Here’s How COVID-19 Affected Hong Kong Consumers’ Financial Health

by Fintech News Hong Kong May 31, 2021The global pandemic continues to take a heavy toll on Hong Kong households’ financial situation with many still concerned over whether they will be able to pay their bills, results from a new TransUnion survey found.

TransUnion’s latest Consumer Pulse study, formerly Financial Hardship Report, indicates that Hong Kong consumers’ financial health is worsening as a result of the prolonged impact of COVID-19.

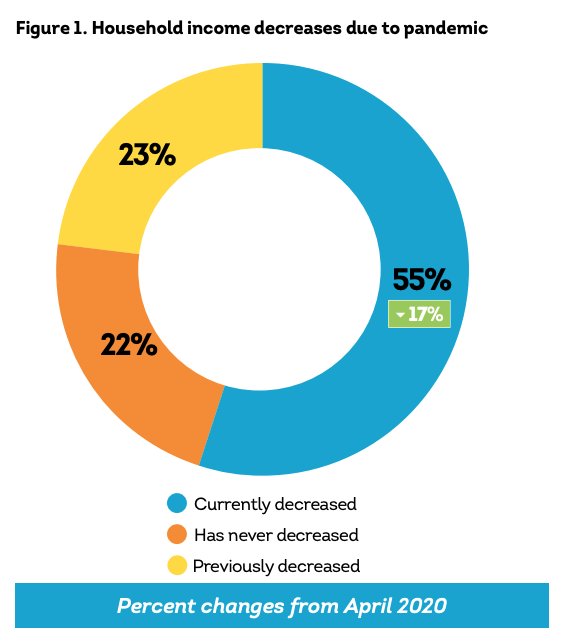

Out of 750+ Hong Kong adults surveyed in March 2021, 78% said their household income was negatively impacted by the pandemic, up from 69% during the last wave of the survey in November 2020.

Household income decreases due to pandemic, Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

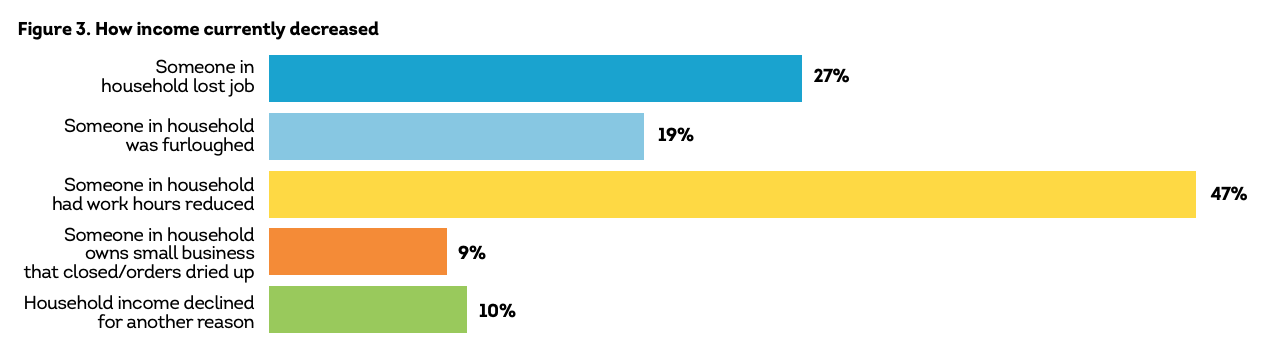

Respondents cited reduced work hours (47%), job loss (27%) and furlough (19%) as the top three reasons for decreased income.

Compared to the last wave of the survey, the percentage of consumers in households with someone who lost their job increased by fourteen percentage points from 13%, while the percentage of those living in a household where someone was furloughed increased three points from 16%.

How income currently decreased, Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

Of those currently negatively impacted by the COVID-19 pandemic, a significant 72% shared concerns about paying current bills and loans, and nearly half (42%) believe they won’t be able to pay them in full in less than four weeks.

When asked how they planned to address their financial obligations, 44% indicated that they’ll use money from savings, 41% will borrow money from friends or family members, and 27% will take out personal loans.

What is your plan to help pay your current bill(s) or loans? (among income currently decreased), Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

Changing consumer behavior and spending habits

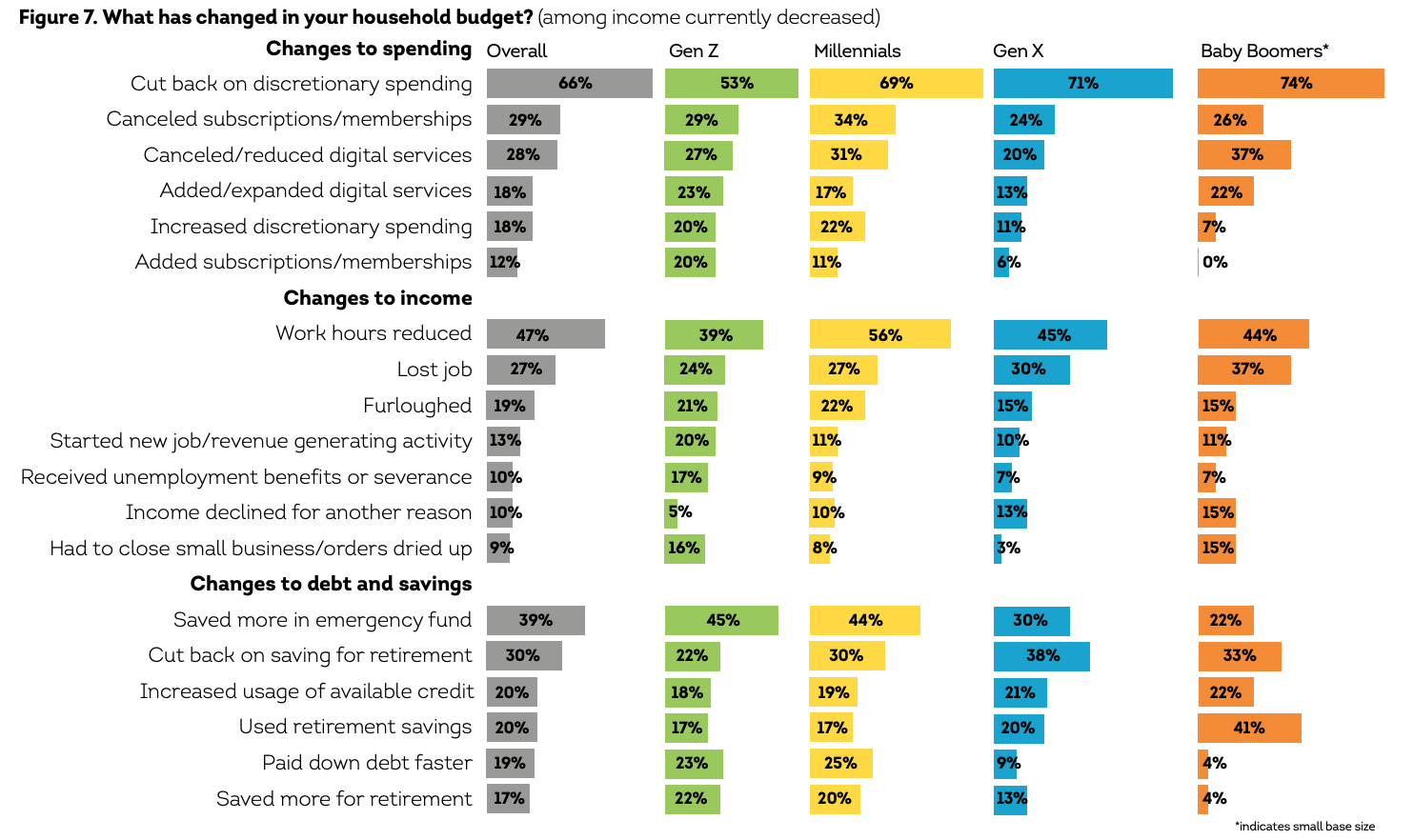

Results of the survey also indicate a profound change in how Hong Kong households are managing their household budget, spending their money and planning for the future.

Consumers impacted by the pandemic made significant changes in their credit and savings behavior. In the last three months, 39% said that they saved more in emergency funds, 30% cut back on savings for retirement, and 20% increased usage of available credit and retirement savings.

Hong Kong consumers also cut back on discretionary spending (66%), canceled subscriptions and memberships (29%), and canceled or reduced digital services (28%) to keep afloat during the pandemic.

What has changed in your household budget? (among income currently decreased), Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

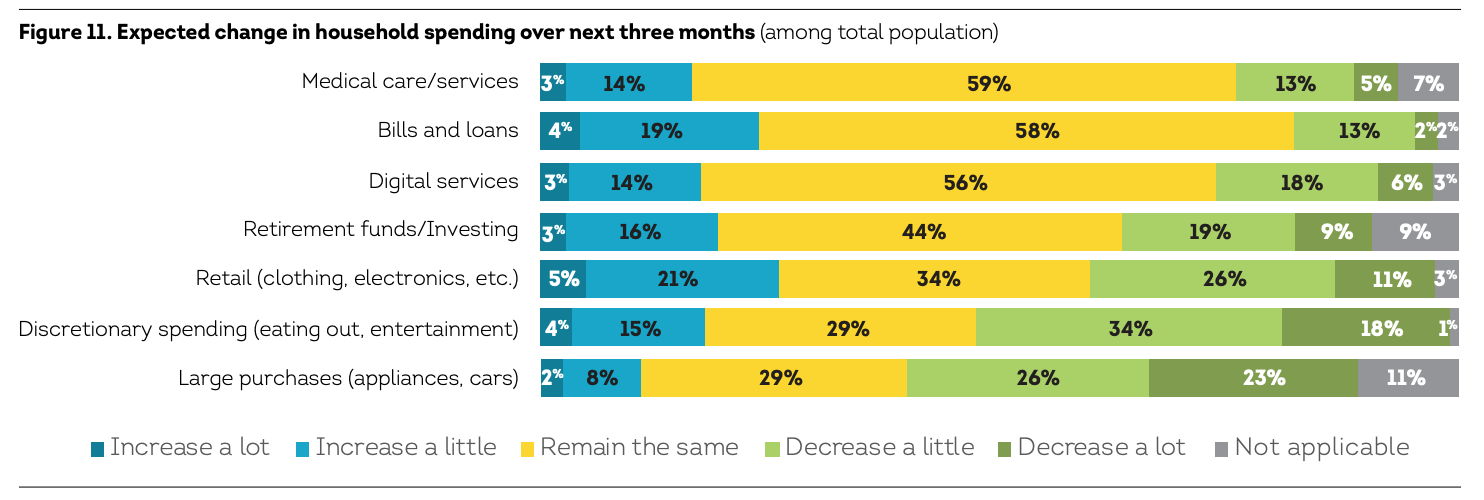

Over the next three months, Hong Kong consumers said they expect to decrease spending on eating out and entertainment (52%), large purchases such as appliances and cars (48%), and retail including clothing and electronics (37%). On the other hand, they expect to spend more on paying their bills and loans (32%).

Expected change in household spending over next three months (among total population), Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

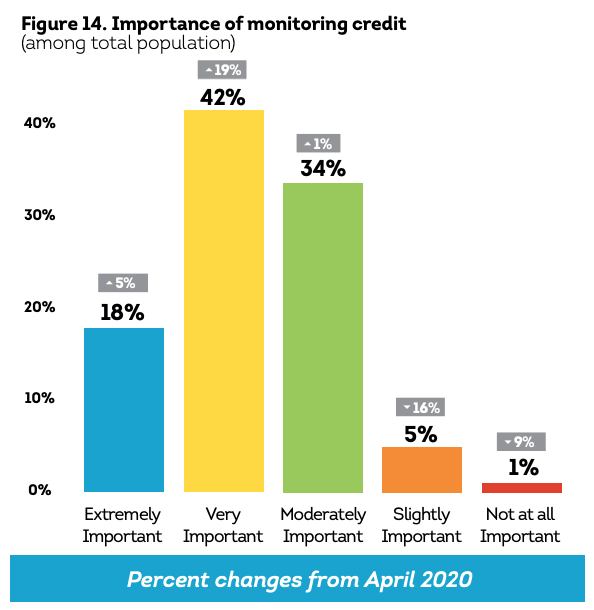

Having experienced a year of disruption, 95% of respondents now feel it is important to have savings for unexpected events or financial setbacks, and 94% believe it is important to monitor their credit.

Importance of monitoring credit, Source: The COVID-19 Pandemic’s Financial Impact on Hong Kong Consumers: Consumer Pulse, TransUnion, April 2021

Long-lasting impact

These changing consumer behaviors and new purchasing habits will likely remain post-pandemic, found a recent survey by Citibank, the consumer division of the US lender Citigroup.

In 2020, Hong Kong consumers cut spending during the pandemic by 13% compared to 2019, the study found.

Out of the 1,200+ Hong Kong residents surveyed, more than 70% of respondents said that they will continue to take a pragmatic approach towards consumption in the post-pandemic world and continue reducing some unnecessary expenses. 44% said that even when the pandemic is over, they will consider more carefully before buying non-necessities than they did in pre-pandemic times.

The Citibank survey results also shed light on how much more digital daily routines and consumption have become.

48% of respondents indicated that they ordered takeaway online, 47% said they participated in virtual meetings, and 33% purchased online at least two to three times a week. In comparison with the online spending amount in 2019, 69% of respondents said there was an increase of up to 12% in 2020.

Featured image credit: Photo by Martin Cox on Unsplash