The telecoms industry is not immune to disruption, according to a new report by Juvo. As Over-The-Top (OTT) service providers profit from revenue streams, mobile operators are forced to move away from commoditised services like network reach and quality and into new differentiated offerings that leverage subscriber data.

On the customer side, they use interactive real-time products that change in response to the behavior from an entire user base, which in the case of Facebook, can correspond to billions of users. This is enabled by data science, which applies advanced mathematical and statistical techniques to big data to uncover insights that can improve performance

Popular start-ups are also disrupting the traditional communications sphere, with Skype, Viber, WeChat and WhatsApp seriously undercutting prices in both text and voice. They are also harnessing massive amounts of data generated by individuals and institutions as they interact with digital devices and services to inform the development of their services. Hence, mobile operators’ ability to develop, deliver and drive the use of new higher value services, is predicated on unmasking previously unknown mobile users.

Just like internet users, with search histories, cookies and IP records, prepaid mobile

subscribers leave digital footprints as they interact with their mobile device. Applying data science to the big data generated by these ‘digital footprints’ is imperative to disrupting the ‘service flow’ away from OTT players and reorienting mobile operator businesses. Data science offers mobile operators an advantage that is difficult or even impossible for OTT players to match, noted the report.

Applying data science

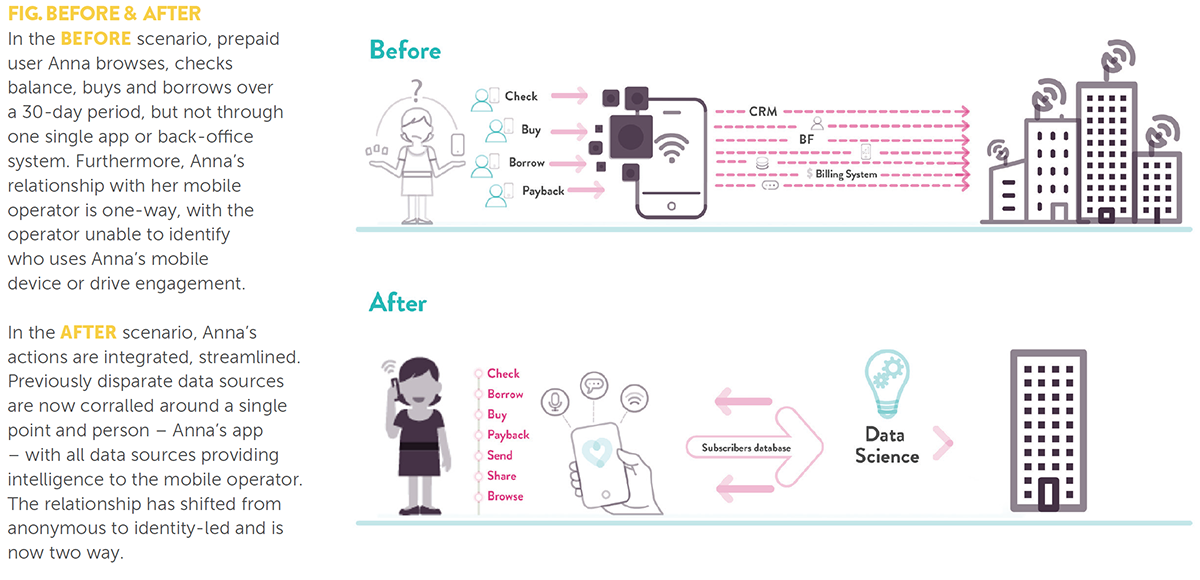

The core strategy for mobile operators is to shift from an anonymous relationship based on a SIM card (or phone number) to an identity-based one. Mobile operators already have innumerable customer data sets but this data is disparate and unconnected, making distillation and comprehension not only an enormous job, but extremely difficult. Furthermore, existing data sets do not provide enough data to unlock identities with real user insight.

The deployment of new tools, like consumer apps and game mechanics, generates new types of engagement and leads to the creation of further valuable data. Here we see how data science transforms customer insight and engagement by bringing together previously disparate data sources:

Image via Juvo

Unlocking identity with data science

One way to prevent prepaid user churn is the provision of mobile financial services by operators. This is especially popular in emerging markets, asit is a marquee service, still beyond the clutches of OTT providers, and intimately tied to digital identity, said the report. In emerging markets, churn rates equate to 3-10% per month which means mobile operators lose at least one third of their existing prepaid customers every year.

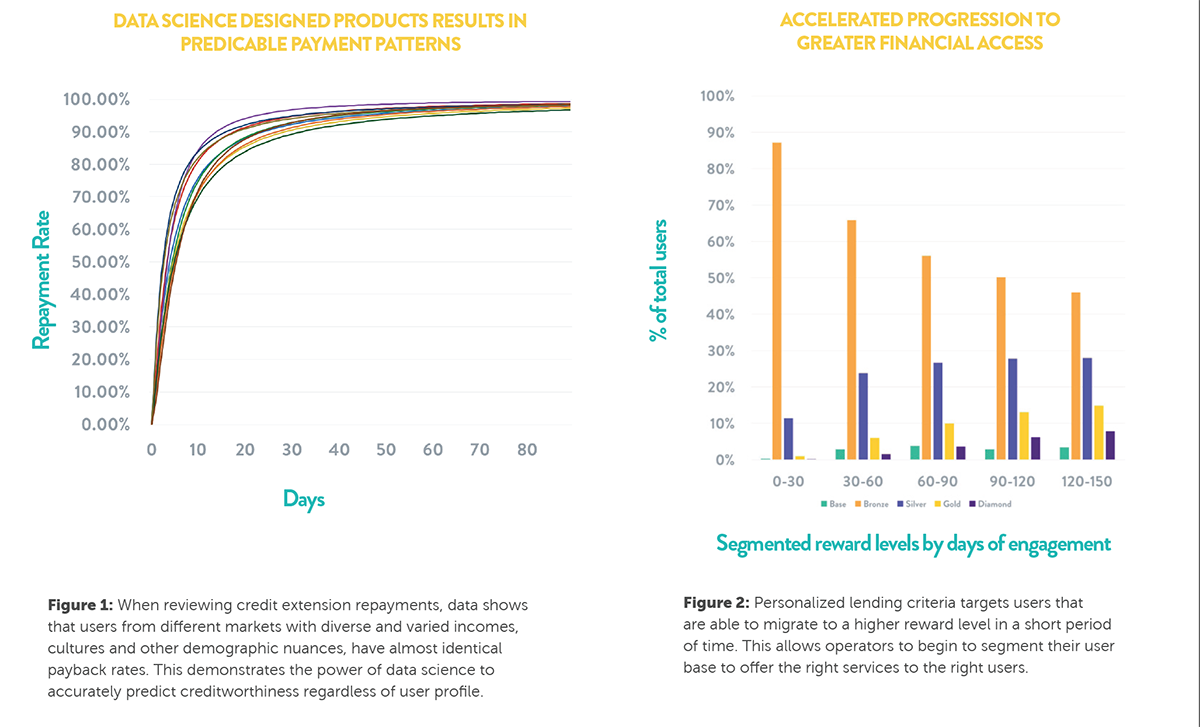

Credit extensions can be a way for operators to reduce churn, increase brand affinity, and begin to offer high-value financial services to subscribers. But most emergency lending programs analyse subscriber data infrequently — sometimes as little as once per month — to create their score for subscribers. The result is a program that is often too conservative that restricts a large majority of an operator’s prepaid subscriber base from taking even the smallest loan.

Image via Juvo

Using data science instead, account and historical top up data from the operator provides a strong foundation for constructing these financial identities for subscribers. To create an intelligent method of scoring for credit extensions from these very large data sets, big data techniques using cloud computing technologies must be used to run analysis and experiments in real-time. These learning algorithms visualises subscriber behaviour in real time.

By capturing mobile operator network data and new data generated by deploying an engaging self-service app, machine learning and credit algorithms are applied to establish financial identities for each individual subscriber, explained the report.

Image via Think With Google

With the right strategy, methodology and platforms in place, the reports noted that operators will have taken the first steps in delivering on digital transformation. After laying the groundwork, it is critical that operators use the subscriber insight unlocked through data science to develop new service offerings.

The report also noted that mobile has enormous potential to change people’s lives by unlocking access to essential financial services to drive financial inclusion. These should be high value, sticky services, that improve loyalty, improve revenues and open-up new opportunities for cross selling and upselling, said the report.