APAC Consumers Turn to Social Media as Main Channel for Customer Support

by Fintech News Hong Kong April 14, 2021In Asia Pacific (APAC), consumers are seeking customer support through social media platforms instead of making a call or sending an email, indicating that customers are expecting real-time responses to their enquiries and want shorter waiting time to solve their problems, a new survey by cloud communications platform Infobip found.

Infobip’s research, which surveyed 2,760 professionals across nine APAC markets, namely China, Singapore, Malaysia, Indonesia, Taiwan, South Korea, Thailand, Vietnam and the Philippines, shows that platforms such as Facebook and Instagram are emerging as the preferred channel for customer support, as consumers perceived them as a faster and more convenient channel.

Businesses in Indonesia in particular have embraced digital avenues, with 74% and 69% of respondents citing social media and emails as their main customer support channels, respectively, against 50% for call centers and hotlines, the research found.

A deep dive to Indonesia, A Year of Disruption: Managing Increasing Complexities in Customer Service, Infobip, April 2021

Across APAC, companies are recognizing the importance of multichannel communications and digital channels, and integrating chat platforms including Facebook Messenger, WhatsApp Business and Viber, into their larger communication strategies.

The Infobip report cites the example of Malaysian life insurance company Gibraltar BSN, which uses WhatsApp to engage better with customers and make sure they receive important and sensitive documents. WhatsApp has allowed Gibraltar BSN to get real-time delivery status tracking and enabled a 40% reduction in cost for delivering e-policies, the report says.

Key market insights, A Year of Disruption: Managing Increasing Complexities in Customer Service, Infobip, April 2021

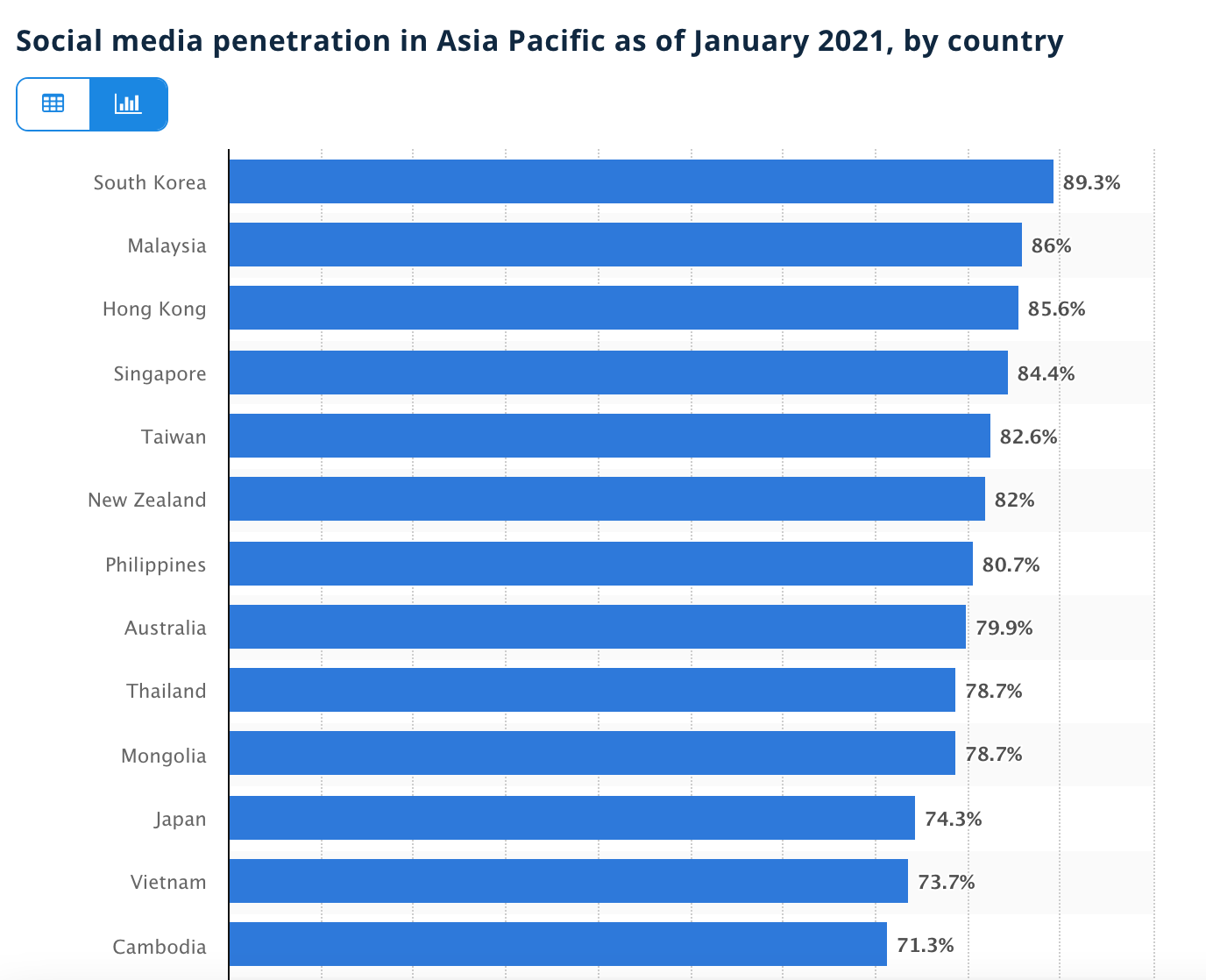

The research findings come on the back of strong adoption of social media platforms in APAC where penetration rates span anywhere between 10.3% (Papua New Guinea) and 89.3% in South Korea, the highest rate of social media user penetration in the region, according to Statista. South Korea is followed by Malaysia (86%), Hong Kong (85.6%), Singapore (84.4%) and Taiwan (82.6%).

Social media penetration in Asia Pacific as of January 2021, by country, Statista, March 2021

While South Korea and Malaysia have the highest social media penetration rates in APAC, the number of active mobile social media users paint a very different picture.

China dominates the rest of the region in terms of absolute numbers, with more than one billion mobile social media users. This far surpasses the number of users in second-placed India with 290 million.

Globally and in APAC, Facebook is the most used social media site, but Asian social networks, such as WeChat and Line, are gaining massive popularity across the region. WeChat, a multi-purpose messaging, social media and mobile payment app owned by China’s Tencent, is amongst the top six most used social media platforms globally, serving over 1.2 billion monthly active users, as of Q4’20.

Line, a Japan-based, cross-platform messaging app, had about 84 million monthly active users in its home market, as of 2020. Line was originally designed as an Internet-based method of communication before expanding its operations into other areas, offering spin-off apps such as the online payment system Line Pay, the music streaming service Line Music, and the digital comic service Line Manga.

These so-called super apps, alongside Kakao from South Korea, GoJek from Indonesia, and Grab from Singapore, are rapidly gaining ground in the banking, financial services and insurance industry.

South Korea’s dominant chat app operator Kakao established a mobile-only bank called KakaoBank in 2016, providing services including loan, deposit, debit card, overseas remittance and group account. As of November 2020, KakaoBank had over 13.4 million customers.

WeBank is a Chinese neobank founded by Tencent, Baiyeyuan, Liye Group, and other companies, that serves more than 200 million individual customers and 1.3 million small and medium-sized enterprise (SME) clients. In addition to WeBank, Tencent also backs Fusion Bank, a new virtual bank in Hong Kong.

Indonesian ride-hailing giant GoJek operates one of the country’s biggest digital wallets. Last year, it bought a 22.1% stake in local bank Jago to provide digital banking services on its GoPay mobile platform.

And Grab, GoJek’s main rival in Southeast Asia, has a burgeoning fintech arm and was recently granted a Singapore digital banking license.

Featured image credit: edited from Freepik