6 Young, Fast-Growing Fintech Startups from Mainland China to Watch

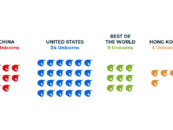

by Fintech News Hong Kong June 22, 2023Mainland China has emerged as a hub of innovation and rapid growth in the fintech sector, with several firms such as the Ant Group, WeBank and Lufax leading the way in transforming the financial landscape. These companies have captured attention and investor interest with their cutting-edge technologies and disruptive business models.

But besides the large and established ones, smaller players are also evolving in this burgeoning landscape. To get a sense of the country’s up-and-coming fintech startups, we’ve selected six of the fastest-growing and hottest fintech startups in Mainland China. These companies have witnessed strong traction over the past few years and have recently secured financing from prominent investors to fuel their growth.

Micro Connect

Founded in 2021 and headquartered in both Shenzhen and Hong Kong, Micro Connect connects global capital with China’s micro and small businesses. The platform allows investors tap into China’s small businesses sector and diversify their portfolios by backing small businesses, all the while making capital more accessible and affordable to business owners.

Since its establishment, Micro Connect has achieved significant milestones, including investing in over 100 micro and small businesses in various industries across multiple provinces in China.

In March 2022, the startup successfully raised US$70 million in its Series B funding round, bringing its total funds raised to US$120 million. The capital will be used to expand the partnership network, enhance platform technology, and develop market infrastructure.

Dowsure Technologies

Introduced in 2016, Dowsure Technologies is a Shenzhen-based cross-border fintech startup. The company specializes in providing streamlined lending experiences for sellers operating on various cross-platform marketplaces such as Amazon, eBay, Shopee and Lazada.

Dowsure Technologies has gained recognition as Amazon’s lending service provider and has developed a proprietary assessment model for evaluating marketplace store owners. Through partnerships with Chinese banks and by leveraging store data with no collateral requirements, Dowsure enables pure credit loans for sellers. In just eight months of operations, the company facilitated over RMB 35 billion (US$4.9 billion) in gross merchandise volume (GMV) for Chinese sellers on Amazon.

In 2022, Dowsure Technologies successfully secured a Series B financing round of US$20 million.

Beta Data

Founded in 2012 and headquartered in Shanghai, Beta Data offers a software-as-a-service (SaaS) platform that utilizes artificial intelligence (AI) algorithms to assist financial institutions and planners in understanding customer investment preferences, interpreting markets, analyzing financial products, and identifying suitable investment tools and products.

The company’s main focus is the digital transformation of wealth management, empowering clients in four main areas: attracting and interacting with customers, transactions, and follow up services.

Beta Data secured a Series B+ funding round in February 2022 which it said it would use increase product research and development (R&D), expand service networks, and build an overall digital solution for financial institutions focused on marketing, investment consulting, and management.

Baigebao

Founded in 2015 and based in Xiamen, Baigebao provides Internet insurance technology and product solutions. The company specializes in customized insurance and tech application solutions. Baigebao’s products include Baige Insurance, Baige SaaS System, Baige Alliance, Baige Public Welfare, and other application products.

Relying on a partnership strategy, Baigebao has provided insurance protection to over 260 million Internet users in China, covering all aspects of people’s life.

Baigebao secured a US$2.3 million Series A+ in August 2022. The company was named as one of China’s top 50 emerging fintech companies by KPMG earlier this year.

Mindigital

Headquartered in Singapore and Foshan, Mindigital is a fintech company specializing in digital banking solutions for Belt and Road countries and emerging markets. The company focuses is on providing one-stop banking-as-a-service (BaaS) solutions to help banks and financial institutions undergo cost-effective digital transformations using standardized open banking architecture, big data, and AI technology.

Mindigital is recognized as a global leader in BaaS, serving clients across continents, including countries such as the US, Spain, Brazil, China, India, Indonesia, Pakistan, Philippines and Vietnam. The company’s expertise lies in upgrading digital infrastructure, improving profitability, managing risk, and reducing operational costs for their partners.

In February 2022, Mindigital secured a Series A funding round of US$10 million, which it said it would use to enhance its products and systems and expand their sales network.

BlockSec

Founded in 2021 and based in Hangzhou, BlockSec provides security infrastructure for the blockchain industry. The company leverages cutting-edge technologies to enhance the security of decentralized applications, detect high-impact blockchain vulnerabilities and block sophisticated security attacks.

Since its inception, BlockSec claims it has provided security audit services to more than one hundred clients, helping rescue more than five million assets, including US$3.8 million worth of tokens from decentralized exchange Saddle Finance.

The startup closed a US$8 million Seed round in July 2022 which it said it would use to expand its research and production team and fuel the growth of its on-chain monitoring and attack interception capability.

Featured image credit: Edited from freepik