The Chinese retail industry is entering a “new retail” era, characterized by the widespread use of technologies such as artificial intelligence (AI) and big data to digitalize the entire value chain, according to PwC.

China is the world’s biggest consumer market with total retail sales in Q1 2018 reaching US$1,436 billion, up by 9.8% year-on-year. China’s retail market is forecast to grow at a compound annual growth rate of 9% from 2017 to 2021.

China is also the world’s biggest e-commerce market with online sales in Q1 2018 reaching US$307.4 billion, an increase of 35.4% year-on-year. According to a PwC survey, 50% of Chinese consumers buy products online weekly, compared to the global average of 22%, and 59% of them are likely to buy grocery online, compared to global average of 21%.

One particular characteristics of the Chinese market is its large pool of millennials. With a population of approximately 410 million, there are more millennials in China than the entire population of North America.

Scale is making the China opportunity strategically significant but it is retail innovation, including in data analytics and digital payments, that truly puts it in a category of one, according to data from PwC’s Global Consumer Insights Survey 2018.

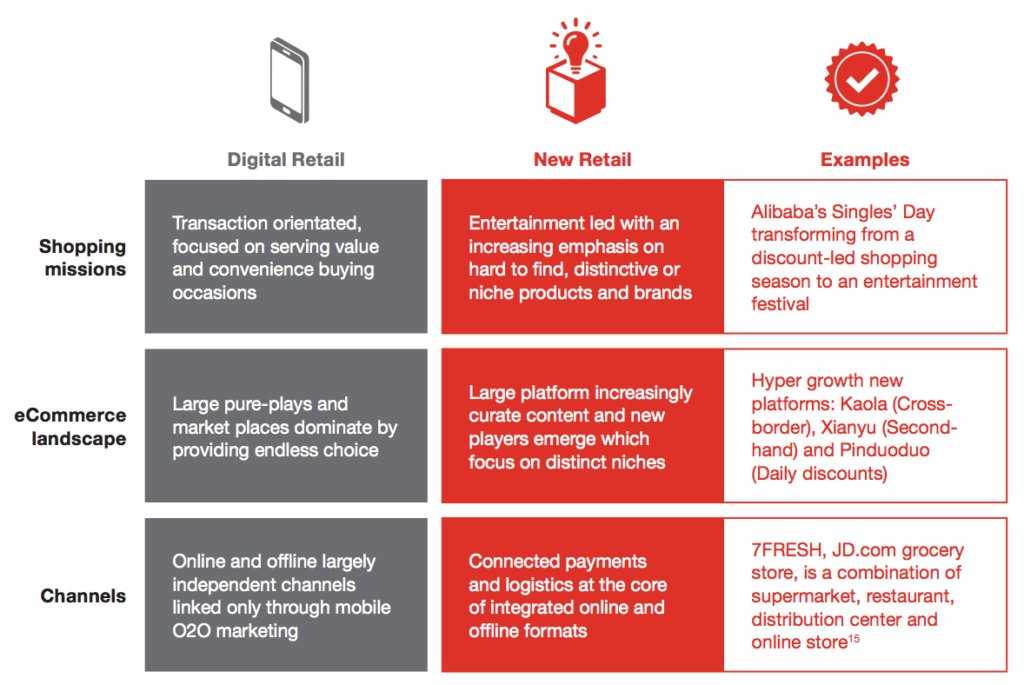

The “new retail”

The report points out the end of the “digital retail” era and the emergence of the “new retail” era. Over the last five years, China’s retail market has experienced a digital growth miracle but its impact has mostly been on the front office: sales channels and marketing. We are now entering a period that will be far more transformative, digitalizing the entire value chain, the research says.

New retail has three key characteristics, according to PwC:

- Genuine consumer-centric operating models;

- Digitalization and integration of the entire retail value chain; and

- Using data to enable smarter, faster decision making and business impact.

Sales: channels become integrated, formats more diverse, China’s next retail disruption: end-to-end value chain digitisation, PwC

China’s Internet giant were at the heart of digital retail and now are ushering in the new retail era. New retail is in fact an Alibaba term, but both Tencent and JD also pursue similar strategies described as “smart” and “borderless retail” respectively.

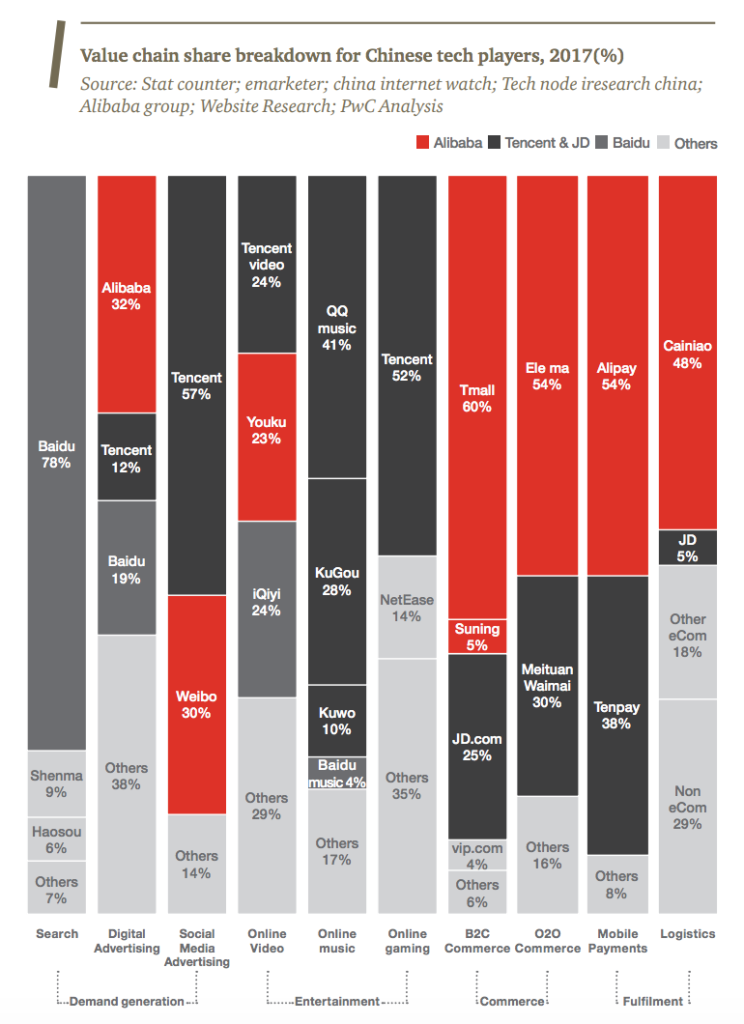

Currently, there are two Internet ecosystems that span the entire value chain of online consumer experience in China: Alibaba, and the Tencent and JD alliance.

Consumers in the Tencent ecosystem can seamlessly move from the discovery of a product endorsed by their favorite Key Opinion Leaders (KOL) on WeChat to a transactional environment in JD.

But in China, seamless consumer experiences and data only exist if consumers stay within the “walled gardens” of the Internet giants. PwC expects the Internet giants to continue to enforce the walled garden approach offline. For example, Walmart, which has a strategic partnership with JD, recently announced that it was no longer accepting Alipay in Western China in favor of WeChat Pay describing the choice as “offer the best all-round shopping experience for our customers.”

Value chain share breakdown for Chinese tech players, China’s next retail disruption: end-to-end value chain digitisation, PwC

China: the leader in mobile payments

Social media, mobile payments and e-commerce have become ubiquitous parts of the shoppers journey in China.

Home to 784 million smartphone users, China is the leader in mobile payments with 86% of consumers having used mobile payments to make purchases, compared to the global average of 24%. The research also found that Chinese consumers continue to be first movers at the forefront of new innovation: 44% would consider a drone as a delivery method for a low value product versus 22% globally.

The intense digital connectivity in China has led to the proliferation of big data which is now being used to optimize how brands create compelling customer experiences and also transform retail business models.

On the consumer side, data driven marketing has become so common that it is changing expectations of engagement. The research found that 67% of Chinese consumers expect retailers to have up-to-date information on them and personalize their experiences accordingly, compared to 42% globally. Artificial intelligence (AI) technologies are being used to enable more effective targeting. Sourcing traceability, particularly via blockchain, is also becoming increasingly important to enable greater consumer trust.