Fintech is Hong Kong’s Strongest Innovation Sector, Study Concludes

by Fintech News Hong Kong July 12, 2019KPMG and Alibaba Entrepreneurs Funds’ joint report has made it official—fintech is ranked as Hong Kong’s strongest innovation sector, beating out segments like smart city, artificial intelligence, e-commerce, big data, and many others.

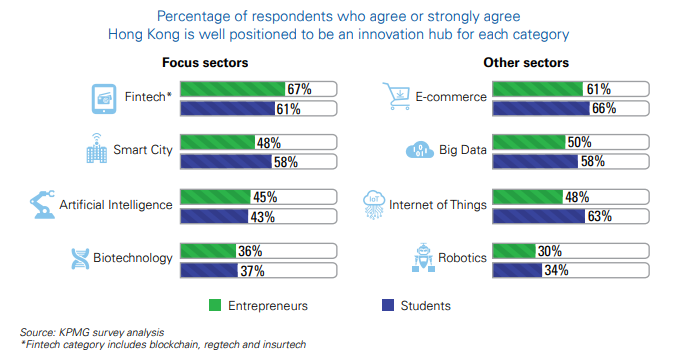

The conclusion was found when entrepreneurs and students were surveyed about whether they agree Hong Kong is well-positioned to be an innovation hub in a number of emerging technology areas.

The results suggest a need for continued effort to drive growth across all of the government’s four key innovation sectors outlined in the Hong Kong budget and the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area (GBA Outline Development Plan): fintech, smart city, artificial intelligence (AI) and biotechnology.

The report stated that it is “unsurprising” that fintech appears to be the most vibrant among these sectors, with 67% of entrepreneurs and 61% of students surveyed agreeing that Hong Kong is well-positioned to be a fintech innovation hub.

Image via KPMG

In 2017, the Hong Kong SAR government announced four priority sectors for I&T investment: artificial intelligence, biotechnology, fintech and smart city. To spur innovation in these sectors, the government has been investing in major new research and development (R&D) facilities, supporting funding schemes for start-ups and reforming the tax code to further boost R&D.

Of these verticals, fintech seems to have generated the biggest impact.

The Fintech Association of Hong Kong was also launched within the same year, and later in 2018, the government introduced the Faster Payment System (FPS), providing opportunities for innovation in the fintech sector.

Cindy Chow Executive Director Alibaba Hong Kong Entrepreneurs Fund agrees:

Cindy Chow

“Fintech and e-commerce ranked as the strongest sectors for innovation in the study. Our cohesion with these two areas allows us to provide a solid network, resources, and advice to our portfolio companies in these areas – our unique contribution to the Hong Kong start-ups working with Alibaba Entrepreneurs Fund.”

Fintech is The Golden Child

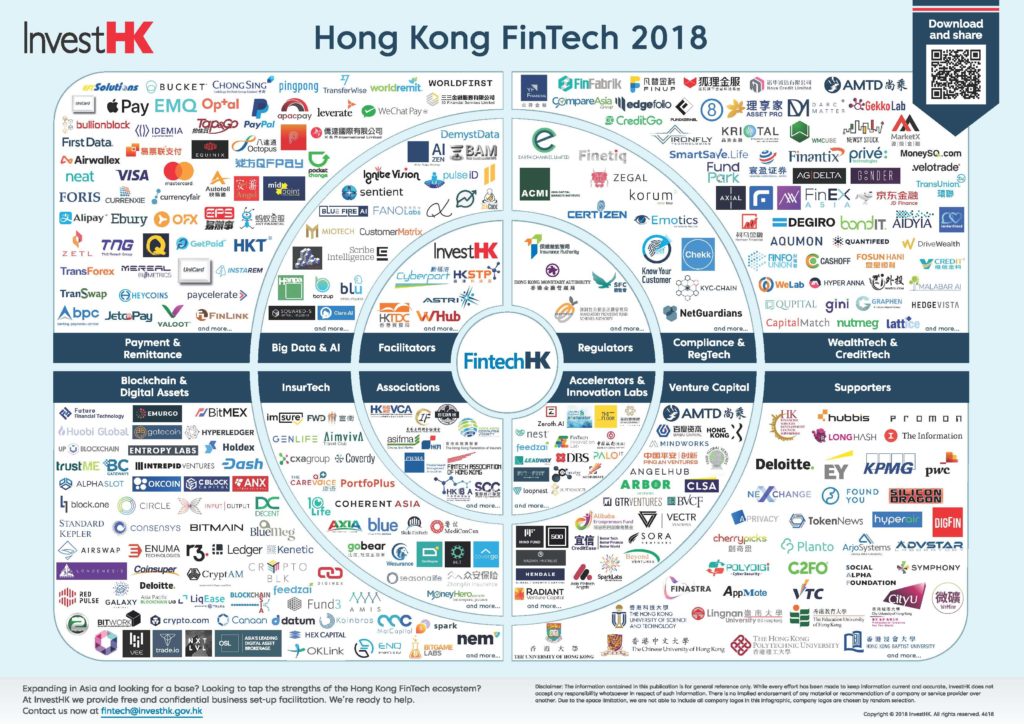

A snapshot of of Hong Kong’s Fintech Ecosytem

The state of the ecosystem is reflected in how there are nearly 50% more fintech startups in Hong Kong than any other sector.

Hong Kong’s largest fintech community is located at Cyberport, which houses more than 200 fintech companies working in areas as diverse as blockchain, cybersecurity, big data and wealth management.

Hong Kong-based online brokerage platform Futu Holdings raised US$90 million when it listed on the US’s Nasdaq Stock Market earlier this year.

Other major funding rounds completed in the past year include Airwallex, joining the unicorn club with a US$100 million round of funding led by DST global in March, while virtual insurer Bowtie completed a US$30 million funding round led by Sun Life and Hong Kong X Technology Fund.

Two recent government initiatives introduced since last year’s Transforming Hong Kong Through Entrepreneurship report are expected to further drive fintech innovation.

Faster Payment System (FPS) enables real-time money transfers and payments using a mobile phone number or email address, while the Common QR Code Standard for Retail Payments makes it easier for small and medium-sized enterprises to accept payment using QR codes.

There is also the launch of the first phase of the Open Application Programming Interface Framework in January, where third-party service providers can access Hong Kong’s banking system in a bid to spur integrated financial services like account aggregation apps and price comparison tools.

The city is also becoming a location for virutal banks, with the Hong Kong Monetary Authority (HKMA) awarding the first eight virtual banking licences earlier this year, with more applications currently under review.

The HKMA is also cooperating with the Office of Financial Development Services of the Shenzhen Municipal Government in a number of areas relating to fintech, including creating a soft-landing scheme to support Hong Kong fintech firms establishing a presence in Shenzhen.

The regulator has also signed a Co-operation Agreement with the Monetary Authority of Singapore to promote collaboration on fintech projects, including the development of a cross-border trade finance platform using Distribution Ledger Technology.

In order for Hong Kong to further develop its capabilities as a fintech innovation hub, there needs to be a focus on talent, both home-grown as well as attracting overseas entrepreneurs, KPMG financial services partner Arion Yiu points out.

Arion Yu

“The use of AI to improve efficiency and provide a greater customer experience will see the demand for data scientists and software developers continue to increase,” Yiu says. “Hence, there will be an ongoing need to train and attract new talent in these areas.”

Conducive to Startups

Fintech’s growth in Hong Kong is correlated with the dynamic and vibrant startup ecosystem, which sees the agreement of 70% of those surveyed in Hong Kong—up from 56% last year.

There are, however, notable differences between how entrepreneurs at different venture stages rate the city’s start-up landscape—for example, 86% of early stage entrepreneurs agree Hong Kong has a dynamic and vibrant start-up ecosystem, compared to 59%t of growth stage entrepreneurs.

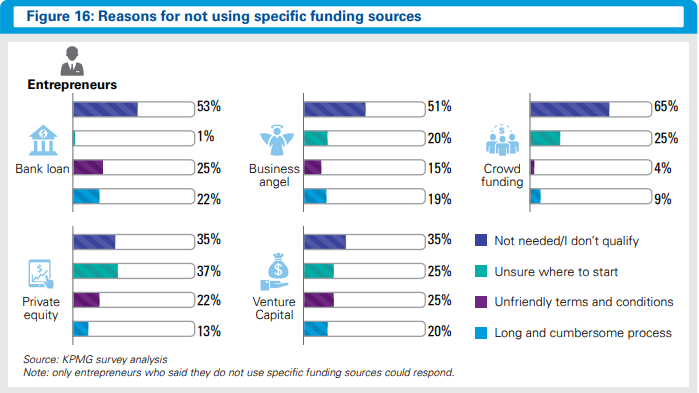

Image via KPMG

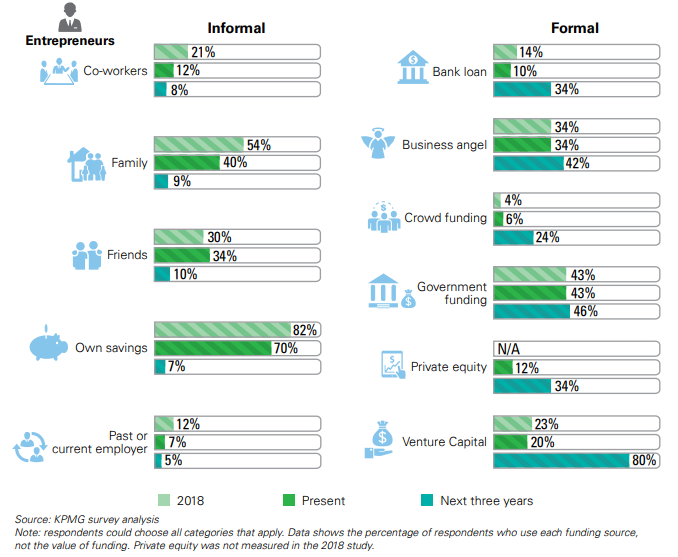

Startups expect to increase their use of formal funding sources, but more education is still needed to improve access to funding Currently, 70% of entrepreneurs surveyed use their personal savings to fund their business.

This is expected to change, with 80 percent of those surveyed expecting to be using venture capital (VC) in three years’ time compared with 20 percent at present. Similarly, more entrepreneurs expect to use other formal funding sources such as bank loans, business angels, crowd funding, government funding and private equity in three years’ time compared to now.

Analysis of VC investment over the past six years highlights a 20-fold increase in capital directed at Hong Kong-based start-ups. Average deal size for private VC investments increased more than 35-fold within the same period.

The findings suggest Hong Kong’s VC ecosystem is maturing and that priority innovation & technology focus areas including artificial intelligence, biotechnology, fintech and smart city are gaining a greater proportion of the total capital invested.

Image via KPMG

Hong Kong’s status as a fintech hub exists because of the region’s conducive environment towards startups, and is then bolstered due to strategic advocacy from the regulators like HKMA and collaborative fintch environments like Cyberport—and all signs point to this continuing on.

Featured image via Wikipedia‘s Yukakei