What is A Digital Currency and Why They Are The Real Revolution

by Fintech News Hong Kong July 1, 2020Technology is transforming payments, and one of the most widely talked about innovations in this regard has been digital currencies. Despite its growing dominance in international headlines, many who are unfamiliar with the scene find themselves asking “what is a digital currency?”

Brought under the spotlight by Bitcoin and later on, the blockchain frenzy, digital currencies have been at the center of attention for their potential to improve efficiency and reduce costs.

Though initially affiliated with the dark web and cyber, criminal activities, digital currencies have since moved out of their historical bad reputation to progressively becoming part of the mainstream.

New regulations put in place by financial regulators, in addition to recent developments involving big names such as Facebook, have helped give digital currencies legitimacy, further propelling them into the limelight.

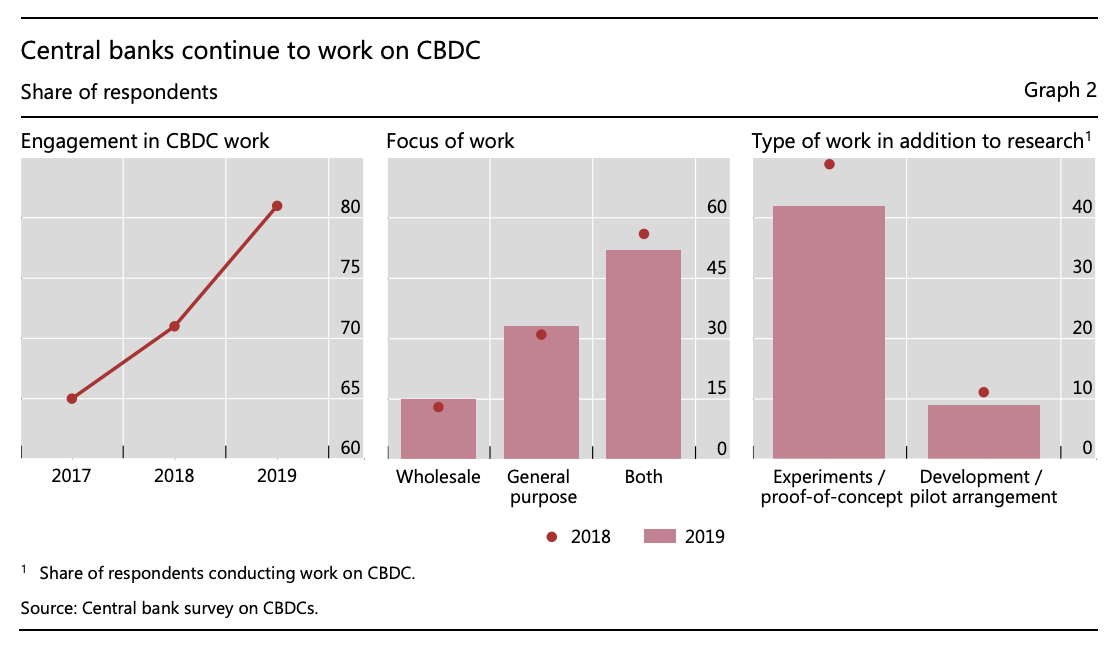

In recent years, central banks themselves have begun exploring the potential of such innovation by experimenting with so-called central bank digital currencies (CBDCs). The Bank of International Settlements (BIS) estimates that as of January 2020, 80% of central banks around the world were engaging in some sort of work-related to central bank digital currency (CBDC).

Central banks continue to work on CBDC, Jan 2020, Source: Central bank survey on CBDCs, Bank of International Settlements

What are Central Bank Backed Digital Currencies (CBDCs)?

CBDC is the digital form of fiat money and differs from existing virtual currencies and cryptocurrencies like Bitcoin in that they are issued by the state and backed by the government.

The BIS identifies two broad types of CBDC based on their levels of accessibility: general purpose and wholesale.

While a wholesale, token-based CBDC is a restricted-access digital token for wholesale settlements (e.g. interbank payments, or securities settlement), a general purpose CBDC is primarily targeted at retail transactions and resemble a type of “digital cash.”

Potential benefits of Central Bank Backed Digital Currencies (CBDCs)

There are a large and diverse number of potential reasons why central banks are investigating CBDC with some of the most prominent ones being to improve payments efficiency, payments safety and financial stability.

Central banks which reported a high reliance on cash also cited reducing costs and improving know-your-customer and countering-the-financing-of-terrorism (KYC/CFT) arrangements as motivations for issuing a CBDC.

And because a CBDC would make it feasible for a central bank to keep track of every unit of currency and transaction, tax avoidance and tax evasion would be much more difficult, helping thus prevent illicit activity.

Additionally, safe money accounts at the central banks could constitute a strong instrument of financial inclusion, allowing any legal resident or citizen to be provided with a free or low-cost basic bank account. In parallel, this would strengthen competition between banks to attract deposits, ultimately benefitting consumers.

China at the forefront

As central banks around the world ramp up the development of CBDCs, one jurisdiction that has made substantial strides in this regard is China.

China rolled out a pilot test of its CBDC, the so-called Digital Currency Electronic Payment (DCEP), in April in four large cities: Shenzhen, Suzhou, Chengdu and Xiong’an, an satellite city of Beijing.

Once fully operational, the digital currency would be used to simulate everyday banking activities including payments, deposits and withdrawals from a digital wallet.

Consumers would download an e-wallet application authorized by the People’s Bank of China (PBOC), which they would then link to a bank card to start to pay with and receive digital yuan. The money from the linked bank account would be converted into digital cash on a one-to-one basis.

Some of the DCEP system’s particularities would include the option to hold digital yuan and conduct transactions without the need of a bank account, and the ability to conduct transactions without an Internet connection through a function called “touch and touch.”

The PBOC began researching the concept of a national virtual currency back in 2014 before it officially inaugurated its Digital Currency Research Institute in 2017. The institute is in charge of developing and testing the digital currency.

For Xu Yuan, a senior researcher with Peking University’s Digital Finance Research Centre, China’s digital yuan will give tremendous power to officials, allowing them to track with extreme precision how money is used. This will ultimately revolutionize the ability of regulatory authorities to scrutinize the nation’s payment and financial system, Xu told the South China Morning Post.

With all business activities and financial transactions moved online and cash flow information and credit data stored on a database, the credit structure of the overall society would become easier to be determined, Xu said.

Additionally, the system would give the authorities up-to-date digital records of citizens who have committed money laundering, tax evasions or other related offenses, he noted.

Ramping up Central Bank Backed Digital Currencies (CBDC) development

But China isn’t the only country that has made significant developments when it comes CBDCs.

This year also, Sweden began testing its digital version of cash, the e-krona. The pilot will run until February 2021 and will use blockchain, the central bank said in February.

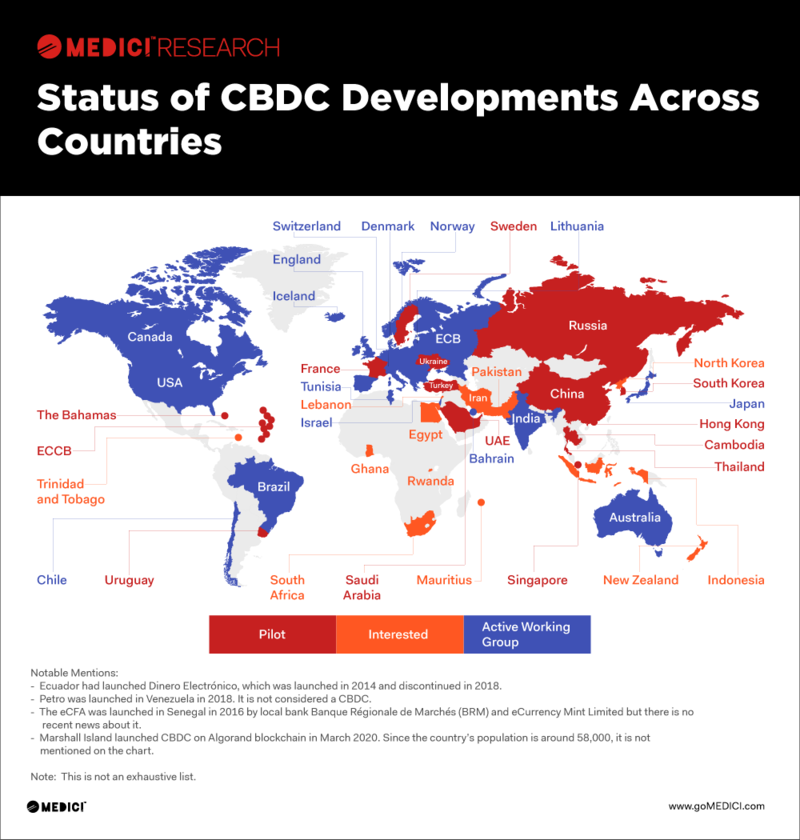

According to a research by Medici, more than 10 jurisdictions around the world are currently piloting a CBDC project. Alongside China and Sweden, these countries include Russia, Ukraine, France, Singapore, Hong Kong, and the United Arab Emirates (UAE).

Status of CBDC developments across countries, June 22, 2020, Source: Medici Research