Hong Kong Internet Registration Corporation Limited (“HKIRC”) announced the results of the “Mobile Payment: Digital Transformation from Customers to Merchants” survey, exploring the market prospects of electronic mobile payments in Hong Kong.

The survey measured public perceptions of the development of the mobile payment market in Hong Kong, as well as user behaviours and experiences.

HKIRC commissioned the Internet Society Hong Kong to conduct the online survey in late July, which successfully collected 1,200 responses from local residents. Most of the respondents ranged in age from 18 to 65 and worked in a variety of industry sectors.

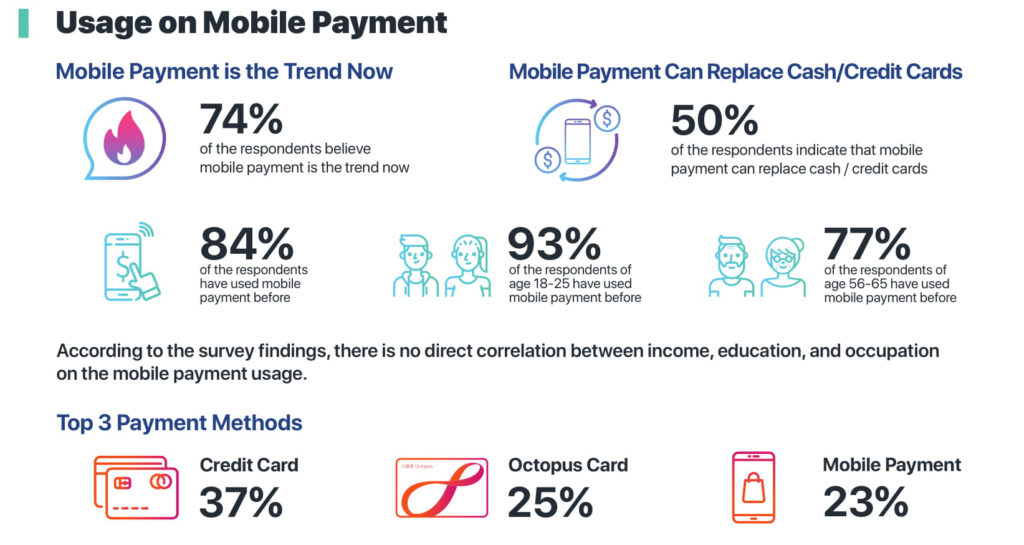

The survey revealed that more than 80% of respondents have used mobile payments before, with more than 40% reporting difficulties, mostly due to unstable networks. Respondents had mixed attitudes towards the development of mobile payments in Hong Kong, with more than 70% expecting to use mobile payment services in the future and nearly 70% feeling optimistic about that.

However, nearly 50% of respondents expressed apprehension about mobile payments, especially regarding cybersecurity and personal privacy issues. Therefore, while a majority of respondents are supportive of large-scale adoption of mobile payments in Hong Kong, more than half feel hesitant about perceived security risks and personal data usage.

Around 80% of survey respondents are frequent users of mobile payments with an average transaction value of less than HK$500

The mobile payment market in Hong Kong is becoming increasingly active. According to statistics from the Hong Kong Monetary Authority, the total number and value of Stored Value Facilities (“SVF”) transactions increased by 5.2% and 30.2% respectively during the first quarter of 2018 compared with the same period last year.

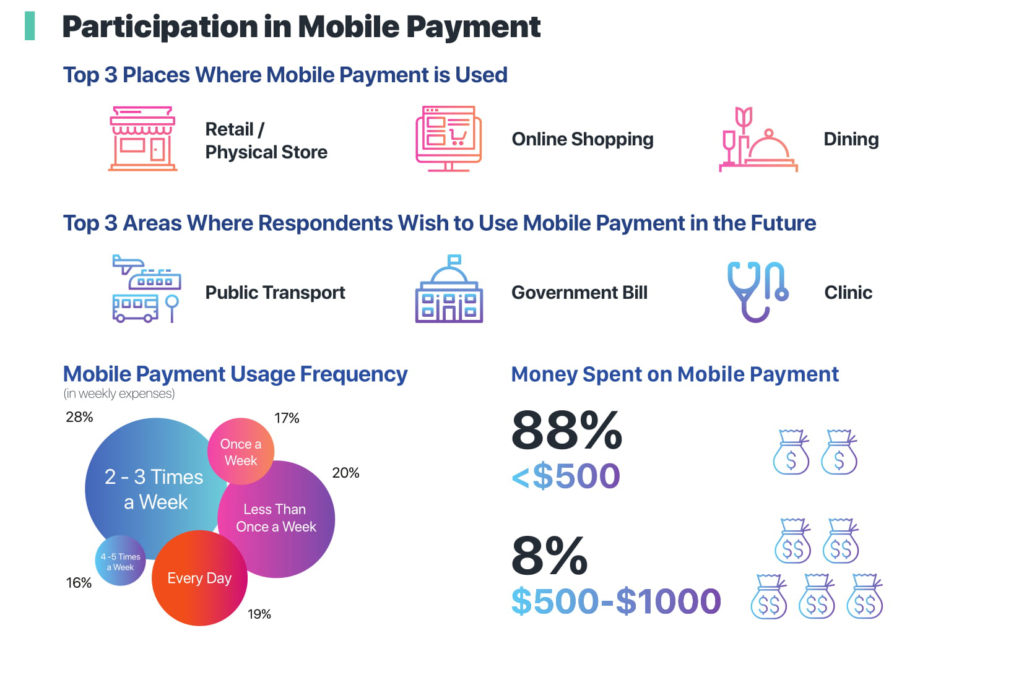

Mobile payment services are used most frequently in retail/physical stores, online shopping, and dining. Around 80% of survey respondents used mobile payments at least once per week (once per week: 17%, 2–3 times per week: 28%, 4–5 times per week: 16%, every day: 19%), and 88% of such payments were for transactions of less than HK$500.

Bonnie Chun

Ms Bonnie Chun, Deputy CEO of HKIRC, said:

“We are pleased to witness that the mobile payment market is gradually gaining popularity in Hong Kong. Based on these survey results, online shopping, shopping in retail stores, and dining may be the major occasions where Hong Kong people use mobile payments.

Respondents also made purchases using mobile payments specifically to enjoy discount promotions, convenience and efficiency. Therefore, companies and corporations in these sectors could proactively consider offering mobile payment services to improve the customer experience.”

An unstable network is the leading problem encountered during mobile payment transactions

While respondents of the survey generally shared positive attitudes towards mobile payment adoption, 53% indicated concerns about mobile payments, namely cybersecurity and personal privacy (personal data, location tracking, etc.). Additionally, 41% of respondents said they had encountered problems when using mobile payments, the most common being network instability.

However, 47% of respondents revealed no concern when using mobile payments because the transaction amount was small enough to ignore any perceived risks.

Urging the Government to strengthen regulation on mobile payment providers and restrict the usage of personal data

Despite the survey exposing some apprehension and concerns about mobile payments in Hong Kong, the majority of respondents still look forward to its development. Overall, 60% of respondents support the Hong Kong Government taking initiatives to promote mobile payment applications, and 70% have a positive impression about mobile payments.

In total, 83% of respondents thought the Government should adopt more policies for mobile and digital wallet payments, including improving the security, reliability and trustworthiness of mobile wallet providers, limiting the usage of personal data collected via mobile payment processes, and imposing severe penalties on cyber crime and cyber attacks.

Respondents also hoped to use mobile payments in the near future for public transport, Government bills, and clinics. This illustrates the public’s interest in the convenience of mobile payment services; however, the authority should supervise personal data usage in order to boost public confidence in mobile payment services.

Simon Chan

Mr Simon Chan, Chairman of HKIRC, said:

“The rapid development of Internet technology has impacted our daily lives in unprecedented ways. This survey reveals the public’s confidence in the future development of mobile payments in Hong Kong, while affirming that both network security and the abuse of personal data usage should be addressed.

HKIRC is dedicated to promoting the best Internet governance standards, and will continue to strive and promote Hong Kong as an international e-commerce hub that keeps pace with the times.”

Featured Image via ShutterStock