E-Wallets Hong Kong: Who’s Leading, Opportunities, and Challenges

by Johanan Devanesan September 4, 2023Since their inception in 2016, e-wallets in Hong Kong which operate under Stored Value Facilities (SVFs) licensing have rapidly expanded, with the market now served by an intriguing mix of thirteen non-bank licensees, plus four traditional banks that also operate SVFs. Of these seventeen, six have emerged as full-service e-wallets offering a comprehensive range of payment functionalities in Hong Kong.

This includes facilitating peer-to-peer (P2P) and person-to-merchant (P2M) transactions both online and offline. Octopus, Alipay HK, WeChat Pay, Tap & Go, PayMe, and BoC Pay are the six significant players in this segment.

Hong Kong e-Wallets Achieving Critical Mass

According to a recent ecosystem report by Quinlan & Associates titled “Winning Hong Kong’s Merchant Payment War – Revisiting the Battle Plans of Hong Kong’s E-Wallet Providers,” these six major e-wallet providers have successfully built sizeable user bases. Octopus leads the pack with a staggering 6.2 million registered users.

In addition, they have gained impressive penetration on the merchant front, amassing over 150,000 acceptance points for digital transactions. For example, Alipay HK and Octopus claim deployments at over 150,000 and 170,000 local retail outlets respectively.

Source: Winning Hong Kong’s Merchant Payment War – Revisiting the Battle Plans of Hong Kong’s E-Wallet Providers, Quinlan & Associates

Moving Beyond Payment: Creating Holistic Ecosystems

Worldwide, e-wallets have made significant strides in democratising access to digital payments, particularly for underserved or unserved customer segments. In a digital age where consumers are increasingly mobile-enabled and digitally savvy, e-wallets offer an unmatchable level of convenience.

The flexibility in top-up options and enhanced digital connectivity brought about by integrated social elements in P2P features are key advantages. While originally functioning as standalone applications focused on digital transactions, most leading e-wallets globally have evolved into holistic ecosystems, often represented on mobile devices as a super-app.

They now offer lifestyle and value-added services that cater to both merchants and customers. This differentiates them from other digital payment solutions and adds layers of utility and attractiveness for end-users.

Impact of COVID-19 and Consumption Vouchers on e-Wallets in Hong Kong

The COVID-19 pandemic triggered a seismic shift in consumer behaviour throughout the world, most notably a sharp rise in e-commerce spending. Transaction values of Hong Kong e-wallets surged by a Compound Annual Growth Rate (CAGR) of 14% between 2019 and 2022, reaching HKD 249 billion. This now constitutes 19% of the total retail Gross Merchandise Value (GMV).

Moreover, for the Special Administrative Region, the distribution of consumption vouchers exclusively through e-wallets led to a substantial increase in user adoption. In 2021, these vouchers saw a cumulative 6.3 million recipients, comprising both existing and new users, across the top four major e-wallets in Hong Kong.

Competitive Landscape and Monetisation Challenges for Hong Kong’s E-Wallets

While these providers continue to grow, there are several headwinds to consider. In a bid to capture a greater share of the local merchant payment market, providers are embarking on numerous strategies designed to bolster their P2M business.

However, this competitive environment means higher customer acquisition costs and limited opportunities for broader merchant adoption. Furthermore, merchant inactivity remains a significant issue affecting monetisation, largely due to suboptimal payment experiences and lack of loyalty programmes aimed at merchants.

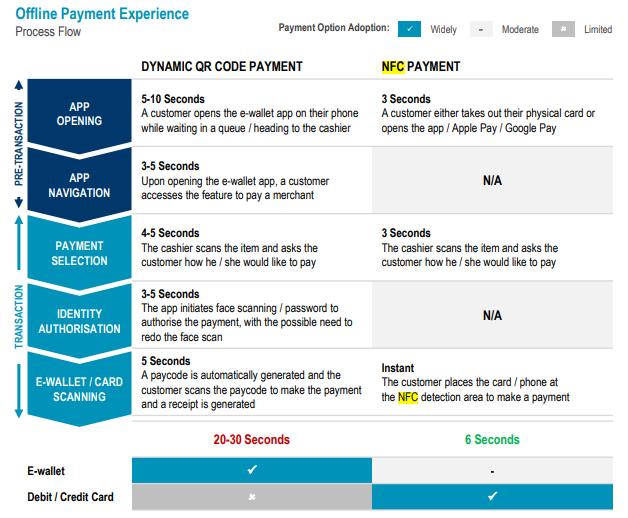

While QR code payments are widely embraced, the research uncovered that they are often seen as less convenient compared to Near Field Communication (NFC) payment methods, such as credit or debit cards. The latter takes a mere six seconds for transaction completion, while QR code payments can take up to thirty seconds.

This has led many customers in Hong Kong to still prefer established NFC payment methods, especially for the quick transactions that e-wallets should be known for.

Source: Winning Hong Kong’s Merchant Payment War – Revisiting the Battle Plans of Hong Kong’s E-Wallet Providers, Quinlan & Associates

Future Directions and Monetisation Strategies

Given the current challenges, e-wallet providers need to refocus their strategies. Quinlan & Associates suggest adopting a mix of merchant acquisition models tailored to the scale and needs of prospective businesses. They also recommend a more nuanced marketing strategy to optimise return on investment (ROI).

To address monetisation challenges, e-wallets could explore avenues such as value-added subscription fees for merchants or fixed fees for specific services, taking cues from service providers in other countries. These include introducing subscription fees for value-adds like Japanese e-wallet provider, PayPay, for merchants to access a range of value-added services.

South Korea’s Kakaopay meanwhile charges merchants to advertise on their messaging platform. In Indonesia, ShopeePay imposes a fixed fee for every top-up made by customers from non-SeaBank (owned by the same parent company as ShopeePay) accounts. Hong Kong e-wallets could also impose a fee to handle chargeback requests, much like global online payment processor, PayPal.

Moreover, beyond their core payment functionalities, e-wallet providers can capitalise on their sizeable user and merchant bases to offer a broader range of financial and lifestyle services. This could include services like restaurant reservations or ride-hailing, turning their platforms into one-stop super apps.

The Hong Kong e-wallets landscape has seen remarkable growth and transformation over the past few years, driven by shifts in consumer behaviour and strategic innovations from service providers. However, as the market matures and becomes more competitive, providers will have to grapple with a variety of challenges, particularly those related to merchant acquisition, customer retention, and monetisation.

And yet despite these hurdles, futureproofing e-wallets looks promising in an ecosystem with matured players like Hong Kong, as with every challenge, comes ample opportunities for those willing to adapt and innovate.