Following the rollout of Open Banking regulations in the UK and the launch this year of the EU’s Payment Services Directive 2 (PSD2), countries across the Asia-Pacific region are following suit to establish their own frameworks to enable banks to share select customer data with third-party providers (TPPs), and TPPs to run transactions on customer accounts.

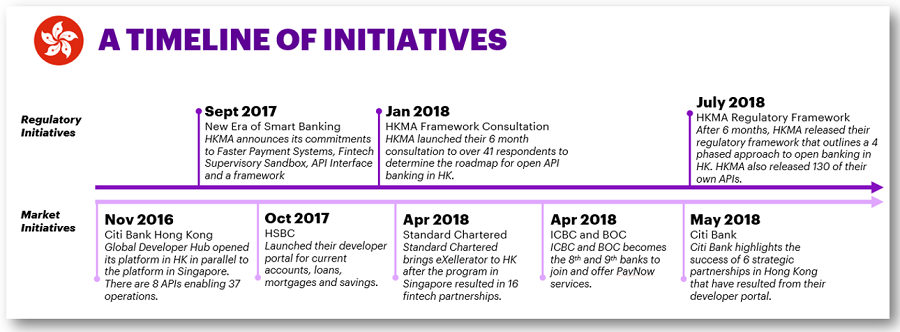

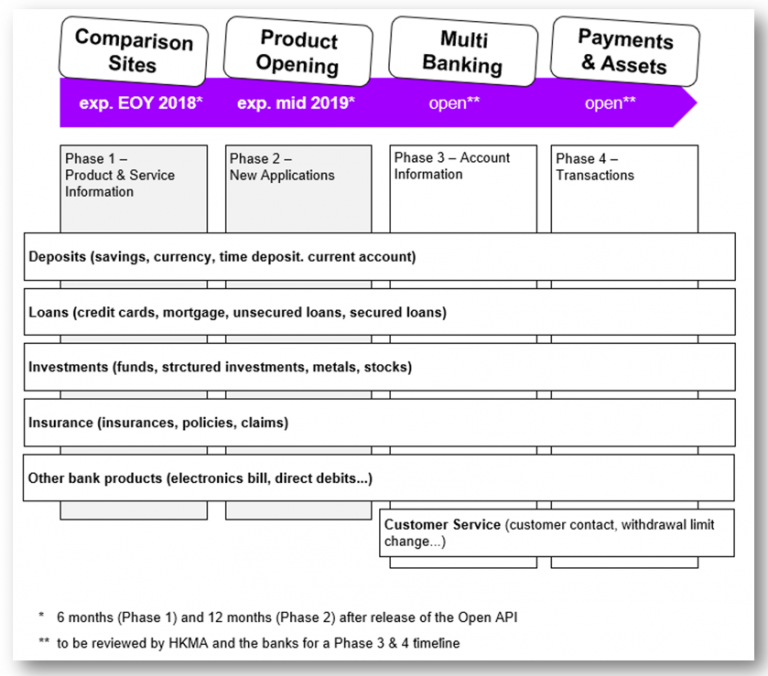

Following a public consultation, the Hong Kong Monetary Authority (HKMA) in July 2018 published a four-phase approach to implement Open Banking in the city. Phase 1 covers “read-only” product and service information, useful for services like comparison sites; phase 2 covers new applications and customer acquisition via TPPs and applications for credit cards, loans and some insurance products; phase 3 covers account information; and phase 4, transaction processing. The first two phases are due to roll out in the next six and 12 months, while the timeline for the third and fourth phases will be clarified in the future.

At the same time, the HKMA published a framework that guides financial institutions with recommendations on how to build open application programming interfaces (APIs), as well as outlining technical standards and the terms for engaging TPPs.

The Open API framework initiative, part of the HKMA’s long-term “Smart Banking” strategy, aims to standardise APIs, security parameters and the architectural framework underpinning Open Banking, thereby increasing efficiency for banks and TPPs by ensuring unified standards for all use cases. A TPP registration and certification process will be established in due course.

also read: Open Banking in Asia Initiatives Overview

As part of its initiative, the HKMA sought to lead by example by launching its own APIs, initially covering the 50 most commonly accessed financial data and information it publishes (such as exchange rate statistics, interest rates and Exchange Fund information), with another 80 sets of information to be made available through APIs in phases through mid-2019.

Key initiatives, opportunities & risks

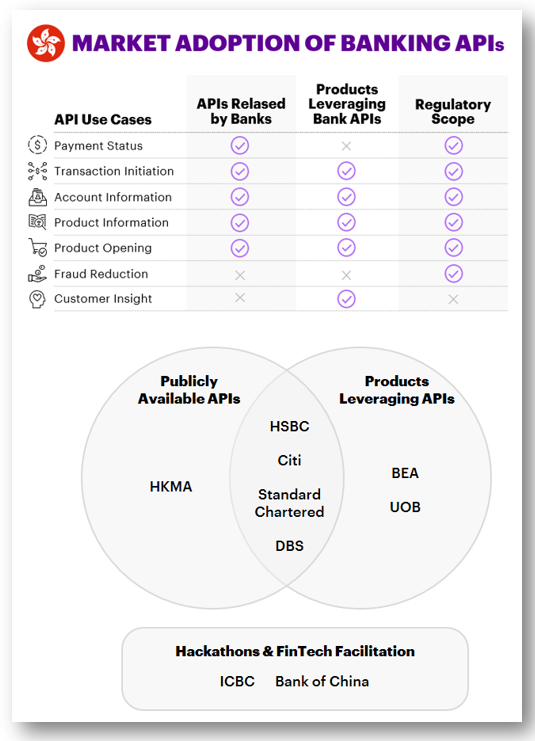

The HKMA’s goal is to increase innovation and ensure Hong Kong maintains its status as a leading global financial centre. Some global banks operating in the city have been a step ahead of the regulator in paving the way for API development with a retail focus, establishing smaller subsets of their developer portals in Hong Kong.

Citi opened its global developer hub in Hong Kong and Singapore in November 2016; HSBC launched a developer portal for current accounts, loans, mortgages and savings in October 2017, and Standard Chartered brought its eXellerator program to the city in April 2018. The developer portals that have been released publicly have fostered fintech and SME partnerships and have resulted in numerous customer-facing products in Hong Kong.

CitiBank for one, has partnered with Hong Kong’s leading contactless payment provider, Octopus, to offer reward points, auto-refills of the Octopus wallet, instant card applications and discounts.

Other banks like BEA and UOB have also released Open Banking products; however, they have done so without the use of publicly available APIs or developer portals.

Instead, these banks have listened to ideas from innovative fintechs and partnered with a select few to release products that leverage their APIs.In November 2017, BEA announced the launch of their i-Payment Hub in collaboration with Mastercard and QFTPay. The partnership enables BEA merchants to consolidate online and offline payments on a single platform.

In the future, banks will seek to continue developing their API strategies to drive retail and SME customer adoption, reduce the cost of servicing their customer base, and ensure they can participate in first- and second-phase developments such as comparison sitesThe opportunities to develop new revenue streams will evolve as the infrastructure rolls out, at first through predetermined pricing models for monetising APIs (e.g. subscriptions, per-call or flat-rate fees), and in the future, through revenue sharing on Open Banking ecosystem platforms, as well as building their own TPP services using other banks’ APIs.

The process also entails risks for slower moving players: phases 3 and 4 of the rollout could threaten banks’ existing business models, such as those dependent on payments or credit card services.Successful TPPs could also seize customer relationships. Banks will have to ensure that Open Banking doesn’t erode their customer bases—a risk that can be offset by preparing for and embracing the opportunities that it presents.

This is a guest post by Graham Rothwell, Managing Director, Asia Pacific Payments, Accenture and was written in collaboration with Ewa Wojcik, Sam Waldman and Hakan Eroglu.

This is a guest post by Graham Rothwell, Managing Director, Asia Pacific Payments, Accenture and was written in collaboration with Ewa Wojcik, Sam Waldman and Hakan Eroglu.

This post was first published here