Posts From Fintech News Hong Kong

HKMA Unveils New Data Strategy During Hong Kong Fintech Week

During his opening speech at the Hong Kong Fintech Week 2020, the city’s flagship fintech event, Hong Kong Monetary Authority (HKMA) Chief Executive Eddie Yue announced that the HKMA is exploring a new data strategy and considering building a new financial

Read MoreRegtech in Hong Kong Grew 10 Times in Last 5 Years

Regtech in Hong Kong has expanded around 10 times in the number of Regtech companies in recent 5 years, and each of the one-fifth of surveyed Regtech companies are targeting to raise over 5 million USD venture investment in 2021,

Read MoreCyberport Venture Capital Forum Forum Kicks Off Today

Cyberport’s annual flagship tech investment event, Cyberport Venture Capital Forum (CVCF), is slated to take place on 3-4 November. During a media briefing, Peter Yan, CEO of Cyberport; Eric Chan, Chief Public Mission Officer of Cyberport and Cindy Chow, Chairlady

Read MoreDigital Payment Startup Statrys Raises US$5 Million in Closed-Door Funding Round

Statrys, a Hong Kong-based digital payment services platform, has raised US$5 million in a closed-door funding round with an angel investor in the region. Statrys is a payments solution alternative geared towards SMEs, startups, and entrepreneurs who require flexible banking

Read MoreConsenSys Picked as Tech Partner for Bank of Thailand’s Retail Digital Currency Project

Ethereum development firm ConsenSys will be developing a proof-of-concept prototype for Bank of Thailand’s (BOT) retail Central Bank Digital Currency (CBDC) project. ConsenSys will be collaborating with Siam Cement Group (SCG) and Digital Ventures (DV), a subsidiary of The Siam

Read MoreSinglife Philippines Launches Life Insurance Products on HK Blockchain Platform Galileo

Galileo Platforms, a Hong Kong-based blockchain technology platform for the insurance industry, collaborated with Singlife Philippines, a mobile-first life insurer from Singapore, and GCash, an e-wallet in the Philippines, to launch a platform for life insurance products. By using Galileo’s

Read MoreHong Kong Fintech Week 2020: 27 Sessions Not to be Missed

Next week, Hong Kong’s annual flagship fintech event, Hong Kong Fintech Week, will take place virtually, featuring 350 global speakers, including fintech entrepreneurs, investors, regulators, and academics, as well as 500 fintech exhibitors and 30 delegations. Themed “Humanising Fintech,” this

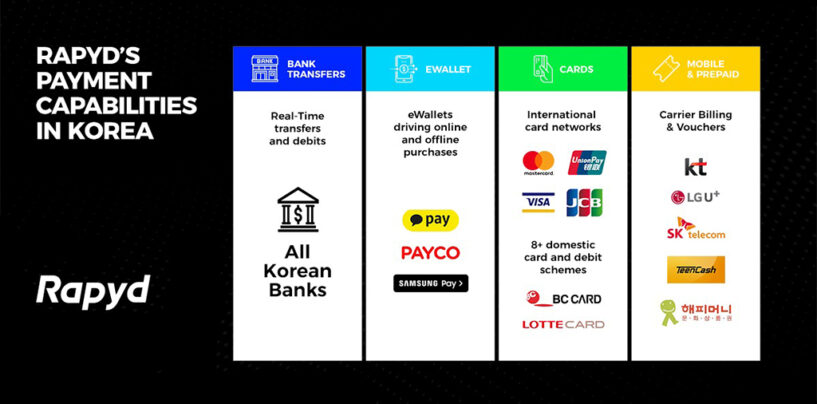

Read MoreRapyd Expands Payment Capabilities to South Korea

Rapyd, a Fintech-as-a-Service company, has expanded its all-in-one payment capabilities in South Korea, its sixth global market. The expansion of the Rapyd Global Payments Network first took place in Singapore in November 2019, followed by Brazil in March 2020, the

Read More5 Reasons Why Hong Kong Fintech Week 2020 Is a Must-Attend Event of the Year

Working over the last eight months with FinTech leaders and experts, together with global software engineers, computer graphic designers, digital artists, event and media professionals, Hong Kong FinTech Week (HKFW) will attract over 25,000 attendees from over 70 economies and

Read MoreBlock AdVenture: Cyberport Launches Blockchain Accelerator

Cyberport has launched a blockchain accelerator programme called Block AdVenture in partnership with R3 and fintech incubator FORMS HK. Blockchain is one of the key technology clusters promoted by Cyberport. Through Block AdVenture, local startups will be equipped with a

Read More