Hong Kong-based insurtech YAS announced the launch of of a NFT (Non-Fungible Token) microinsurance called NFTY, joining hands with Generali‘s Hong Kong Branch to co-develop it.

YAS claims that NFTY will become the world’s first microinsurance product to cover NFTs.

The launch leverages the growing popularity of the advanced blockchain technology that certifies a digital asset such as media, songs, arts and collectibles to be unique and therefore not interchangeable.

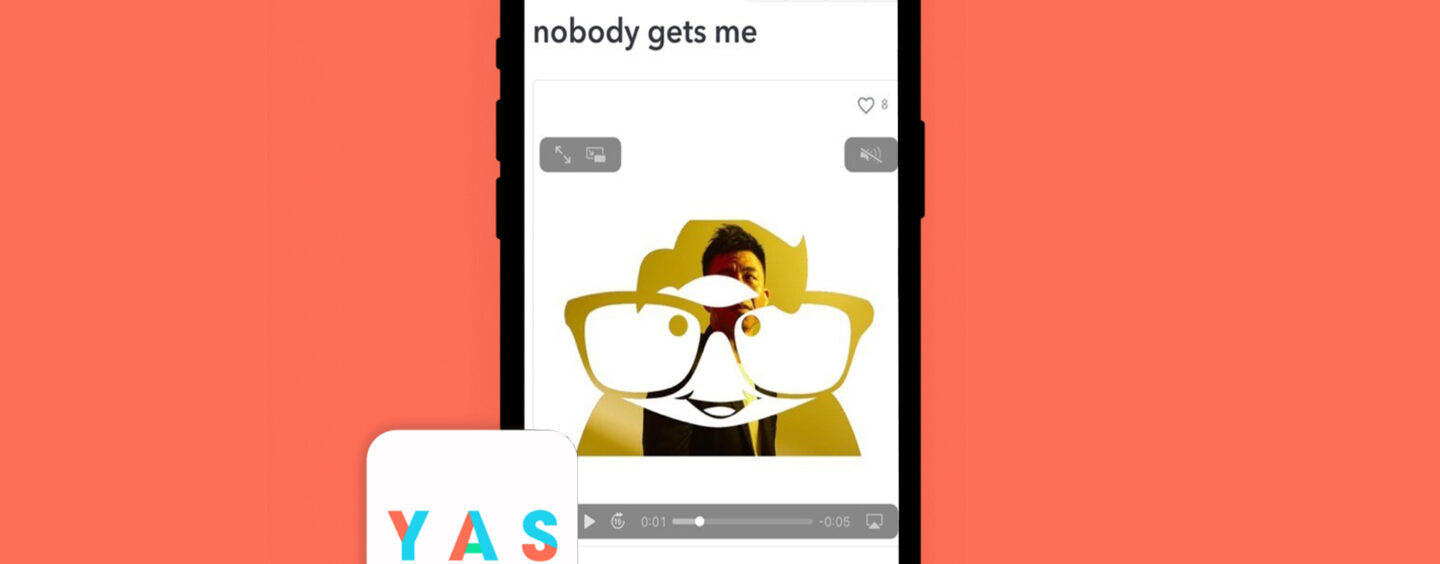

This microinsurance product will be first used to cover the NFT of “Nobody Gets Me”, a non-released song by Hanjin Tan, a Singaporean Chinese songwriter and music composer. The policy covers the theft and loss of the NFT for its buyer.

YAS joined hands with Generali’s Hong Kong Branch again to co-develop NFTY, which is a combination from YAS’ agile innovation and technology with Generali’s 190 years of industry experience, tapping the uncharted areas of NFT insurance coverage.

William Lee

William Lee, Co-Founder of YAS said,

“We understand the importance of driving thought leadership to solve problems and to contribute to the transformation of the insurance industry.

YAS products and experience will become the new norm and a seamless integration of insurance into the new generation and emerging economies; microinsurance will be embedded as an essential part of our daily lives,”

Andy Ann

Andy Ann, Co-Founder of YAS added,

“The launch of ‘NFTY’ demonstrates infinite creativity and potential of microinsurance marketplaces and insurtech companies like YAS, which is far beyond the digital distribution channels for traditional insurance of incumbent insurers.

YAS is planning to launch a series of microinsurance products covering various NFT assets, such as famous paintings, animations, songs, lyrics, audio visual works, watches, cigars, red wines and photographer’s works, etc., offering the necessary protection for the world’s new economies.”