Retail banking, also known as consumer banking, is on the cusp of a new era of amazing growth and opportunities.

Asia will reach over US$900 billion in retail banking revenue by 2020, growing at about 14% per year, according to McKinsey & Company, and is expected to be the second largest wealth management region globally after the US, with more personal financial assets residing in Asia than Europe.

But in the Asia-Pacific (APAC) region, consumer banking is being dramatically revamped by changing consumer behaviors, faster adoption of new technology and the growth of the middle class and urbanization.

Here are the top trends finance professionals should keep track to leverage opportunities in this sector in Asia:

1. Changing customer demands and behavior

Image via PxHere.com

One major trend in retail banking in Asia is the move to a customer-centric understanding of the banking journey. Consumer banking now goes beyond banks digitalizing their banking services and is more about empathizing with customers, understanding their needs, frustrations and aspirations, and using that as a basis to eliminate pain points and provide practical solutions.

EY’s consumer banking survey confirms that trust, convenience and personalization form the foundation of today’s customers’ relationship with their bank. In mature markets, customers expect 24/7 real time and seamless banking across channels. In emerging markets, low-cost mobile banking technologies are enabling profitable engagement with new customers in markets with low banking penetration.

According to research conducted by the Economist Intelligence Unit (EIU), 55% of bankers surveyed in APAC think that changing customer demands and behavior will have the biggest impact on retail banks in the next three years.

2. Data analytics and decision science

Banks hold a wealth of data on their customers that can be used to provide more targeted segmentation and improve the customer experience at an individual level.

With improved customer experience comes increased engagement and customers who are more willing to invest with their bank.

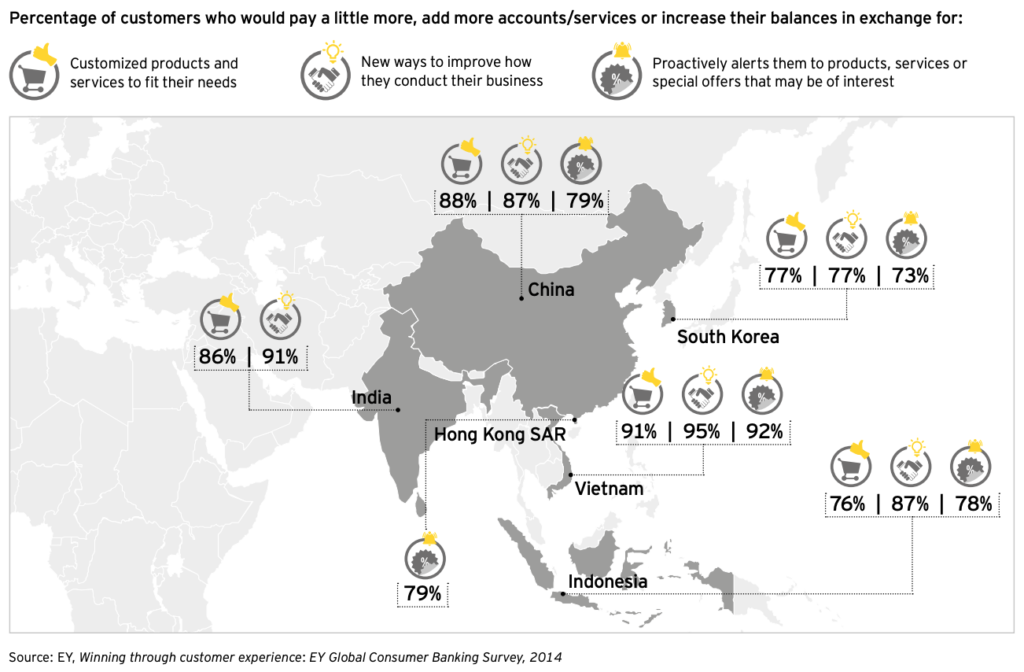

According to an EY study, more than three-quarters of customers in China, India, Indonesia, and South Korea say they would invest more in return for personalized products and services, and for their bank helping them to find new ways to conduct their business. In Vietnam, more than 90% of customers would do so. Similarly, being alerted to relevant products, services and special offers is appealing to customers in China, Hong Kong, Indonesia and Vietnam.

3. Increased Digital Transformation

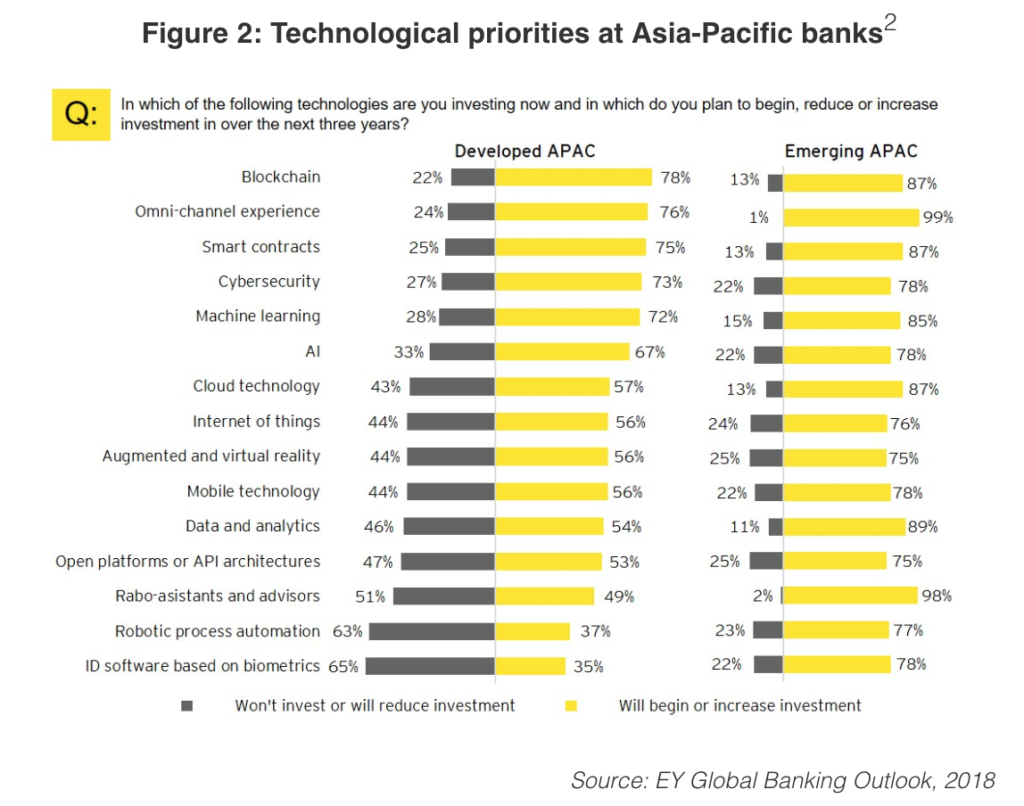

Across APAC, banks are increasingly leveraging digital technologies including artificial intelligence (AI), blockchain, chatbots, mobile apps and open APIs, to put customers at the center of their innovation strategies and create personalized banking experiences.

Most banks in APAC and particularly those in emerging markets are focusing on areas to drive digital transformation, according to a EY study.

Malaysia’s CIMB is disrupting its own business and thrives to transform itself into a leading regional digital banking group, OCBC Bank’s annual innovation challenge has enabled the bank to pilot new fintech solutions based on technologies including AI and machine learning, DBS Bank is creating a culture of innovation to integrate banking into customers’ lives, and UnionBank has launched the Philippines’ first fully-digital bank branch and banking chatbot.

4. Payments players to be banks’ biggest competition

Image via PxHere.com

New payments players are driving the shift to digital with emerging payments solutions, including mobile wallets and peer-to-peer (P2P) payments networks, slowly but steadily displacing legacy payment options and cementing themselves in the day-to-day lives of consumers. In China, for instance, Alipay and WeChat, already dominate smartphone payments.

In APAC, mobile payments usage climbed 30% in 2018 and the trend is only going to accelerate in the coming years.

Bankers have taken notice, and 48% of survey respondents of a recent EIU survey believe that payments players will be their biggest competition over the next three years. Most respondents believe that by 2020 the majority of payments will flow outside traditional networks.

5. Consumers Becoming Mobile First

APAC has witnessed the rapid rise of mobile in the past years and with that comes the rise of mobile banking.

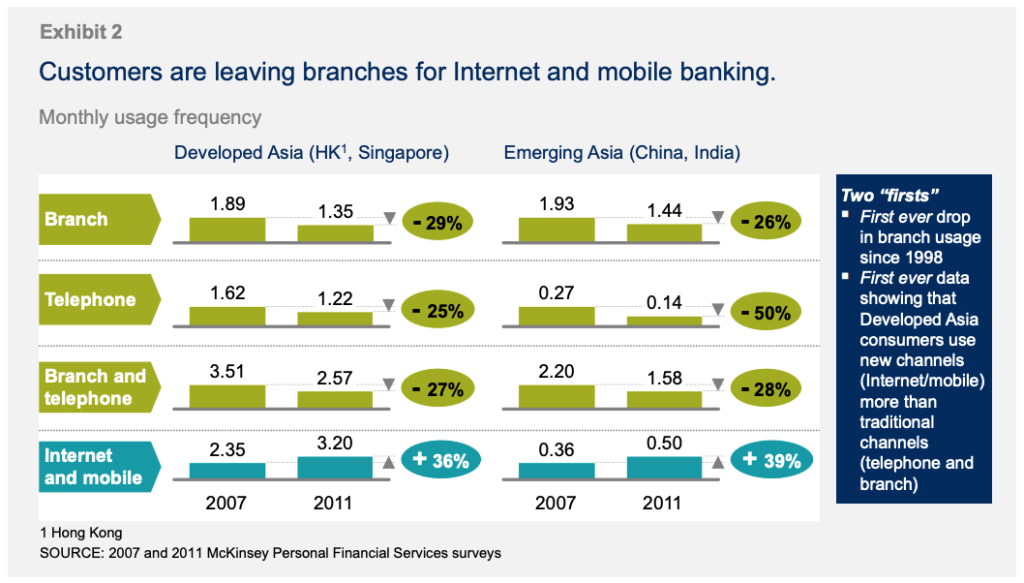

In 2011, for the first time in its 13-year history, the McKinsey Personal Financial Services survey found that Asian consumers were visiting branches less often than in earlier years. In mirror image, digital-channel usage increased by 36% in developed markets, or markets where people use digital channels more than branch and telephone banking put together, and 39% in emerging Asia.

Low financial inclusion in a number of emerging markets in APAC due to the lack of banking infrastructure, geographic challenges and regulatory impediments also represents a major opportunity for mobile banking and mobile money solutions.

“APAC is leading the world in the rapid adoption of digital banking due to consumers’ constantly evolving demands, combined with the unbanked potential and benign regulation,” said Martin Frick, managing director, Asia Pacific, at Temenos.

“Non-traditional challengers are also shaking up the market. When a consumer’s chat app already offers a single point of entry for all their financial needs, banks need to innovate fast and at scale if they want to remain relevant.”

6. Shifting Communication Mediums

Banks are increasingly using social media platforms such as Facebook Messenger and WeChat to deliver banking services more effectively to their customers. But apart from using third-party social channels, some banks are also developing their own communication tools.

UBS, for instance, has partnered with Singapore-based technology firm FinChat to develop a solution that enables secured social chat communication between its clients and advisors.

7. Rise of Bigtech Disruption in Financial Services

For many industry participants and analysts, it is not so much fintechs that are the biggest threat to banks’ market share but rather established bigtechs such as e-commerce, payment or social platforms which are increasingly offering financial services.

Especially within APAC emerging countries like China and India where traditional banks are less entrenched and more consumers trust well-known tech firms with their money, bigtechs including Tencent’s WeChat and Alibaba’s Ant Financial have established a comprehensive multi-licensed integrated financial ecosystem.

These platform players have the advantages of being generally asset-light, not saddled with legacy IT systems, digitally savvy and well-funded. They are better able to quickly adopt new technologies and agile data-driven operating models, and already have massive captive customer bases and low online acquisition costs. WeChat surpassed the one billion monthly active user milestone in March 2018 and Ant Financial has more than 600 million users across its financial services platforms.

8. Platform model

Image via PxHere.com

Emerging technologies, elevated client expectations and the entry of disruptive competitors are driving traditional financial institutions to explore new business constructs such as platforms.

A platform is a digital infrastructure that allows multiple stakeholders, including providers, third-party developers, distribution and services partners, and end-user consumers, to connect online, interact, create and exchange value with each other.

The platform model is a radical shift from the traditional model where banks operate within a specialized industry. Instead, it focuses on being part of a broader ecosystem and linking up to businesses and services from across multiple sectors. Operating in an ecosystem allows providers to switch focus from simply selling their own offerings to fulfilling customers’ desired outcomes.

Platforms matter because, these days, services must be personalized and delivery methods must cater to the customer.

A relevant example is the case of Ping An Insurance in China which offers services including finance, P2P lending, healthcare consultations, real estate and auto listings, and entertainment to over 430 million digital users via its One Account customer portal.

These multiple offerings generate consumer traffic back to Ping An’s core services and have elevated its position to the world’s largest and most valuable insurance brand, and one of the largest investment and asset management companies globally.

Featured image via PxHere.com.