Now That The HKMA Faster Payment System is Live, What Does it Mean For Hong Kong?

by Fintech News Hong Kong September 28, 2018In an effort to push Hong Kong towards a cashless society, the HKMA Faster Payment System was launched earlier this month

To date 21 banks and 10 digital wallet have signed up for the system which includes well known names likes of Citibank, Hang Seng Bank, DBS, TNG Wallet, Alipay, WeChat Pay and Octopus.

What is The HKMA Faster Payment System?

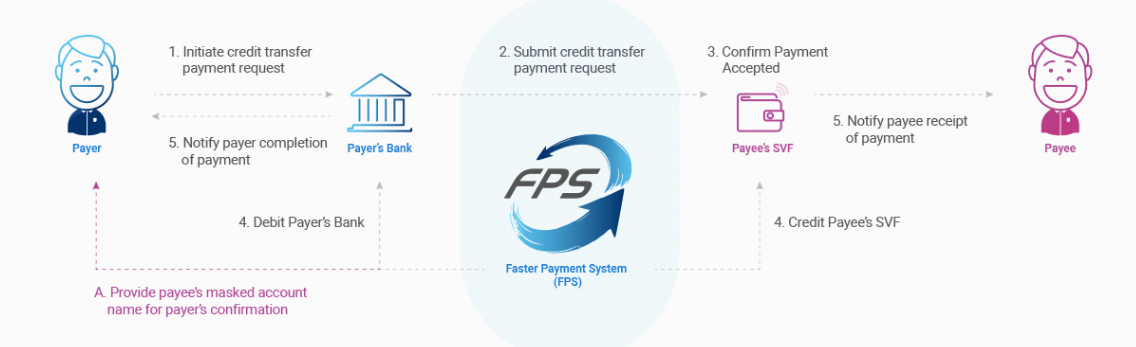

The HKMA Faster System, introduced by the authority and operated by Hong Kong Interbank Clearing is built to enable instant payments in Hong Kong. Though it is interesting to note that not all of the banks/wallets have enabled real time funds transfer.

It is a platform agnostic system that allows for payments to happen regardless of what bank or E-Wallet the user is tied to.

Image Credit: HKMA

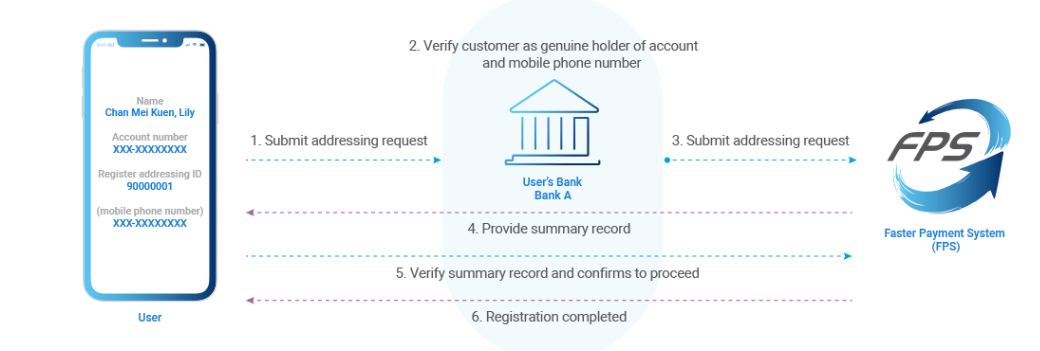

The HKMA Faster Payment system also has an addressing system built in which simply means you can register your mobile number have payments made to you only using your mobile number or an email address once you’ve registered it to the system.

Image Credit: HKMA

With the HKMA Faster Payments System P2P payments, E-commerce payments, retail payments and B2B payments are all supported. It also enables direct debit services, with this service a user for example will be able to automate monthly bill payments and loan installments.

The system is also said to support both Hong Kong Dollars and Reminbi, a feature that no doubt be useful to many Hong-Kongers. In addition to all these features, HKMA also recently announced the launch of the Common QR Code Standard, which will eliminate the need of a messy store-front littered with multiple QR codes from various providers.

What Does The HKMA Faster Payment System Mean for Hong Kong?

Hong Kong is not unique in it’s push for a cashless society, much like other markets in the world there is often a bulge of digital wallets each trying to push their own brand.

While the combined efforts of the players often means that there is a more concerted battle against cash it often also poses a challenge to consumers when the systems are not interoperable. When consumers have to install different digital wallet apps just to be able to pay different merchants they will often resort to just using card payments or cash.

HKMA’s Faster Payment System in principle is able to address this issue. We’ve also observed a 15.4% growth in digital wallet accounts and sharp growth 900% in P2P payments. With the new system in place and these positive numbers as its bedrock, Hong Kong is on track towards its cashless ambition.

Image Credit: Screengrab from HKMA’s Youtube Channel