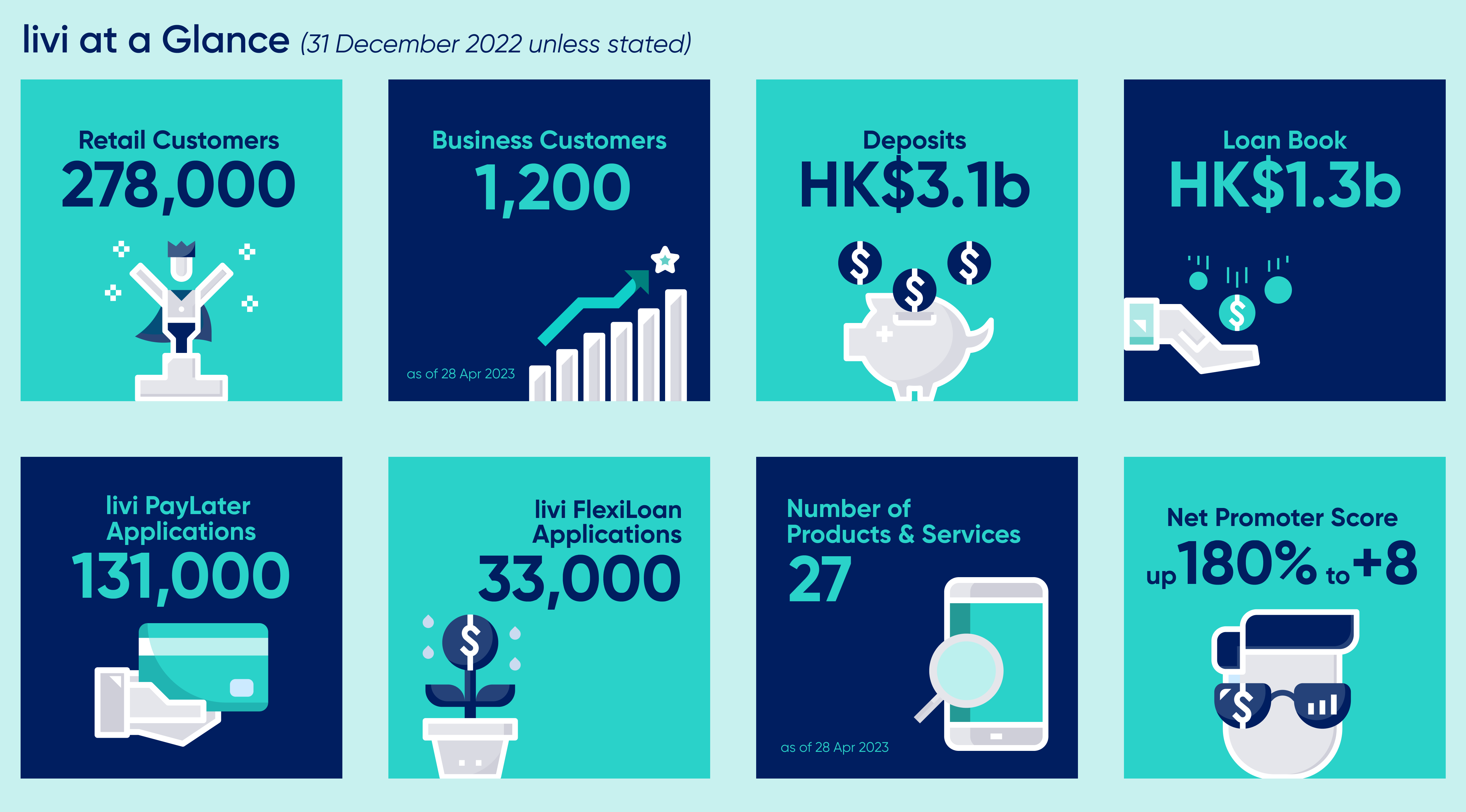

livi Reports Strong Growth in 2022, Records HK$3.1 Billion Deposits

by Fintech News Hong Kong May 2, 2023Hong Kong’s livi bank, has announced accelerated growth in 2022 driven by revenue-generating offerings in retail banking, small and medium-sized enterprise (SME) banking, and the Greater Bay Area (GBA).

The bank’s operating income turned positive in 2022, reaching HK$17 million, thanks to the successful launch of livi FlexiLoan, with a loan balance of over HK$1.3 billion. Meanwhile, the deposit balance remained stable at HK$3 billion.

In addition, livi Business, which offers a fully digital process, gained 1,200 customers by the end of April 2023, with a total approved loan amount of HK$70 million. Invoice financing was also introduced, using livi’s shareholder networks to address customers’ financing needs.

David Sun

CEO, David Sun of livi bank, said, “As we progress the growth of our business, we are increasing our emphasis on innovative revenue-generating offerings.”

In the retail segment, livi launched a range of attractive products and services in 2022, including the three-Year Insurance Savings Plan, Time Deposit, Travel Now Insurance Plan, HomeCare Insurance Plan, livi Rewards, livi Saving Space, and the market-first “Mochi” NFT Collectible Artworks. Meanwhile, livi FlexiLoan generated a loan book of over HK$1 billion by April 2023.

In the SME market, livi Business is changing the banking experience with its fully digital process, data-driven capabilities, and open architecture. Franchise financing and invoice financing serve customers’ different needs, while the bank also remains positive on the potential of the GBA market.

Image: livi bank

“We believe that livi is adopting the right strategy on the path to profitability. We will continue to introduce innovative products to help local entrepreneurs seeking responsive support to grow their businesses,” said David.

As a digital bank, livi benefits from ongoing shareholder support, including BOCHK, JD Technologies, and Jardine Matheson.