Taiwan’s Digital Banks Will Struggle to Turn a Profit, Says Consulting Firm

by Fintech News Hong Kong October 3, 2022Despite showing potential to address market needs and foster innovation in the banking sector, Taiwan’s new digital banks still have a long road ahead to reach profitability amid a saturated retail banking market and limitations in the services they are allowed to offer, a new report by research and consulting firm Kapronasia says.

Taiwan’s three digital banks, namely Line Bank, Rakuten Bank or Next Bank, are competing against 38 commercial banks for a piece of the island’s 23 million population in one of Asia’s most oversaturated retail banking markets. This is all the while being restricted from potentially more lucrative businesses like wealth management, the report says.

It will take them at least a couple of years to break even on deposits and payments, and they will need to convince consumers to open what might be their fourth or fifth banking account, rather than primary one, considering that nearly 95% of Taiwan’s population already have a bank account, the report points out.

Where Taiwanese digital banks have an edge on is their digital capabilities, superior customer experiences and more compelling and engaging services, Zennon Kapron, director of Kapronasia, told the American Chamber of Commerce’s Taiwan Business TOPICS in March.

“Taiwan may be overbanked, but the financial sector is under-digitized,” he said. “For people who spend a lot of time online, especially younger people, there is strong demand for banking services tailored to their lifestyles.”

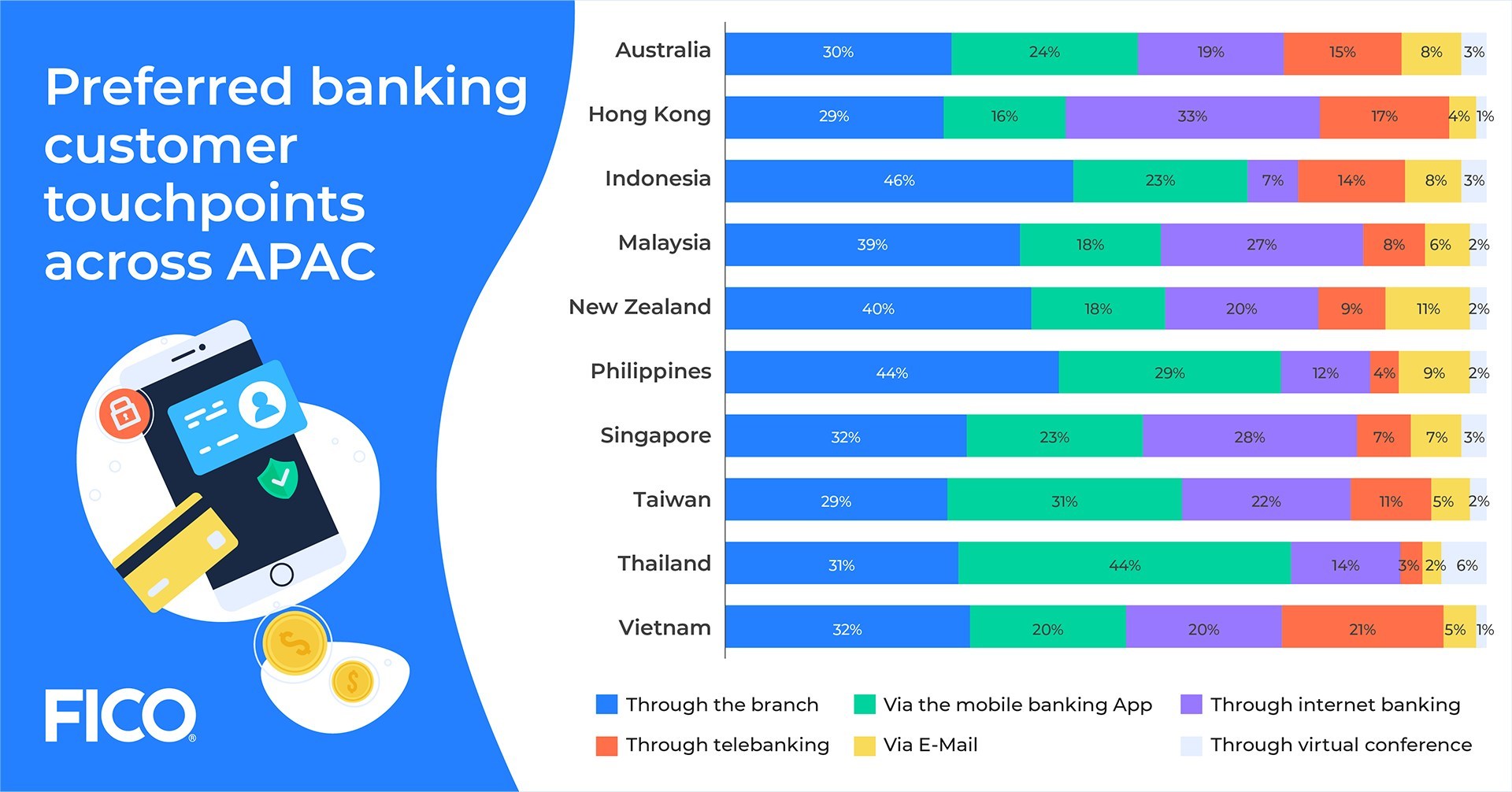

Results of a consumer survey conducted by global analytics software firm FICO in 2020 showed strong demand for online banking, with 71% of respondents indicating preferring to use digital channels to engage with their bank during financial hardship.

Preferred banking customer touchpoints across Asia Pacific – December 2020, Source: FICO 2021

Heavy losses reported

Line Bank lost almost NT$2.3 billion (US$78.7 million) after less than one year of full operations, according to Taiwan’s top financial regulator, the Financial Supervisory Commission (FSC).

A report filed by Line Bank with the FSC’s Banking Bureau attributed the digital bank’s losses – the largest among Taiwan’s three Internet-only banks – to its aggressive marketing policy to attract customers, which increased its operating costs.

In May, Line Bank shareholder Taipei Fubon Commercial Bank approved a plan to increase its stake in the digital bank to 27.18% from 25.1%, with an investment of about NT$2.20 billion (US$74 million). Taipei Fubon Commercial Bank is the second largest shareholder in Line Bank after Line Financial Taiwan Corp, which holds a 49.9% stake.

Rakuten Bank recorded a loss of NT$705 million (US$24.1 million), as of the end of January 2022, and Next Bank reported a loss of about NT$1.38 billion.

As of the end of January, Line Bank had 732,600 depositors with a total of NT$28.8 billion (US$985 million) in deposits, implying an average of NT$39,312 (US$1,345) per account. Next Bank said in April 2022 that it had nearly 60,000 customers and an average deposit of more than NT$70,000 (US$2,374). Rakuten Bank has about 63,000 accounts and its average account balance stands at NT$84,000 (US$3,020), according to Kapronasia.

Research from McKinsey estimates that digital accounts opened in Taiwan exceeded 10 million, by the end of 2021. Digital units of large incumbent lenders, including Richart (Taishin Bank), Koko (Cathay Pacific), and Dawho (Bank SinoPac), had the most digital accounts. Line Bank stood at the fourth position.

Taiwan issued its first virtual banking licenses to three consortia led by Taiwan and Japanese investors back in 2019.

Line Bank is led by Japanese app operator Line Group and includes participation from Standard Chartered, alongside Taipei Fubon Commercial Bank. The digital bank is pursuing a similar strategy to that of Kakao Bank in South Korea, leveraging the large userbase of its messaging app (20 million users in Taiwan) to build an extensive digital ecosystem comprising various products and services.

Rakuten Bank, which is operated by Japanese e-commerce firm Rakuten and Taiwan’s IBF Financial Holdings, is more of a niche product aimed at Taiwanese using the broader Rakuten ecosystem, Kapronasia notes.

Next Bank, meanwhile, is led Chunghwa Telecom, a Taiwan telecom operator. The company has a trove of user data at its disposal, which could be put to use to develop differentiated products and services, according to Jessica Liu, a partner at the Taipei-based venture capital firm AppWorks.

Featured image credit: Edited from Unsplash