Hong Kong, one of the world’s leading fintech hubs, have been experiencing incredible growth in recent years, thanks to a supportive government, its large pool of investors, and lots of startup programs aimed at supporting promising ventures. As of 2017, 48 of the world’s leading 100 fintech companies were reaping rewards from the city’s technologically advanced ecosystem.

In particular, six key fintech segments have witnessed tremendous growth:

Artificial intelligence (AI): Local banks and financial institutions are proactively implementing AI as part of their modern financial strategy. AI promises to revolutionize financial services by increasing efficiency, reducing costs and helping clients make better financial decisions.

An AI lab jointly funded by SenseTime, which specializes in large scale facial recognition systems, and the Alibaba Hong Kong Entrepreneurs Fund, was launched in May to boost development in a space and support promising startups.

In July, two government enterprises, namely ASTRI and Cyberport, partnered to support the tech startup community, particularly those in the AI, fintech, blockchain and healthtech verticals.

Some of Hong Kong’s most notable AI startups working in fintech include Trend Lab, Aidyia, Amareos, and Clare.ai.

Blockchain: Hong Kong boasts a strong telecommunications industry and has attracted major cloud service companies to facilitate the growth of blockchain technology. Hong Kong’s financial services industry has been actively exploring the use of blockchain to increase efficiency and cut costs.

A trade finance platform based on blockchain technology was recently developed by the Hong Kong Monetary Authority, signifying the city’s commitment to harnessing the power of the technology. Recently, the Hong Kong Exchanges and Clearing announced a partnership with blockchain company Digital Asset to introduce a blockchain platform that would allow international investors trade mainland Chinese shares via Hong Kong’s Stock Connect system.

Notable blockchain companies in Hong Kong include remittance startup BitSpark, crypto exchange Gatecoin, and crypto and blockchain R&D lab IOHK.

Regtech: Hong Kong has been pushing for regtech innovation in a bid to find more efficient ways to address the increased complexity and scope of more stringent regulations globally, as well as the growing volume of transactions and data banks need to handle.

In September, the HKMA unveiled four regtech initiatives during the annual conference of the Hong Kong Institute of Bankers and introduced plans for a fintech “supervisory ‘sandbox’ to regtech projects or ideas raised by banks and technology firms.”

The University of Hong Kong has committed itself to regtech research and is collaborating with partners in Europe and Australia to support the city’s ambition.

Regtech companies in Hong Kong include Know Your Customer, Zegal, Chekk, and Blue Umbrella.

Wealthtech: The development of wealthtech in Hong Kong has been largely influenced by the city’s expertise in wealth management as well as clear and straightforward regulations.

According to a report by the Private Wealth Management and Association and KPMG, up-and-coming tech entrants offering wealth management services in Hong Kong are expected to snap 5-10% of assets under management (AuM) from incumbents like private banks by 2023

Notable wealthtech companies in Hong Kong include FinFabrik, 8 Securities, and Quantifeed.

Insurtech: Hong Kong has been promoting insurtech innovation, instigating several initiatives to facilitate partnerships and development in the space.

Last year, Hong Kong’s Insurance Authority launched two flagship programs, the Insurance Sandbox and Fast Track, to provide an opportunity for insurers to finally move away from their clunky legacy systems and collaborate with insurtechs in a more open and encouraging environment.

Additionally, many Hong Kong insurance companies have been adopting the latest technologies and innovation. Blue, the Hong Kong digital insurance joint venture owned by Aviva, Hillhouse and Tencent, officially opened for business in September, providing customers with zero commission, easy-to-use digital insurance.

Other insurtech companies in Hong Kong include ImSure, GenLife, and Wesurance.

Cybersecurity: Cybersecurity has become a top priority in Hong Kong where cyber crimes has surged in recent years. Additionally, cybersecurity is an important element to Hong Kong’s ambition to become a leading fintech hub.

From 2012 to 2016, financial losses related to cyber crimes have risen 680%, according to statistics from the Hong Kong Police Force. This year, the number of fraudulent banking websites reported in Hong Kong has surged, with over two million Hongkongers thought to have been affected by cybercrime, as reported by International Investment.

Notably cybersecurity companies in Hong Kong include Nexusguard and VXRL.

The 2018 Hong Kong Fintech Week, which took place from October 29 to November 2, 2018, brought together 8,000 attendees, including 260 world-class speakers, 100 exhibitors and 60 startups, into the world’s largest cross-border fintech event that showcased the Guangdong-Hong Kong-Macao Greater Bay Area.

The five-day event was packed with important announcements, presentations and panel sessions covering all key aspects of fintech, and involved experts from around the globe. It also featured many side events, including visits to innovation labs and education events organized by universities.

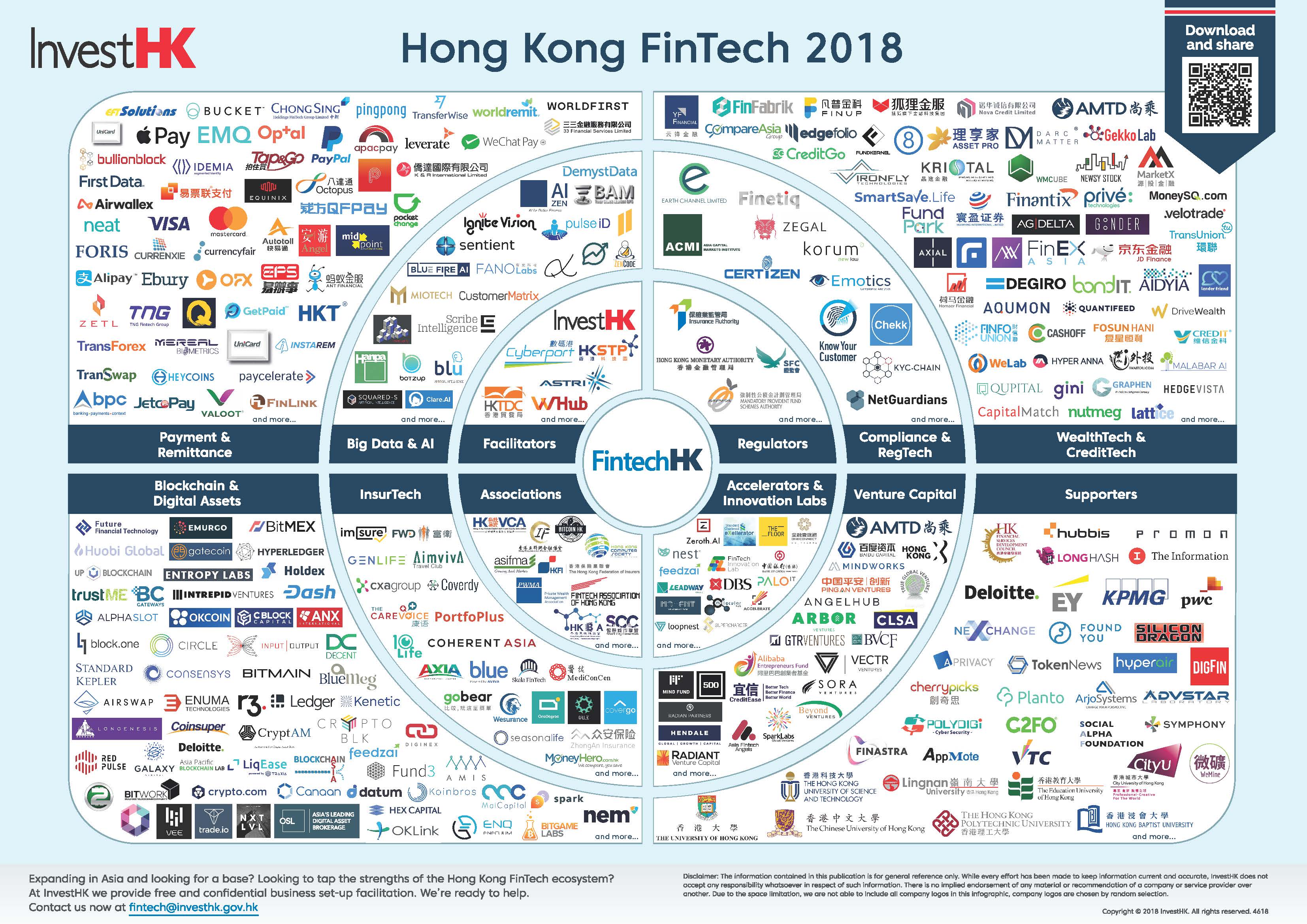

For the Fintechweek in Hong Kong Invest HK also put together a fintech map 2018, which we think is perfect complement to our Fintech Hong Kong Startup Report.

You can download and share this new fintech map hong kong via the QR code on the map.

Hong Kong Fintech Map 2018:

Other resources you might be interested in

Curious about other Asian Fintech Startup Maps? Here’s a handy guide looking at the fintech startup maps in Asia by country.