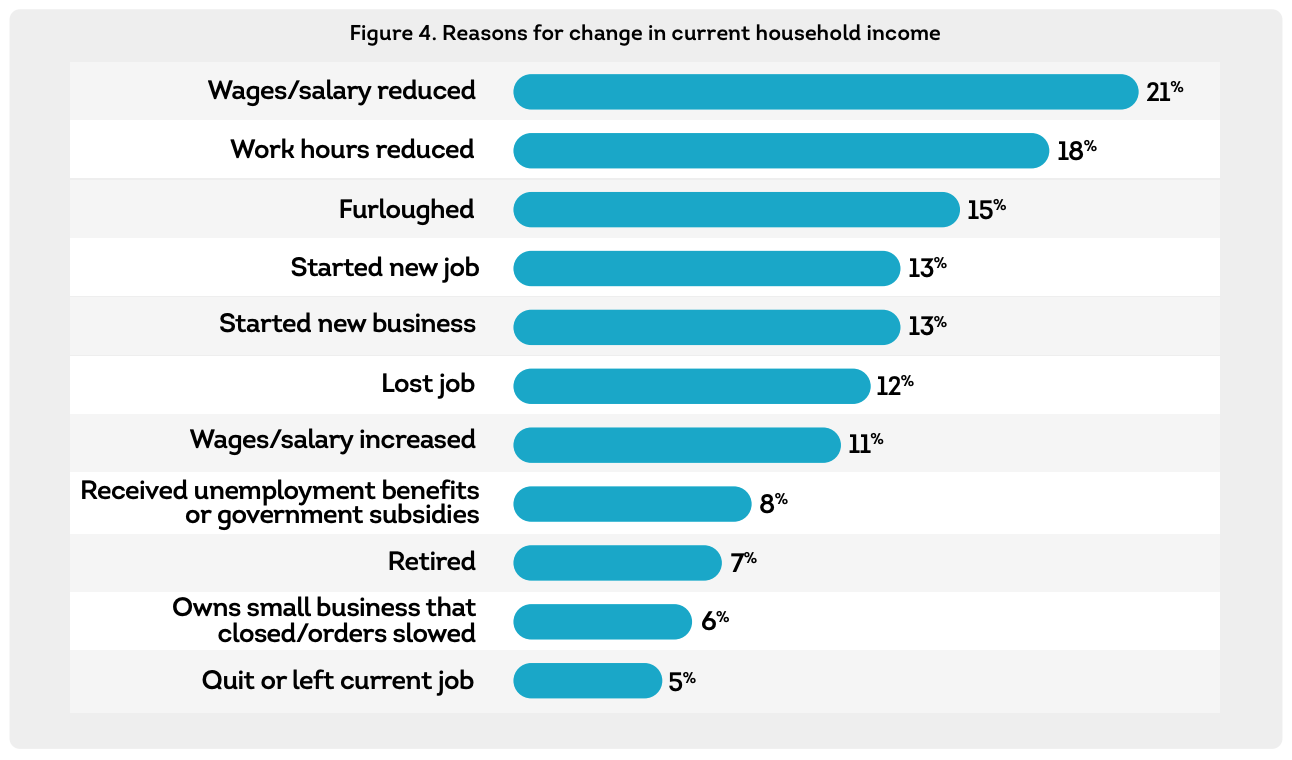

Employment hardship has affected the finances of households, with 66% of the 1,088 adults surveyed in Hong Kong indicating that their household income stayed the same or decreased in the last three months, and 58% expecting the trend to continue in the next 12 months. Reasons cited for this decrease included reduced salaries (21%), reduced work hours (18%) and being furloughed (15%).

Reasons for change in current household income, Source: Q1 2022 TransUnion Consumer Pulse Survey, April 2022

Financial difficulties

These setbacks led to an increasing trend of consumers not being able to pay their bills and loans in full (27% in Q1 2022 compared to 22% in Q4 2021).

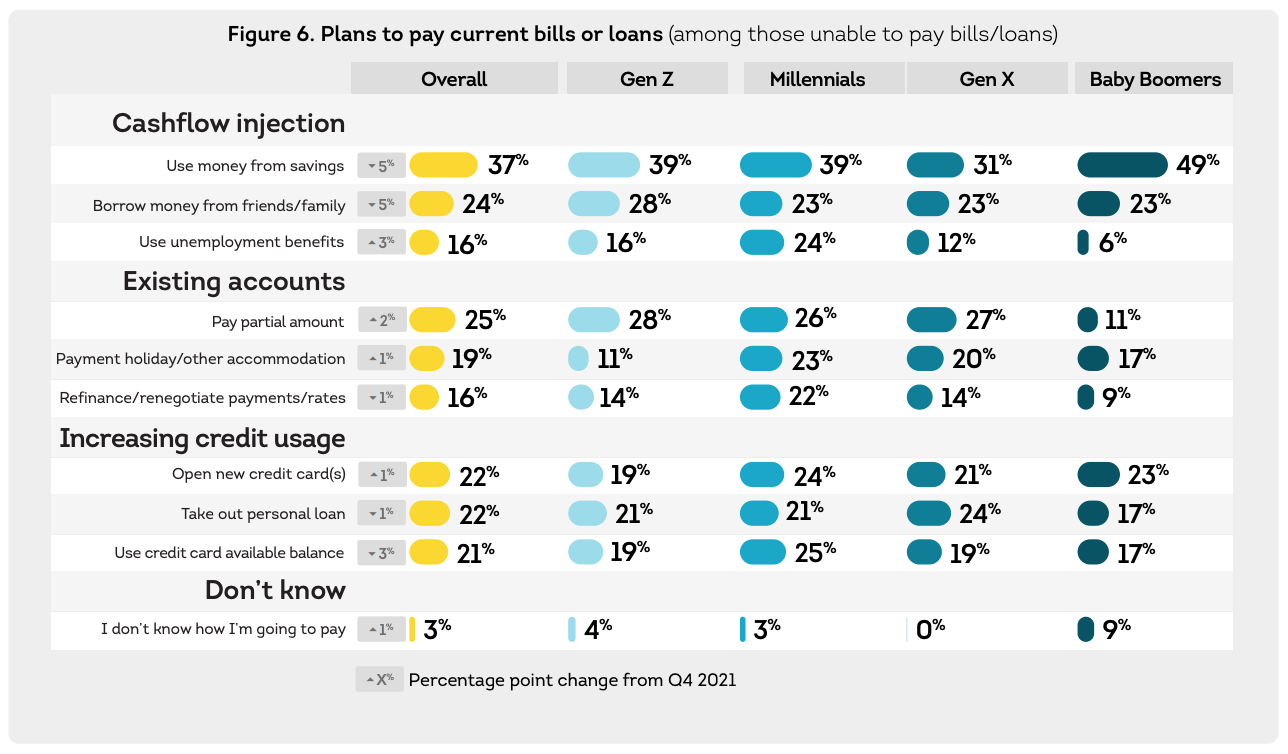

When asked how they planned to pay their bills and loans, the study found a continuing trend of more people using their credit accounts to handle bills, with less planning on dipping into their savings (37%, down five percentage points from Q4 2021) or borrowing money from friends or family (24%, down five percentage from Q4 2021).

Instead, over a quarter (25%) planned to pay a partial amount (up two percentage points from Q4), and 19% planned to utilize a payment holiday or other accommodation (up one percentage point from Q4 2021).

Plans to pay current bills or loans (among those unable to pay bills:loans), Source: Q1 2022 TransUnion Consumer Pulse Survey, April 2022

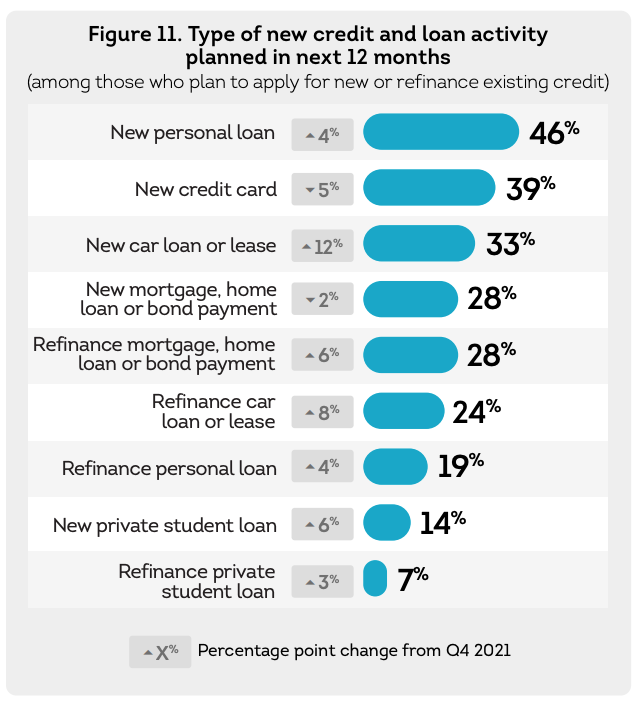

To meet their financial needs, the study found that a rising number of people are looking to turn to credit tools. Of the Hong Kong respondents surveyed, nearly half (48%) planned to apply for new credit or refinance existing credit in the next 12 months, up eight percentage points from Q4 2021.

Personal loans were the most popular type of credit cited by consumers (46%), followed by credit card (39%) and auto loans (33%).

Type of new credit and loan activity planned in the next 12 months, Source: Q1 2022 TransUnion Consumer Pulse Survey, April 2022

Crime and fraud on the rise

In addition to consumers’ household finances, the study also sought to understand Hong Kongers’ attitudes to identity risks, and online commerce.

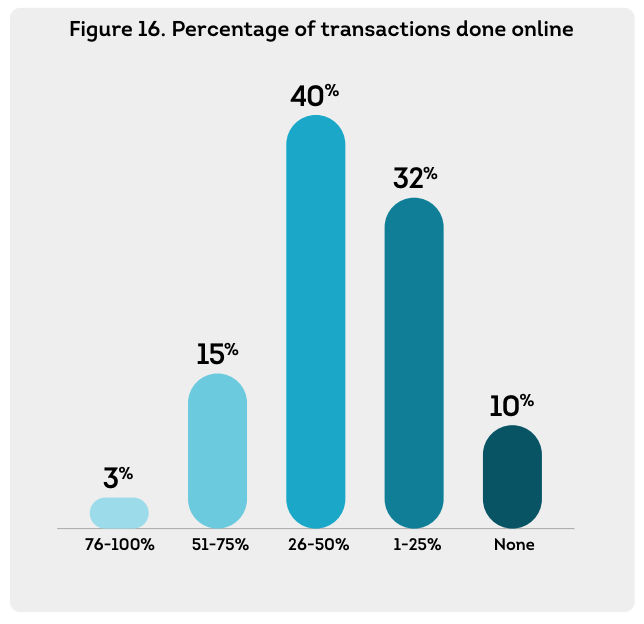

Like other markets, the survey found that amid social distancing rules, consumers in Hong Kong have shifted to digital channels, embracing e-commerce at a fast pace. Of the 1,000+ Hong Kong consumers polled, 18% said they now conducted more than half of their transactions online. Millennials led the chart, with one in five conducting more than half of their transactions online.

Percentage of transactions done online, Source: Q1 2022 TransUnion Consumer Pulse Survey, April 2022

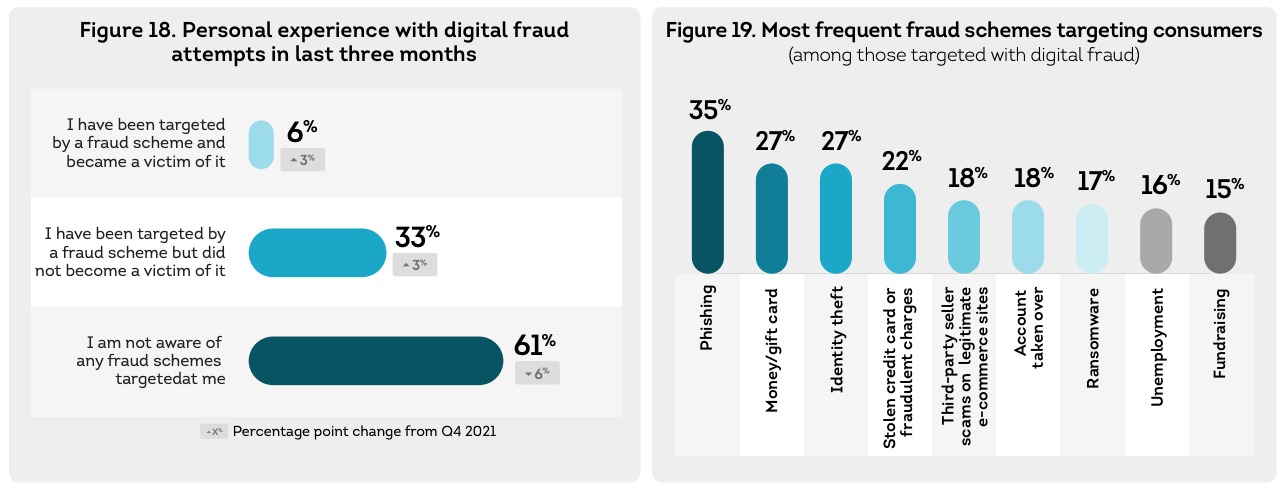

But the shift to digital channels has also brought with it new cyber risks. 39% of the consumers surveyed indicated having been targeted by a fraud scheme, with 6% of them falling victim of it, up three percentage points from Q4 2021.

Phishing (35%), money/gift card scams (27%) and identity theft (27%) were cited as the top three most frequent fraud schemes targeting Hong Kong consumers.

Digital fraud and fraud schemes in Hong Kong, Source: Q1 2022 TransUnion Consumer Pulse Survey, April 2022

In the wake of the pandemic, people moved comprehensively online, increasing the surface area for attacks and creating unprecedented opportunities for bad cyber actors.

A 2021 consumer study by TransUnion found that the percentage of suspected fraudulent digital transaction attempts originated from Hong Kong increased nearly 20% when comparing pre-pandemic to pandemic levels.

Data from law firm Allen & Overy show that cybercrime in Hong Kong has spiked over the past decade, jumping from 2,206 cybercrime reports in 2011 to 12,916 in 2020. This trend has been exacerbated by the global pandemic, with the number of cases in 2020 representing a 55% increase on the 2019 figure alone. The value of those crimes also increased twenty-fold between 2011 and 2020, rising from HK$148 million to HK$2.96 billion.

Last week, Hong Kong police revealed that fraudsters swindled more than HK$132 million from victims of online investment scams in just the first two months of the year, representing a 268% increase from the HK$35.9 million lost by victims in the same period last year, reported the South China Morning Post. 243 cases were reported between January and February 2022, against 110 a year prior.