ZA and Mox Leading Hong Kong’s Virtual Banking Race, Capturing 70% of All Deposits

by Fintech News Hong Kong May 17, 2021ZA Bank and Mox are leading Hong Kong’s virtual bank race, making up 70% of all virtual banking customer deposits as of the end of 2020, Reuters reported, citing the lenders’ annual reports.

Hong Kong’s eight virtual banks accumulated total customer deposits of HK$15.8 billion (US$2.03 billion) at the end of 2020. Of this, ZA Bank, operated by a unit of online-only insurance firm ZhongAn, had deposits of HK$6.04 billion (US$780 million), representing a 39% market share, while Standard Chartered-backed Mox Bank, which garnered HK$5.2 billion (US$670 million), accounted for 33% of the market.

Financial services consultancy Quinlan and Associates estimates that by 2025, up to HK$76 billion worth of revenue could be up for grabs for virtual banks. They could be holding a combined revenue market share in the larger banking sector of 19.3%, and could be serving as many of 1.9 million customers, or 24.9% of the Hong Kong population, the firm estimates.

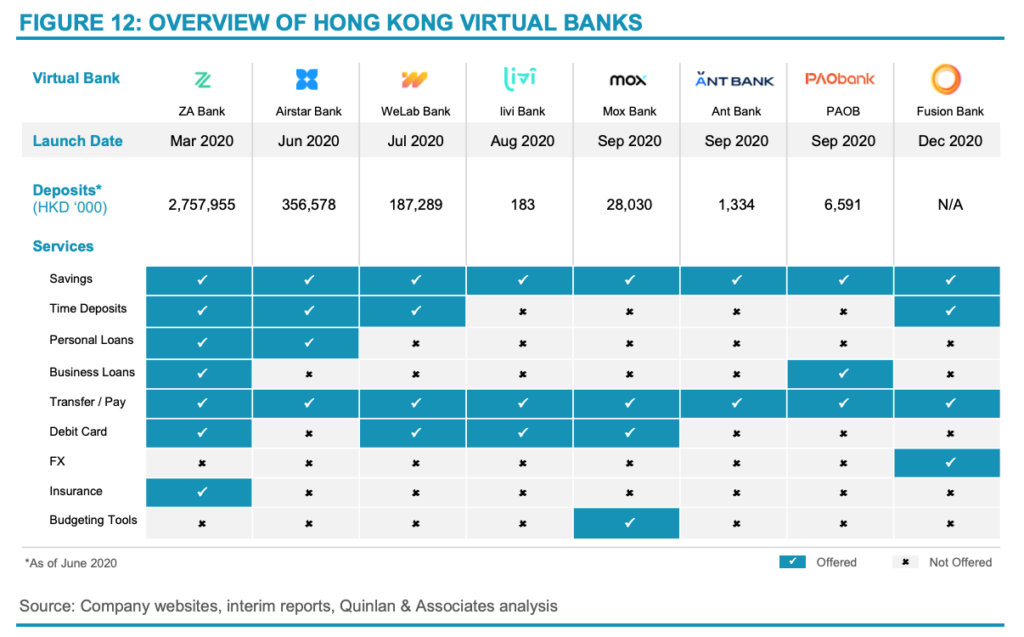

Overview of Hong Kong virtual banks, Source: Branching Off: The Outlook for Hong Kong’s Virtual Banks, Quinlan and Associates, March 2021

All eight virtual banks in Hong Kong reported losses in 2020 as they focused on setting up operations, building brands and attracting deposits. According to Andrew Gilder, who leads EY’s Asia Pacific banking and capital markets practice, getting a large deposit base quickly can be a good indicator of efficient client onboarding and how consumers perceive early products and services.

In the longer term, however, virtual banks will need to roll out new products such as loans and credit cards to make the most of these customer numbers and drive profitability, he said.

Hong Kong’s virtual banks serve a combined 580,000 customers

In 2019, the Hong Kong Monetary Authority licensed eight virtual banks. All of them launched during 2020 and so far have found a receptive user base in Hong Kong.

Hong Kong’s Eight Virtual Banks: The Progress So Far, Fintech News Hong Kong

Citing regulatory data, an April 2021 report by the South China Morning Post (SCMP) says that Hong Kong virtual banks currently serve a combined 580,000 customers. ZA Bank, Mox Bank and WeLab Bank, Hong Kong’s only homegrown virtual bank, account for 86% of that total.

ZA Bank, which was recently granted an insurance agency license, currently offers the broadest range of products and services, a recent analysis by Quinlan and Associates found, which include personal and business loans and a debit card. The virtual bank declared in March that it had reached 300,000 customers in its first year of operations.

Mox Bank crossed the 100,000 customers mark last month, just eight months since its official debit, CEO Deniz Guven told the SCMP in April 2021. The virtual bank plans to double its customer base by the end of 2021 and has plans to introduce personal loans, installment payments, foreign exchange, and wealth planning services within six to 12 months, Guven said. It launched a credit card in partnership with Mastercard in April.

WeLab Bank picked up 10,000 new accounts within just ten days of opening to the public and expects to reach the 100,000 mark by June 2021, according to the SCMP report.

Recent developments in Hong Kong’s virtual banking scene

WeLab Bank’s parent company and fintech unicorn WeLab had 50 million customers across Hong Kong, mainland China and Indonesia by the end of 2020, it said in March. Besides virtual banking, the company also operates in the online lending space.

WeLab is currently in talks with investment banks in preparation for an initial public offering (IPO) expected later this year that could value it in the range of US$1.5 billion to US$2 billion, sources told Nikkei Asia in April 2021.

Livi Bank, another Hong Kong virtual bank, became earlier this month the first of the eight virtual banks to offer a buy now pay later (BNPL) product. Livi PayLater offers an instant instalment service with a virtual Mastercard debit card and key features that include nearly instant approval, and flexible repayment periods from three to 36 months.

Livi Bank is backed by Bank of China (Hong Kong) (BOCHK), JD Technology, a fintech firm and a unit of Chinese e-commerce giant JD.com, and the Jardine Matheson Group, a multinational conglomerate and a Fortune Global 500 company.

Other virtual banks in Hong Kong include Airstar Bank, a joint venture between Chinese electronics firm Xiaomi and financial conglomerate AMTD Group; Ant Bank (Hong Kong), the virtual banking arm of Ant Group; Ping An OneConnect Bank (PAObank), a wholly-owned subsidiary of OneConnect Financial Technology and a member of China’s biggest insurer Ping An Insurance; and Fusion Bank, a joint venture owned by Tencent, Industrial and Commercial Bank of China (Asia), Hong Kong Exchanges and Clearing, Hillhouse Capital and renowned Hong Kong entrepreneur Adrian Cheng.