Central Banks Balance Innovation with Stability in the Age of Digital Currency

by Rebecca Oi December 5, 2023Innovation has severely rattled monetary systems as emerging technologies rapidly transform how money and finance operate globally. The landscape of monetary systems is at a crucial crossroads, marked by the dual forces of technological progress and the accompanying challenges that necessitate a delicate balancing act.

While these advancements yield benefits like faster and more affordable payments, they simultaneously surface risks, presenting policymakers with the complex task of encouraging innovation while safeguarding financial stability.

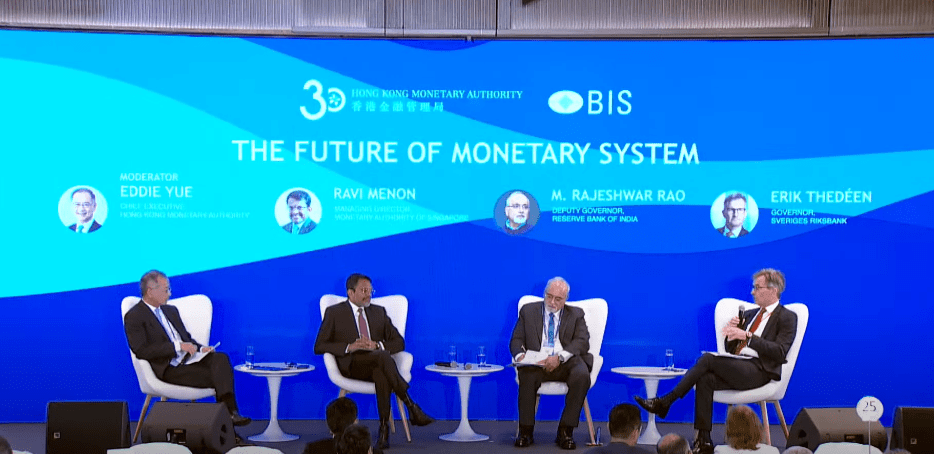

At the heart of this transformation is the HKMA-BIS High-Level Conference, where the panel on ‘The Future of Monetary System’ provided a platform for crucial insights.

Key central bank figures, including Ravi Menon of the Monetary Authority of Singapore, Erik Thedéen of Sveriges Riksbank, and M. Rajeshwar Rao of the Reserve Bank of India, moderated by Eddie Yue of the Hong Kong Monetary Authority, shared their perspectives on the evolving landscape of global monetary systems.

A “tokenisation tidal wave.”

“Tokenisation is at the heart of this movement,” explained Ravi Menon, the outgoing Managing Director of the Monetary Authority of Singapore.

Tokenisation transforms asset ownership into digital tokens on distributed ledgers, facilitating two key innovations.

Firstly, it enables direct peer-to-peer exchange of assets in real-time, known as ‘atomic settlement’, eliminating the need for intermediary reconciliation. Secondly, it allows for the fractionalisation of assets into smaller, tradeable units, significantly broadening investor access.

Ravi believes the core two-tier money structure comprising central bank liabilities and commercial bank deposits is unlikely to change. However, parts of this monetary system will get “tokenised” to enable frictionless exchange of tokenised assets.

Well-regulated stablecoins are also strong contenders for tokenised money, said Ravi. While scepticism exists on unstable cryptocurrencies like Bitcoin that are unfit as monetary alternatives, stablecoins could still provide useful innovations if fully asset-backed and guaranteed to hold nominal value.

Hence, they offer a complementary digital money choice, giving non-banks like fintechs space for innovation.

How central banks are exploring CBDCs

Globally, central banks face the dual challenge of embracing technological advancements while ensuring financial stability.

Their role extends beyond traditional monetary policy to foster innovation and mitigate the risks of new financial technologies. This necessitates a balance between progressive adoption and prudent regulation.

According to Erik Thedéen, Governor of Sweden’s Riksbank, which pioneered a Central Bank Digital Currency (CBDC) pilot in 2017, while it is technically feasible to integrate a CBDC into existing systems, the utility for an already digital economy like Sweden is questionable.

However, CBDCs could promote resilience, provide alternatives to public money, and anchor private money.

M. Rajeshwar Rao, Deputy Governor of India’s central bank, highlighted how India has rapidly scaled up its central bank digital currency pilots. The retail CBDC is designed to replicate physical cash features, while the wholesale central bank digital currency is already used for government securities settlement.

India emphasises offline functionality and interoperability with national payment infrastructure like the Unified Payments Interface.

While risks around digital currencies need governance, M. Rajeshwar believes they can modernise infrastructure, enhance financial inclusion, and improve resilience, cost efficiency, and transparency.

Cresting the tokenisation wave

M. Rajeshwar emphasised that tokenisation riding on common standards and seamless atomic settlement unlocks vast potential. Asset tokenisation promises to eliminate cumbersome reconciliation processes, especially cross-border, significantly cutting settlement times and lowering collateral needs.

Wholesale CBDCs are well-suited for such atomic settlement, highlighted Menon, given their trusted stature. Domestic asset tokenisation may bring fewer efficiency gains, but huge cross-border promise beckons.

Various production-grade initiatives have already tokenised bonds, equities, and currency across jurisdictions like Singapore, Hong Kong, and Switzerland.

Hurdles to mainstream adoption involve barriers between multiple platforms and the absence of unified ledgers. Concepts like a joint global asset ledger and an International Monetary Fund-led “global layer one” system allowing smart contract-enabled regulatory compliance could prove game-changing.

However, achieving international cooperation remains challenging, although the payoffs warrant persistence.

Transforming cross-border payments

While domestic CBDCs appear less compelling in largely digitalised economies, their potential to smooth trillion-dollar daily cross-border flows is substantial.

Efforts like Singapore’s linkages with India and Thailand confirm that connecting national instant payment systems accelerates flows and cuts costs without relying on CBDCs.

However, complete optimisation requires banks to settle such payments directly. CBDCs excel at facilitating such interbank settlement, confirming their international relevance.

Collaborative endeavours like the m-CBDC bridge and Project Nexus seek multi-country payment platforms enabling settlement finality quicker than multiple bilateral links.

Yet, practical implementation needs aligned standards between jurisdictions on managing risks, capital flow controls, and more. Simplifying end-to-end cross-border transfers needs continued commitment from regulators across nations.

Well-regulated stablecoins could complement CBDCs and bank money, as suggested by Menon, by importing non-bank innovations, but robust backing and controls are vital to prevent instability risks.

Accordingly, India has adopted a cautious approach with “governance required for managing digital currency risks”, as M. Rajeshwar elucidated.

Responsible innovation for a promising yet uncertain future

While the monetary sphere’s foundation remains unchanged, large portions could operate far more proficiently via tokenised central and commercial bank money exchanged on distributed ledgers.

Responsible regulation and interoperability efforts enabling such financial atomicity could determine how radically money and finance are disrupted.

Regardless of specific futures, relentless change seems guaranteed as technology reinvents this vital realm. Those crafting apt responses amidst the turbulence might shape central banking’s role and global stability for the next era.