HKMA Research Paper: The Benefits of Digital Bond Tokenisation

by Fintech News Hong Kong December 7, 2023Tokenization, which refers to the process of converting financial assets into digital tokens on a blockchain or distributed ledger (DLT), offers many benefits in capital markets.

Promising enhanced efficiencies, cost reductions, and improved market liquidity are the main benefits, a new paper by the Hong Kong Institute for Monetary and Financial Research, the research arm of the Hong Kong Academy of Finance (AoF) and affiliate of the Hong Kong Monetary Authority (HKMA), concludes.

The report, titled “An Assessment of the Benefits of Bond Tokenisation”, shares findings of a research on the potential on tokenization that used data sourced from Bloomberg, the International Capital Market Association and S&P Global Ratings to understand the extent to which the technology can benefit the bond market.

Findings from the study reveal that tokenization can help bond issuers reduce underwriting fees and borrowing costs, and has the ability to enhance the liquidity of bonds in the secondary market.

Results show that underwriting fees of issuing a tokenized bond are lower than those of a conventional bond by an average 0.22% points of the bond’s par value. This result is economically significant, as it represents a 25.8% reduction on average in the underwriting fees of matched conventional bonds.

Results also suggest that investors value the benefits of tokenization and are willing to accept a lower yield spread of 0.78% points on average when investing in tokenized bonds, compared to matched conventional bonds. Likewise, this result is considerable as it is equivalent to lowering the yield spread of matched conventional bonds at issuance by 23.9%.

Finally, estimates show that tokenized bonds exhibit higher liquidity, with a lower bid-ask spread than that on similar conventional bonds by 5.3%. The liquidity gain is even doubled to 10.8% if the bond is open to retail investors.

In addition, findings reveal that the liquidity of conventional bonds would be improved after their issuers issue a similar tokenized bond, with results suggesting that the average bid-ask spread of conventional bonds would be reduced by 0.049% points after the issuance of a tokenized bond. The reduction is equivalent to 8.5% of the average bid-ask spread of conventional bonds.

Asia leads bond tokenization movement

Though still at an early-stage of development, the tokenized bond market is a fast-growing industry that’s attracted the interest of both financial institutions and the public sector.

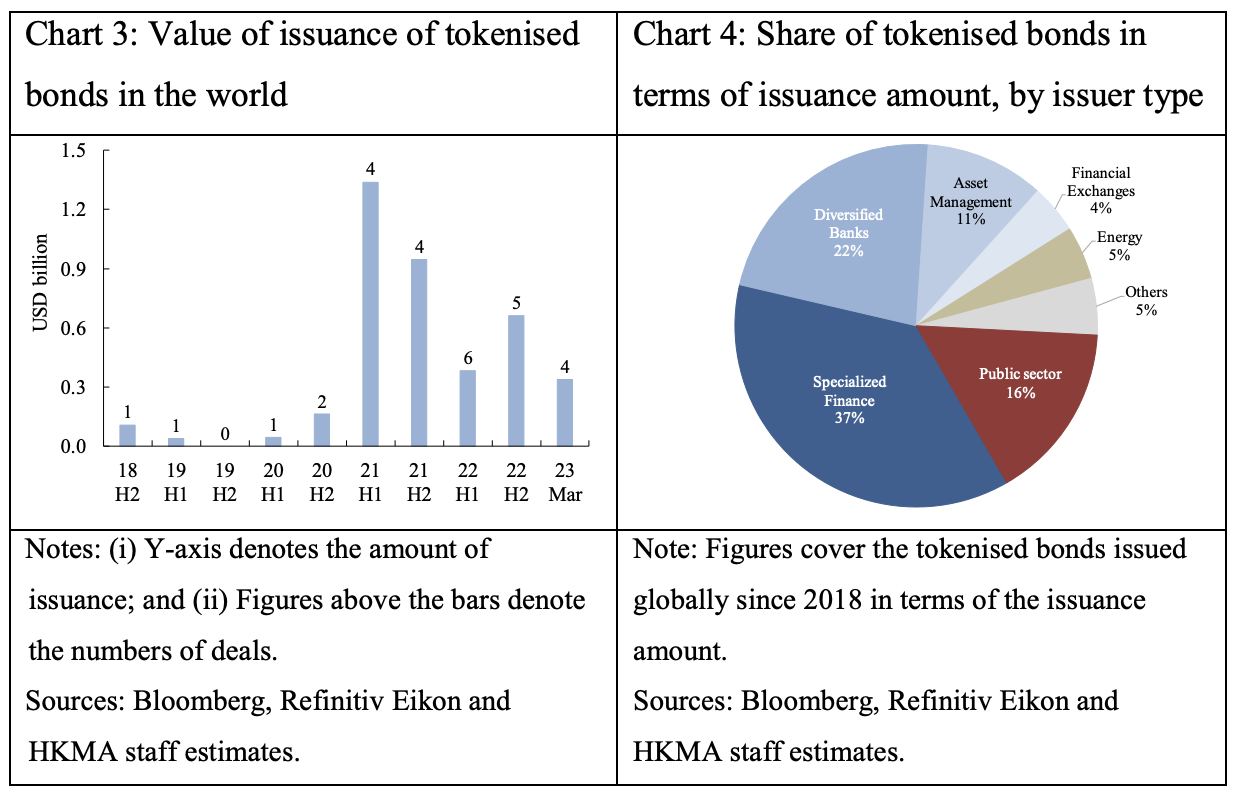

At the end of March 2023, the value of issuance of tokenized bonds globally had reached US$3.9 billion, with nine-tenths of issuance occurring in and after 2021. These figures suggest that the market is still at a nascent stage of development.

Among these tokenized bond issuances, financial institutions, including banks, asset managers, financial exchanges and specialized finance providers, were the leading issuers, accounting for 74% of all tokenized bonds issued since 2018.

The public sector is also embracing the trend towards tokenization, making up for 16% of all tokenized bonds issued. Notable initiatives highlighted in the report include the world’s first tokenized bond launched by the World Bank and the world’s first government-issued tokenized green bond launched by the Hong Kong Government.

Value of issuance of tokenized bonds in the world and share of tokenized bonds in terms of issuance amount by issuer type, Source: An Assessment on the Benefits of Bond Tokenisation, Hong Kong Institute for Monetary and Financial Research, Nov 2023

Looking at geographic distribution, the study found that Asia is leading the world in tokenized bond issuance, accounting for about 70% of all tokenized bonds issued. Singapore makes up the lion’s share, accounting for 45.5% of all issuances, followed by Thailand and the Philippines, neck-and-neck at 9%, Hong Kong at 3% and Japan at 0.3%.

Europe account for most of the rest (31%). The region is led by the European Union (12%), the UK (10%) and Switzerland (9%).

Share of tokenised bonds in terms of issuance amount, by issuer domicile, Source: An Assessment on the Benefits of Bond Tokenisation, Hong Kong Institute for Monetary and Financial Research, Nov 2023

Financial institutions accelerate tokenization efforts

The rise of tokenized bond issuance in Asia and Europe is being supported by the development of digital platforms and infrastructure for tokenization. Many of the platforms currently in operation are backed by traditional financial institutions.

For example, the Singapore Exchange Group is one of the co-owners of Marketnode and financed ADDX in a Series A round in early 2021. ADDX also received investment from the Stock Exchange of Thailand in a Series B round in 2022.

The SIX Group, Switzerland’s stock exchange operator, launched the SIX Digital Exchange (SDX) in 2021, and the Japan Exchange Group invested in Nomura-affiliated Boostry in early 2023.

In addition, some banks have launched their own digital platforms also, such as Goldman Sachs’ digital asset platform, GS DAPTM, HSBC’s Orion platform, and Standard Chartered’s Libeara platform.

Share of tokenized bonds, by digital platform and domicile, Source: An Assessment on the Benefits of Bond Tokenisation, Hong Kong Institute for Monetary and Financial Research, Nov 2023

Bonds are just one type of financial assets that can be tokenized and the concept can be applied to various asset classes, including real estate, stocks, commodities and even art.

Global management consultancy Roland Berger forecasts that the market for asset tokenization could mushroom to at least US$10 trillion by 2030, with real estate, debt and investment funds emerging as the top three tokenized assets. These assets will dominate the tokenized market due to the sheer size of the underlying markets and the high prevalence of use cases, the firm predicts.

The amount implies a 40-fold increase of the value of tokenized assets from 2022 to 2030, and marks a significant rise from the current value of around US$300 billion.

Estimated value of tokenized assets by 2030, Source: Roland Berger, Oct 2023

Featured image credit: edited from freepik