Salary is the Top Issue Exacerbating Hong Kong’s Fintech Talent Gap

by Fintech News Hong Kong November 7, 2022The HKU-SCF Fintech Academy, Cyberport and Hong Kong Productivity Council have published a Fintech Talent Study Report which found an urgent need to nurture more talents to address the fintech talent gap.

The report, which was unveiled at the Hong Kong Fintech Week 2022, was produced based on insights from interviews with 12 financial executives and a survey of over 390 financial institutions.

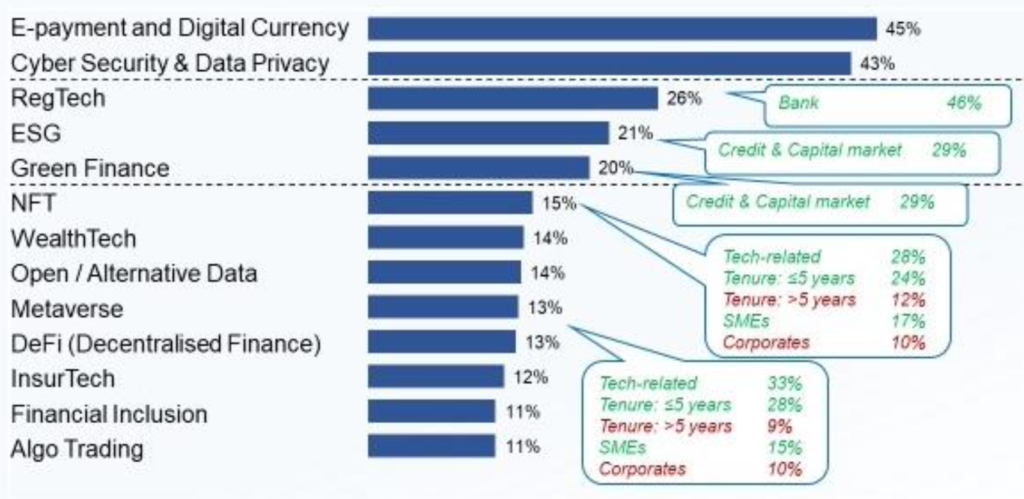

Upcoming trends of fintech development in the industry. Source: HKU-SCF Fintech Academy’s Fintech Talent Study Report (2022).

The survey reveals that e-payments and digital currencies, as well as cybersecurity and data privacy are considered the top fintech trends in Hong Kong.

Furthermore, big data analytics and artificial intelligence are expected to be the key driving technologies to transform the industry in the near future.

In terms of demand for fintech professionals, over half (57%) of the companies surveyed are actively looking for fintech professionals, especially for technical roles.

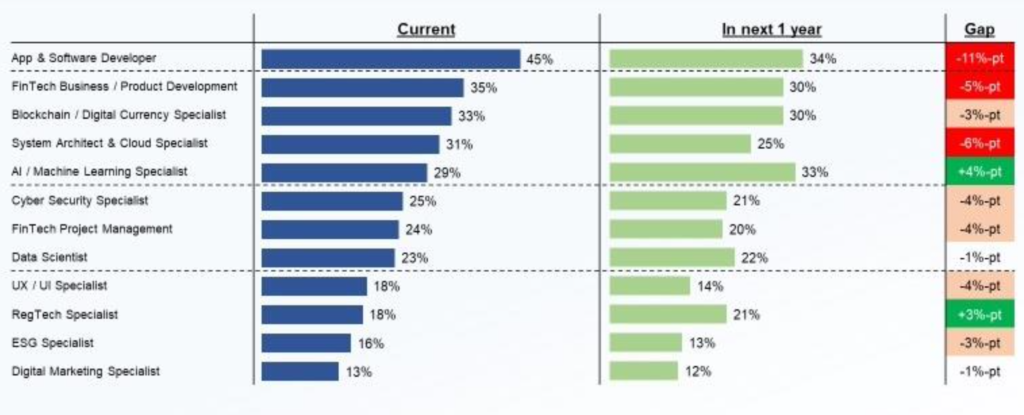

Fintech roles with shortage of talents. Source: HKU-SCF Fintech Academy’s Fintech Talent Study Report (2022).

The technical roles to be most in demand in the next year include app and software developers, AI / machine learning specialists, blockchain / digital currency specialists, system architects and cloud specialists, as well as data scientists.

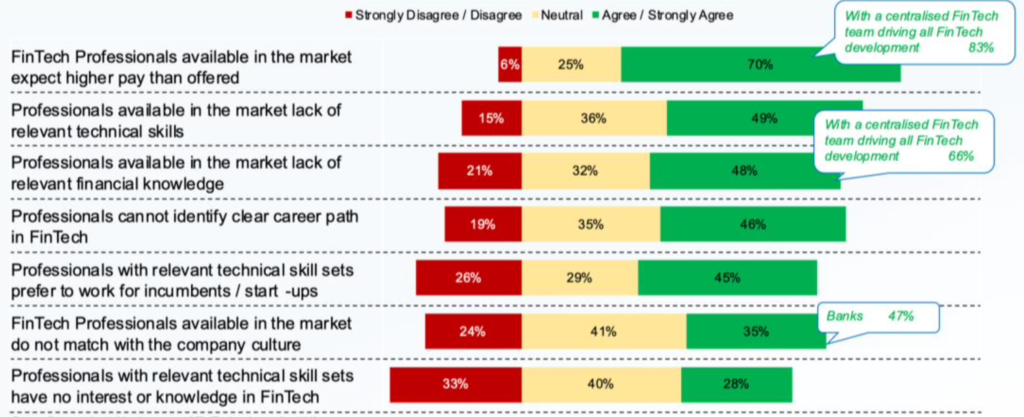

The salary expectation gap was found to be the top issue leading to the fintech talent gap, and the lack of relevant skillsets being the second issue.

Factors leading to fintech talent gap. Source: HKU-SCF Fintech Academy’s Fintech Talent Study Report (2022).

Regarding the skillsets of technical fintech roles, two-thirds of the companies surveyed (65%) do not have strong requirements on financial services knowledge.

For non-technological fintech roles, nearly two-thirds of the companies surveyed (64%) require some knowledge of technology, and knowledge in cyber security and data analytics is most desired.

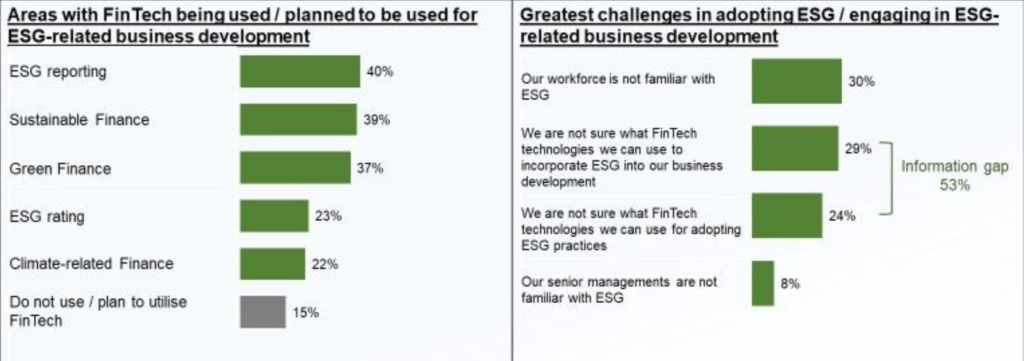

ESG (environmental, social and governance) has become an increasingly important factor in finance. However, 38% of the companies reported having no knowledge of ESG, and 42% reported having some.

Use of fintech in ESG-related business development. Source: HKU-SCF Fintech Academy’s Fintech Talent Study Report (2022).

Of the companies that adopt ESG practices or engage in ESG-related business development, 85% are currently using or planning to apply fintech in ESG.

To increase the supply of local fintech talents, 69% of the companies consider practical experiences to be more important, while providing more fintech courses is another effective means.

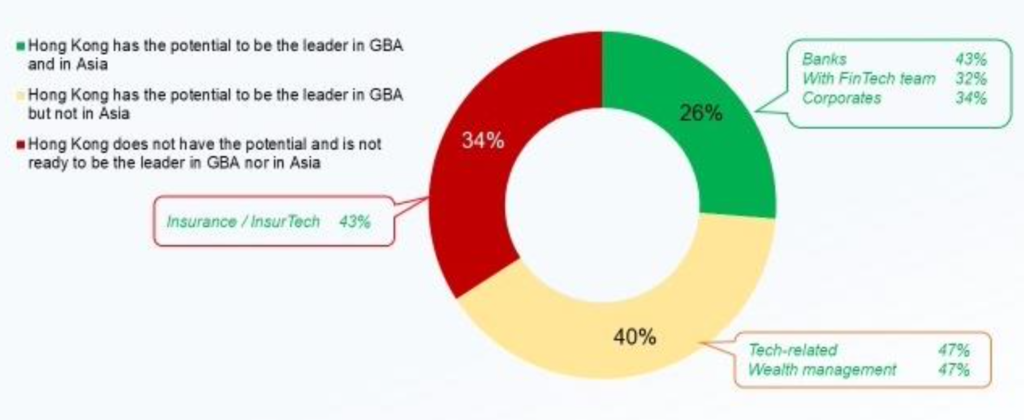

Perceived potential of Hong Kong to be the leader of fintech in the Greater Bay Area or in Asia. Source: HKU-SCF Fintech Academy’s Fintech Talent Study Report (2022).

Two-thirds (66%) of the companies surveyed say Hong Kong has the potential to be the fintech leader in the Greater Bay Area, out of which 26% believe that Hong Kong can become the fintech leader in Asia.

The HKU-SCF Fintech Academy at the University of Hong Kong (HKU) was established in April 2020 through a HK$60 million grant from the Standard Chartered Foundation (SCF).

Tak-Wah Lam

“The survey has provided us with a comprehensive and timely guidance on the enhancement of fintech education on and off campus, and on how to further foster industry-community-university partnerships to advance fintech and ESG innovation,”

said Professor Tak-Wah Lam, Executive Director of the HKU-SCF Fintech Academy and Head of Department of Computer Science in HKU.