Globally, Insurtechs Received over US$1 Bil in Funding Q1 of 2019

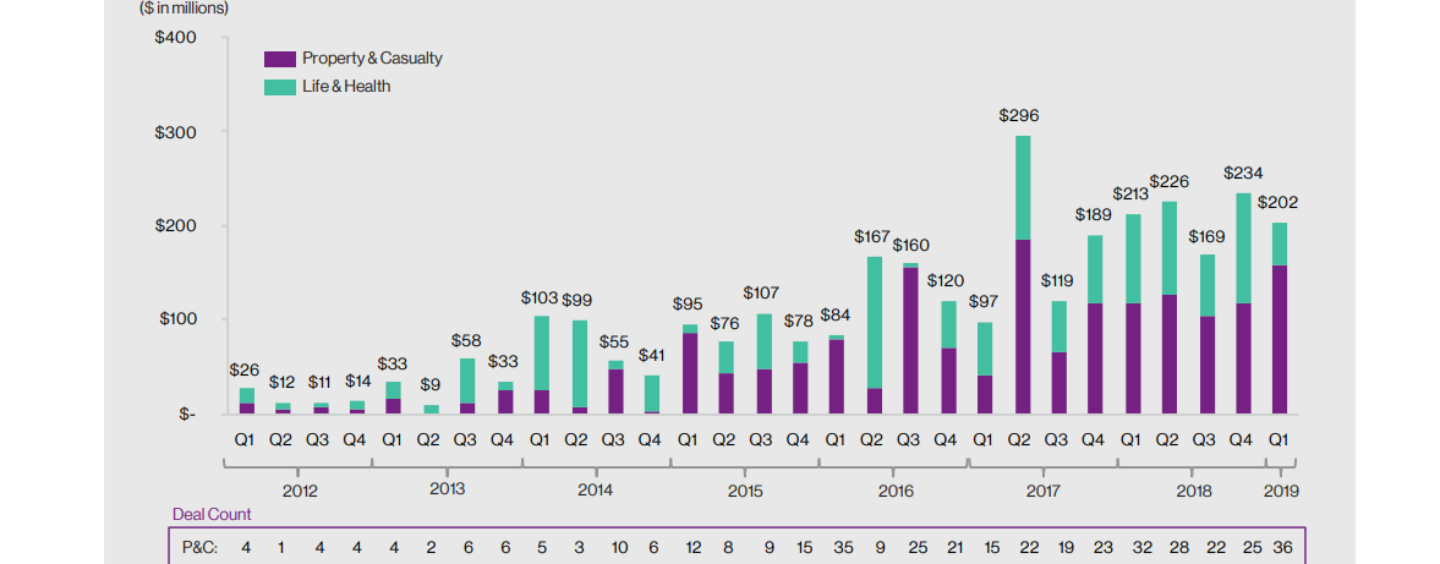

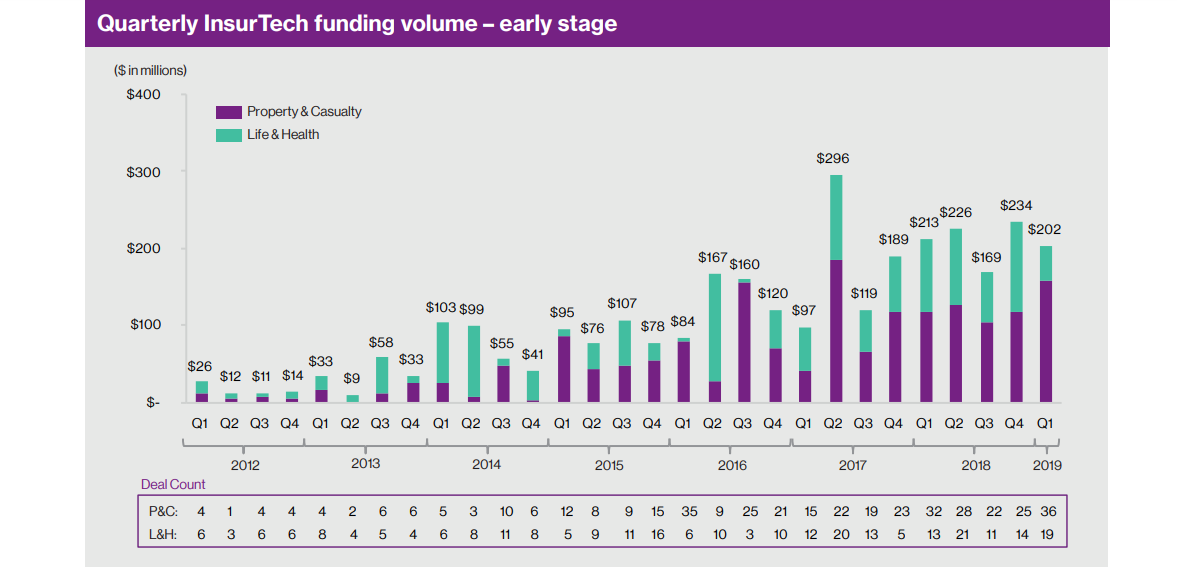

by Fintech News Hong Kong May 14, 2019Insurtech investment continued its momentum with 85 deals totaling US$1.42 billion recorded in Q1 2019, marking the third-straight quarter to register more than US$1 billion in funding.

Over Q4 2018, the deal count increased by 35%, although total funding decreased by 11%, according to the new Quarterly Insurtech Briefing from Willis Towers Watson, a global advisory, broking and solutions company.

54% of the deals of Q1 2019 were outside the US, marking a continuing trend, the firm says. Deal count in the UK increased by 50%, and in the US by 44%. However, deal count in China fell by 38%. Q1 2019 witnessed the highest-ever numbers of Series B and C funding rounds at 12 and 6 respectively “as more nascent insurtechs reach adolescence” – though two-thirds of investments were in seed and Series A rounds.

The paper, released earlier this month, put a special focus on pricing and underwriting. It notes that data have become both “a suit of armor and a powerful weapon.” These are enabling insurers to better tailor offers, pricing and underwriting to individual customers, while improving customer experience and outcomes.

The report mentions the emergence of data aggregators, which serve the industry by bringing together diverse relevant external data sources across many different aspects of the risk, including geography, customer and risk characteristics, into a “one stop shop” for insurers, and enable real-time integration with insurer pricing and underwriting systems.

Another area that has attracted a lot of interest is the Internet of Things (IoT) and its application in and to monitored insurance. Information received from monitors provides granular data on which insurers can make more sophisticated pricing and underwriting decisions.

In motor insurance, this can be information on acceleration, braking, cornering or speeding behaviors, which are correlated with risk. In marine insurance, cargo tracking and monitoring can support risk authentication in traditional coverages.

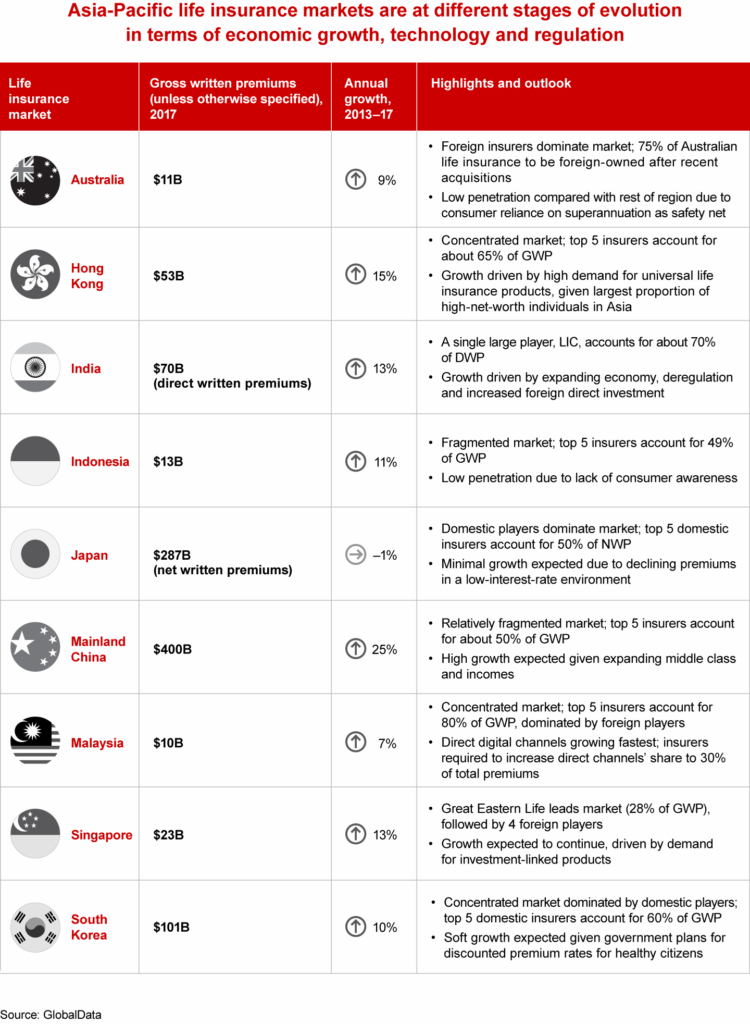

The Willis Towers Watson paper comes on the heels of the release of Bain & Company’s Making the Most of Asia-Pacific (APAC)’s Insurance Boom report, which explores the state of the region’s insurance market and points out the many opportunities that it offers.

Bain & Company notes APAC’s rapidly expanding middle class, socio-demographic shifts, rising demand for life insurance and related products, as well as deregulation push in markets including China, India and others, as some of the key factors that will fuel the industry’s growth in the region.

But the firm warns that each country in APAC has unique characteristics, meaning that “there is no one-size-fits-all strategy for insurers operating across the region.” It highlights four main markets categories: the booming giants that are China and India; the dynamic developing markets, especially in Southeast Asia; the mature markets that include Japan, South Korea and Australia; and hybrid markets that are Hong Kong and Singapore.

In China, large insurers like Ping An, China Life, China Pacific and the People’s Insurance Company of China (PICC) are holding commanding positions, posing challenges for overseas insurers trying to enter the market. But last year, China announced the gradual lifting of restrictions on foreign insurers, allowing companies that are 100% foreign-owned to operate in the country.

The Indian insurance industry is relatively consolidated with the top five players, New India, United India, National, ICICI Lombard and Oriental, accounting for 53% of the general insurance market and government-owned LIC controlling about 70% of the life insurance market, but reforms launched in 2015 have lifted the ceiling on foreign ownership of domestic insurers from 25% to 49%, and the government has been actively promoting the microinsurance industry.

In Southeast Asia, major developing markets like Indonesia have a highly fragmented general insurance market with the top five players accounting for just 35% of direct written premiums. Though gross written life insurance premiums grew at 11% annually from 2013 to 2017, consumer awareness of the value of insurance remains low.

In mature markets like Japan, insurers are beset by an aging population, sluggish economic growth and near-zero bond yields, and must contend with slow growth or no growth. Meanwhile, the Singapore and Hong Kong markets are mature in some respects but still developing in others. Both are competitive and highly fragmented, and both have slowly growing general insurance markets.

Finally, Bain & Company urges companies looking to expand in the region to put a particular focus on digitalization and digital solutions, noting that APAC consumers are “exceedingly receptive to new ideas and new players” with more than 85% of consumers in Thailand, Indonesia, mainland China and Malaysia, being open to buying from new entrants, according to a Bain & Company survey.

Featured image: Health, Pixabay.