BIS Raises Concern Over Digital Monopolies by Bigtech Like Tencent and Alibaba

by Fintech News Hong Kong November 28, 2023Bigtech companies such as Alibaba, Meta and Tencent, are rapidly expanding their presence in the financial services sector. This increasing influence presents opportunities to improve financial inclusion but also brings challenges relating to market dominance and price, as well as privacy issues, a new report by the Bank for International Settlements says.

The report, titled “Bigtechs in Finance”, explores the rise of tech giants in the financial industry and its implications, both positive and negative.

According to the report, bigtechs’ footprint in the finance sector is expanding at a fast pace and their activities have attained macroeconomic significance in several countries including China, Indonesia and South Korea.

These companies, whose primary activity is digital services rather than financial services, are leveraging their extensive user data to enter new markets. In the financial sector, they begin with payment services before expanding into credit, insurance, savings, and investment products once the payment business is well established. This expansion occurs both in collaboration and competition with traditional financial institutions.

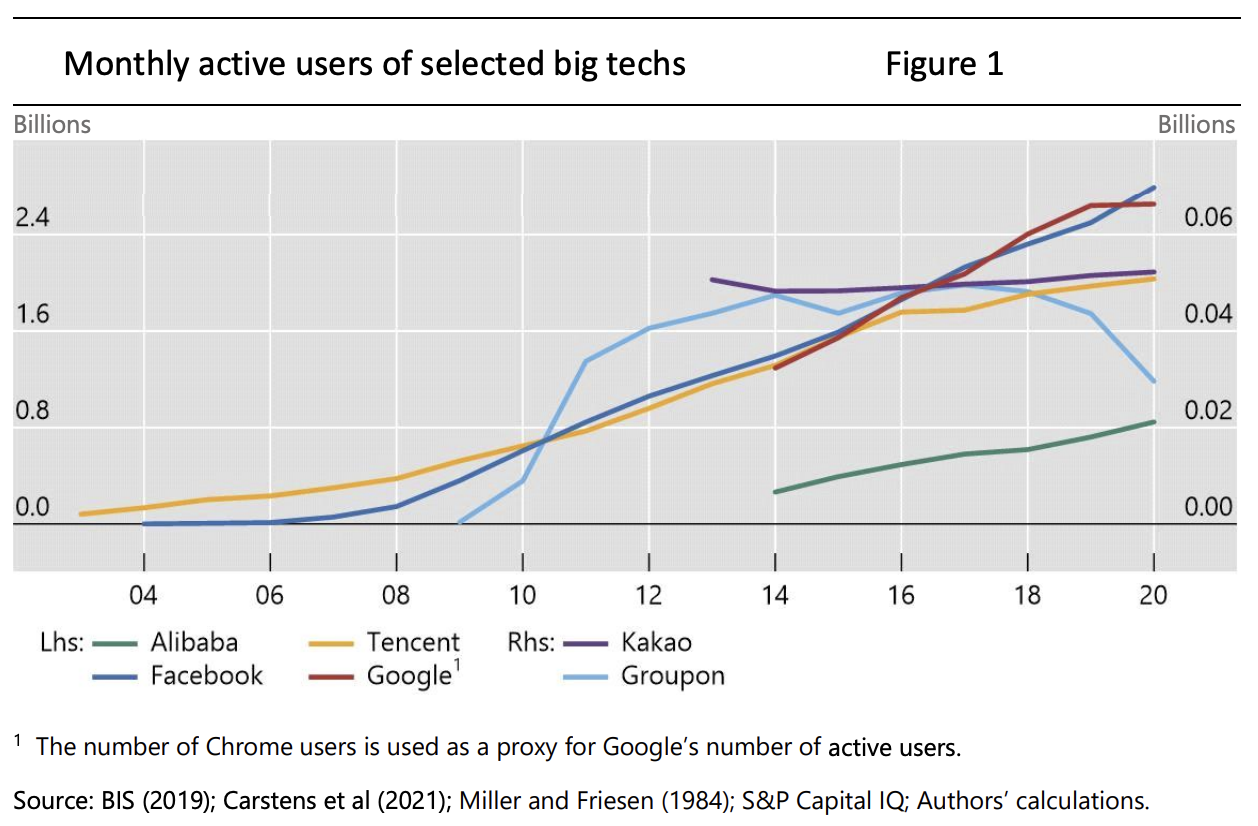

Over the years, bigtech companies have become increasingly popular, a trend that’s evidenced by the number of active users firms like Alibaba, Tencent and Facebook are boasting.

Data from the report show that in 2006, Facebook had about 100 million monthly active users. By 2020, that number had soared to 2.5 billion. Similarly, Tencent, the owner of China’s top messaging app and super-app platform WeChat, saw its monthly active user base surge from about 10 million in 2008 to 40 million in 2020.

Monthly active users of selected bigtechs, Source: Bigtechs in finance, Bank for International Settlements, Oct 2023

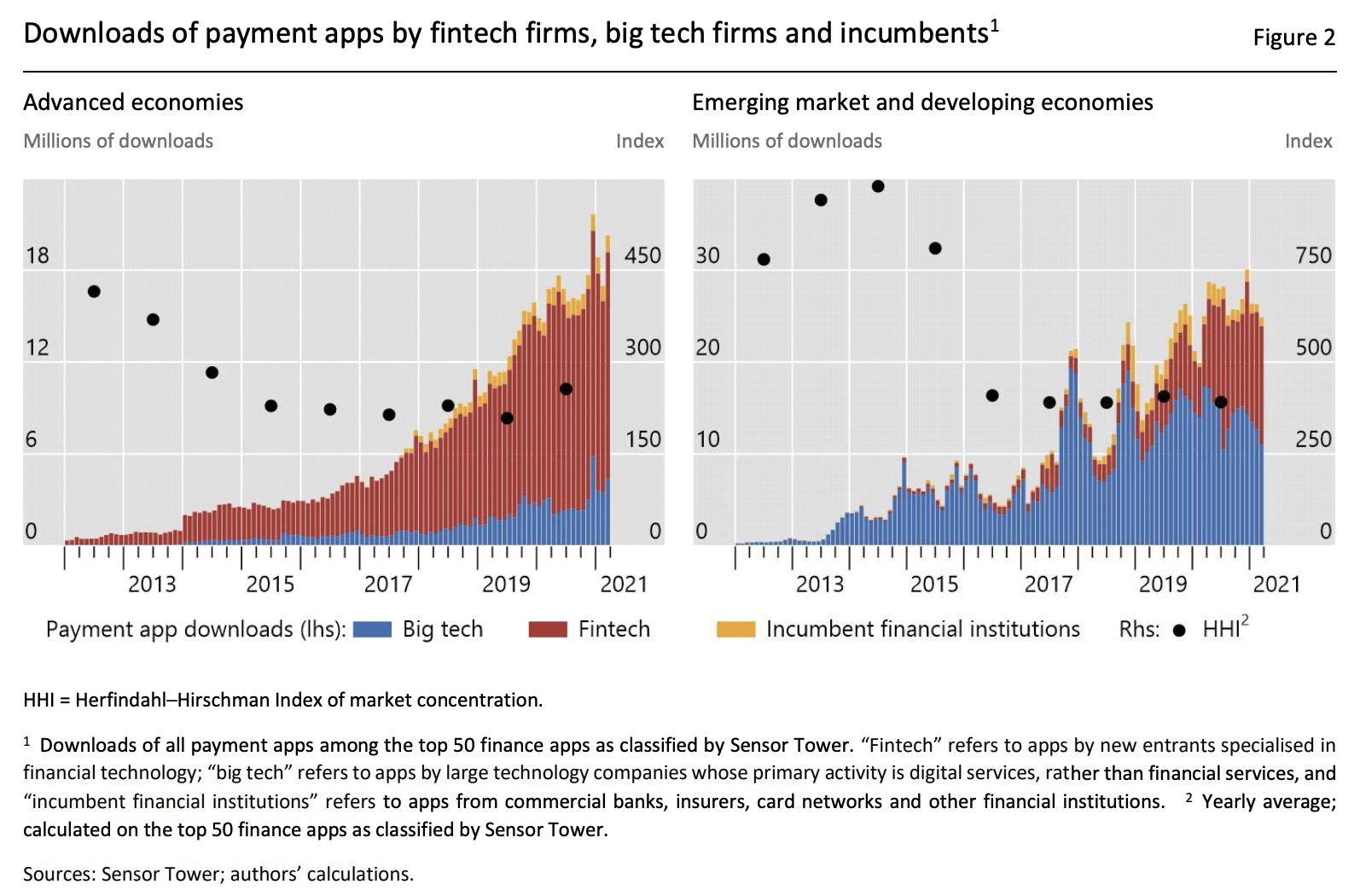

In numerous markets, bigtechs’ payment businesses have surpassed those of fintech companies and incumbent banks.

This trend is most pronounced in emerging markets and developing economies where their payment apps are being downloaded more often than those of fintechs and traditional banks, data from the BIS report show.

Downloads of payment apps by fintech firms, bigtech firms and incumbents, Source: Bigtechs in finance, Bank for International Settlements, Oct 2023

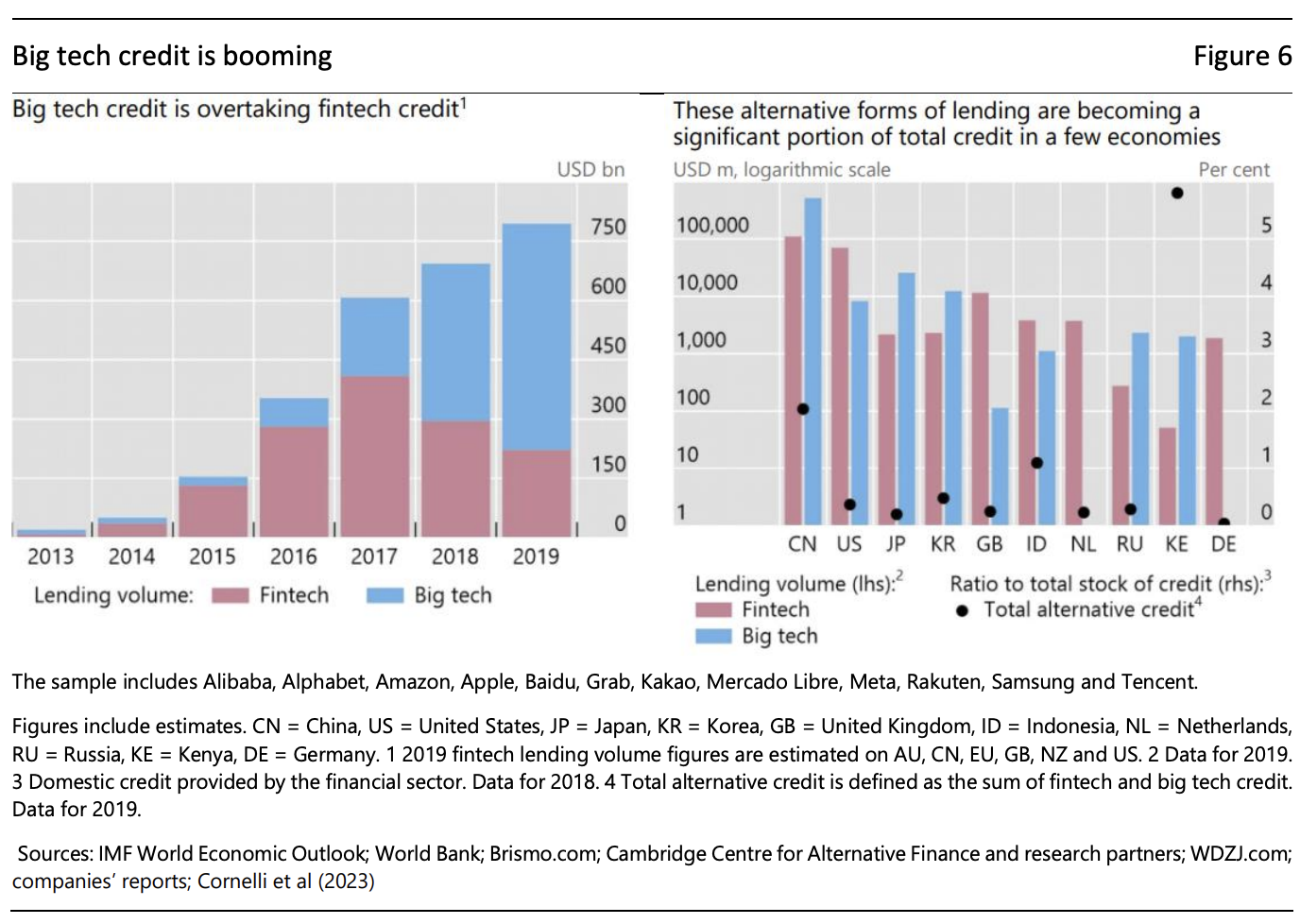

Besides payments, bigtechs’ influence in the financial services industry is also visible in other segments including credit where these players are taking market share from fintechs and incumbents.

In 2018, bigtech credit overtook fintech credit, totaling about US$375 billion in lending volume for bigtechs against US$300 billion for fintechs. That trend carried on the year that followed, with bigtech lending volume reaching about US$560 billion in 2019, against US$200 billion for fintech lending.

Recently, the pace of increase in bigtech credit has been faster than that for bank credit. For instance, during 2020-2021, bigtech credit in China recorded an estimated growth rate of 37%, compared with 13% for bank credit.

The growth of bigtech credit globally, Source: Bigtechs in finance, Bank for International Settlements, Oct 2023

Improving financial inclusion

Through their use of machine learning (ML) and big data, bigtechs can potentially enhance financial inclusion by offering more efficient and nuanced credit services, particularly for individuals and businesses excluded by traditional banks, the BIS report says.

Traditional banks face challenges in providing credit due to the costs associated with assessing credit risk and enforcing repayment. Moreover, incumbents often rely on collateral and conventional credit scoring methods, which may exclude individuals or businesses lacking tangible assets or a well-established credit history.

Bigtechs, on the other hand, use alternative data sources, such as non-traditional financial information, online activities, and transaction histories, to create a more comprehensive and nuanced view of the borrower’s creditworthiness. Leveraging these data with technologies such as ML algorithms and predictive models, bigtechs are able to gain a more accurate and dynamic understanding of a borrower’s financial health, allowing them to overcome some of the limitations of traditional banking systems.

Another important feature of bigtech credit outlined in the BIS report is the use of data from ancillary services such as payments to generate digital footprints for small firms that can be used to generate credit scores. For example, in China, Ant Group uses information from merchants’ payment histories through QR code payments to determine credit access.

“Digital monopolies” and privacy concerns

The BIS report argues that while the entry of bigtechs into finance could bring efficiency gains and further financial inclusion, their provision of financial services can also lead to regulatory challenges like market dominance, price discrimination, algorithmic discrimination and threats to user privacy.

In particular, it notes that bigtechs have the potential to quickly dominate the market due to the inherent nature of their business model. Once a bigtech has established a captive consumer base, it can abuse its dominant position to prevent the entry of competitors, increase switching costs, bundle products and promote its own products at the expense of third-party sellers, leading to the emerging of a “digital monopoly”, it says.

The risk of abuse of market dominance is heightened because bigtechs increasingly serve as essential selling infrastructures for financial service providers while competing with them, the report stresses.

Concerns also arise regarding potential biases in algorithms used by bigtechs, leading to discrimination against minorities. For example, evidence suggests that in the US mortgage market, Black, Native American and Latino applicants are more likely to be rejected from ML-based credit scoring models.

The extensive access to personal data by bigtechs also raises privacy concerns, with instances of health websites sharing individual health data with major tech companies.

In light of these risks and challenges, the BIS report calls for more coordination between national and international authorities, particularly central banks and financial regulators, as well as competition and data protection authorities, to introduce proper regulations.

It notes that while the regulatory landscape is evolving, the complexity of their activities requires a multifaceted approach that considers competition, data protection, business conduct, operational resilience, and financial stability, stressing that coordination among regulatory bodies is essential to address the dynamic challenges posed by bigtechs in the sector.