Baidu, Alibaba and Tencent (BAT) are the three most prominent technology companies from China. The Co-founder of PayPal, Peter Thiel, had famously remarked that Beijing had a startup culture that is second only to Silicon Valley.

The rise of the Chinese tech scene is the envy of the world. NTU research fellows Lim Wee Kiat and Jeremy Chen wrote a case study about it and this is an summary of its highlights.

China’s Unicorpse & The Shanghai Bullet Proof Vest

Let us begin with something counter-intuitive : failure. Behind the BAT glory, it is a well known fact that most start-ups fail. For those who had climbed to the ranks of unicorns (valuation of US$1 billion and above), their failure is known as unicorpse.

Reuters had written about a well-known Chinese unicorpse known as Shequ001 in December 2015.

Source: Technode (Shequ001 Website)

This supermarket delivery app firm burnt through its investors money to gain market share in the ultra competitive Chinese market. The Chinese market was so competitive that even Uber had to exit the market despite having Baidu as its partner.

Alibaba and Tencent are fierce rivals who backed different companies in several market verticals.

Today, the offline to online (O2O) market is deemed as the next bubble waiting to burst with overly high valuation and little revenues in their grab for market share. In this light, the Shanghai government had boldly stepped out to guarantee startup losses with public funds.

This is criticized by professionals for violating the risk-reward market principles. It would be interesting to see how Shanghai startups fare.

Fierce Rivals : Alibaba and Tencent

For instance, in the group buying space that is dominated by Groupon globally, we have Meituan and Dianping clones in China. Meituan is backed by Alibaba while Dianping is backed by Tencent. In the cab-hailing vertical, Tencent backed Didi Dache (滴滴打车) and Alibaba backed Kuaidi Dache (快的打车).

Source: TechInAsia

In both instances, the fierce rivalry caused an unsustainable price war which observers say would guarantee 4 unicorpses if left unchecked. Perhaps the reality of the untimely death of their investments woke up Jack Ma and Pony Ma.

Didi and Kuaidi merged in February 2015 and Uber China folded in August 2015 to the combined entity of Didi Chuxing. Baidu would get a 20% share of Didi Chuxing from its original investment in Uber China

Meituan and Dianping merged in October 2015 which posted a threat to Baidu’s Nuomi. The combined entity will monopolize 81.4% of the market compared to the Nuomi’s 13.6% market share. This marriage placed pressure on the remaining players in China’s O2O market.

Funding Routes – VC, CVC, Alumni & Government

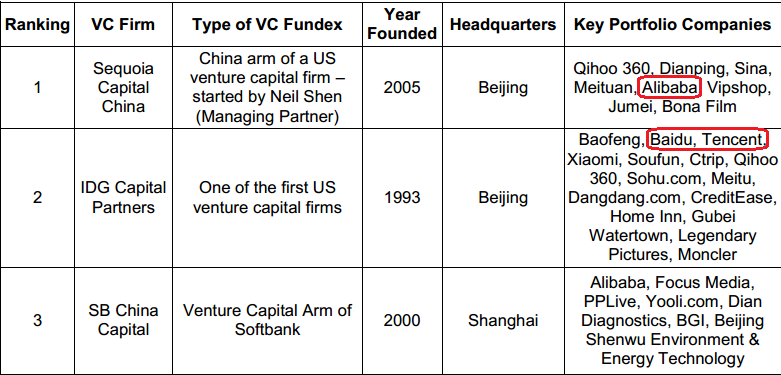

One big question for aspiring entrepreneurs would be how to get funding. There are primarily 4 methods. The first would be venture capitalists which is how BAT got funded in the first place.

Source: Harvard Business Review

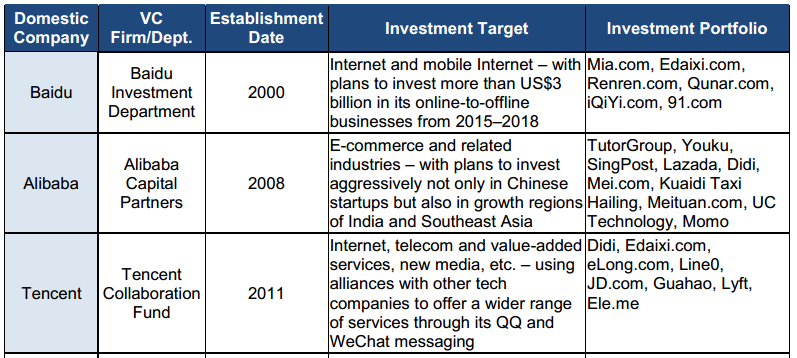

For instance, Alibaba was invested by the early venture capitalist players, Sequoia and Softbank (SB China Capital). IDG Capital invested in Baidu and Tencent. Now that they had become the famous BAT, they had their own Corporate Venture Capital (CVC) arms.

For instance, Alibaba Capital Partners invested in Singapore’s SingPost and Lazada while Baidu Investment Department invested in social networking site Renren.

Source: Harvard Business Review

Since 2014, the Chinese government emerged as a major source of funding with the Government Guided Funds (GGF) which invested RMB$57 billion in 213 venture capitalists firms.

In 2015, the Chinese government invested another RM$40 billion in a GGF program. In total, the Chinese government has RMB$2.2 trillion to back startups.

Finally, we have the corporate alumni clubs in this age where BAT employees are regularly encouraged to form their own companies. Baidu has Bai Lao Hui (百老汇) with 10,000 members.

Alibaba has Qian Cheng Hui (前橙会) with 150,000 members and Tencent has Nan Ji Quan (南极圈) with 15,000 members.

These alumni provides valuable informal networks for startups to get funding. Prominent examples include Didi Dache, Lilith Games and Da Da Bus among others. Young Chinese have the gotten the entrepreneur bug and some even start as soon as they graduate from university.

It is a major cultural change from their parent’s preference for government jobs and corporate alumni associations are key for their success.

Conclusion

BAT are known as the Big Dragons in the Chinese technology world and there is another layer of aspiring Big Dragons known as Little Dragons made up of the likes of Xiaomi.

The Chinese tech start started in 1985 with the liberation of the Chinese economy and various legislation changes which paved the way. There are strong government support for it.

Interestingly, the report noted that US$1 Trillion or 10% of Chinese GDP are flowing abroad in search for investments and South East Asia is a top destination for it.

The landscape of the Chinese technology and venture capitalist are not often cited in studies compared to Silicon Valley. Most news report are seen individually but this NTU report piece them together masterfully.

I would highly recommend that you spend US$8.95 to buy it from Harvard Business Review if it interests you for the full picture.