Posts From Fintech News Hong Kong

Airwallex’s Closes US$ 200 Million Fundraising Round for Global Expansion

Airwallex, a cross border payment company, announced that the company has closed its extended Series D fundraising with an additional US$40 million from new and existing investors. This builds on the Hong Kong-based fintech unicorn’s US$160 milion Series D round

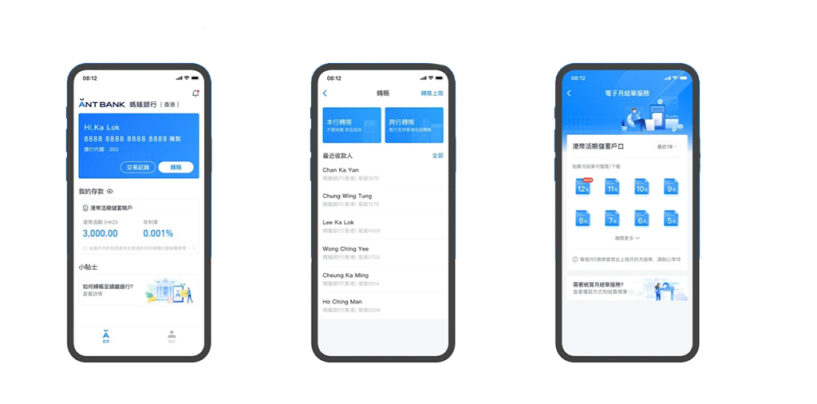

Read MoreAnt Group Launches its Virtual Bank Ahead of Its IPO

Ant Bank, part of Ant Group, has officially launched to offer banking services to Hong Kong citizens. Ant Bank was one of the 8 recipients of the virtual banking license by the Hong Kong Monetary Authority (HKMA), this launch makes

Read MoreConsenSys Bags the Lead for the Second Phase of HKMA’s Digital Currency Study Project

US-headquartered blockchain firm ConsenSys has been granted the lead for the second phase of Project Inthanon-LionRock, a cross-border payment network study project by the Hong Kong Monetary Authority (HKMA). Previously, HKMA and the Bank of Thailand (BOT) had signed a

Read MoreAnt Group’s INCLUSION Fintech Conference Makes Its Debut in Shanghai

Ant Group, yesterday officially launched its much-talked about inaugural INCLUSION Fintech Conference both to a live audience and virtually. The first day of the conference began with a morning plenary session, followed by 17 forums in the afternoon and a

Read MoreHuawei Developer Conference: Brett King Talks Financial Inclusion, Banking 4.0, and More

At the 2020 Huawei Developer Conference held earlier this week, fintech influencer, best-selling author, and entrepreneur Brett King joined the finance tech.session to talk about the role of technology to improve financial inclusion and shared his views on how banking

Read MoreMox Officially Opens Its Doors to Hong Kongers

Mox has officially launched to the general public in Hong Kong. Mox is the virtual bank created by Standard Chartered in partnership with PCCW, HKT and Trip.com, which provides its suite of fully digital retail banking services over its app.

Read MoreHuawei Developer Conference: Product Launches, AppGallery Updates, and Other News

From September 10 to 12, 2020, Huawei Consumer Business Group (BG) held the annual Huawei Developer Conference. Themed HDC.Together, the event saw multiple announcements being made, including the launch of new products, as well as updates on the Huawei Mobile

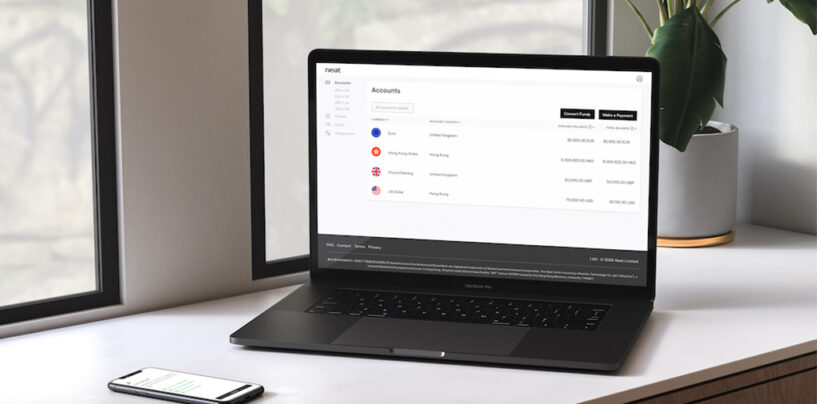

Read MoreHong Kong’s Neat Ties up With Sequoia-Backed Snowflake for Enhanced Data Insights

Neat, a Hong Kong-based financial technology startup, announced its partnership with Snowflake, a cloud data platform. Under the new partnership, Neat will utilise Snowflake’s cloud data platform to integrate their data into a single source for data harmonisation, enabling business teams

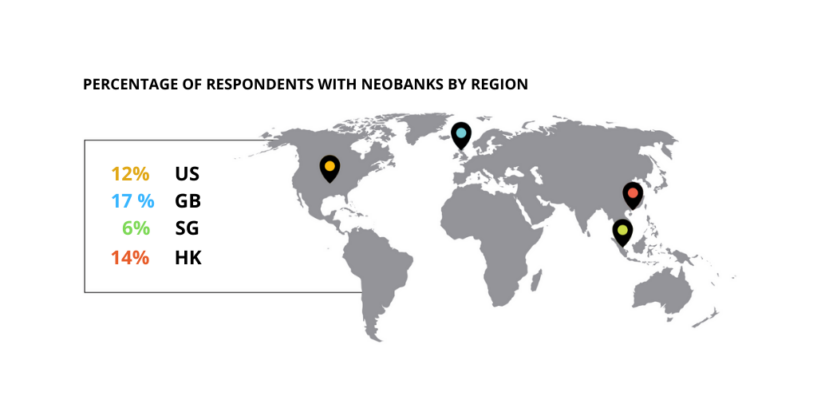

Read MoreMost Consumers Still Prefer Incumbent Banks Over Virtual Banks and Neobanks

A recent report published by consulting firm EPAM Continuum outlined behaviors, expectations and motivations, with key findings suggesting that, despite recent innovations in financial services, the fundamental behavioral drivers of customers remain largely unchanged. The report surveyed 4,500 people across

Read MoreASTRI and the University of Hong Kong Join Hands to Nurture Fintech Talent

The Hong Kong Applied Science and Technology Research Institute (ASTRI) has partnered with the University of Hong Kong (HKU) to jointly nurture fintech talent in the region. The agreement will see both parties develop the Technology Oriented Practitioner (TOP) programme,

Read More