Despite having a rich history of financial innovation, Japan has remained a relatively cash-based society, lagging well behind neighbouring countries in the adoption of cashless payments and fintech services.

Recognizing the country’s decline in global competitiveness, the government is now working diligently to catch up with global counterparts, a report by the Australian Trade and Investment Commission (Austrade) says.

The report, titled “Fintech Playbook: Japan”, outlines the drivers for demand in fintech in Japan, and presents opportunities for foreign companies aiming to enter the market.

In particular, the report highlights the government’s efforts to foster fintech innovation and adoption, outlining its regulatory reforms, focus on startups, as well as supportive initiatives which, combined, reflect Japan’s significant commitment to reclaiming its leadership position in the global fintech arena.

Among these initiatives, the report mentions the establishment of the “Fintech Proof-of-Concept Hub” last year, which focuses on supporting fintech companies, banks and other organisations in their fintech efforts and helping them develop new, innovative products.

To spur a competitive playing field, the Financial Services Agency of Japan also launched in 2021 the Financial Market Entry Office, a one-stop English support center for overseas companies looking to establish a presence in the country.

At the metropolitan level, the government of Tokyo is supporting foreign financial players to establish in the city through various incentives. Through its “Global Financial City: Tokyo” plan, grants and market entrance support are being provided to encourage overseas financial service players to set up in Tokyo, and with its “Tokyo Business Establishment Center”, launched in 2015, it offers a range of specialised services for overseas companies and entrepreneurs.

Regulatory reforms and fintech ambitions

These initiatives come in tandem with regulatory reforms introduced over the past couple of years to enable the adoption of fintech solutions.

In 2010, the Payment Services Act came into effect, providing a regulatory framework for companies offering prepaid payment instruments, exchange services, and more. The revised Banking Act, which became effective in 2018, requires banks to develop systems for the introduction of open application programming interfaces (APIs). Finally, in 2018, the financial regulator launched a regulatory sandbox regime, allowing businesses to trial new technologies and business models.

Japan has set out a number of ambitious fintech goals, including increasing the cashless payment ratio to 40% by 2025, from 32.5% in 2021, and digitizing back-office finance and accounting operations of small and medium-sized enterprises (SMEs).

The government has also been pushing businesses to modernize their financial infrastructure and invest in emerging technologies including robotic process automation (RPA) and accounting automation to realise new business growth, address declining labor productivity and labor shortages, the report Austrade says.

These efforts come as the Japanese government is recognizing the potential of fintech to drive economic growth, enhance global competitiveness, and accelerate the country’s digital transformation, it adds.

According to Austrade, these initiatives and the government’s supportive stance towards fintech are making Japan a compelling market for fintech companies. In addition, the report notes that many banks are proactively investing in fintech startups and are on the lookout globally for innovative fintech solutions that can be introduced to the Japanese market, providing startups with interesting partnership opportunities.

Japan’s fintech sector

Japan has a relatively small fintech footprint with only approximately 600 companies, the organization claims. This compares starkly with countries such as the UK and Germany, which have smaller populations and lower gross domestic products (GDPs) but yet boast 2,100 and 950 fintech companies, respectively.

According to the report, the sector has faced certain challenges that have contributed to its lag behind international counterparts. These include its society’s strong preference for cash transactions, an advanced banking sector that’s highly trusted by consumers, and a corporate culture that’s oftentimes risk-averse and which emphasizes stability and incremental progress over disruptive change.

Nevertheless, certain fintech areas have managed to thrive. Cryptocurrencies, a market that’s reportedly worth over US$1.3 trillion in Japan, has emerged into one of the country’s top fintech segments owing to supportive regulations and efforts to streamline procedures related to cryptocurrency services.

At the same time, the Bank of Japan has supported the concept of digital currencies, having been working on its own digital yen effort since at least 2021. The central bank digital currency (CBDC) could go live as early as 2026, an official said last year.

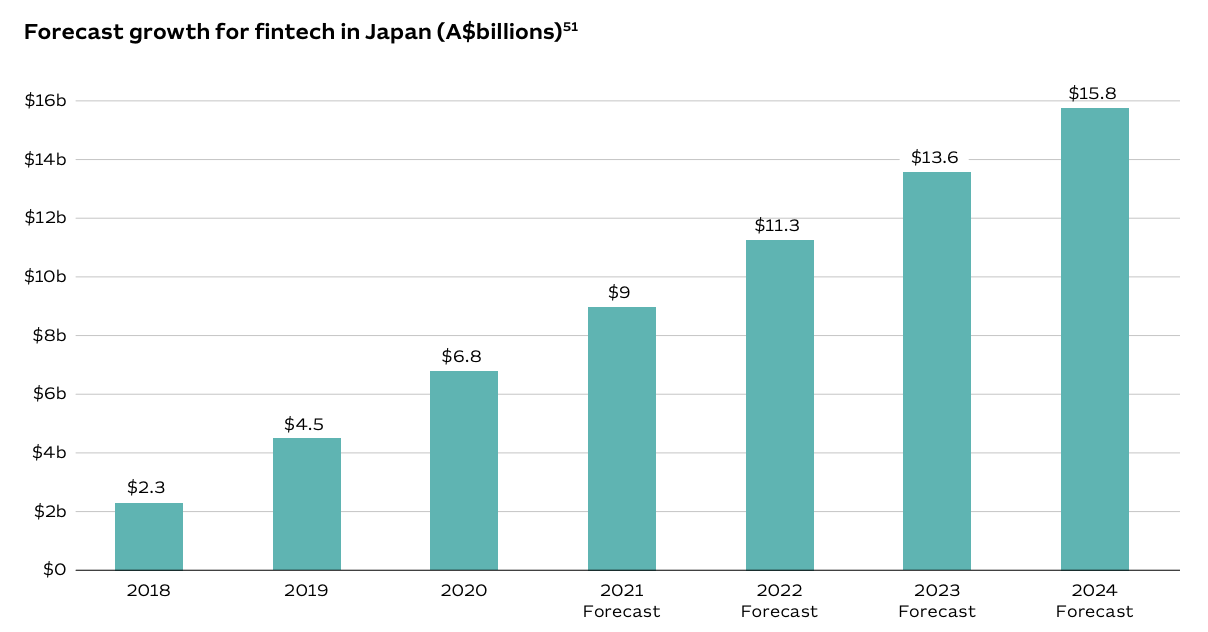

According to the Yano Research Institute, a leading market research and consulting firm in Japan, the domestic fintech market is projected to be worth A$15.8 billion (US$10 billion) in 2024, up 132% from A$6.8 billion (US$4.3 billion) in 2020.

Forecast growth for fintech in Japan (A$billions), Source: Fintech Playbook: Japan, Australian Trade and Investment Commission (Austrade), Nov 2022

Featured image credit: edited from freepik