Financial Services Are Among The Most At Risk For Digital Fraud in Hong Kong

by Fintech News Hong Kong April 17, 2024In Hong Kong, financial services ranked second among the most targeted industries for suspected digital fraud last year, tied with travel and leisure at 7.8% each, new data released by American consumer credit reporting agency TransUnion show.

In 2023, the financial services sector experienced a staggering 190% year-over-year (YoY) increase in suspected digital fraud compared to the previous year, marking the highest growth rate across all industries analyzed.

The data, released as part of the 2024 State of Omnichannel Fraud Report, draw on proprietary insights from TransUnion’s global intelligence network and a consumer survey conducted in December 2023 among 13,000+ adults in 18 countries and regions globally to unveil digital fraud trends observed in 2023.

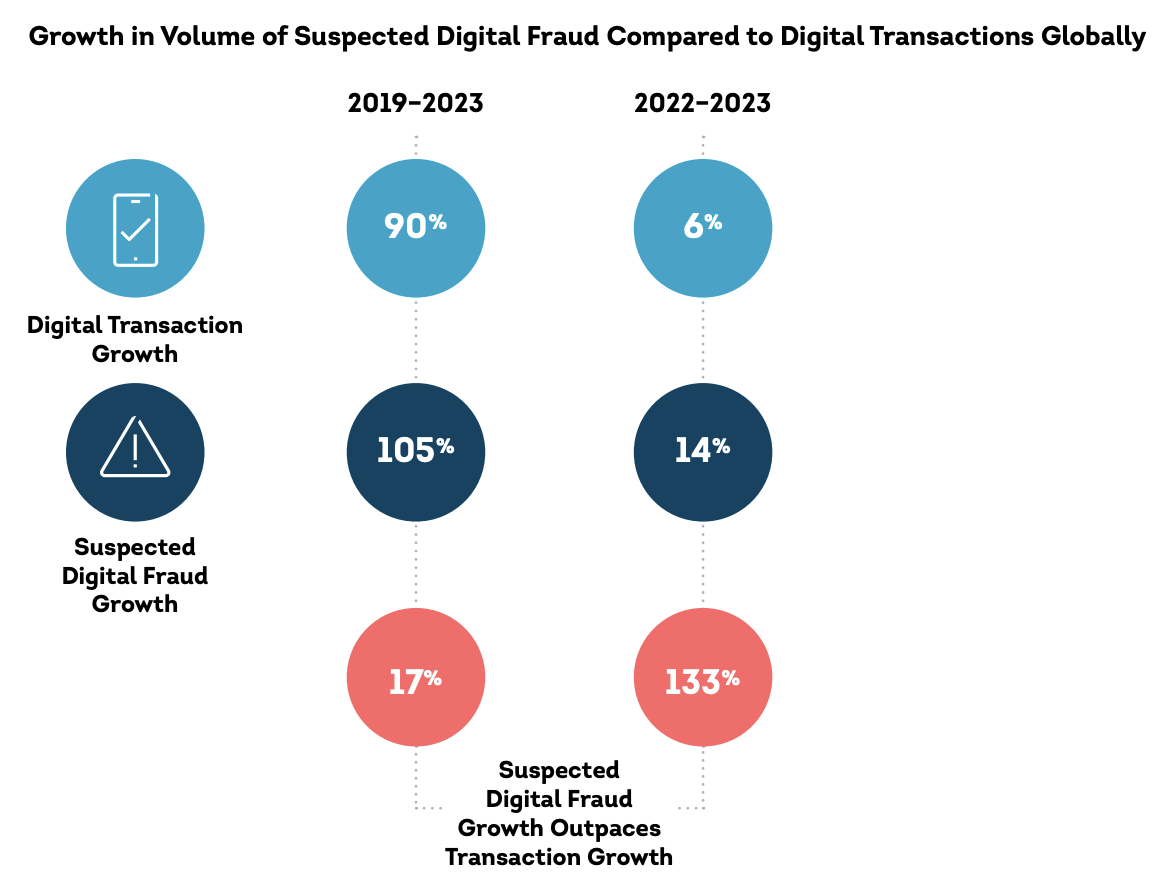

The report highlights the global trend of escalating digital fraud, with suspected cases outpacing the growth of digital transactions. Globally, the volume of suspected digital fraud rose by 14% YoY in 2023 and by 105% from 2019 to 2023, surpassing the growth in digital transactions, which increased by 6% between 2022 and 2023, and 90% from 2019 to 2023.

Growth in volume of suspected digital fraud compared to digital transactions globally, Source: The 2024 State of Omnichannel Fraud Report, TransUnion, Apr 2024

Rising awareness among Hong Kong consumers

In Hong Kong, digital fraud is more rampant than many other locations, accounting for 6.6% of all digital transactions in 2023, against 5% for the global average. But despite the higher incidence of suspected fraud, the research show that Hong Kong witnessed fewer victims in 2023.

Half of the Hong Kong consumers surveyed last year indicated being targeted by fraudsters through email, online, phone calls or text messages in the preceding three months, though only 5% of the respondents targeted said they fell victim, a relatively lower figure compared to the 11% of consumers in the 18 countries and regions surveyed. This result suggests rising consumer awareness and increased efforts from local regulators and industry players to provide anti-fraud education and other preventive measures.

Financial Services is the most targeted for digital fraud in Hong Kong

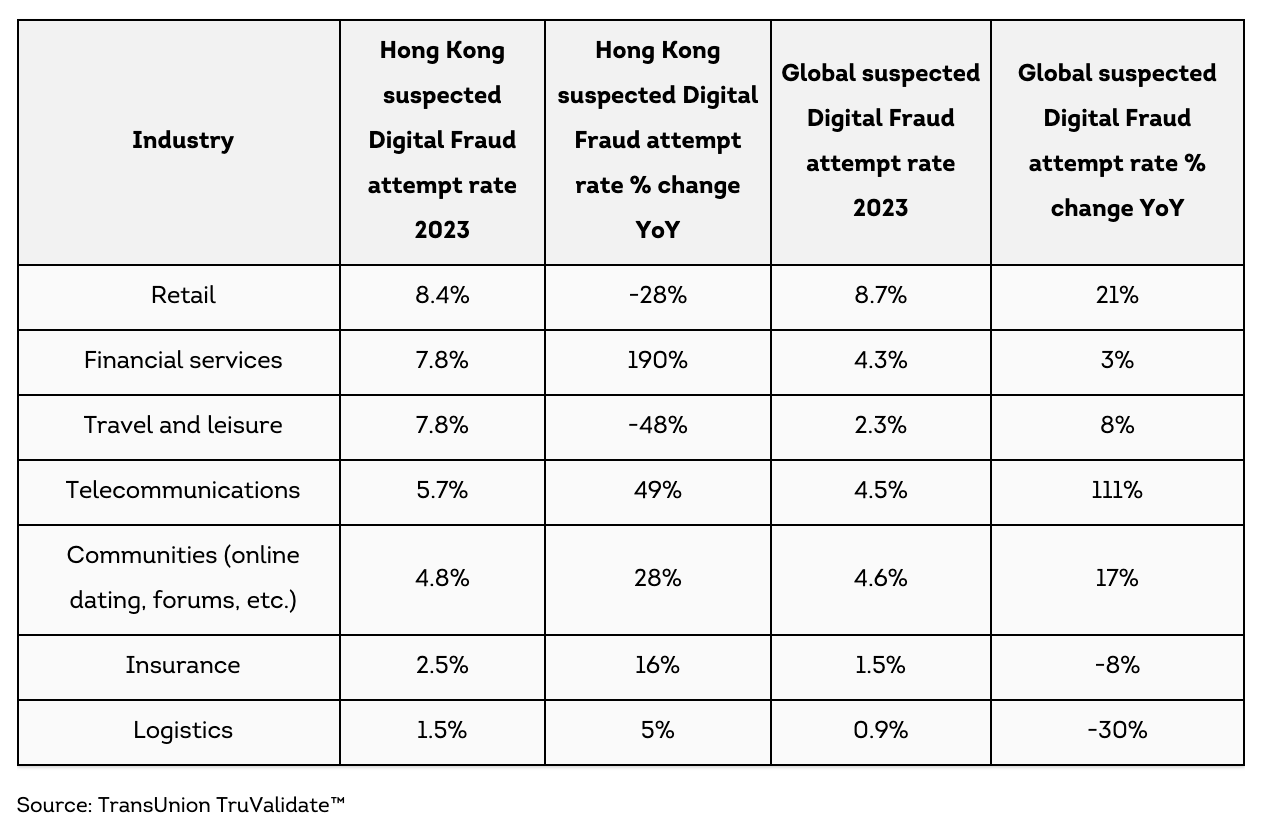

An analysis of sectoral patterns reveals that retail was the most targeted industry by suspected digital fraud in Hong Kong, with an 8.4% share in 2023, followed by financial services and travel and leisure. Despite not being the primary target in 2023, the financial services sector witnessed the biggest YoY increase, correlating with the surge in reported fraud cases to the city’s central banking institution.

Digital fraud rate in 2023 in Hong Kong and globally, Source: The 2024 State of Omnichannel Fraud Report, TransUnion, Apr 2024

During 2023, the Hong Kong Monetary Authority (HKMA) reported a notable increase in fraud-related banking complaints. More than 1,200 cases were received, which was more than the number for 2022. The trend mirror the 52% increase in deception cases reported to law enforcement in the first ten months of 2023, totaling 33,923 cases, with estimated losses to victims of about HK$7.2 billion.

Similarly, Hong Kong has also seen a surge in illegal crypto activity as well, according to a report by TRM Labs.

Rise of fintech fuels digital fraud

The push for digitalization in financial services has prompted an increase in digital fraud. A 2023 study conducted by PYMNTS Intelligence and ACI Worldwide found that US consumers are experiencing more payment fraud than before, with data showing an 87.7% increase between December 2021 and March 2023. Some forecasts predict that losses to online payment fraud could reach more than US$340 billion between 2023 and 2027.

US consumers experiencing fraud, Source- The Next Chapter in Fraud- Using AI to Unveil Payments Intelligence, PYMNTS Intelligence and ACI Worldwide, Oct 2023

LexisNexis Risk Solutions, an American data analytics company, estimates that the annual impact of global fraud across all sectors surpasses US$1 trillion, with each dollar lost to fraud costing US financial services firms approximately US$4.23.

Hong Kong central bank ramps up FRAML initiatives

In response to the surge in fraud, regulators in Hong Kong are bolstering their digital capabilities and teaming up with industry stakeholders to combat fraud and money laundering.

The Fraud and Money Laundering Intelligence Taskforce (FMLIT), an initiative established by the Commercial Crime Bureau (CCB) in May 2017 in collaboration with the HKMA, the Hong Kong Police Force, the Independent Commission Against Corruption, the Customs and Excise Department, and the banking sector, is an intelligence-sharing platform aimed at facilitating early detection and prevention of money laundering and serious financial crimes.

Similarly, the 24/7 stop-payment mechanism is a collaborative effort between banks and the police’s Anti-Deception Coordination Centre that aims to prevent financial losses due to scams and fraud by enabling real-time intervention.

Additionally, 28 retail banks introduced last year real-time fraud monitoring and detection capabilities last year.

These efforts have yielded significant results, with FMLIT alone leading to approximately HK$1.1 billion in restrained or confiscated crime proceeds since its inception.

Most recently, the Hong Kong Association of Banks, supported by the HKMA and the police, introduced the Financial Intelligence Evaluation Sharing Tool (FINEST), an electronic platform allowing retail banks to share information where there are indications of criminal activity.

Since its launch in June 2023, FINEST has allowed for the exchange of information on cases involving investment, online shopping and romance scams. The HKMA is currently looking to broaden FINEST’s coverage beyond corporate accounts, aiming to encompass all customers, accounts, or transactions deemed by financial institutions.

Featured image credit: Edited from freepik