Finance Firms Gear up for Transformative Impact of AI on Hong Kong’s Work Landscape

by Fintech News Hong Kong December 14, 2023The impact of artificial intelligence (AI) is well recognized in the financial sector with industry professionals showing concerns about job displacement.

However, the industry is taking proactive measures to address the transformative impact of AI on work, including enhancing technical and soft skills, increasing investment in technology, and revising business strategies, a new report released on December 06 by the Hong Kong Institute for Monetary and Financial Research (HKIMR), the research arm of the Hong Kong Academy of Finance (AoF), says.

The report, titled “Advancing Talent Development in Financial Services: Emerging Global Trends and Their Impact on Hong Kong”, discusses the results of two surveys commissioned by the HKIMR that focused on gathering the perspectives of financial services practitioners in Hong Kong and across ten major international financial centers. These surveys were complemented by the results of a study that looked at granular data from over a million online LinkedIn profiles of finance professionals working in some of the major international financial centers.

Findings from the research reveal that the impact of AI on the talent landscape is well acknowledged by the financial services industry, with respondents recognizing AI’s role in automating tasks and the technology’s potential to enhance productivity.

However, concerns about AI taking over parts of finance professionals’ work were also expressed. Although no respondent anticipated a complete job replacement, more than two thirds (69%) expressed some degree of apprehension about AI taking over parts of their work, with an additional 6% believing that AI could replace a significant portion of their job responsibilities.

To address the transformative potential of AI, both individuals and financial services firms said that they were taking proactive measures to tackle the technology’s implications.

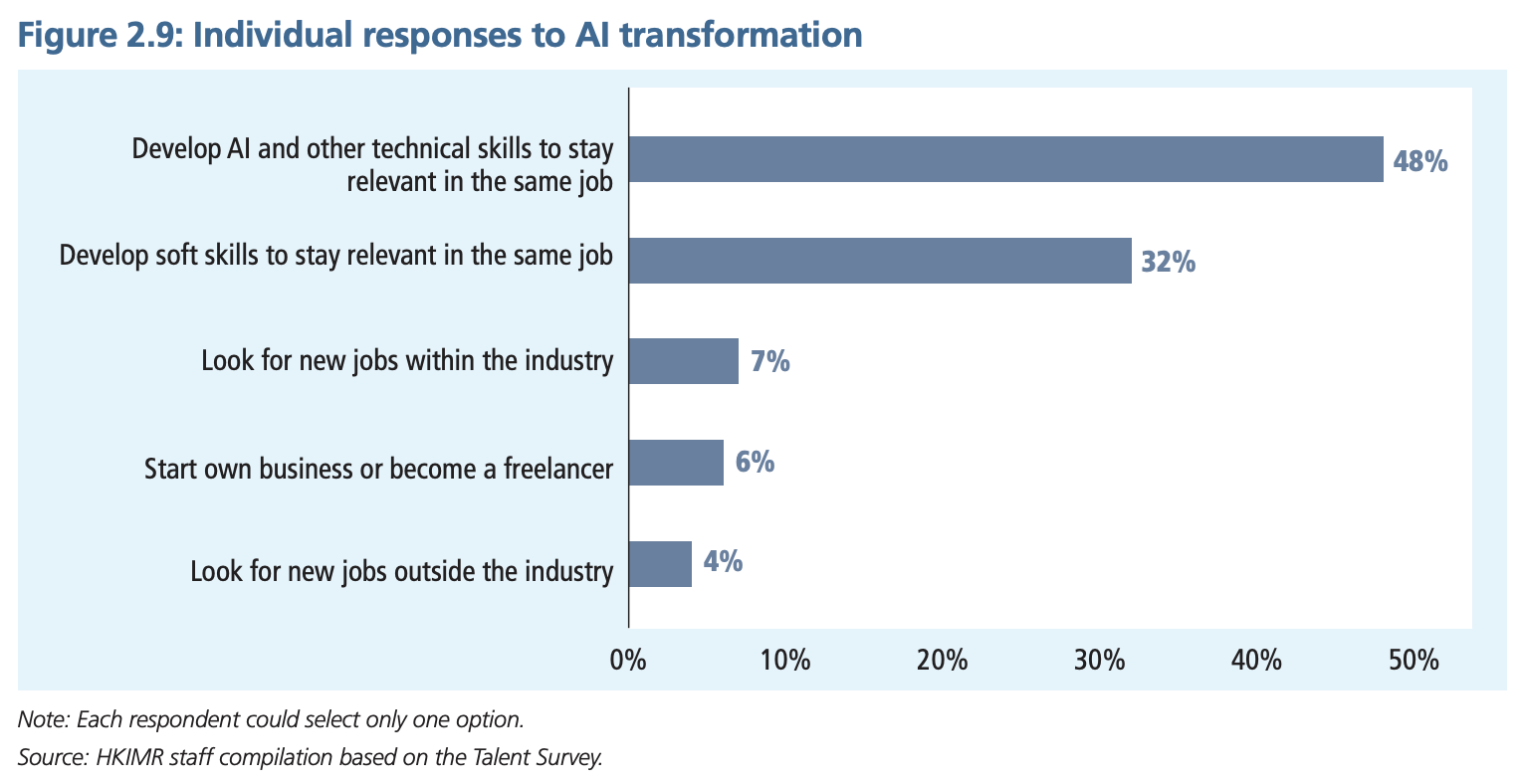

Half of the respondents (48%) said that they planned to stay relevant by enhancing their AI and other core technical skills, and approximately one third of them (32%) indicated considering improving their soft skills to strengthen their competitive edge over AI. Only a small segment of the respondents were contemplating a career transition, either within (7%) or outside the industry (4%), or a shift to freelance work (6%).

Individual responses to AI transformation, Source: Advancing Talent Development in Financial Services: Emerging Global Trends and Their Impact on Hong Kong, Hong Kong Institute for Monetary and Financial Research (HKIMR), Dec 2023

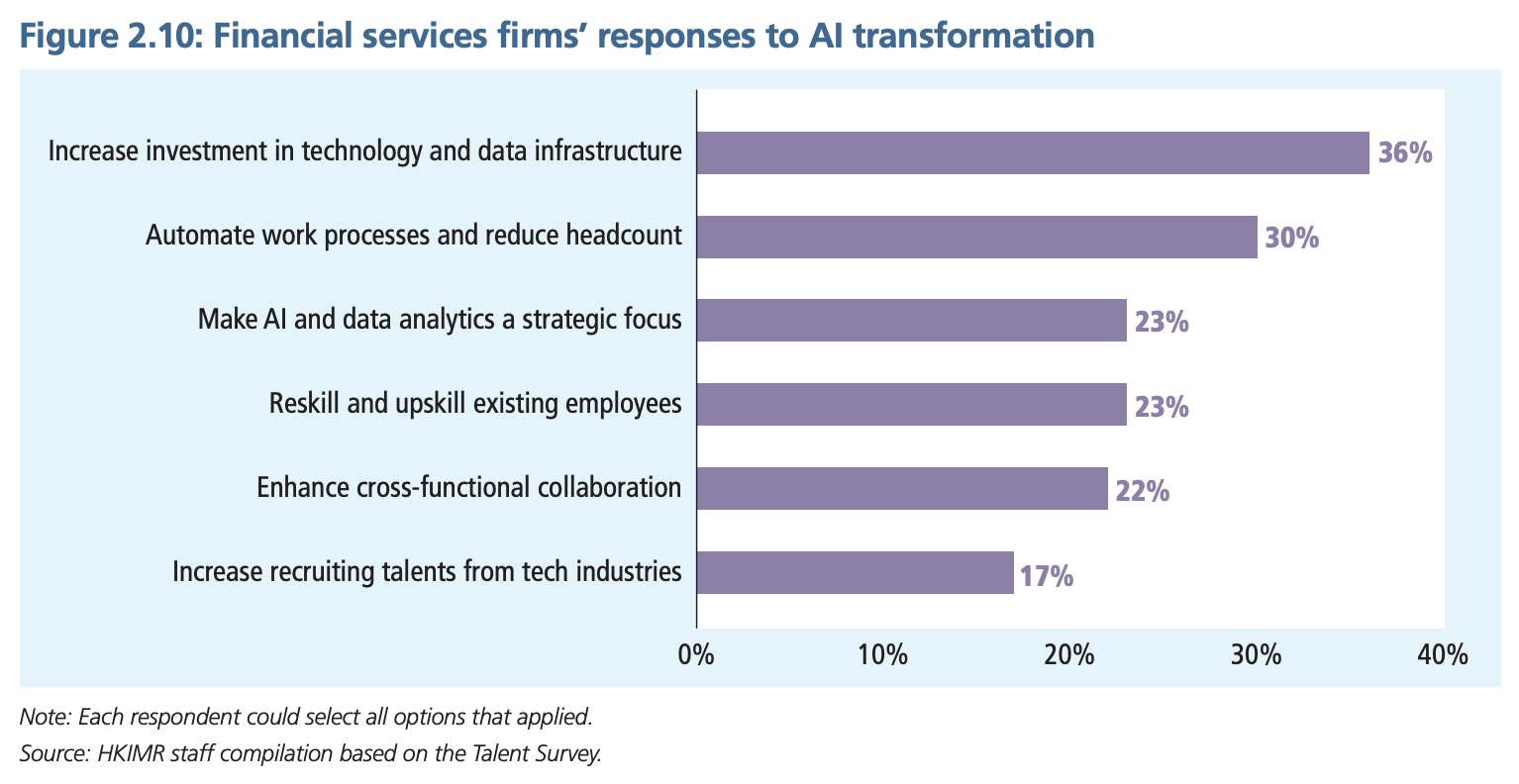

Financial services firms, meanwhile, are adopting a variety of strategies to respond to the impact of AI. The most common approach is to increase investment in technology, with many firms stating that they were enhancing their technology platforms and data infrastructure (36%), automating existing processes and reducing their workforce (30%). Some are revising their overall business strategies to prioritize AI and data analytics (23%) and modifying their organizational structures to promote cross-functional collaboration (22%).

Financial services firms’ responses to AI transformation, Source: Advancing Talent Development in Financial Services: Emerging Global Trends and Their Impact on Hong Kong, Hong Kong Institute for Monetary and Financial Research (HKIMR), Dec 2023

Skill gaps

Overall, the study identified a notable disparity between the skills that employers seek in their workforce and the skills that the current pool of job seekers or employees possess.

In particular, a significant number of respondents in Hong Kong reported a gap in core technical skills, including fintech, AI and data analytics, within their firms, a proportion that’s higher by half than the global average, revealing a higher demand for technical expertise in the city’s rapidly digitalizing financial services industry.

A quarter of the respondents also acknowledged a gap in core soft skills such as leadership and management, and 13% identified gaps in additional soft skills such as communication and relationship management.

Core financial skills, such as accounting and financial analysis; sustainability-oriented skills, including environmental, social and governance (ESG)-related skills and climate risk management; and additional technical skills, such as cloud computing and cybersecurity, were cited by a minority of respondents as the most significant skill gaps in their firms.

These results reveal a sustained demand for composite talents who integrate technical proficiency with effective leadership.

Skill gaps in the financial services industry, Source: Advancing Talent Development in Financial Services: Emerging Global Trends and Their Impact on Hong Kong, Hong Kong Institute for Monetary and Financial Research (HKIMR), Dec 2023

From 2021 to 2023, the global financial services workforce exhibited varied growth rates, with an annual employment growth rate ranging between 1% and 2.2% across the eight financial centers studied. Despite a seemingly healthy growth, annual quit rates stood in the 8.6%-18% range, suggesting a global talent challenge and contributing to performance gaps.

In London, for example, the annual employment growth rate stood at 2.1% during the period but the city’s quit rate was 16.2%.

HK Fintech employment growth

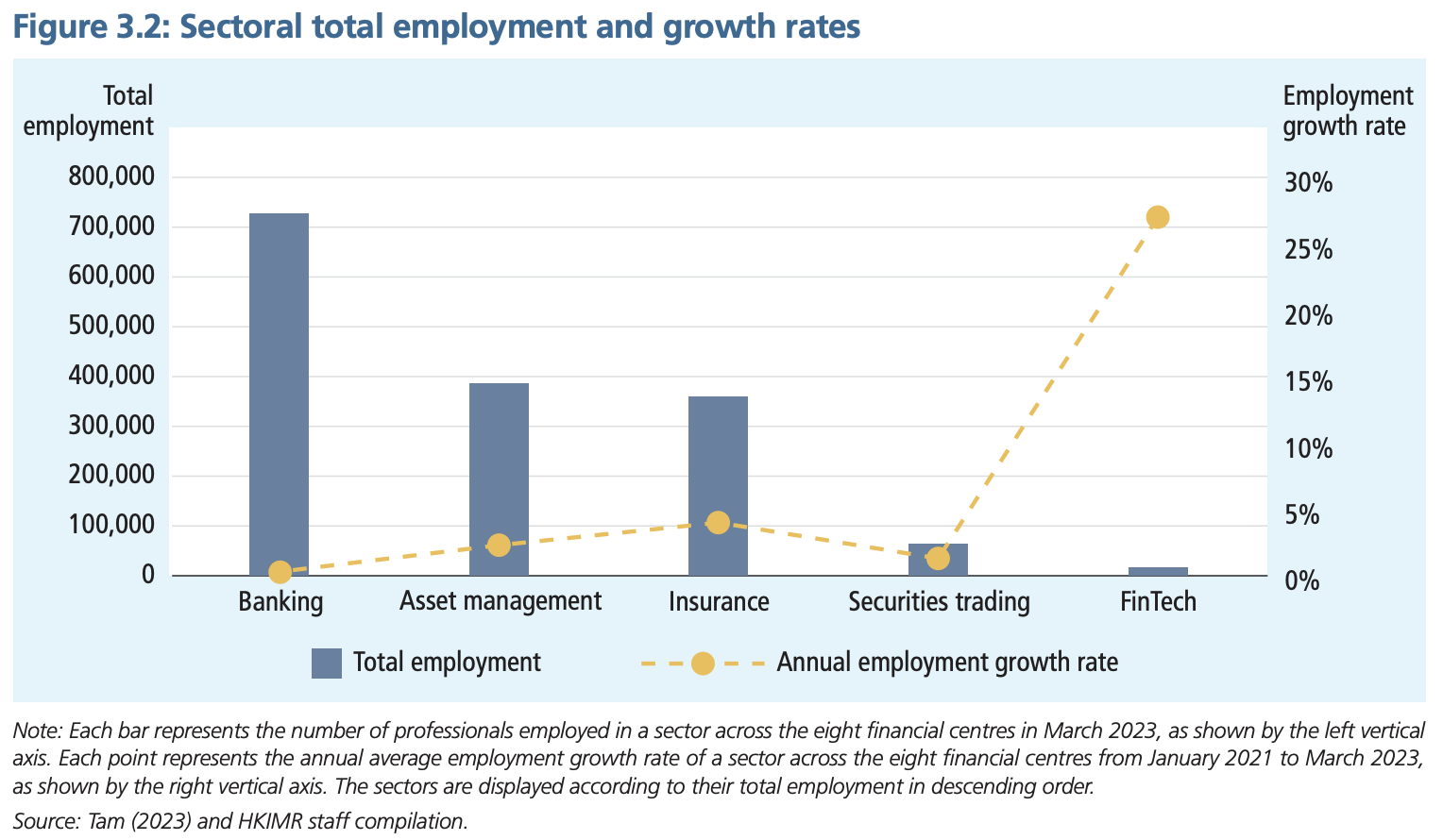

Across the eight financial centers, the banking sector had the highest number of employees among the four traditional industry sectors, followed by asset management, insurance and securities trading.

Despite ranking last in total employment, fintech was identified as the fastest-growing sector in employment growth, expanding at a significant rate of 27% per year.

Sectoral total employment and growth rates, Source: Advancing Talent Development in Financial Services: Emerging Global Trends and Their Impact on Hong Kong, Hong Kong Institute for Monetary and Financial Research (HKIMR), Dec 2023

Findings of the HKIMR research are consistent with those of similar studies which have identified a significant demand for talent in the fintech sector.

A 2021/2022 study conducted by specialist recruitment agency Robert Walters revealed a staggering 176% increase in advertised jobs in fintech firms last year.

Across the eight so-called fintech “mega-hubs” studied, the USA saw the biggest jump in new tech jobs within fintech with a 223% increase across the board. The majority of this growth was driven by New York (+246%) and San Francisco (+200%).

Second to the USA in job growth was Japan with an increase of 214%, followed by Spain (+210%), Australia (+167%) and Singapore (+163%).

According to the report, the most in-demand roles within fintech across the globe was at the time projects management (IT), software engineering, as well as user interface and user experience design and development.

Top 8 fintech mega-hubs ranked by job growth, Source: Global Fintech Talent Report, Robert Walters, 2022

To address the fintech talent shortage, the Hong Kong government has introduced a number of initiatives designed to expand the local talent pool all the while providing opportunities for the industry to identify and recruit young talent.

These initiatives include the Industry Project Masters Network (IPMN) scheme, which aims to groom fintech talent by providing opportunities to postgraduate students to work on banks’ fintech or industry projects and gain hands-on experience and skills; and the Gap Year Placement Programme of the Fintech Career Accelerator Scheme, which gives select applicants a full-time, semester-based internship in which interns work on fintech projects at the Hong Kong Monetary Authority, banks (including virtual banks) or stored value facility operators for six months or one year and receive technology training and regulatory updates respectively.

Featured image credit: Edited from Freepik