Posts From Ong Kai Kiat

Chained Finance’s Supply Chain Blockchain Breakthrough In China

Blockchain is one of the exciting technology for the financial industry. The Monetary Authority of Singapore (MAS) had partnered with banks and blockchain technology company, R3 to pilot a proof of concept to use blockchain for payments in November 2016.

Read More3 Insights To China’s Impressive Rise on the Tech Startup Scene

Baidu, Alibaba and Tencent (BAT) are the three most prominent technology companies from China. The Co-founder of PayPal, Peter Thiel, had famously remarked that Beijing had a startup culture that is second only to Silicon Valley. The rise of the

Read MoreE-Wallet Hong Kong Player Stepping Up Its Game Amid Competition

Mobile payment is a major source of financial innovation which is gaining traction rapidly around the world. China is the number 1 market with US$67.7 billion transaction followed by the United States at US$24.9 billion and the United Kingdom at

Read MoreExploring The Evolving Fintech/Insurtech Regulatory Landscapes For China, Hong Kong & Singapore

A lot of link has been spilled about the potential of fintech and insurtech for the Asia Pacific region. However, we don’t have as much reports which looks at these two industries from the point of regulatory risks and trends.

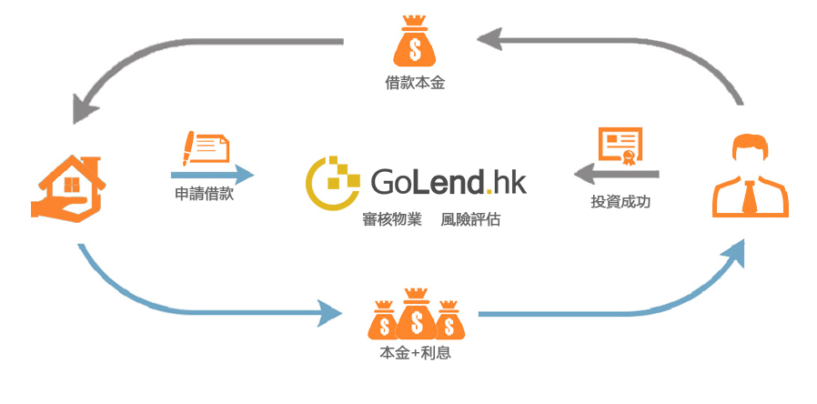

Read MoreThe Peer To Peer Lending Industry In Hong Kong – High In Potential & Competition

Hong Kong is a well known financial centre in Asia which serves as a gateway to China. According to one of the subsidiary Hong Kong Exchange, there are 157 licensed banks and 1280 licensed money lenders in Hong Kong. So

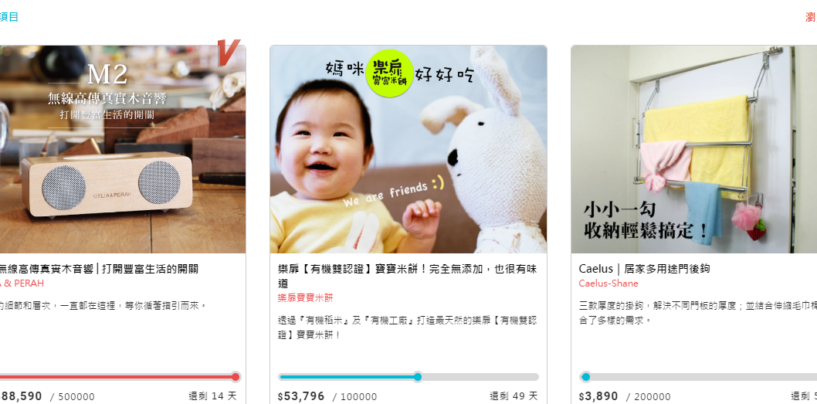

Read MorePeeking Into Taiwan Fintech Sector Of Crowdfunding

Singapore might be the leading financial technology (fintech) hub but it has to contend with a new challenger : Taiwan. The recent fintech festival shows that the Singapore Government is looking at fintech seriously and so is the Taiwanese government.

Read More