Global Efforts Curb Crypto Hacks and Fraud, But Challenges Remain in Hong Kong

by Rebecca Oi April 15, 2024In 2023, the cryptocurrency ecosystem saw a significant decline in illicit activity, according to data from TRM Labs.

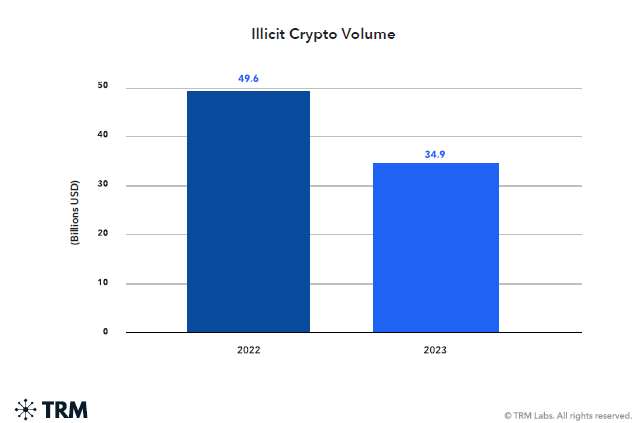

Despite the overall proportion of total illicit funds shrinking by 9 percent year-on-year, criminals still handled over US$34 billion (HK$266 billion) worth of cryptocurrencies.

While some crime categories, such as darknet drug sales, remained buoyant, the volumes of hacked and sanctions-exposed funds posted significant declines.

These downward trends were accompanied by increased pressure from governments and law enforcement bodies. For example, the US alone tripled the number of crypto crime-linked entities and individuals subject to sanctions.

In Hong Kong, specifically, crypto scams and fraud have emerged as significant concerns, reflecting the global challenges posed by the misuse of digital currencies.

The intensified regulatory and enforcement actions are part of a broader attempt to curb these fraudulent activities, safeguarding the integrity of the cryptocurrency market.

The shifting sands of illicit crypto transactions

TRM Labs’ findings for 2023 highlight a noteworthy decline in the volume of illicit funds circulating within the cryptocurrency markets. From US$49.5 billion (HK$387 billion) in 2022, illicit volumes plummeted to US$34.8 billion (HK$272 billion), marking a near one-third reduction.

This downward trend was not isolated; it accompanied a 22 percent shrinkage in the total cryptocurrency transaction volume, suggesting a broader cooling of the crypto fervour.

Yet, this decline in illicit transactions outpaced the overall market contraction, indicating a potential tightening of the noose around criminal activities in the digital currency space.

Sanctioned volumes plummeted

The total value of funds sent to sanctioned addresses and entities fell to US$ 16.2 billion (HK$126 billion) in 2023 from US$ 25.4 billion (HK$199 billion) in 2022.

Sanctions designations rose three-fold, from 11 events in 2022 to 33 in 2023, targeting 12 ransomware groups, six high-risk exchanges, and a cryptocurrency mixing service.

These aggressive actions by governments and law enforcement agencies likely significantly impacted the crypto crime landscape. Sanctions can disrupt the flow of funds to sanctioned entities, making it more challenging for them to access and move their illicit proceeds.

The increased scrutiny and enforcement pressure may have deterred some criminals from engaging in certain activities, leading to the observed decline.

Hacks proceeds halved

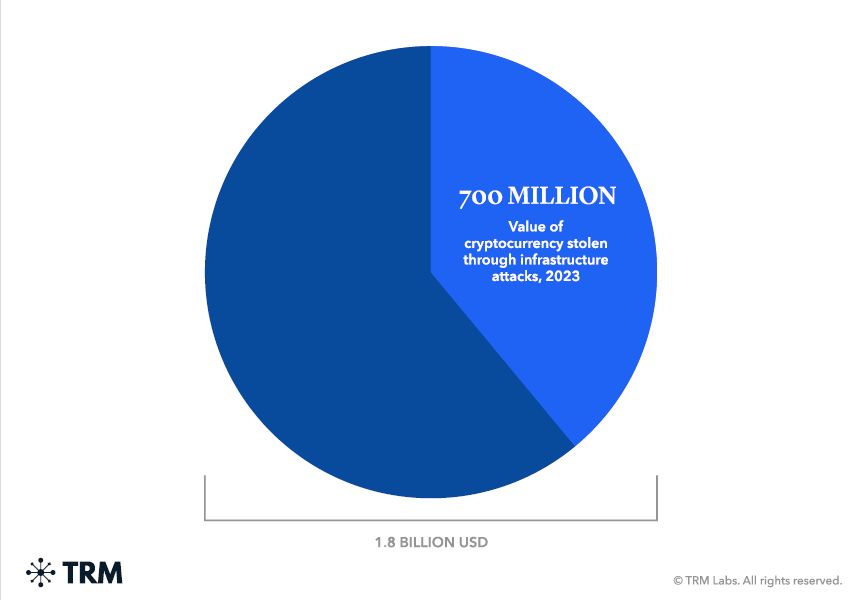

Hack proceeds fell by over 50 percent to US$ 1.8 billion (HK$14.10 billion) from US$ 3.7 billion (HK$28 billion) in 2022.

Actors linked to North Korea, responsible for nearly a third of all funds stolen in crypto attacks, made off with 30 percent less than they did in 2022.

The reasons behind the reduction in hacking volumes are likely multifaceted. Improved security measures, such as better critical management practices and increased use of hardware wallets, made it more challenging for attackers to compromise user funds successfully.

Additionally, enhanced coordination among industry participants and law enforcement efforts to track and recover stolen assets could have contributed to the decline.

Scams and fraud declined by 10.6 percent

Scams and fraud volumes—the total payments into addresses that TRM has connected to fraud or scams—dropped to US$12.5 billion (HK$97 billion) from US$ 13.9 billion (HK$108 billion) in 2022.

Apparent Ponzi and pyramid schemes were the largest subcategory of frauds, receiving around US$6.6 billion (HK$51.17 billion) annually.

Income generated from so-called pig butchering scams, where fraudsters employ psychological tactics to swindle victims via counterfeit investment opportunities, saw a minor decrease from US$ 4.7 billion (Hk$36.83 billion) in 2022 to US$ 4.4 billion (Hk$34.48 billion) in 2023.

The decrease in scams and fraud volumes may be linked to heightened public awareness of these schemes and enhanced regulatory oversight.

Additionally, the downturn in the cryptocurrency market could have made it more difficult for fraudsters to entice new victims.

Tron accounted for 45% of all illicit transactions

In the realm of illicit transactions, Tron (TRX) accounted for 45 percent of all such volume, marking an increase from 41 percent in 2022, with Ethereum and Bitcoin following at 24 percent and 18 percent, respectively.

Tether (USDT) emerged as the stablecoin with the highest illicit volume, reaching US$19.3 billion (Hk$151 billion), which represents 1.63 percent of its total volume.

The shift towards alternative blockchains and stablecoins may indicate that criminals seek to exploit perceived vulnerabilities or evade detection on more prominent platforms.

This highlights the need for comprehensive, cross-chain monitoring and analysis to combat crypto-enabled crime effectively.

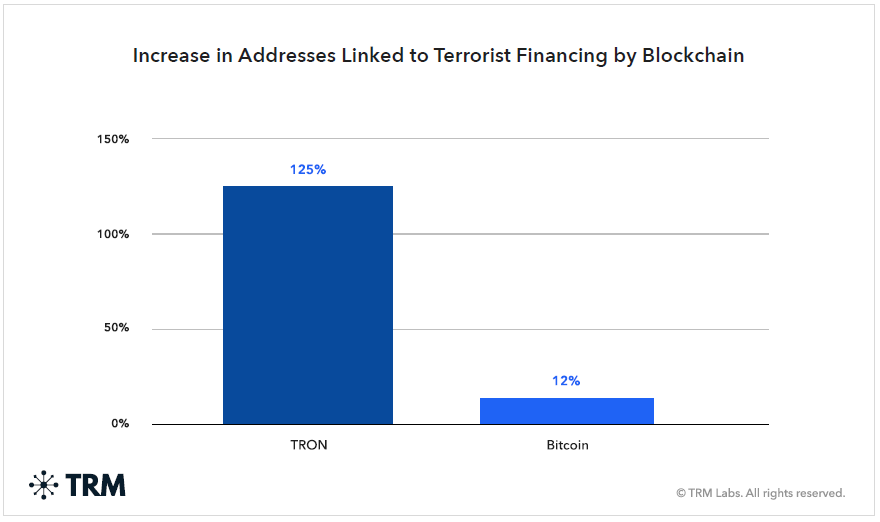

Terrorist Financing rose by 125 percent

While terrorist groups have announced moratoriums on crypto donations, the number of unique TRON addresses that received Tether (USDT) rose by 125 percent among those campaigns that continued to accept cryptocurrency.

Tether on TRON remains the currency of choice for terrorist financing, with three-quarters of donations being under US$500 (HK$3917).

The preference for Tether on TRON among terrorist financing entities may be driven by factors such as low gas fees, minimal price fluctuations, and perceived difficulty tracing transactions.

However, the relatively small size of individual donations suggests that cryptocurrency may still play a limited role in the broader landscape of terrorist financing, which continues to rely more heavily on traditional methods.

The surge of illicit crypto activities in Hong Kong

Hong Kong has seen a significant uptick in crypto-related crimes, with incidents tripling over the past three years. In 2023 alone, the reported value of crypto crimes amounted to approximately 4.4 billion yuan ($611 million), highlighting this financial hub’s growing challenge.

The Securities and Futures Commission (SFC) of Hong Kong documented a stark increase in crypto crime cases, from 1,397 in 2021 to 3,415 in 2023. Additionally, the SFC has flagged 24 crypto exchanges on its ‘List of Suspected Virtual Asset Trading Platforms’, signalling concerns over platforms that may facilitate fraudulent activities.

A significant contributor to the surge in crypto crimes in Hong Kong is online investment fraud, which saw a 170 percent increase from the previous year. The complexity and allure of high returns from crypto investments have made many fall prey to sophisticated scams.

Hong Kong’s regulatory bodies and law enforcement are intensifying efforts to combat crypto crimes through enhanced surveillance, public awareness campaigns, and stringent regulatory measures.

In response, the Hong Kong Monetary Authority and the Hong Kong Association of Banks have launched the Anti-Scam Consumer Protection Charter 2.0, an initiative supported by the SFC, among other regulatory bodies, to bolster public defence against digital fraud.

However, blockchain transactions’ anonymity and cross-border nature present persistent challenges in tracking and prosecuting offenders.

High-profile cases of market manipulation and undisclosed promotional activities further complicate the regulatory landscape. One such case involves the Securities and Exchange Commission (SEC) charging crypto entrepreneur Justin Sun and celebrity backers of his crypto asset companies, Tronix (TRX) and BitTorrent (BTT).

The charges stem from the unregistered offer and sale of crypto asset securities and the illegal promotion of TRX and BTT by celebrities who failed to disclose compensation. This case highlights the broader challenges of ensuring transparency and compliance in promoting and selling crypto assets.

In addition, Google has initiated legal proceedings against persons from China and Hong Kong, accused of running cryptocurrency scams via the Play Store. Allegedly utilising 87 fraudulent apps, these scammers deceived more than 100,000 users, leading to substantial financial losses since 2019.

A turning tide in crypto crime

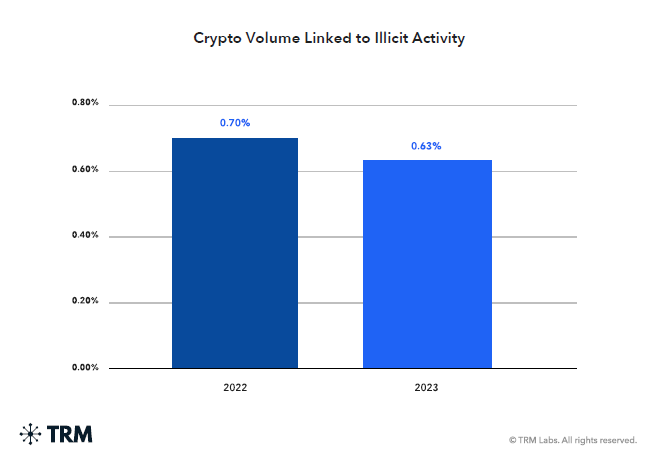

The reductions observed in many crypto crime categories over 2023 were welcome news, with the decline in illicit fund volumes surpassing the shrinkage of the overall crypto ecosystem. However, TRM found the share of illicit funds to be substantially higher than existing industry estimates.

Looking ahead, with cryptocurrency prices potentially reaching new peaks, criminals may find greater incentives to exploit the re-energised marketplace. Increasing geopolitical tensions could also embolden hackers and other threat actors.

Against this backdrop, vigilance and cooperation among crypto businesses, blockchain analytics companies, governments, and international bodies are more essential than ever to understanding and combating crypto crime.

Continued investment in advanced analytics, information sharing, and coordinated enforcement actions will be crucial in disrupting cyber criminals’ activities and ensuring long-term integrity and trust in the cryptocurrency ecosystem.

While the progress made in 2023 is encouraging, the battle against crypto-enabled crime remains. Sustained and collaborative efforts will be required to reduce the prevalence of illicit activities further and safeguard the cryptocurrency industry’s future.

Featured image credit: Edited from Freepik