CoverGo Teams up with Jetco to Build Car Insurance Open API Platform

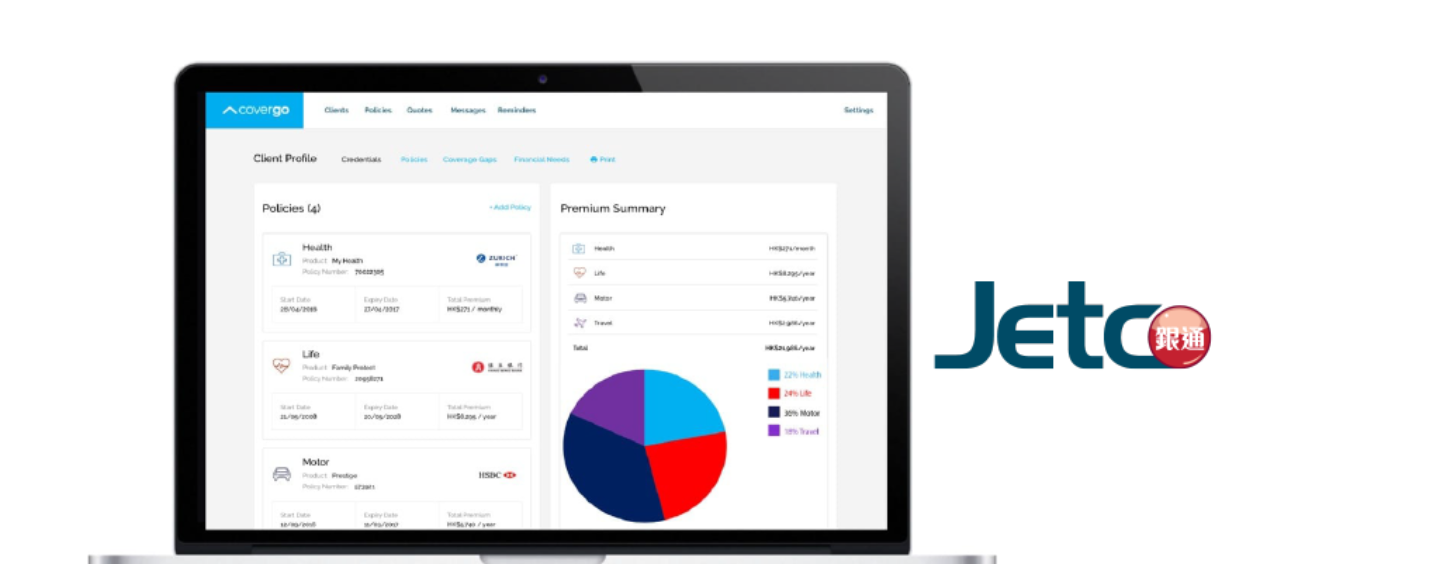

by Fintech News Hong Kong September 9, 2019Joint Electronic Teller Services Limited (“JETCO”) today announced its collaboration with insurtech provider CoverGo to build car insurance API platforms that will offer price comparison, online applications, claiming and a range of other innovative features based on JETCO APIX, an open API (application programming interface) exchange platform.

According to government statistics there are more than 680,000 private cars and motorcycles in Hong Kong as of the end of 2018 with new registration of private cars amounting to over 40,000 annually over the past 3 years.

This represents an attractive market for local car insurance providers. Yet consumers generally believe that there is a lack of transparency in the car insurance market. Premiums of comprehensive insurance in the market could vary more than double, and variances existed also in premiums and policy terms among different sales channels

JETCO and Covergo share the common goal of leveraging open APIs to drive the digital transformation of the local car insurance industry, bringing about more transparency, convenience and innovations that will benefit all stakeholders in the ecosystem, including insurers, insurance brokers and agencies, third-party service providers (TSPs) and consumers.

JETCO Chief Executive Officer Angus Choi said

“The car insurance market has always been highly competitive and customer satisfaction is key to retaining loyalty and acquiring new customers. We are pleased to work with CoverGo which is a recognised insurtech innovator. JETCO APIX, currently offering over 270 APIs from 13 banks and many TSPs, will provide easy and seamless connectivity for car insurance agents, distributors, insurers and external parties and allow them to collaborate and co-create new services on a highly secure platform.”

CoverGo CEO and Founder Tomas Holub said

“JETCO APIX enables us to build white label solutions through API for car insurance distributors such as traditional and virtual banks, brokers and TSPs on the one hand. On the other hand, for agents and TSPs like online car re-sellers, we can provide end-to-end solutions including car insurance instant pricing to online applications, purchasing and claiming which no similar digital platform is available in the local market. We are confident to provide cost-effective solutions for all types of companies irrespective of their legacy system setup. Besides, this fully digitised process will help customers minimise hassles and time in dealing with multiple parties which is typical for the traditional buying and claiming process. We believe car insurance is a good start.”