Increasing popularity of initial coin offerings (ICOs) as a means of funding startups brought particular attention to this thriving market and helped the blockchain industry grow drastically in recent years.

According to a June 2018 PwC report, ICOs continue to surpass traditional venture capital (VC) funding, especially in technology and blockchain-related startups, and there are many reasons to choose an ICO over traditional VC funding, including crowd support, and the freedom for founders to innovate.

But as ICOs make their way into the mainstream, many challenges remain, including unclear regulations, flawed token valuation, and transparency and security risks. Here are 10 statistics from ICO Dashboard, EY, and PwC, showcasing where we’re currently at with ICOs:

ICO funding reaches all-time high: US$18,024,050,117 raised so far this year

In 2018, ICO funding has reached new highs. So far, ICOs have raised more than US$18 billion this year, driven by “mega crowdsales” of over US$100 million.

ICO funding in Q1 2018 alone surpassed 2017’s total ICO funding of approximately US$4 billion. According to CoinDesk, during Q1 2018, ICO funding reached US$6.3 billion, 118% of the total for 2017.

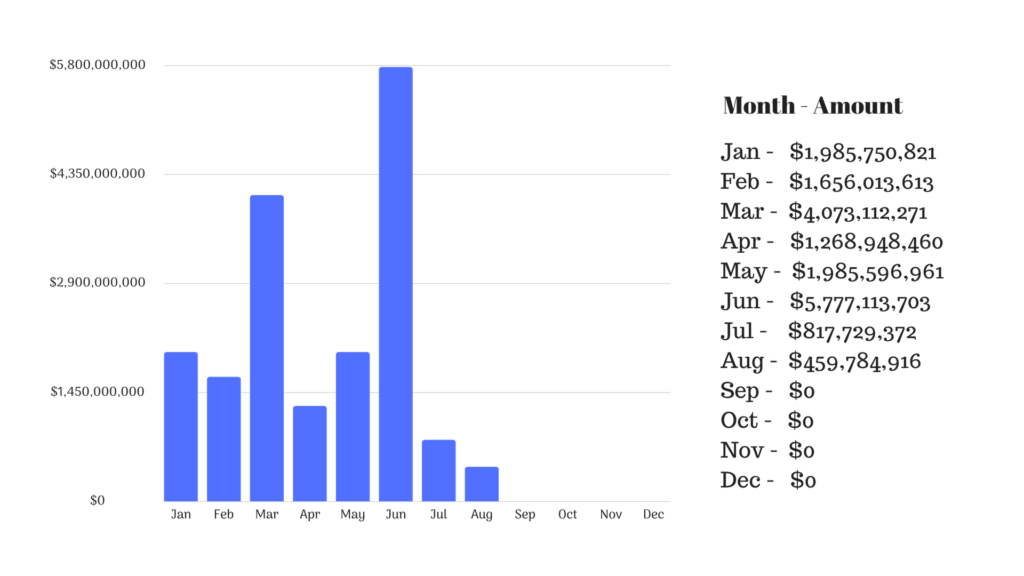

Token sales by month

The number of token sales have multiplied this year but amount raised has widely fluctuated implying that recent token sales are not particularly raising more money.

One third of ICOs close successfully

According to PwC, around a third of all announced ICOs projects have successfully closed the funding round. Many projects have delayed and lost momentum during ICO preparation processes. ICOs for which no funding is available are believed to be cancelled.

The majority of top funded ICOs are on track, and projects are further being developed (65%). 20%, however, are struggling with major problems such as legal or governance issues, 10% have no product yet, and 5% have altogether been dissolved.

Largest ICOs by funding rounds in 2018

2018 has seen some outstanding ICO funding rounds. The largest ICO went to blockchain platform EOS which raised a whooping US$4.1 billion. It’s followed by messaging service Telegram with US$850 million, and trading platform and token tZero with US$250 million.

USA, the ICO leader

The USA remains the leading ICO destination, reinforced by clear and firm regulatory requirements. So far this year, 25% of all ICOs were conducted in the US, followed by the UK with 15%, and Russia, Singapore and Switzerland, with 11%.

Finance is the most popular industry

12% of all ICO funding raised so far this year went towards finance-related applications and projects, which represents the most popular industry. It is followed by payment and wallet applications, commerce and retail, asset management and blockchain platforms.

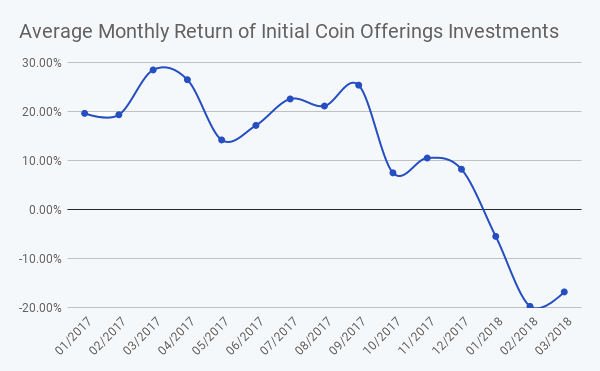

Average Return on Investment (ROI) drops dramatically

From Q1 2017 to Q3 2017, the average monthly return of ICO investments has oscillated between 15% and nearly 30%. But since the end of 2017, ICOs have become much less profitable and since the beginning of 2018, ICOs have actually generated negative returns on average.

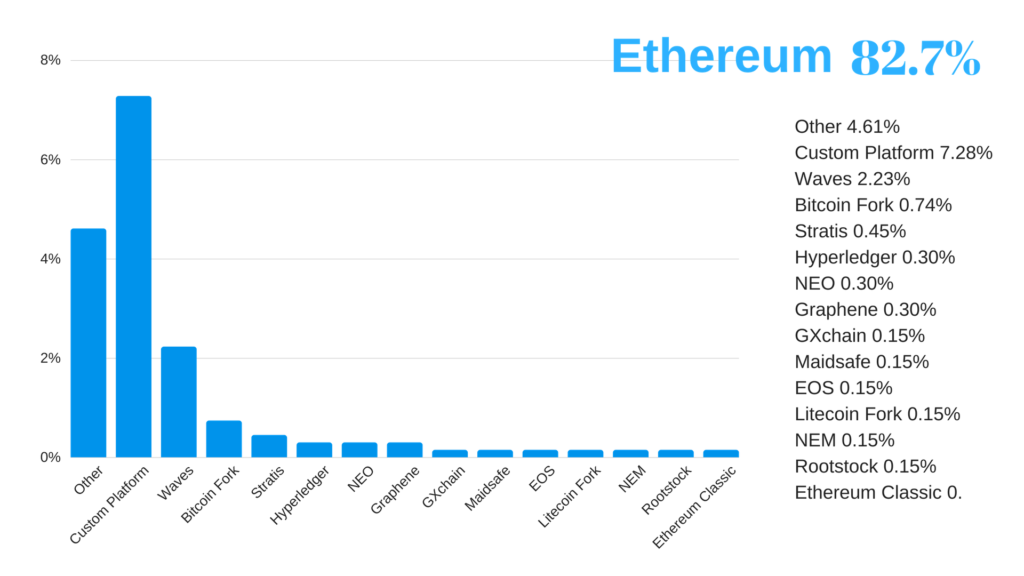

Ethereum, the preferred platform

Ethereum continues to dominate the ICO space, representing 82.7% of this year’s ICOs. 7.28% have opted for custom platforms, and 2.23% for the Waves Platform.

ICOs fuel demand for ether and bitcoin

The prices of ether and bitcoin are closely correlated to ICO activity, according to EY. ICOs are fueling demand for ether and bitcoin. The rise of the price of ether leads to an increase of transaction costs on the Ethereum network.

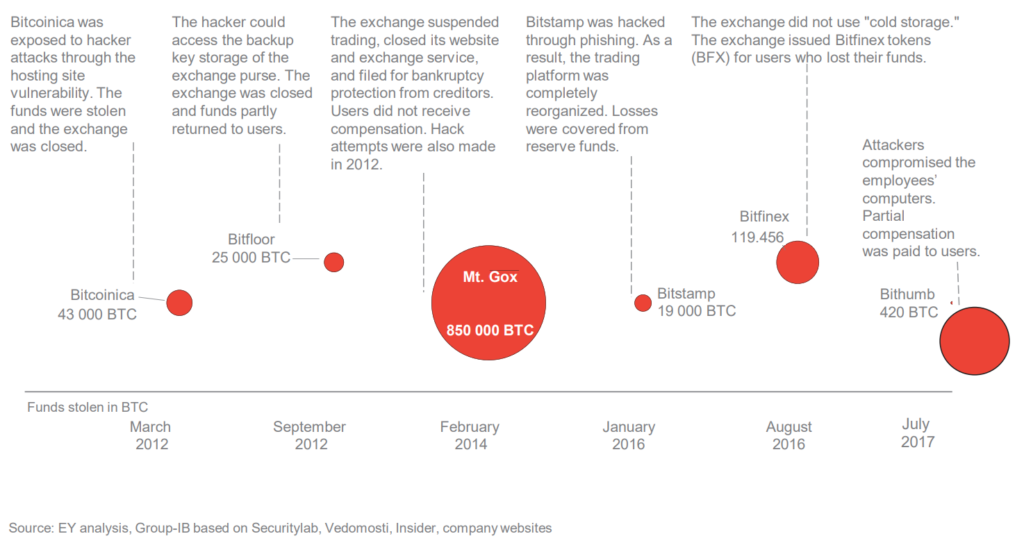

ICO market plagued by hackers

Professional services firm EY analyzed 372 ICOs and found that close to US$400 million of the funds raised (US$3.7 billion) had been stolen, or about 10%. Their research suggests cybercriminals are stealing approximately US$1.5 million per month in ICO proceeds.

The main types of attacks are phishing websites, distributed denial of attack (DDoS), and hacking of a website/web application.

But it is the hacking of cryptocurrency exchanges that is the most critical, leading to loss of both funds and personal data. Exchange hacking occurs regularly and the frequency of attacks is increasing.